What is the Uniform Residential Loan Application?

The Uniform Residential Loan Application, also known as the URLA, Freddie Mac Form 65, Fannie Mae Form 1003, and ULAD (Uniform Loan Application Dataset), is a standard application form approved by the Federal Housing Finance Agency. This document is used by most mortgage lenders throughout the United States. It is intended to collect crucial information about a borrower (personal identification, income, employment history, expenses, assets, debts, etc.), details about the property, and loan terms.

Looking for a suitable loan program?

Choose among 20+ programs and get

a detailed loan calculation

Loan Calculator

Programs

The use and purpose of the URLA

The purpose of the URLA is to provide lenders with a comprehensive understanding of the borrower’s creditworthiness, which helps them assess the risk of lending money. The form is also used by underwriters to approve or deny mortgage loan applications.

Every borrower deals with this doc before they’re considered for a loan. Moreover, the homebuyer must fill out this form twice during the process – the first time when applying for a mortgage loan and the second time when confirming the loan terms. Borrowers who are going to refinance an existing loan will also be asked to fill out the URLA. Refinancing the borrowers existing loan, may increase total finance charges over the life of the loan.

About the URLA structure

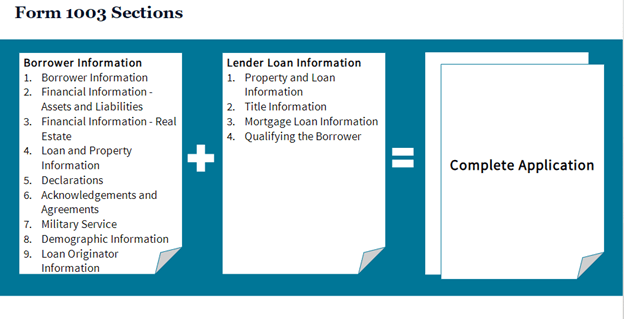

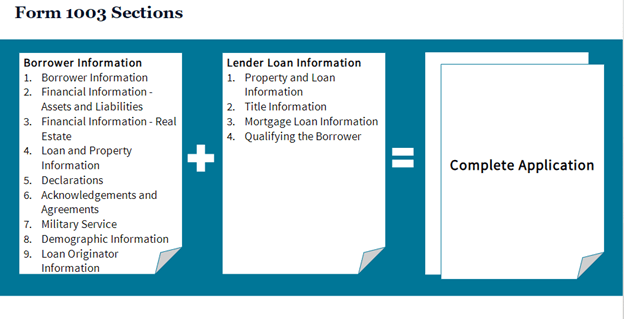

The URLA consists of two main forms, the Borrower Information Form and the Lender Information Form, which together make up the complete loan application. However, depending on certain situations, additional forms may be required. These are the Additional Borrower form, Unmarried Addendum, and Continuation Sheet.

Why is it worth paying attention to?

To complete the form properly, each applicant needs to understand the format and know the necessary information. Incomplete or inaccurate information can result in a delay or even denial of a loan. Therefore, it’s crucial for brokers to be familiar with the form and be able to assist borrowers in completing it correctly. Help your clients understand the URLA with our comprehensive guide and make their application process faster!

Uniform Residential Loan Application

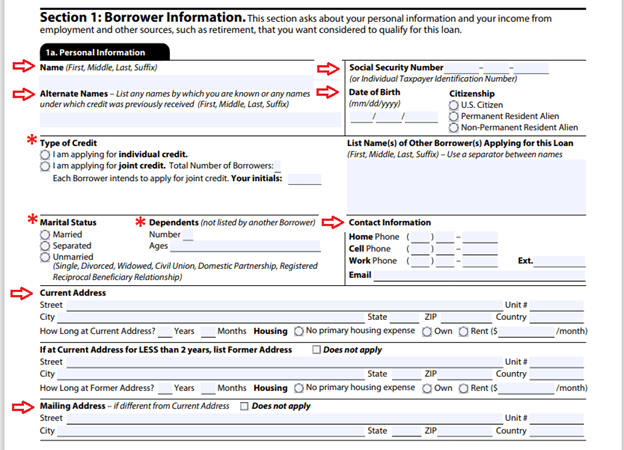

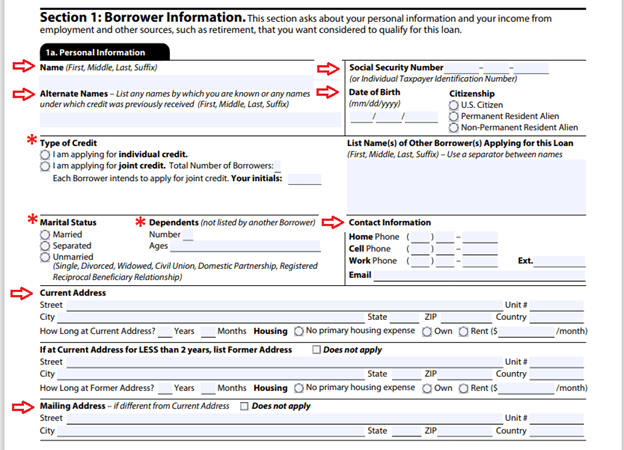

The section is designed to collect information about the borrower’s identity, employment, and income.

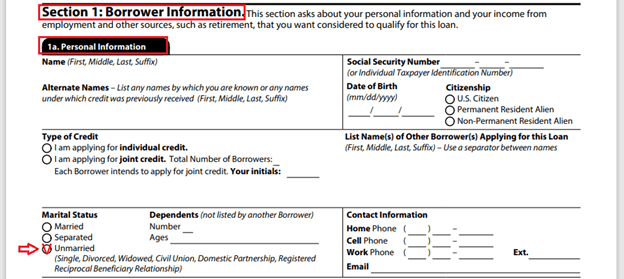

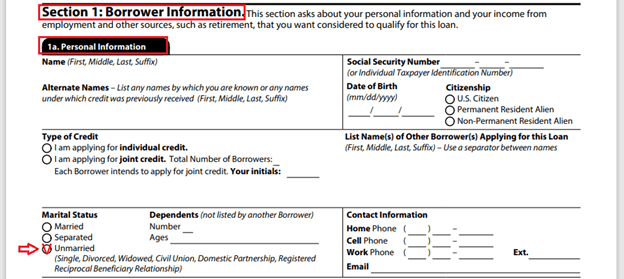

a. Personal Information

This sub-section collects data on the borrower’s identity, marital status and dependents, address and contacts, and type of credit.

- That’s where the borrower should put their name along with alternate names, that is, any names by which they are known or any names under which they previously received credit.

- The borrower should also input their Social Security Number, date of birth, and citizenship here.

- When selecting a joint type of credit, the applicant should indicate if other borrowers may be qualifying for this loan.

*If your client is doing a joint credit, an additional borrower will have their own four pages to complete.

- The borrower should list dependents, if applicable.

*Note that the definition of a dependent may vary between FHA, VA, USDA, and Conventional loan programs. Therefore, the borrower should record this information in accordance with the loan program.

- The applicant is required to list their marital status, contact information (phone number and email address), and current address.

*If the borrower is unmarried, they do have to complete an Unmarried Addendum.

