AD Mortgage

Grow your business with DSCR,

Bank Statement, ITIN, and more!

As one of the top Non-QM mortgage lenders, we empower brokers with competitive non-qualified mortgage programs designed to close deals faster

Close DSCR loans with fast turn times

A perfect fit for self-employed borrowers

Expand your mortgage portfolio for borrowers without an SSN

Qualify Foreign Nationals seeking investment properties with minimal documentation and fast closings

See ProgramsNon-QM loans are suitable for the self-employed, investors, and foreign nationals

Including your favorites: 12/24 Month Bank Statement loans and DSCR loans

Non-QM loans skip the strict credit, down payment, debt-to-income (DTI) ratio requirements

Investment properties, second homes, and even unique scenarios

We do — as the #1 Non-QM Lender ranked by Scotsman Guide

At AD Mortgage we offer the turnaround times

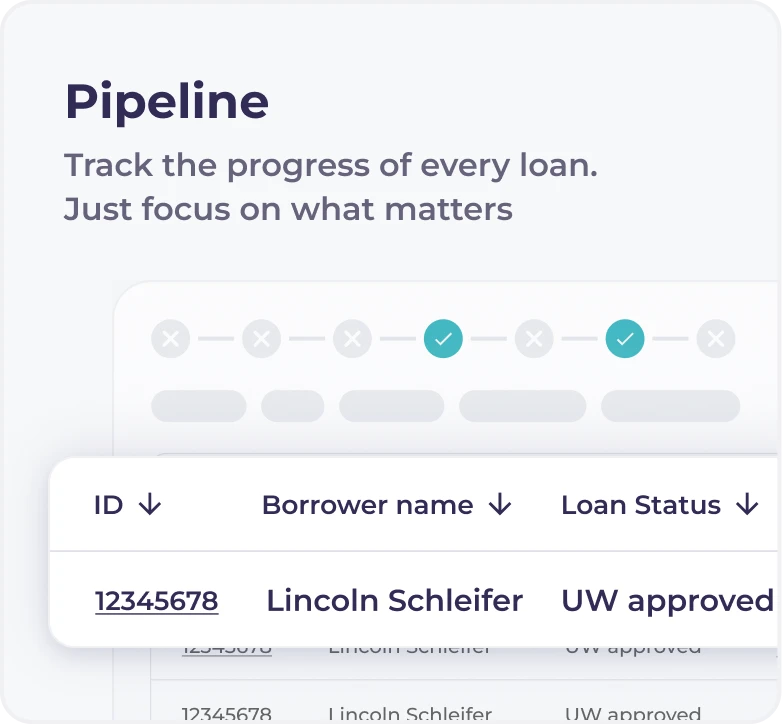

Easy to avoid with our AIM Partner Portal, providing a clear pipeline for every loan

“The demand for Non-QM products has surged,

particularly as more borrowers seek flexible options outside

conventional loans.

As the #1 Non-QM lender, we are proud

to offer diverse solutions

for borrowers who fall outside

traditional

qualification

standards.”

