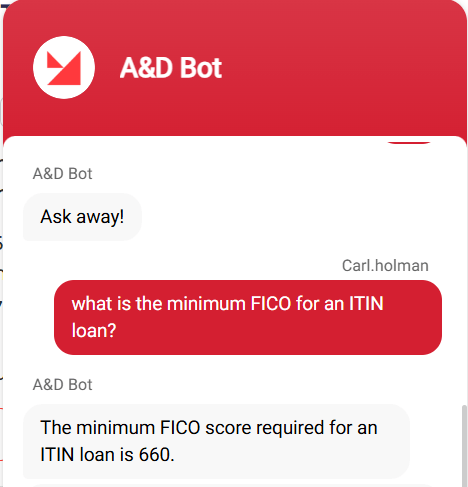

As a mortgage broker specializing in Non-QM loans, you know how challenging it can be to keep track of constantly evolving guidelines. Searching through lengthy documents or waiting for clarification can slow you down—and in this competitive market, time is money. That’s why A&D Mortgage is excited to introduce the AI Guideline Assistant, a new feature available through A&D Bot. Designed with brokers like you in mind, this cutting-edge tool is here to make your job easier. The Assistant provides instant, accurate answers to your Non-QM guideline questions.

Whether you’re double-checking borrower eligibility, confirming underwriting standards, or clarifying program details, the AI Guideline Assistant has you covered.

What Is the AI Guideline Assistant?

The AI Guideline Assistant is an advanced tool built into A&D Bot, our proprietary platform. It leverages smart technology to analyze your specific queries and provide immediate responses. No more flipping through pages of guidelines or waiting for email replies—this tool gets you the information you need, when you need it.

Key Benefits

Here’s how the AI Guideline Assistant can make your life easier:

- Up-to-Date Guidelines. The tool constantly monitors the latest Non-QM guideline updates to ensure your answers are always accurate.

- Instant Query Analysis. It processes your specific questions and delivers precise, actionable responses in real time.

- Time Savings. By reducing the time spent searching for information, you can focus on what really matters—closing deals and serving your clients.

- Streamlined Workflow. This tool eliminates guesswork and simplifies your processes, so you can work smarter, not harder.

How to Use the AI Guideline Assistant

Using the AI Guideline Assistant is quick and easy:

- Visit the A&D Mortgage Website. Head to our homepage.

- Open A&D Bot. You’ll find it conveniently located on the main page in the bottom right corner.

- Select “AI Assistant”. Choose the AI Guideline Assistant option and start asking your questions.

Whether you’re at the office, working remotely, or on the go, the AI Guideline Assistant is available 24/7 to support your Non-QM lending needs.

Who Is It For?

The AI Guideline Assistant is specifically designed for brokers working with Non-QM loans. If you’re juggling multiple clients and have little time to spare, this tool will become your go-to resource for quickly validating Non-QM guidelines.

Why It Matters

Navigating Non-QM guidelines can be one of the most time-consuming aspects of the loan process. With the AI Guideline Assistant, you can:

- Avoid delays in your client interactions.

- Feel confident in your responses with accurate, real-time information.

- Work more efficiently and close deals faster.

Real-World Example: How It Helps

Let’s say you’re working with a self-employed borrower and need to confirm if their bank statements meet Non-QM income documentation requirements. Instead of combing through a detailed guideline document or waiting for an underwriting response, you can simply type your question into the AI Guideline Assistant. In seconds, you’ll receive a clear, concise answer—allowing you to move forward with confidence.

A&D Mortgage: Empowering Brokers with Smarter Tools

At A&D Mortgage, we’re committed to helping our brokers. With nearly two decades of Non-QM expertise, award-winning leadership and technology, and a network of over 6,000 broker partners nationwide, we continue to lead the industry in innovation and support. That’s why we’ve been recognized by National Mortgage Professional in its Originator Choice Awards and by Scotsman Guide as the #1 Non-QM Lender.

The AI Guideline Assistant is just one example of how we’re making it easier for you to grow your business. Try it today and see how much time you can save!

Have questions or need assistance? Reach out to our team for more information.