*In some states, marital status affects several things in the process, such as receiving the disclosures if married, alerting the UW on child support/alimony if divorced, etc.

- The applicant is also asked if they currently rent or own a property, what the monthly payment is, and how long they have lived in the property.

*When providing the data, your client should typically go by a two-year history on everything as much as possible.

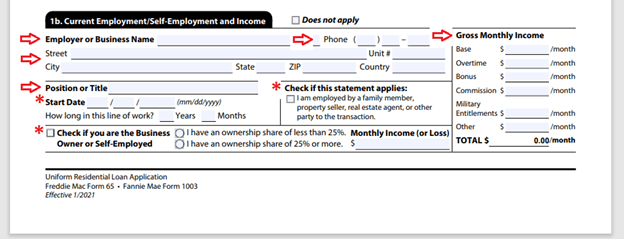

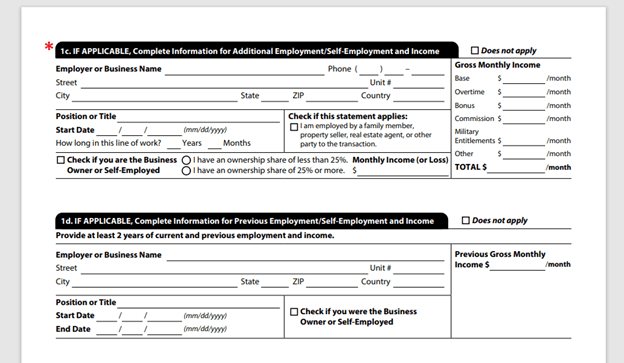

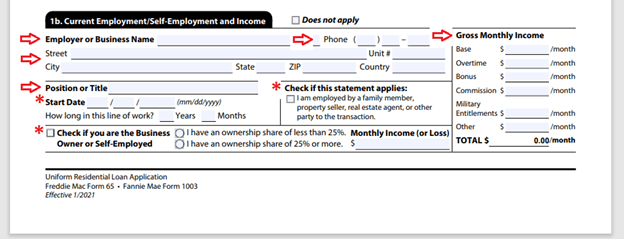

b. Current Employment

This sub-section collects the applicant’s current employment and income information.

- It requires that the borrower provide detailed information about their employer, including business name, address, and contact info.

- The applicant should also specify their job title and monthly income.

*The sub-section allows the borrower to self-identify if they’re employed by a family member or a property seller, or someone involved in the transaction.

*The borrower can also identify if they are self-employed. To be considered self-employed, a person must own 25% or more of a company’s stock. In this case, the applicant has to select the checkbox and provide their monthly income or loss but doesn’t have to enter gross monthly income (it’s only one or another). A borrower may be self-employed and get a W-2 from that business. Borrowers typically must be self-employed for two years, although documentation allows for only one year to be documented.

*Your client should also go by a two-year history when providing data for this sub-section.

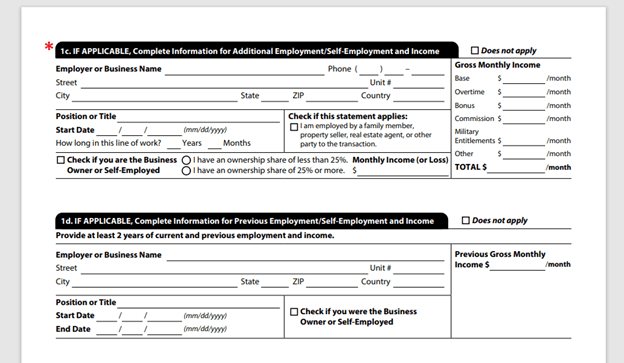

*If your client had more than one employer, they need to provide information about each of them in sub-sections 1c and 1d.

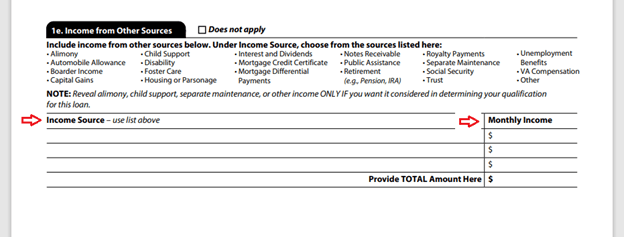

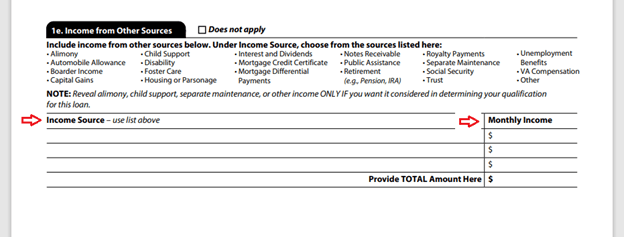

e. Income from Other Sources

The sub-section collects data on other sources of income, if applicable. This refers to any additional income other than base salary or an hourly wage.

- The applicant should select an income source from a provided list and enter the monthly income amount.

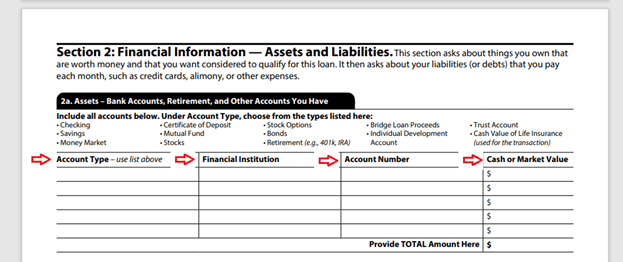

In this section, the homebuyer is asked to list their savings and investments, as well as any outstanding debts and other financial obligations, such as alimony or child support.

It’s essential that the applicant provide an accurate and complete picture of their liabilities and assets since it affects the creditworthiness and loan approval process. In case the applicant has more liabilities than assets, it may be challenging to obtain a loan.

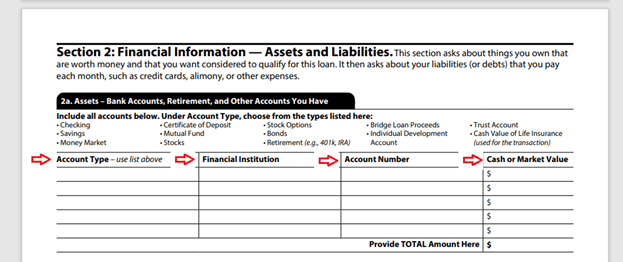

2a. Assets – Bank Accounts, Retirement, and Other Accounts

This refers to liquid assets and the assets that are going to be used for cash to close (how much money the borrower has to bring in at closing) or reserves (how much money is needed to be left in the bank account after closing for the reserve requirements for the loan). Assets need to be sourced (where are they coming from) and seasoned (sitting in a bank account for at least 60 days, except for gifts).

- The applicant has to select the account type from the list, specify the financial institution and enter the account number and cash value.

*If a gift or grant has already been received and deposited into a bank account, your client will list it here; if not, the applicant will list it in section 4d.

