Ever had a client come to you with a unique financial need – maybe they’re looking to renovate their kitchen, consolidate some high-interest debt, or even fund their child’s college education – and a traditional mortgage just doesn’t quite fit the bill? That’s where the power of home equity loans comes in, giving your clients a way to borrow more against the equity they’ve built up in their homes. For you as a mortgage professional, this isn’t just another product to offer; it’s a chance to connect with your clients on a deeper level, helping them unlock the value of their homes while growing your own business.

But here’s the catch: to truly stand out, you need to understand these loans inside and out. You need to know how these loans fit into your clients’ financial picture, who they’re best for, and how to explain them in a way that makes sense. That’s where AD Mortgage can make a difference. As your trusted partner, we’re here to make sure you’re not just offering home equity loans – you’re offering the right solutions with confidence and ease. We’re not just a lender. We’re your support system, providing the tools and expertise you need to succeed.

That’s why in this guide, we’ll break down everything you need to know about home equity loans: how they work, their pros and cons, the qualification process, and even alternatives for clients who may need a different solution. Let’s get started.

What is a Home Equity Loan?

So, what exactly is a home equity loan? It’s a type of loan that allows homeowners to borrow money by using the equity they’ve built up in their property as collateral. Moreover, it typically offers lower interest rates compared to unsecured loans, making it an attractive option for many homeowners. But what’s driving the demand for this type of product? Homeowners are currently sitting on record levels of equity, and many are looking for ways to put it to work.

“Home equity is driving record growth for American household wealth. Homeowners now have more than $35 trillion in home equity as of the second quarter of 2024, according to Federal data – an all-time high” (The Currency editors). In that quarter, the average U.S. homeowner gained approximately $25,000 in equity over the past year (CoreLogic). Whether it’s funding a major life expense, like education or medical bills, or simply improving their living space, home equity loans provide a flexible, low-interest option that’s hard to beat. Borrowers receive the full loan amount at once and repay it over time with a fixed interest rate and consistent monthly payments. This structure makes it a popular choice for homeowners who need a large sum of money for a specific purpose.

Other Names for Home Equity Loans

You might also hear home equity loans referred to by other names. “Second mortgage” or “second lien” is a common synonym, and it’s easy to see why. Since it’s a loan taken out in addition to a primary mortgage, it effectively becomes a second lien on a borrower’s home. Another term you might come across is “home equity installment loan.” This name emphasizes the structured repayment plan, where borrowers receive a lump sum upfront and repay it in fixed monthly installments over a set term. These different terms all refer to essentially the same product. That’s why it’s good to be familiar with them so you can explain them clearly to your clients.

Second Mortgage:

Solutions for brokers!

- Up to 85% CLTV

- $500K max loan, up to 50% DTI

- No prepay penalties

Expand Your Offerings — Contact Us Today!

Discover Program

How Does a Home Equity Loan Work?

So, how does the process of borrowing against home equity actually unfold? Let’s go through it step by step.

As homeowners pay down their mortgage over time, the difference between what they owe and their home’s current market value becomes their equity. A home equity loan lets them tap into that equity, providing a lump sum of cash. It’s important to note that this loan uses the home as collateral, meaning if the borrower fails to repay, the lender could foreclose on the property.

1. Determining Borrowing Limits

To determine how much a homeowner can borrow, the lender will assess the home’s value and the remaining balance on the existing mortgage. This calculation helps establish the available equity. Lenders use a Combined Loan-to-Value (CLTV) ratio, which takes into account all loans secured by the property, including the first mortgage and the potential home equity loan. Each lender has its own CLTV limit, typically ranging from 80% to 85%.

For example, let’s say a homeowner’s property is valued at $600,000, and they still owe $300,000 on their original mortgage. That means they currently have $300,000 in equity. If the lender’s maximum CLTV is 80%, they will calculate 80% of the home’s value ($600,000 x 0.80 = $480,000). Then, they subtract the existing mortgage balance ($480,000 – $300,000 = $180,000). In this case, the homeowner could potentially borrow up to $180,000 with a home equity loan. It’s important to note that the homeowner’s credit score, income, and debt-to-income ratio also play a significant role in determining the final loan amount.

