Capital gains tax – you’ve likely heard the term, especially when discussing investment properties with your clients. But do you fully understand its implications? As a mortgage professional, you’re deeply involved in transactions where capital gains tax plays a significant role, and having a solid grasp of this tax can be a real asset, both for your clients and your business.

For many of your clients, capital gains tax often comes into play when they sell a property, whether it’s their primary residence, a second home, or an investment property. The stakes are high: a large capital gains tax bill can eat into their profits, leaving them with less money to reinvest, pay down debt, or achieve other financial goals. As someone they trust, you’re in a great position to help them figure this out. By understanding how capital gains tax works, you can provide valuable advice that helps them save money and make the right decisions about refinancing or purchasing new properties.

This guide is here to help you do just that. We will break down everything you need to know about capital gains tax. From the fundamental definitions and how it’s calculated to the differences between short- and long-term rates, special asset considerations, and strategies for minimizing tax liabilities, we’ll explain all the ins and outs of capital gains tax.

What Is Capital Gains Tax?

Capital gains tax is a tax on the profit, or ‘gain,’ made when selling a capital asset – something a person owns that has increased in value. This tax is only applied when the asset is actually sold, a process known as ‘realization.’ Simply owning an asset that rises in value does not trigger capital gains tax; the tax is due only when the gain is converted into cash through a sale. This profit is referred to as a capital gain. For example, let’s say one of your clients bought a house for $400,000, and its current market value is $500,000. They haven’t sold the house yet. This $100,000 increase in value is called an unrealized gain. They don’t owe any capital gains tax on it at this point. The tax only becomes due if and when they sell the house for a profit. Only then does the gain become realized.

The types of assets that can trigger capital gains tax vary. For mortgage professionals, the most common capital asset you’ll encounter is real estate. This includes houses, apartments, land, and other types of property. It’s essentially any property your client owns that’s expected to increase in value over time. However, capital gains tax isn’t limited to real estate. It can also apply to a wide range of other assets, such as:

- Stocks and bonds. Selling stocks or bonds for more than their purchase price can result in a capital gain

- Collectibles. High-value items such as artwork, antiques, rare coins, or stamps can be considered capital assets. Selling them for a profit may trigger taxation.

- Digital Assets. In today’s digital economy, cryptocurrencies like Bitcoin and Ethereum, as well as NFTs (Non-Fungible Tokens), are increasingly subject to capital gains tax when sold for a profit.

- Business Assets. If someone sells a business, certain assets within it (e.g., equipment, intellectual property, or goodwill) may be taxed as capital gains.

How Do Capital Gains Taxes Work?

Now that you have a basic understanding of what it is, let’s take a closer look at how capital gains tax works. The key to calculating capital gains tax is figuring out the capital gain, the profit made when an asset is sold. This might seem complicated, but it boils down to a relatively straightforward process. The basic idea is to subtract the adjusted cost basis of the asset from its selling price. The result is the capital gain (or loss). Let’s break down each of these components.

Selling Price

The selling price is simply the amount of money received when the asset is sold. It is usually a straightforward figure.

Adjusted Cost Basis

The adjusted cost basis is essentially what was paid for the asset, plus any costs added over time to improve or maintain it. These additions are important because they reduce the taxable gain. For real estate, which is a key area for mortgage professionals, these additions can include either things related to purchase expenses, including appraisal fees and closing costs, or capital improvements to the property, such as adding a new room, renovating the kitchen, or replacing the roof. Minor repairs, such as fixing a leaky faucet, typically do not qualify as part of the adjusted cost basis. The key is that the improvement must add value to the property or extend its useful life.

Example Calculation

Once you have both the selling price and the adjusted cost basis, calculating the capital gain is simple. Here’s how it works in practice. Let’s say your client, a savvy investor, purchased a building in 2012 for $1,800,000. Over the years, they spent $200,000 on upgrades, like a new HVAC system and roof repairs. These improvements increased the building’s adjusted cost basis to $2,000,000. After more than a decade, they decide to sell it for $3,450,000

To calculate the capital gain:

Selling Price ($3,450,000) – Adjusted Cost Basis ($1,800,000+$200,000) = Capital Gain ($1,450,000)

This $1,450,000 gain is the amount that gets taxed. Notice how the improvements reduced their taxable gain. However, exemptions and deductions may apply depending on the type of property and how long it was owned.

Timing of Capital Gains Taxes

It’s crucial to remember that capital gains taxes are due in the tax year the asset is sold. As SmartAsset notes, “Capital gains tax is typically reported and paid when you file your federal income tax return, due in April each year for individuals.”