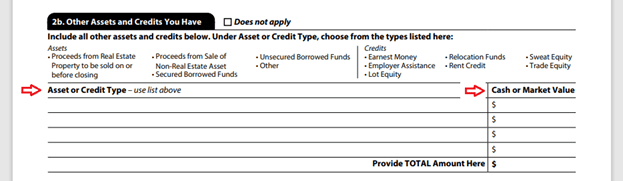

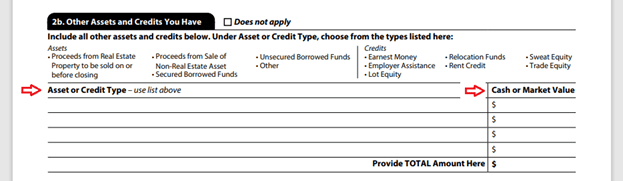

2b. Other Assets and Credits

In sub-section 2b, the borrower needs to provide data on all other assets and credits. For example, if the borrower is selling a house to receive proceeds in order to put it down, but the funds are not yet received, then the borrower puts info on it in this section.

You should pay special attention to unsecured borrowed funds. If your client has borrowed money to make a down payment, you will need to tell them that unsecured borrowed funds are not allowed in the mortgage transaction.

- The applicant should select an asset or credit type from the list and enter the value.

*If the earnest money has not yet been given at the time of application and it is still in the bank account, the applicant lists it in sub-section 2a, but if it has already been given, the applicant counts it here in sub-section 2b.

*You need to be sure that your client is not duplicating their assets listing in one place and then listing them in another place, since this makes inaccuracies when qualifying the borrower.

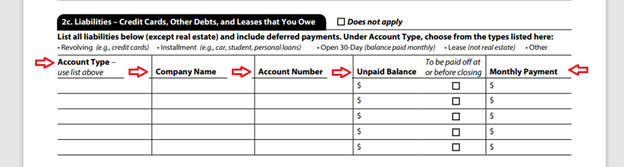

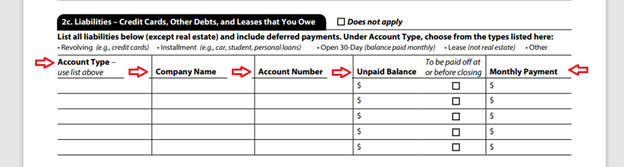

2c. Liabilities – Credit Cards, Other Debts, and Leases

Here, the applicant has to input any liabilities (e.g., judgments, liens) and outstanding debts (e.g., credit card debts, student loans, car loans) listed on their credit report.

- The applicant has to select the account type from the list, specify the company name, and enter the account number, unpaid balance, and monthly payment.

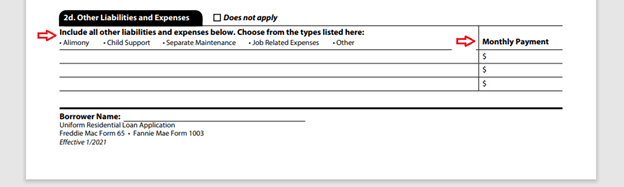

2d. Other Liabilities and Expenses

Sometimes a borrower may have a debt or liability that isn’t shown on their credit report (e.g., alimony child support, separate maintenance). In this case, they mention it in sub-section 2d, specifying the type and monthly payment.

*It’s important to remember that general household expenses, cell phone bills, utilities, personal insurance, or voluntary payroll deductions are not included in the debt-to-income ratio.

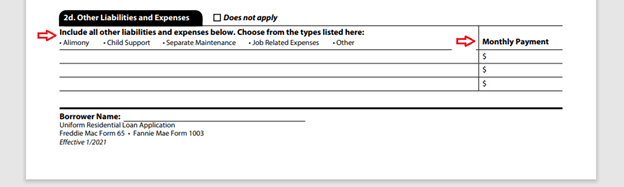

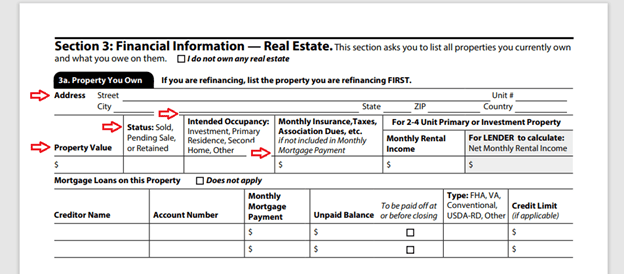

The section captures the details about the real estate owned, if any.

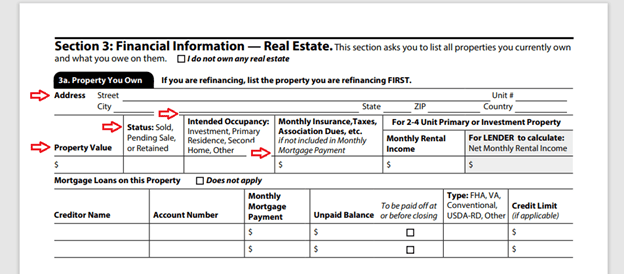

3a. Property You Own

The applicant needs to list all subject properties first (e.g., refinance transaction).

- Your client should enter the full address, property value, status (sold, pending sale, or retained), occupancy type, monthly insurance, taxes, association dues, monthly rental income (if applicable), and loans on this property (if applicable).

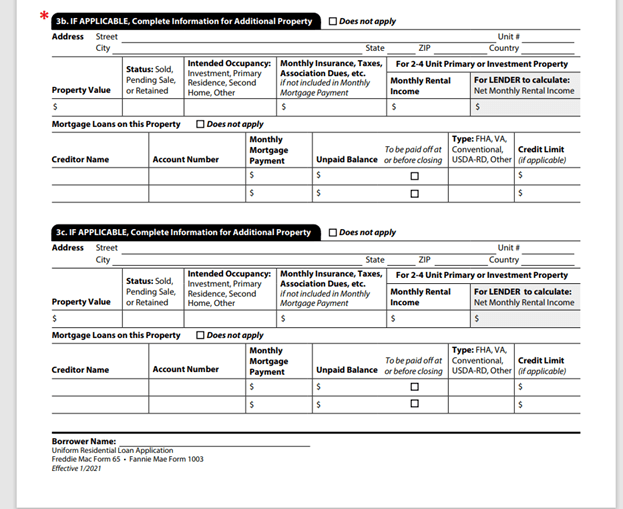

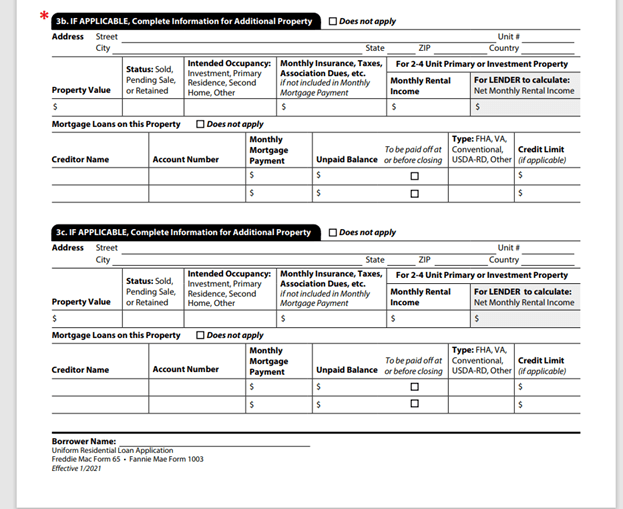

3b & 3c Information for Additional Property

The applicant fills in these sub-sections in case they have multiple properties.

