By the end of 2026, mortgage rates are expected to drop below 6%, making homeownership more affordable than in recent years. In addition, many markets are experiencing growth in listings, helping supply catch up with demand after many years of tight inventory. If you want to buy a house in 2026, examine this list of the most prominent places across the country. We have created it by examining three crucial parameters – housing prices, buyers’ market, and investment prospects.

US Housing Market Forecast 2026

After the rapid home price growth during the pandemic, prices are finally slowing down. According to the Zillow Home Value Index, the prices are expected to drop by 0.9% between April 2025 and April 2026. It might be the first year that prices decline since 2011.

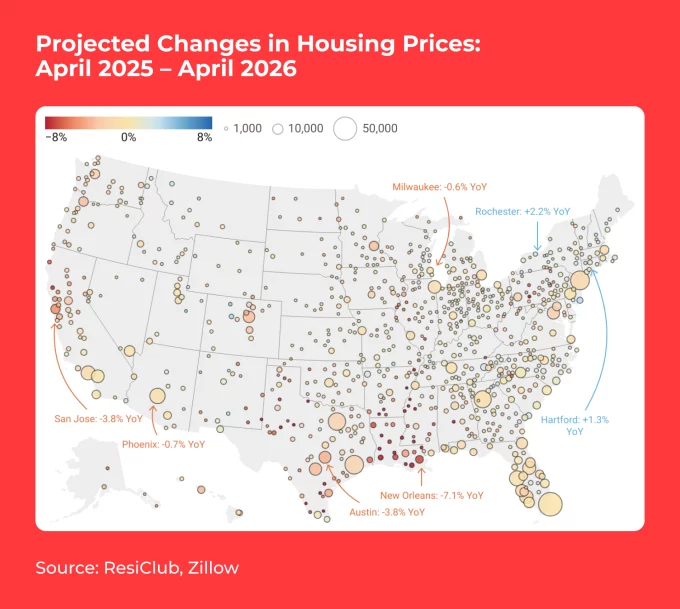

While the projected nationwide trend is clear, there are significant regional variations in housing prices. The map below shows how prices are expected to change between April 2025 and April 2026:

Generally, experts expect an increase in overall real estate sales. The NAR chief economist forecasts that existing home sales will increase by 13% and new home sales will grow by 8% in 2026.

Overall, 2026 might be a good year to purchase a house, build long-term wealth, and improve living conditions. Rick Sharga, founder of CJ Patrick Company believes the lower rates are definitely going to help some borrowers get into the market. Let’s look closely at regions and metros where price growth has slowed and inventories have risen.

1. Florida: Tampa, Miami, Jacksonville

Florida is a popular state, attracting both domestic movers and people from around the world. The warm climate, natural beauty, job opportunities, and supportive tax policies make this place perfect for purchasing residential or investment properties.

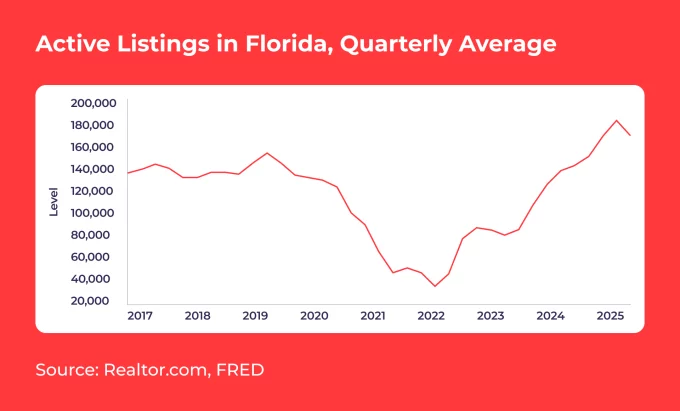

In 2025, Florida is experiencing rapid growth in housing inventory. The tendency is especially striking in some areas: for example, St. Petersburg recorded a +164% year-over-year increase in active listings. Customers now have a wider choice of housing options and more opportunities to negotiate prices with sellers.

Price growth is slowing down, averaging $378,031, down 5.1% from the previous year. However, current median prices are just about 4.6% less than the all-time-high, set in April 2024.

Although prices for Florida’s real estate are still elevated due to long-term high demand, it might be a good time to enter this market and buy a house at a better price.