For example, if your client sells a property in 2025, they will owe capital gains taxes on that sale when they file their 2025 taxes, typically by April 2026.

Importance of Record-Keeping

Keeping accurate records of purchase costs and capital improvements is essential for your clients to properly calculate their capital gains and avoid any issues with the tax authorities. As a mortgage professional, you can advise your clients on the importance of this record-keeping and how it ties into their overall financial picture.

Capital Gains Tax Rates & Classifications

Capital gains aren’t all taxed the same way. The tax rate depends on how long the asset has been held and the owner’s income level. Let’s break it down.

Choose a top nationwide lender that cares about your growth!

Get Started

Short-Term vs. Long-Term Gains

The key difference between short-term and long-term capital gains is the holding period. If an owner sells an asset they’ve owned for “one year or less,” the gain is considered short-term. These gains are taxed as ordinary income, meaning they’re subject to the same rates as salary or wages. For most taxpayers, this results in a higher tax rate compared to long-term gains. On the other hand, if an owner sells an asset they’ve owned for “more than one year,” the gain is classified as long-term. Long-term gains benefit from lower tax rates, which are designed to encourage long-term investment. According to the IRS, “To determine how long you held the asset, you generally count from the day after the day you acquired the asset up to and including the day you disposed of the asset.”

Capital Gains Tax Rates

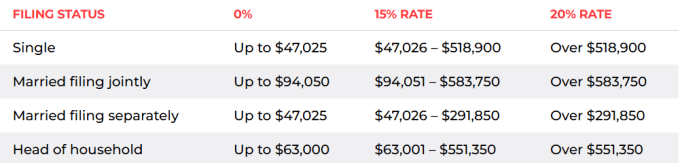

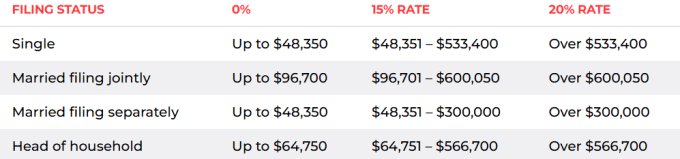

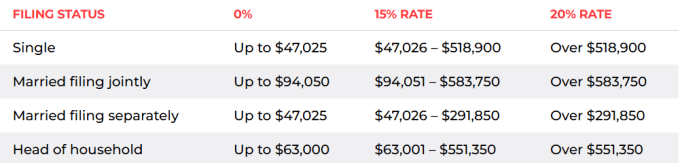

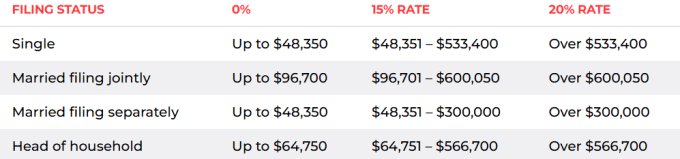

Tax rates on long-term capital gains depend on a person’s taxable income and filing status. According to Bankrate, the 2024 and 2025 long-term capital gains tax brackets are as follows:

For the 2024 tax year

For the 2025 tax year

As mentioned, short-term gains are taxed at ordinary income tax rates. These rates range from 10% to 37%, depending on the taxable income and filing status. This highlights the significant tax advantage of long-term capital gains for many taxpayers.

According to Bankrate, the 2024 and 2025 short-term capital gains tax brackets are as follows:

For the 2024 tax year

| FILING STATUS |

10% RATE |

12% RATE |

22% RATE |

24% RATE |

32% RATE |

35% RATE |

37% RATE |

| Single |

Up to $11,600 |

$11,601 to $47,150 |

$47,151 to $100,525 |

$100,526 to $191,950 |

$191,951 to $243,725 |

$243,726 to $609,350 |

Over $609,351 |

| Head of Household |

Up to $16,550 |

$16,551 to $63,100 |

$63,101 to $100,500 |

$100,501 to $191,950 |

$191,951 to $243,700 |

$243,701 to $609,350 |

Over $609,351 |

| Married Filing Jointly |

Up to $23,200 |

$23,201 to $94,300 |

$94,301 to $201,050 |

$201,051 to $383,900 |

$383,901 to $487,450 |

$487,451 to $731,200 |

Over $731,201 |

| Married Filing Separately |

Up to $11,600 |

$11,601 to $47,150 |

$47,151 to $100,525 |

$100,526 to $191,950 |

$191,951 to $243,725 |

$243,726 to $365,600 |

Over $365,601 |

For the 2025 tax year

| FILING STATUS |

10% RATE |

12% RATE |

22% RATE |

24% RATE |

32% RATE |

35% RATE |

37% RATE |

| Single |

Up to $11,925 |

$11,926 to $48,475 |

$48,476 to $103,350 |

$103,351 to $197,300 |

$197,301 to $250,525 |

$250,526 to $626,350 |

Over $626,351 |

| Head of Household |

Up to $17,000 |

$17,001 to $64,850 |

$64,851 to $103,350 |

$103,351 to $197,300 |

$197,301 to $250,500 |

$250,501 to $626,350 |

Over $626,351 |

| Married Filing Jointly |

Up to $23,850 |

$23,851 to $96,950 |

$96,951 to $206,700 |

$206,701 to $394,600 |

$394,601 to $501,050 |

$501,051 to $751,600 |

Over $751,601 |

| Married Filing Separately |

Up to $11,925 |

$11,926 to $48,475 |

$48,476 to $103,350 |

$103,351 to $197,300 |

$197,301 to $250,525 |

$250,526 to $375,800 |

Over $375,801 |

Special Asset Classes

While the above capital gains tax rates apply to most capital assets, there are some exceptions. Certain types of assets have specific tax rules. According to the IRS, these are: “1. The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate.

- Net capital gains from selling collectibles (such as coins or art) are taxed at a maximum 28% rate.

- The portion of any unrecaptured section 1250 gain from selling section 1250 real property is taxed at a maximum 25% rate.”

| Asset Type | Tax Rate |

|---|

| Section 1202 Qualified Small Business Stock Single | Up to 28% |

| Collectibles | Up to 28% |

| Unrecaptured Section 1250 Real Property Gains | Up to 25% |

As a mortgage professional, you often work with clients who own or are looking to own real estate. Understanding the tax implications of real estate transactions, including the special rules for depreciable property, can be a valuable asset in your interactions with clients. For example, knowing how long-term vs. short-term gains are taxed can help clients make decisions about when to sell a property.

Capital Gains on Investment Property

As a mortgage professional, you frequently deal with real estate transactions, and many of your clients are investors. Knowing how capital gains tax works for investment properties is a real advantage – it helps you give your clients better advice and strengthens your relationship with them.

When your client sells an investment property, like a rental home or a vacation house, they are subject to capital gains tax on the profit according to the rules and rates mentioned above. However, the sale of a primary residence can often qualify for a tax break. As the IRS explains, “If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint return with your spouse.” This exclusion only applies to the place where your client actually lives. There are also rules about how long a taxpayer must own and live in a home to qualify for the exclusion. The main ones are:

- Ownership and residence requirement. “You owned the home and used it as your residence for at least 24 months of the previous 5 years.”

- Look-back requirement. “You didn’t sell another home during the 2-year period before the date of sale.”

This tax break can save homeowners a lot of money, but it’s not available for investment properties. For example, if your client sells a rental, a second home, or just a piece of land, they’ll owe capital gains tax on the entire profit. The good news is that real estate investors have a few options to minimize their tax burden.

1. 1031 Exchange

This is a popular strategy among real estate investors. A 1031 exchange allows sellers to defer capital gains taxes if they reinvest the proceeds into another investment property. According to the IRS: “.01 Section 1031(a) provides that no gain or loss is recognized on the exchange of property held for productive use in a trade or business or for investment (relinquished property) if the property is exchanged solely for property of like kind that is to be held either for productive use in a trade or business or for investment (replacement property).”

In simple terms, this means that an investor can sell one investment property and buy another similar property without immediately paying capital gains tax. However, this doesn’t eliminate the tax liability, it only postpones it. The IRS clarifies: “IRC Section 1031 provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free.”

To qualify, investors must identify the new property within 45 days and complete the purchase within 180 days of selling the original property (IRS).

2. Opportunity Zones

Opportunity Zones are another way for real estate investors to save on taxes. These are special areas in the U.S. that the government has designated as needing economic growth. If your client sells an investment property (or any asset) and reinvests the profit into one of these zones, they can defer taxes on eligible gains.

3. Installment Sales

Rather than receiving a lump sum, an investor can structure the sale as an installment sale, receiving payments over time. Capital gains tax is only due as payments are received, potentially keeping the seller in a lower tax bracket and spreading out the tax liability.

4. Converting an Investment Property to a Primary Residence

Investors may reduce capital gains tax by converting an investment property into their primary residence. According to real estate expert Scott Westfall, “Moving into your investment property could allow you to sell your current primary home right away. After two years, you can then sell your rental property and avoid paying capital gains tax on most, if not all, of the profit from that sale as well.” (Investopedia)

This strategy works because if an investor moves into their investment property and lives in it for at least two years, they may qualify for the same capital gains exclusion available to homeowners. This could allow them to avoid taxes on gains from the sale of both properties, assuming all the IRS requirements are met.