*Even if there’s no lien on the property, the borrower still has to list every single property they own because property taxes, homeowner’s insurance, rental income, etc., must be accounted for w when calculating the accurate debt-to-income ratio.

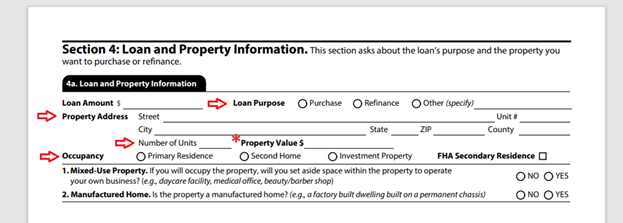

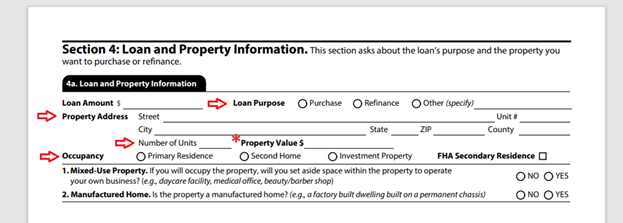

Section 4 focuses on the details of the property the borrower is purchasing. This includes information about the property type, value, address, etc.

4a. Loan and Property Information

This sub-section asks about the purpose of the loan and the property your client wants to purchase or refinance. These are all very important components that affect underwriting, loan-to-value, the loan program they are qualifying for, the interest rate, the months of reserves that are required for the loan, and even the credit score requirements.

- Here, the borrower needs to identify whether they are applying for a purchase or a refinance.

- The applicant should input the address and number of units of the property.

- The borrower should specify if it is an owner-occupied, non-owner occupied/investment, mixed-use property, or manufactured home.

*If the offer has already been made, the applicant needs to provide information about the purchase price and down payment made.

*It is important to note that residential property is defined as one to four single-family dwellings (i.e., the house consists of up to four units, but each unit is for one single family). Anything more than four units would be a commercial type.

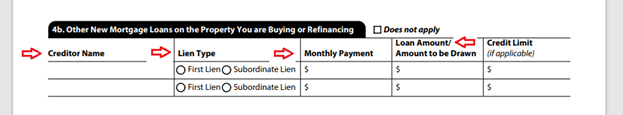

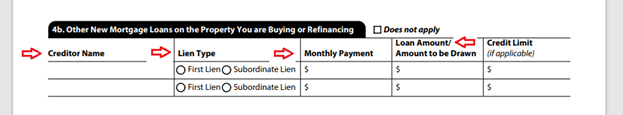

4b. Other New Mortgage Loans on the Property You are Buying or Refinancing

If there are any other loans being taken out simultaneously with this mortgage, the applicant should list them here in sub-section 4b. If there’s a HELOC involved, this is where the borrower would input that information for subordinate financing.

- The borrower enters the creditor’s name, lien type, monthly payment, and the amount.

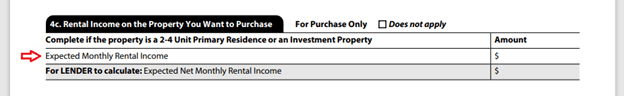

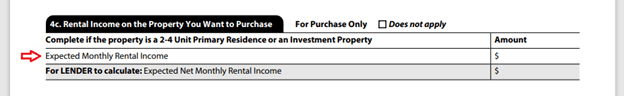

4c. Rental Income on the Property You Want to Purchase

The sub-section applies to 2–4-unit properties and purchases only.

- Here, the applicant needs to provide the expected monthly rental income.

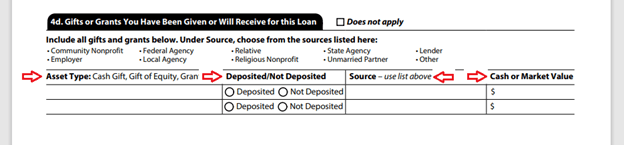

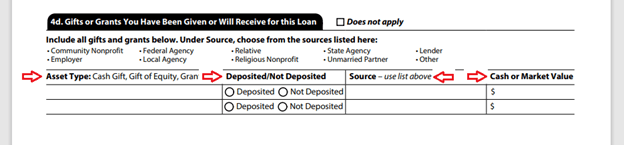

4d. Gifts or Grants You Have Been Given or Will Receive for this Loan

In this sub-section, the borrower has to report any gifts or grants that will help cover the cost of the loan.

- The applicant would select the source from the list, input the asset type, specify if it’s deposited or not deposited, and enters the value.

*Gifts must be evidenced by a gift letter signed by the donor.

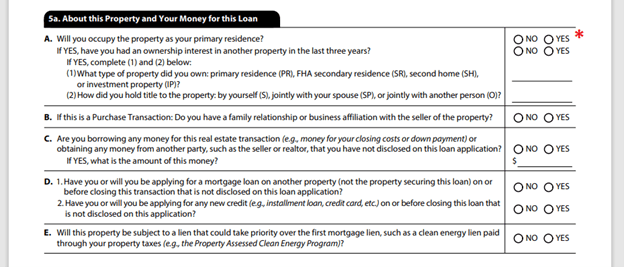

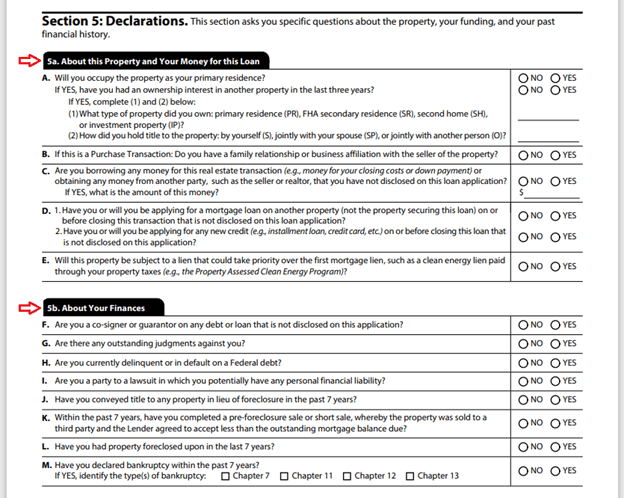

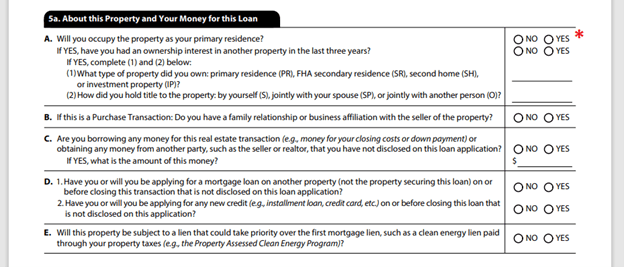

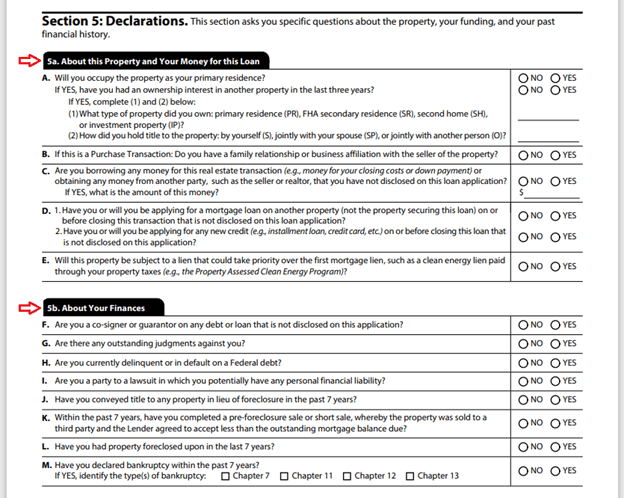

Section 5 Declarations

The section contains questions about the property, how the property is going to be financed, and the applicant’s past financial history.