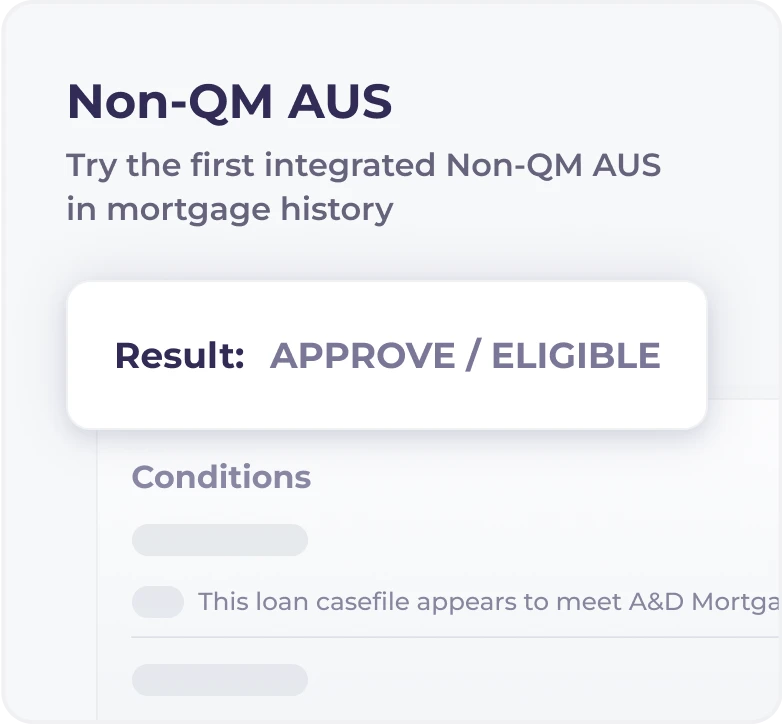

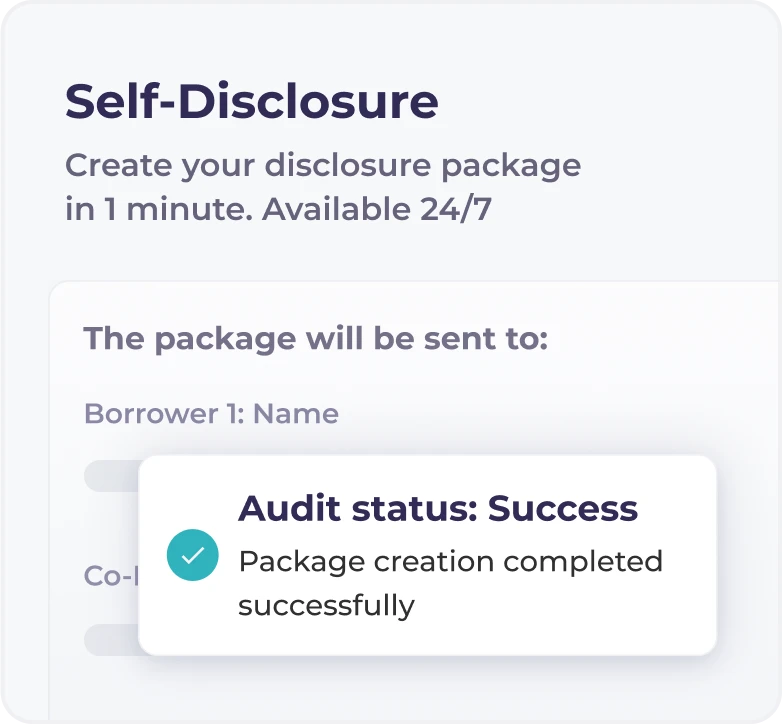

Leverage AIM — the Partner Portal with AI-powered features and tools for fast closings

Take advantage of all the features and tools to streamline your workflow

Partner with AD Mortgage today and explore the benefits of non-QM lending with a team that understands your needs. From non-qualified mortgage solutions to tailored support, we’re here to help you succeed in the non-QM space

Tailored Non-QM home loans

for self-employed, investors,

and unique financial profiles.

Streamlined process

with clear

Non-QM loan requirements.

Dedicated team to guide you

through every step of Non-QM lending.

Innovations that keep you ahead

in Non-QM mortgages.

What is a Non-QM loan?

A Non-QM loan (also known as a non-qualified mortgage) is a type of home loan designed for those borrowers who can’t qualify for traditional mortgages. It is suitable for:

Non-QM products offer flexibility. They often come into play and help secure needed financing when Conventional options just don’t work.

What types of Non-QM loans are there?

Non-QM loans come in many types to suit a range of unique cases.

Self-employed people often pick Bank Statement

loan first. Lenders look at 12/24 months of bank records to check the borrower’s income, instead

of W-2s or pay stubs.

Real estate investors find DSCR loans perfect.

These home loans focus on how much rent a borrower’s property brings in, not their personal

earnings.

People who need a bigger loan often go for Jumbo loans. These

apply to pricey properties that go beyond the usual Conventional

loan caps. People with substantial assets, like savings or investments, can opt for

asset-based loans. They can use these assets to qualify instead of providing standard income

documentation.

AD Mortgage offers all these Non-QM loan types, and the choice is always

yours to decide which loan type you would prefer.

Who offers Non-QM loans?

Typically, specialized non-qualified mortgage

lenders like AD Mortgage offer Non-QM loans. We understand that not everyone has a

steady income stream and traditional docs. That’s why we offer flexible solutions for different

financial situations.

What about taxes and Non-QM loans?

Taxes for Non-QM loans depend on how a borrower uses the loan. If they

are buying an investment property, their interest payments might be tax deductible. It is a good

idea to consult a tax professional about your specific case.

What's the process for getting a Non-QM loan?

The process of getting a Non-QM loan is straightforward. Usually, it

consists of these 5 steps:

What do I need to qualify for a Non-QM loan?

Non-QM loan requirements vary from lender to lender. Here is what AD

Mortgage provides:

Credit

score: At least 620

Combined Loan-To-Value (CLTV): up to 90

Proof of income: Bank statements, tax returns, or proof of rental

income

Down

payment: From 10%

Debt-to-income ratio (DTI): Depends on the type of

loan

How to apply for a Non-QM loan?