Consider the following metros as they tend to offer great price-to-quality ratio:

- Tampa – Projected 5.7% year-over-year price decline, with stable occupancy rates and high rental demand, making it attractive to investors

- Miami – Projected 3.7% year-over-year price decline and cooling down of prices, with longer days on the market

- Jacksonville – Projected 4.0% year-over-year price decline, offering long-term stability in one of Florida’s most affordable large metros

Overall, Florida tends to slightly shift toward a more stable and balanced market. 2026 might be a great opportunity for homeowners and investors to buy a house in this high-value state.

2. Texas: Dallas-Fort Worth, San Antonio, Austin

The extensive job market and favorable cost of living attract many people to Texas. The state offers great opportunities for a convenient lifestyle and for building long-term wealth.

Currently, the average housing price in Texas is 300,079, which is 2.5% lower than the year before. However, this slight decrease does not balance the almost 40% growth in home value during 2019-2023.

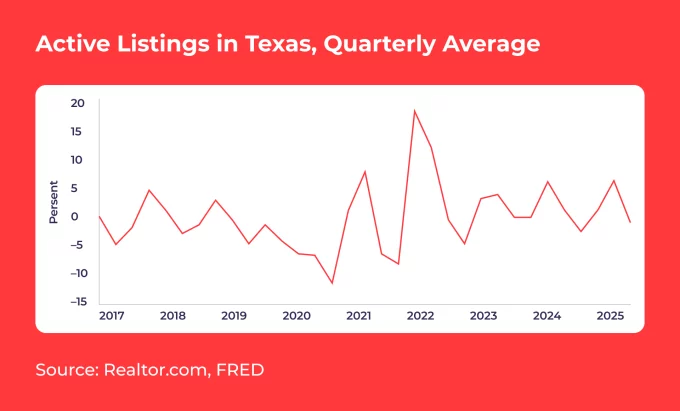

After a major drop in 2021, the inventory has been gradually recovering. In April 2025, Texas’ inventory reached an eight-year high and showed a 31.4% year-over-year growth.

In the second quarter of 2025, the number of closings increased by 1.4%, reaching 95,364. While in 17 metros the prices went up, 9 of them showed a slight price reduction. The following areas are expected to be the most prominent in the Texas market in 2026:

- Dallas-Fort Worth – Projected 2.2% year-over-year price decline and a rise in available properties to choose from

- San Antonio – Projected 3.6% year-over-year price decline, with a rapid increase in active listings

- Austin – Projected 4.2% year-over-year price decline, and existing home sales are expected to rise by 11% in 2026

After being a tight sellers’ market for several years, Texas is slowly moving toward a more balanced market. New listings, especially in the metros mentioned, are driving negotiations between sellers and buyers.

3. Arizona: Phoenix, Tucson

Arizona is a desirable destination for many out-of-state movers, thanks to its mild climate, scenic beauty, and job opportunities.

As of 2025, the median Arizona home value is $422,446, down -3.2% year-on-year. On average, homes spend 43 days on the market, which is relatively short, compared to the national average of 51.

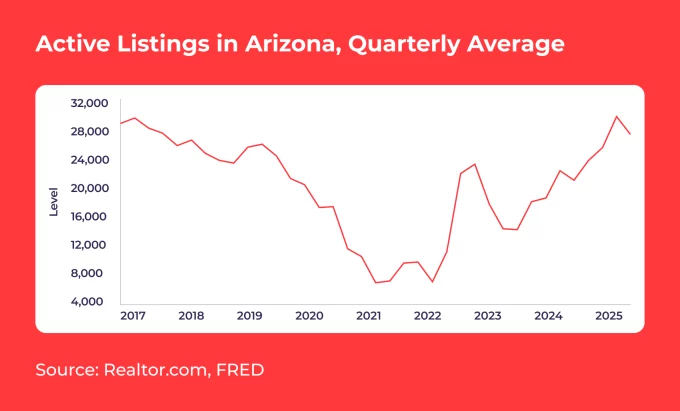

Beyond declining prices, active home listings increased by +17%, compared to last year, and reaching around 45,000, or a four-month supply, in April 2025.

In 2026, existing and new home sales are expected to grow 11% and 5%, respectively, compared with the past year. However, median home prices might grow by a couple of percentage points across the state. In certain metro areas, the situation might be more favorable:

- Phoenix – Projected 1.7% year-over-year price decline and strong investment potential

- Tucson – Projected 1% year-over-year price decline, with more affordable offerings than in Phoenix

Housing prices in Arizona are beginning to stabilize, and new listings are rising continuously. Although average housing prices in Arizona are higher than the national average, 2026 might be a good year for purchasing properties in this high-demand area.