5a. About this Property and Your Money for this Loan

This sub-section asks about the occupancy of the property and how the applicant intends to pay for the property.

Thus, here, your client has to disclose

- if the property is going to be their primary home,

- if they have a relationship with somebody involved in the transaction,

- if they are borrowing money for this transaction,

- if they have debts that aren’t listed on the credit report,

- if they are going to apply for a mortgage loan on another property,

- if they are going to apply for any new credit.

*Answering “yes” will require additional documentation.

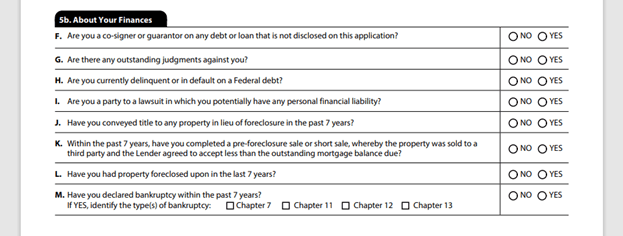

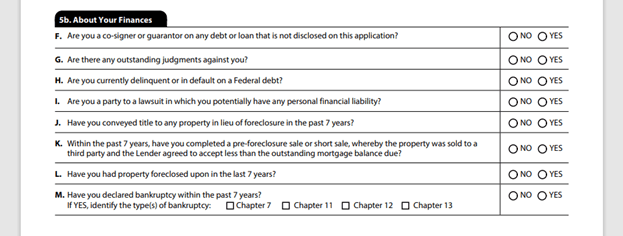

5b. About Your Finances

In this sub-section, the applicant has to make declarations about their legal history and creditworthiness. The borrower is asked to confirm that they have not been convicted of any crime, have not filed for bankruptcy, and that their credit report doesn’t contain any derogatory information.

Thus, here, your client has to disclose

- if they are a co-signer or guarantor on any debt or loan that is not disclosed on this application,

- if there are any outstanding judgments against them,

- if they are currently delinquent or in default on the federal debt,

- if they are a party to a lawsuit in which they potentially have any personal financial liability,

- if they have conveyed title to any property in lieu of foreclosure in the past 7 years,

- if they have completed a pre-foreclosure sale or short sale in the past 7 years,

- if they have faced foreclosure in the past 7 years,

- if they have declared bankruptcy in the past 7 years.

* If, for some reason, the borrower did not fill out this section, you should go back to them to have them fill it out.

*If any of the answers are yes, the applicant needs to attach a continuation sheet to their application providing more details about the answer.

*If the borrower fails to disclose the data accurately that’s considered fraud. Note that mortgage fraud is a $1 million fine or 30 years in prison.

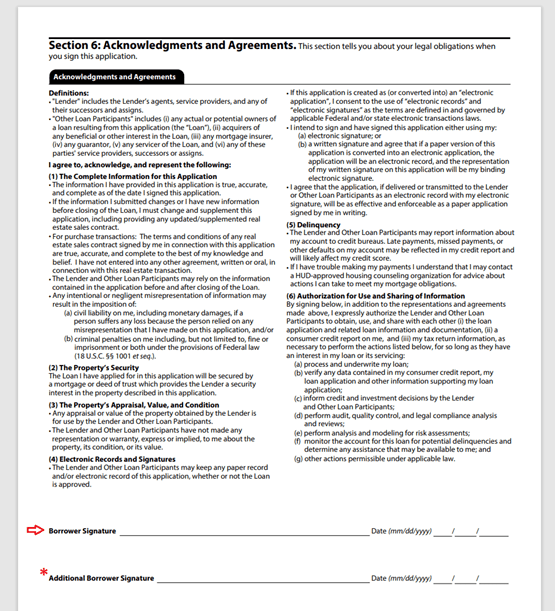

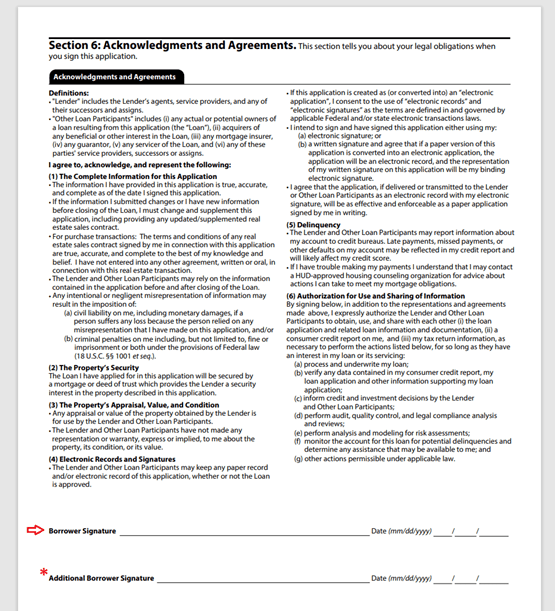

Section 6: Acknowledgments and Agreements

This section tells a borrower about their legal obligations when they sign the application. This is where they acknowledge and sign that everything they have provided is true, correct, and complete. The applicant also needs to state that they understand and agree with the provided terms on

- the use of appraisal and use of electronic records and signatures,

- reporting of late payments to credit reporting agencies,

- use and sharing of a borrower’s personal information disclosed on the URLA.

*The applicant’s signature here also authorizes the lender to perform a credit check and other inquiries.

*If the URLA is being used with the URLA – Additional Borrower form, the co-signer should read this section and acknowledge they have read it and agree with its terms by signing their name.

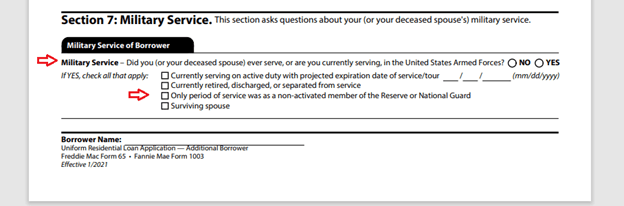

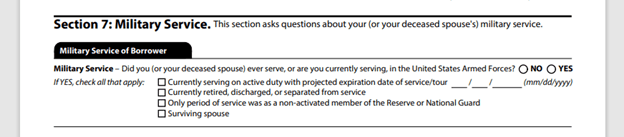

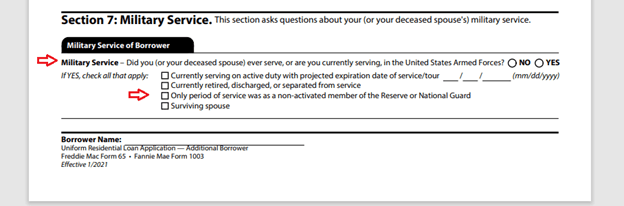

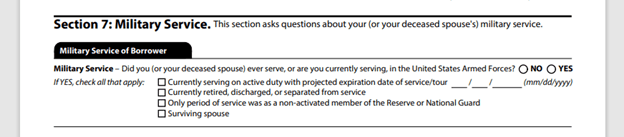

Section 7: Military Service

The section captures information on any military service, either if your client currently serves or previously served in the US armed forces (or has a deceased spouse who did).