While these approaches may save your clients money, each situation is unique. Encourage them to consult a tax professional to determine the best course of action for their specific circumstances.

Strategies for Minimizing Capital Gains Tax

Nobody likes paying more taxes than they have to. As a mortgage professional, you can be a real asset to your clients if you have some smart strategies for minimizing capital gains tax in your arsenal. Here are a few things you can discuss with them:

Enhanced Broker Portal

that makes your job easier

- All operations at your fingertips

- Easy-to-use intuitive interface

- Integrated AI technology

Show Me How

1. Holding Period Considerations

One of the simplest ways to reduce capital gains tax is by holding investments for over a year. This converts profits into long-term capital gains, which are typically taxed at lower rates than short-term gains. That extra time can significantly reduce your client’s tax liability.

2. Tax-Loss Harvesting

Your clients can offset taxable gains by selling underperforming investments at a loss, a strategy known as tax-loss harvesting. For example, if a client makes a $50,000 profit on a rental property but sells stocks at a $20,000 loss, they can use that loss to lower their taxable gain to $30,000. Unused losses can even be carried forward to future years.

3. Cost Basis Adjustments

Cost basis (the original purchase price plus improvements and fees) directly affects taxable gains. A higher cost basis reduces the taxable gain when selling an asset. For real estate, this includes renovations, repairs, and closing costs. Keeping detailed records of these expenses is crucial to maximizing tax savings.

4. Utilizing Tax-Advantaged Accounts

Retirement accounts like 401(k)s, IRAs, and Roth IRAs can also help with capital gains tax. Investments in these accounts grow tax-free or tax-deferred, so your clients won’t owe capital gains tax on the growth until they withdraw the money (or at all, with Roth IRAs). For clients investing in stocks or mutual funds, these accounts are a smart way to avoid immediate taxes.

5. Timing Asset Sales

If your client with a potential gain is nearing the end of the tax year, it may be better to wait until the next year to sell it, so they can postpone paying the tax.

6. Choosing the Right Cost-Basis Method

When selling stocks or other investments, your clients can choose how their cost basis is calculated. The two most common methods are:

- FIFO (First In, First Out). The oldest shares are sold first. If prices have risen, this may result in a higher taxable gain.

- LIFO (Last In, First Out). The most recent shares are sold first. If prices have increased, this often results in a lower taxable gain.

Choosing the right method can significantly impact tax liability, so it’s wise to consult a tax professional.

7. Consulting With a Tax Advisor

Tax laws are complex, and every situation is unique. For complicated scenarios, or if your client is dealing with big gains, it’s always a good idea to talk to a tax advisor or financial planner. They can give personalized advice and help create a tax-smart investment plan.

Frequently Asked Questions

1. What is the difference between short-term and long-term capital gains?

The key difference is the length of time an asset is held before being sold. If an asset is owned for one year or less, the profit is considered a short-term gain. If it is held for more than one year, it qualifies as a long-term gain. Long-term gains are typically taxed at lower rates, making the holding period an important factor in tax planning.

2. How to calculate capital gains?

It is a two-step process. First, determine the adjusted cost basis, which typically includes the original purchase price of the asset plus certain expenses such as closing costs or the cost of major improvements. Then, subtract the adjusted cost basis from the selling price. The result is the capital gain or loss.

3. What strategies can help reduce tax liabilities?

- Holding investments for more than one year to qualify for lower long-term capital gains rates.

- Using a 1031 exchange to defer taxes when selling an investment property and purchasing another.

- Offsetting gains with losses through tax-loss harvesting by selling underperforming investments to reduce taxable gains.

- Tracking cost basis by including improvements and fees to minimize taxable profits.

- Utilizing retirement accounts such as IRAs and 401(k)s, which offer tax-free or tax-deferred growth.

- Consulting a tax professional for guidance on large sales or complex transactions.

Conclusion

Capital gains tax may seem overwhelming, but with the right knowledge, it becomes manageable. Now, you have valuable insights to better serve your clients. From understanding the core mechanics of capital gains calculations and the impact of holding periods to 1031 exchanges and other tax-minimizing strategies, you’re ready to offer proper guidance.

The best next step? Stay informed and proactive. Keep track of tax law updates, educate your clients on potential tax liabilities, and connect with experienced tax professionals when needed.

If you want to learn more about how capital gains tax impacts mortgage financing, reach out to our team. We’re here to support you with the insights and solutions that help you and your clients make smarter financial moves.