4. Pennsylvania: Philadelphia, Pittsburgh, Allentown

An attractive place to relocate, Pennsylvania offers a stable and balanced housing market.

Sale prices are modestly increasing, showing a steady appreciation in home values. In August 2025, the median home price was $281,369, up 3.1% year-over-year.

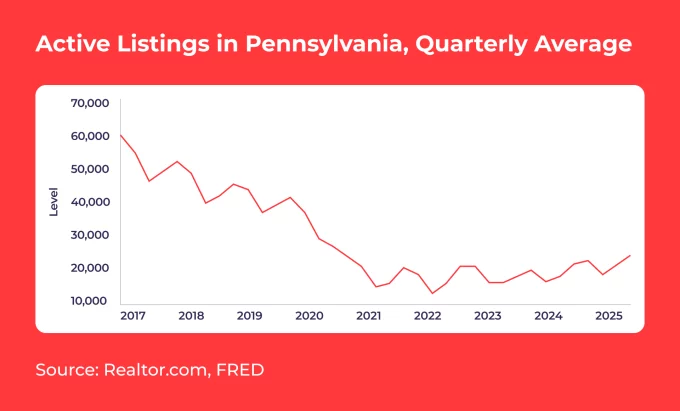

Apart from prices, the number of homes for sale is also growing. Compared to last year, about 45,000 are available, marking a +5.1% increase and creating a two-month supply.

On average, homes are sold within 32 days, which is faster than in the country in general. However, some areas have more favorable conditions for buyers:

- Philadelphia – Projected slowdown in price growth, making housing in the state’s largest metro more affordable

- Pittsburgh – Projected modest price growth, with homes spending slightly longer on the market than the state average

- Allentown – Projected stable price growth, while increased inventory and longer days on the market indicate a more balanced environment

While Pennsylvania’s housing market shows slight price increases, it is still an affordable entry point for first-time home buyers. Large metro areas with stable job markets, such as Philadelphia and Pittsburgh, also offer strong rental potential and solid long-term investment prospects.

5. Ohio: Columbus, Cleveland, Cincinnati

Although housing prices have been rising, showing a +3.6% year-on-year increase, Ohio’s real estate market remains one of the most affordable in the country. Additionally, purchasing property here is often more cost-effective than renting, attracting both buyers and investors.

In September 2025, the typical home value was $240,288, with houses spending 41 days on the market on average.

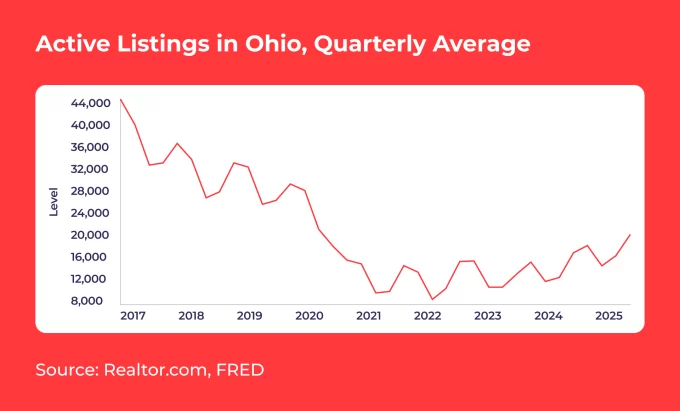

The number of houses available rose by 11.1% compared to the previous year, reaching about 45,000 properties.

Ohio’s “3C” – Cleveland, Columbus, and Cincinnati – are the state’s key areas experiencing notable market dynamics in 2026:

- Cleveland – Projected moderate price growth, while the market remains balanced

- Columbus – Projected price stabilization, maintaining its status as a top-performing Ohio market

- Cincinnati – Projected slight price growth, reflecting national trends, though inventory remains relatively tight

Ohio’s market is expected to resume sales activity, supported by increased inventory and a slight shift toward a more balanced environment. Real estate prices remain to be affordable, compared to other states, attracting buyers and investors from all across the country.

Conclusion

2026 might be a great time to buy a house, achieve homeownership, and start building your long-term wealth. AD Mortgage, a leading mortgage lender, provides over 20 loan programs to help brokers turn their clients’ dreams into reality.

Submit a loan scenario today, and our experts will contact you within 30 minutes with a personalized solution tailored to your clients’ needs.