- The applicant should specify if they have any military service status and select the appropriate option from the list.

*The length of service or service commitment, duty status, and character of service determine the eligibility for specific home loan benefits.

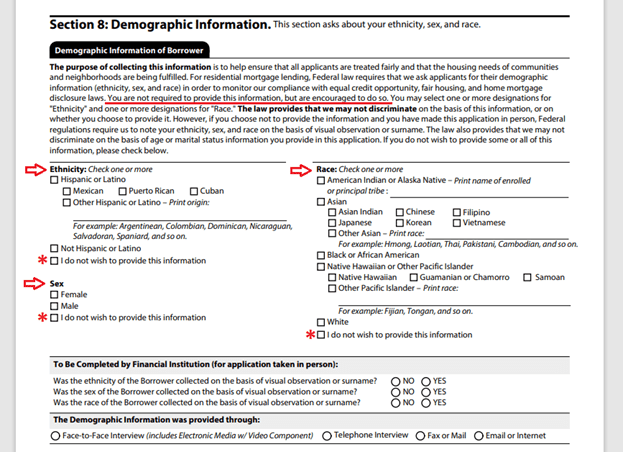

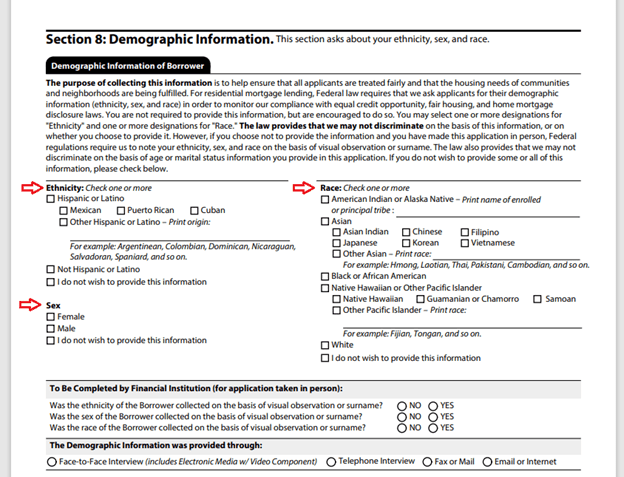

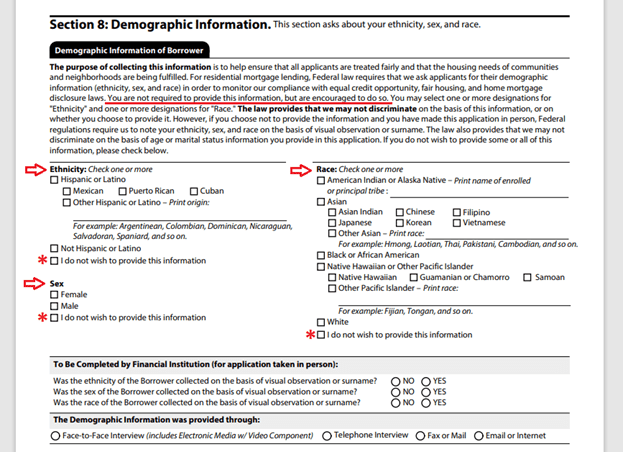

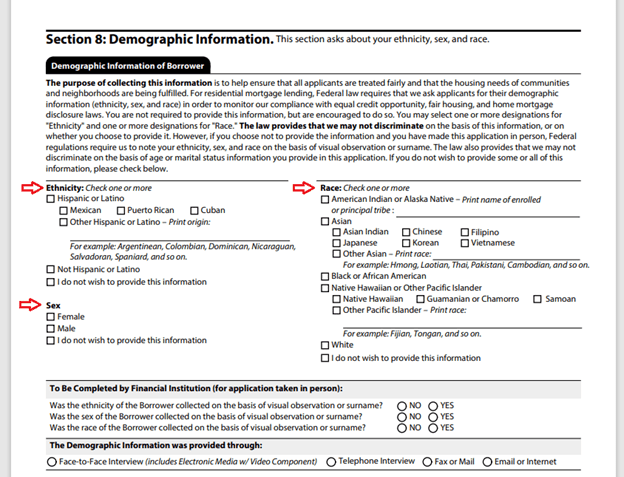

The section captures the borrower’s HMDA (Home Mortgage Disclosure Act) demographic information, including ethnicity, race, and gender. These questions must be included in the application in accordance with federal law.

*The questions are optional, and the applicant may indicate that they do not wish to answer some or all of them.

*The main purposes of HMDA are to determine whether the financial institution is serving the community’s housing needs, assist public officials in distributing public investment, and identify potential discriminatory lending patterns.

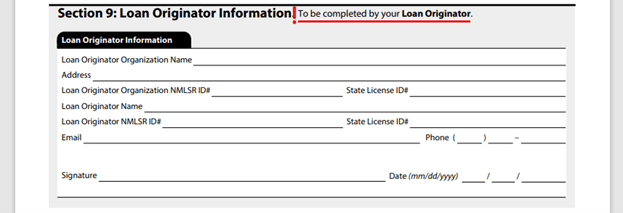

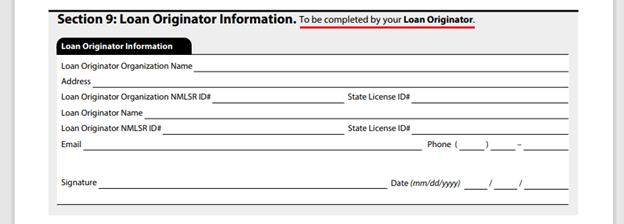

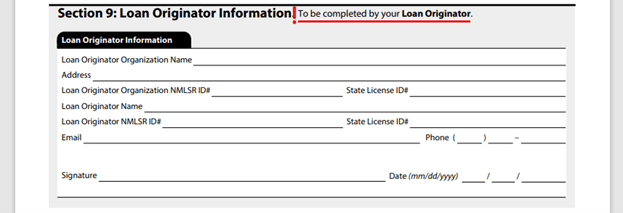

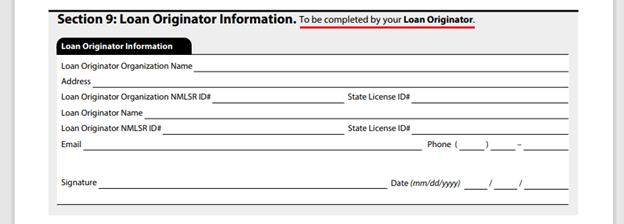

The section is designed to collect Loan Originator’s data; this is where the originator would put their NMLSR IDs, contact details, and signature.