At AD Mortgage we created Artificial Intelligence in Mortgage (AIM) to

streamline the Non-QM loan process, from submitting the application to closing the loan. AIM is

our Partner Portal that helps partners grow their businesses. See the key features and tools of

AIM:

Not a partner yet? Just fill in this form

Already have an account? Log in now

Looking for the basic steps to apply for a loan? Here they are:

1. Finding a lender

It’s a good idea to start by looking for reliable Non-QM lenders, like

AD Mortgage, that understand and work with different financial situations.

2. Gathering documents

Next, it’s necessary to prepare documents, such as bank or investment

account statements and tax returns, to show financial stability.

3. Submitting the application

Then, a borrower should work on their application with their chosen

lender.

4. Getting approved

Once approved, a borrower can move forward confidently and close on their

loan.

Why pick AD Mortgage for Non-QM loans?

At AD Mortgage, we get that everyone has a different story. Not everyone

fits into the usual loan criteria. We’re all about giving Non-QM borrowers flexibility. Whether

they’re a self-employed individual, a property investor, or have a unique situation, we can

help. We offer good rates, fast approvals, and several Non-QM options to keep things simple.

Does AD Mortgage offer specials on Non-QM loans?

Of course we do! We run promotions for both non QM and conventional loans

on a regular basis. Check out our website to

stay updated on our current promotions and

special offers.

How to start working with AD Mortgage?

It is easy – just fill out the broker package. Whenever you are ready, go

to Broker

Package page and submit the

form.

Are Jumbo loans Non-QM?

Jumbo

loans can be Non-QM if they go over the usual loan limits or do not stick to the regular

rules. These kinds of loans are suitable for more expensive homes. They work well for borrowers

with good financials who want more flexibility than typical loans offer.

The borrower wants to refinance a Non-QM loan. Is it possible?

It is possible. If your client wants a better rate, lower monthly

payments, or to tap into their home equity, refinancing a Non-QM loan is a smart choice. AD

Mortgage provides such an option. If a borrower’s financial situation has improved since the

original loan, it’s worth checking out.

I want to learn more about the risks of using Non-QM loans

The transparency in everything is our priority, so let us dive deeper

into some of the risks associated with using Non-QM loans:

The risk of financial overextension. Non-QM borrowers may have to spend

more funds on interest rates, fees, and down payments.

The risk of losing the home. The borrower may face foreclosure if they

cannot keep up with the payments.

Who are Non-QM loans for?

Non-QM loans are for people who don’t fit into the usual mortgage rules.

This includes:

What payment options are there for Non-QM loans?

Flexibility matters! Borrowers can choose from various payment plans.

They can go for fixed rates, adjustable rates, or interest-only payments. We will help borrowers

find what works best for their budget.

I want to compare Non-QM loans to conventional loans, how are they different?

They are completely different from each other. The most crucial

difference is that Conventional loans are governed by Fannie Mae and Freddie Mac guidelines. It

means that Non-QM borrowers have to meet all the criteria to qualify. Instead of Conventional

loans, Non-QM loans are more flexible and suitable for those who don’t follow

traditional loan paths, e.g., self-employed or investors.

Tell me about the benefits. What are they for Non-QM loans?

Here is why Non-QM loans stand out:

1. Higher loan amounts

Non-QM loans include Jumbo options, making it possible to finance larger

properties. At AD Mortgage we have a special program called Prime Jumbo, with loan amounts up

to $3.5 million.

2. Flexibility

Multiple options to qualify. Not only can borrowers rely on traditional

pay stubs, but they can also use bank statements, rental income, or even assets.

3. Accessibility

Have your clients already applied for a traditional loan but been turned

down because they did not meet the requirements? Non-QM loans can be the perfect solution for

their scenarios.

As you can see, Non-QM products can accommodate borrowers with specific

needs.

How does equity work in Non-QM loans?

If you have equity in your home or investment property, you can use it to

get cash. This money can help you:

Do Non-QM loans protect borrowers, and if so, how?

It depends on the lender. Basically, Non-QM loans don’t have the same

protection as other mortgages, like Consumer Financial Protection Bureau (CFPB) for Conventional

loans. But Non-QM lenders like AD Mortgage always keep things clear and fair. We have 20 years

of experience with more than 8,500 partners. Before you commit to a loan, it is crucial to fully

understand all terms, conditions, and risks. Make sure everything is clear to you.

I want to buy a second home or investment property. Can I get a Non-QM loan for these purposes?

Yes, you can. Non-QM loans are perfect for buying a second home or an

investment property. Options like DSCR

loans help real estate investors qualify based on rental income.

Struggling with a scenario?

Will help in 30 minutes!