2. Lump-Sum Disbursement

Once the loan amount is determined and approved, the borrower receives the entire amount as a lump sum. This one-time disbursement can be used for any purpose, whether it’s consolidating debt, funding home improvements, or covering major expenses.

3. Fixed Interest Rate and Repayment

Repayment begins shortly after the funds are disbursed. As we’ve mentioned before, home equity loans typically have fixed interest rates and fixed repayment schedules. This means the monthly payments will remain the same throughout the loan term. This makes budgeting much easier for borrowers. The fixed interest rate also protects them from potential interest rate increases during the loan term.

4. Building Equity Back

Each monthly payment includes both principal and interest. Early in the loan term, a larger portion of payments goes toward interest, while a smaller portion reduces the principal. Over time, as the principal balance decreases, more of the payment goes toward paying down the principal. Thus, borrowers build equity back as they repay the loan.

Pros and Cons of Home Equity Loans

Home equity loans come with their own set of pros and cons. Understanding both sides of the coin is essential for you as a mortgage professional, and even more so for your clients. A balanced perspective will help you provide the best advice possible.

Pros of Home Equity Loans

1. Lower Interest Rates

Home equity loans often have lower interest rates compared to credit cards or personal loans because they are secured by the property. For example, the average interest rate for a home equity loan is around 8.43% (CBS News), while credit card rates average 22.80% (CBS News). This makes them a cost-effective borrowing option.

2. Predictable Payments

Most home equity loans come with fixed interest rates and predictable monthly payments, making it easier for clients to budget and plan their finances.

3. Borrowing Potential

Homeowners can often borrow a significant amount of money, depending on their home’s equity.

4. Tax Deductibility

In some cases, the interest paid on a home equity loan may be tax-deductible if the funds are used for home improvements. This can provide additional financial benefits for your clients.

5. Flexibility

Unlike some loans that restrict how the money can be used, home equity loans allow borrowers to spend the funds on almost anything, from medical bills to starting a business.

Cons of Home Equity Loans

1. Risk of Foreclosure

Since the loan is secured by the home, failing to make payments could result in the loss of the property. This is a significant risk for clients who may face financial instability.

2. Additional Debt Load

Taking out a home equity loan increases the borrower’s overall debt, which can strain their finances if they’re not prepared. Additionally, it extends the time clients spend paying off debt, which could delay other financial goals like retirement savings or investments. The typical repayment term for a home equity loan is 5 to 30 years, depending on the lender (Experian).

3. Closing Costs and Fees

Home equity loans often come with closing costs, appraisal fees, and other expenses, which can add up and reduce the overall benefit of the loan. On average, closing costs for a home equity loan range from 2% to 5% of the loan amount (Bankrate).

4. Reduced Home Equity

Borrowing against home equity decreases the amount of ownership your client has in their property. This could be problematic if they plan to sell the home or need equity for future financial needs.

The role of mortgage broker is to present these pros and cons clearly and objectively. You need to help your clients weigh the benefits against the risks and determine if a home equity loan is the right financial solution for their specific circumstances. This involves understanding their financial goals, their risk tolerance, and their ability to manage the additional debt. For example, for clients with steady incomes and clear plans for using the funds, a home equity loan can be a smart choice. However, for those with uncertain financial situations or who are uncomfortable risking their home, alternative options may be more suitable.