Additional forms

The URLA has some additional forms and addenda that may be required for the loan. They may not always be applicable to your transaction.

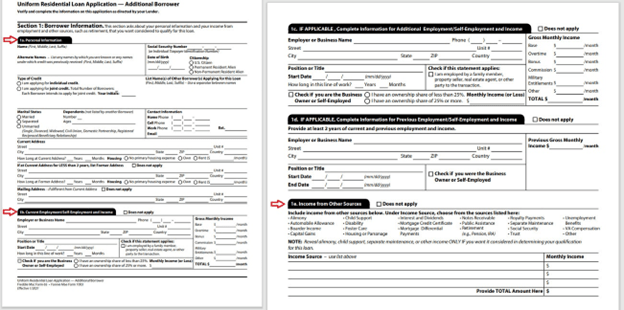

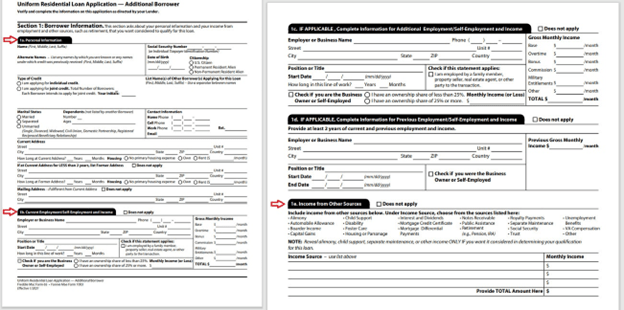

If your client is applying for joint credit, each of all additional borrowers has to fill out a four-page addendum.

The addendum collects individual borrower information, including personal details, employment, and other income. This form does NOT collect data on assets, liabilities, real estate owned, subject loans, and property – this information is listed on the Uniform Residential Loan Application with the primary borrower’s name and should not be duplicated on more than one application.

Section 1: Borrower Information

The section duplicates the URLA Section 1, asking to provide the applicant’s personal information, income from employment and other sources, such as retirement, that they want to consider to qualify for this loan.

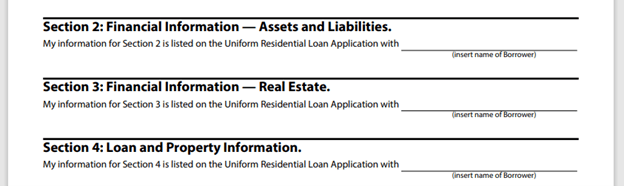

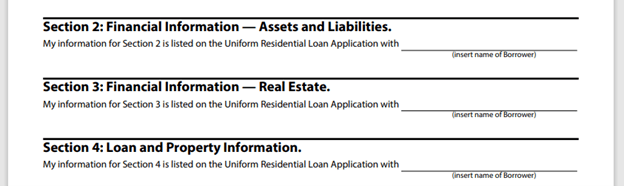

Section 2-4, Section 6

Section 2 (Financial Information – Assets and Liabilities), Section 3 (Financial Information – Real Estate), Section 4 (Loan and Property Information), and Section 6 (Acknowledgements and Agreements) contain a statement that the information is listed on the uniform residential loan application with the primary borrower’s name.

Section 5 Declarations

The section is identical to section 5 on the URLA, asking the applicant to provide answers to specific questions about their property, funding, and past financial history.

Section 7 Military Service

The section duplicates the URLA Section 7, intended to collect info on the applicant’s military service status.

Section 8 Demographic Information

The section is identical to section 8 on the URLA, collecting data on the co-borrower’s ethnicity, race, and sex.

Section 9 Loan Originator Information

The section is identical to section 9 on the URLA, completed by Loan Originator.

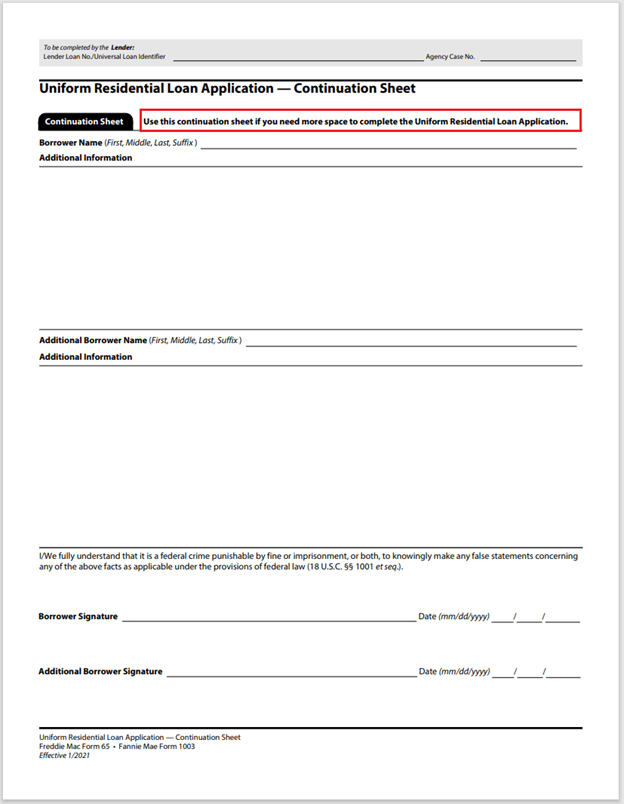

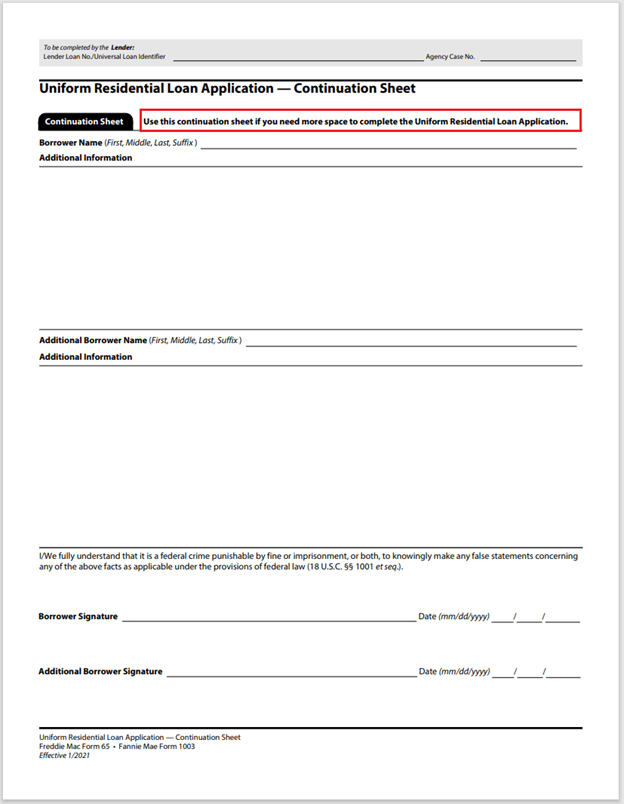

If, for example, the borrower has more liabilities in credit history, assets, or real estate than the lines on the initial application, they should use a continuation sheet to fill in that information there (in case the URLA is being manually completed). There’s a continuation sheet for every single section.

