Click here to print this page or back to page.

Click here to print this page or back to page.

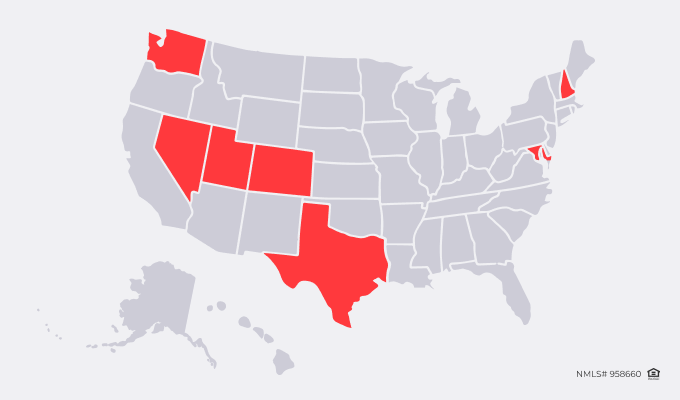

We are excited to announce a limited-time offer for our valued mortgage broker partners! From April 6 until April 30, we are offering a 0.25 lender credit on Non-QM purchase loans locked for your borrowers in Colorado, Utah, Texas, Nevada, Washington, Maryland, and New Hampshire.

At A&D Mortgage, we understand that providing your clients with the best possible loan options and competitive rates is crucial to your business success. That’s why we are committed to working closely with our mortgage broker partners to ensure that their clients receive exceptional service and support throughout the loan process.

Our Non-QM purchase loan programs offer a wide range of loan options to meet the unique needs of your clients. With our flexible underwriting guidelines, we can provide financing solutions for borrowers who may not qualify for traditional loan programs.

Our team of experienced Account Executives is dedicated to providing personalized service and support to you and your clients. We understand that every borrower has different financial circumstances and goals, and we work closely with you to find the best loan options available.

Take advantage of this limited-time offer to help your clients save money and get the financing they need to purchase their dream homes. Contact us today to learn more about our Non-QM purchase loan programs and how you can take advantage of this incredible offer.

Thank you for your continued partnership with A&D Mortgage. We look forward to working with you to help your clients achieve their homeownership goals.

Submit your Scenario today!

Disclaimer: This offer is valid for any new Non-QM purchase loans locked between 4/6/23 and 4/30/23. The borrower will receive a lender credit of 0.25 bps toward closing costs at the time of closing. Properties must be located within Colorado, Utah, Texas, Nevada, Washington (business purpose loans only), Maryland, and New Hampshire. Offer cannot be used in conjunction with any other published offer and its terms and conditions are subject to change without notice.

Allowed Property types include:

Prime/Super Prime:

Single Family Residences, Townhomes, Condo Warrantable/Non-warrantable (Limited Review OO: 85% (FL 75%) CLTV Max, Inv & 2nd Home:75% (FL 70%) CLTV Max ), Condotel, 2-4 Units (not available for 2nd home), PUD, SFR Rural (70 CLTV Max, Min FICO 680), Manufactured housing (70 CLTV Max, Min FICO 680), Short term rentals (70% CLTV Max), Leasehold and mixed-use.

DSCR/Foreign National DSCR:

Single Family Residences, Townhomes, Condo Warrantable/Non-warrantable (Limited Review 75% (FL 70%) CLTV Max), Condotels, 2-4 Units (80 CLTV Max), PUD, Short-Term Rentals (70% CLTV Max), Leasehold, SFR Rural (70 CLTV Max, Min FICO 680), Manufactured housing (70 CLTV Max, Min FICO 680), Multifamily property (70 CLTV Max, Min FICO 680, DSCR ≥ 1.1), Mixed Use (70 CLTV Max, Min FICO 680, DSCR ≥ 1.1)

Foreign National Full Doc

Single Family Residences, Townhomes, Condo Warrantable/Non-warrantable, Condotels, 2-4 Units, PUD, SFR Rural (70 CLTV Max, Min FICO 680), Manufactured housing (70 CLTV Max, Min FICO 680), Short-Term Rentals (70% CLTV Max), Multifamily property (70 CLTV Max, Min FICO 680, DSCR ≥ 1.1), Mixed Use (70 CLTV Max, Min FICO 680, DSCR ≥ 1.1), Leasehold.

All other property types may be considered on a case-by-case basis.