*It may also include state-specific disclosures.

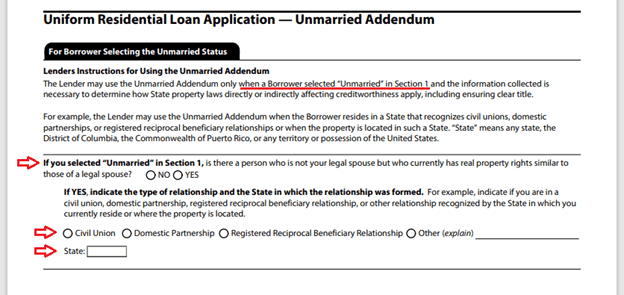

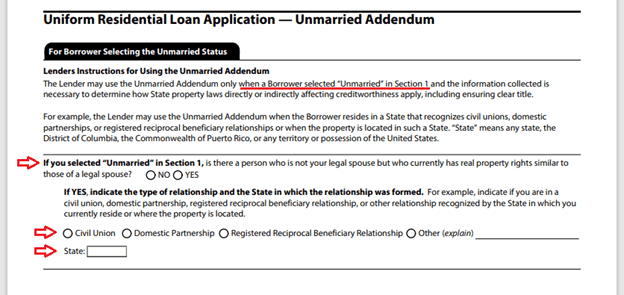

If your client selected the Unmarried option in section 1 of the initial application, they have to fill out the Unmarried Addendum, whether or not they’re in a civil union, domestic partnership, or registered reciprocal beneficiary relationship.

The borrower should disclose if there is a person who will have real property rights similar to a spouse. If so, the applicant must indicate the nature of that relationship and the state of registration.

Tips on how to help your client fill out the URLA properly

You need to know the form and the information the borrower has to provide in order to qualify. You should be able to explain the purpose of the URLA to the client and make sure they understand why the data are needed and what they will be used for. Additionally, you should be able to explain to the borrower any term that seems incomprehensible to them.

Know the ECOA

Since the ECOA (Equal Credit Opportunity Act) regulates behavior toward credit applicants, it’s crucial to know it, with a focus on the below provisions.

Notification of Action Taken, ECOA Notice, and Statement of Specific Reasons – 12 CFR § 1002.9(a)

A creditor shall notify an applicant of action taken within:

- 30 days after receiving a completed application concerning the creditor’s approval of, counteroffer to, or adverse action on the application

- 30 days after taking adverse action on an incomplete application, unless notice is provided in accordance with the requirements for incomplete applications under § 1002.9(c);

- 30 days after taking adverse action on an existing account; or

- 90 days after notifying the applicant of a counteroffer if the applicant does not expressly accept or use the credit offered.

Content of Notification When Adverse Action is Taken – 12 CFR § 1002.9(a)(2)

A notification given to an applicant when adverse action is taken shall be in writing and shall contain a statement of the action taken; the name and address of the creditor; a statement of the provisions of section 701(a) of the ECOA; the name and address of the Federal agency that administers compliance with respect to the creditor; and either:

- A statement of specific reasons for the action taken; (§ 1002.9(a)(2)(i)) or

- Disclosure of the applicant’s right to a statement of specific reasons within 30 days, if the statement is requested within 60 days of the creditor’s notification.

Notice of Incompleteness – 12 CFR § 1002.9(c)(2)

If additional information is needed from an applicant, the creditor shall send a written notice to the applicant specifying the information needed, designating a reasonable period of time for the applicant to provide the information, and informing the applicant that failure to provide the information requested will result in no further consideration being given to the application.

Providing Appraisals and Other Valuations – 12 CFR § 1002.14(a)(1)

Regulation B requires that creditors provide applicants with a copy of all appraisals and other written valuations developed in connection with an application for credit to be secured by a first lien on a dwelling. A creditor shall provide a copy of each such appraisal or other written valuation promptly upon completion, or at least three business days prior to consummation of the transaction (for closed-end credit) or account opening (for open-end credit), whichever is earlier.

Check for documents

In addition to filling out the application form, your client must provide the lender with various documents that support their application and allow them to properly review it.

Therefore, make sure that your client has the below documents when applying for a loan.

- Personal identification documents, such as driver’s license, passport, or social security card.

- Employment history verification documents listing employer names and addresses for the past two years.

- Income verification documents, including pay stubs, W-2s, and tax returns for the past two years.

- Asset verification documents, such as bank statement, investment account statements, and retirement account statements.

- Property documentation listing the address of the property being purchased or refinanced, estimated value, etc.

- Proofs of debts and liabilities, including credit card balances, car loans, student loans, and other outstanding debts.

- Documents on any other properties your client may have, including rental ones.

- Documentation to verify the event of bankruptcy, foreclosure, or legal judgments your client may have faced.

- Documents containing information about any co-borrower, including their income, employment history, and personal identification.

- A signed authorization for the lender to request a credit report.

- Policy documents for any life insurance in your client’s name.

In addition to the fact that a lender needs these documents, they will also make it easier for your client to fill out the application when they need all these details.

Check for completeness

You should have a complete application before you move the loan file further in the journey. Therefore, encourage your client to answer all questions on the form, even if they seem irrelevant. Incomplete information can delay the loan approval process. Also, make sure your client has completed all of the required additional forms.

Watch for inconsistencies

Review the form for inconsistencies or inaccuracies in the information provided by your client. Be sure to ask for clarification or additional information, if anything seems unclear or contradictory.

Be ready for follow-up requests

After the application has been submitted, the lender may follow up, requesting additional information or documentation. Make sure that your client is prepared to respond promptly and provide the required information.

Struggling with a loan scenario?

Get a solution in 30 minutes!

Fill out the short form and get your personal offer

Submit a Scenario

Double-check everything

Before submitting the form to the lender, double-check and reconcile the data on the application with the data provided in the applicant’s supporting documents. Errors and discrepancies can cause the application to be delayed or rejected.

Conclusion

Completing the URLA is an important step in the mortgage application process that may seem challenging and daunting. By following the steps and tips outlined in this guide, you can ensure a smooth and efficient submission process as well as increase your client’s chances of being approved for a mortgage loan.

As a mortgage broker, your clients rely on your expertise to find them the best deals. The AD Mortgage Quick Pricer tool can be an invaluable asset in your quest to secure the most advantageous mortgage rates. Be sure to explore our Programs section for additional resources tailored to your needs. If you have specific scenarios in mind, don’t hesitate to request them; we’re here to assist you. And if you’re interested in joining forces to provide even more value to your clients, consider becoming a partner with us. Together, we can empower individuals and families to achieve their dreams of homeownership.

References

- Instructions for Completing the Uniform Residential Loan Application

display (fanniemae.com)

- Equal Credit Opportunity Act (ECOA)

- Lending – Equal Credit Opportunity Act (fdic.gov)

- URLA form

Uniform Residential Loan Application (fanniemae.com)

- URLA additional forms

Uniform Residential Loan Application — Lender Loan Information (fanniemae.com)

Uniform Residential Loan Application — Additional Borrower (fanniemae.com)

Uniform Residential Loan Application — Continuation Sheet (fanniemae.com)