How to Qualify and Get a Home Equity Loan

Helping clients qualify for a home equity loan can feel like a big task, but breaking it down into clear steps makes it much easier. So, here’s a simple, step-by-step guide:

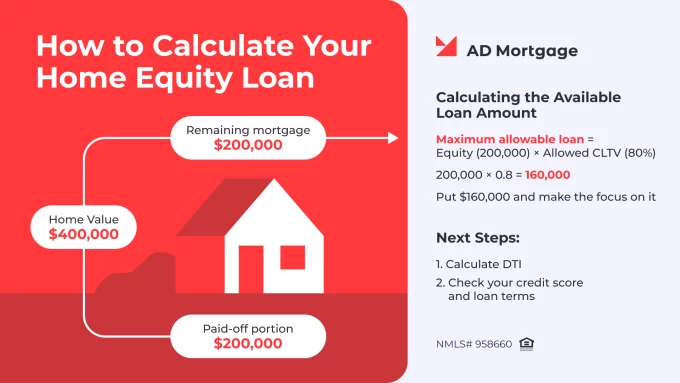

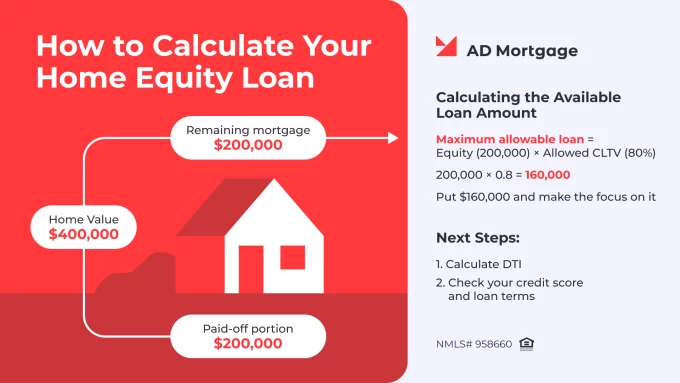

1. Getting a Home Appraisal and Calculating Available Equity

Lenders need to know how much equity is in the home before approving a loan. This starts with a home appraisal to determine the current market value. The available equity is calculated as follows:

Home Value – Remaining Mortgage Balance = Available Equity

Most lenders allow borrowing up to 80 – 85% of a home’s equity (according to NerdWallet). For example, if a home is worth $400,000 and the mortgage balance is $200,000:

$400,000 – $200,000 = $200,000 (Total Equity)

At an 80% loan-to-value (LTV) ratio, the homeowner could qualify for up to $160,000.

2. Checking Debt-to-Income Ratio (DTI)

Next, lenders want to make sure your client can comfortably repay the loan. So, they will look at the client’s debt-to-income ratio, or DTI. This is just an easy way of figuring out how much of their income is already going toward debt payments. To calculate it, add up all your client’s monthly debt payments (like credit cards, car loans, and the new home equity loan payment) and divide that by their gross monthly income. Here’s how it works:

DTI = (Total Monthly Debt Payments / Gross Monthly Income) x 100%

For example, if your client has 2,000 in monthly debt payments and makes 6,000 per month, their DTI is (2,000 / 6,000) x 100 = 33.3%. Most lenders prefer a DTI below 43% (according to NerdWallet), though some may accept higher ratios for clients with strong credit scores or other assets.

3. Assessing Credit Score

Credit scores play a significant role in qualifying for a home equity loan. Most lenders require a score of at least 620 (according to NerdWallet) to qualify for a home equity loan, but the higher the score, the better the terms. For example, someone with a 750 score might get an interest rate of 7.5%, while someone with a 650 score might be looking at 9%. If your client’s score is on the lower end, you can suggest ways to bump it up before applying, like paying down credit card balances or fixing any errors on their credit report.

4. Gathering the Paperwork

Once the numbers look good, it’s time to help your client gather the documents the lender will need. This usually includes things like pay stubs, tax returns, and proof of identity. It’s also helpful to have details about the property ready, like the address and any recent improvements. You can make this step easier by giving the client a checklist of everything they’ll need. The more organized they are, the smoother the process will be.

5. Comparing Offers and Closing the Loan

After the application is submitted, the lender will come back with an offer. This is where you can really help by walking your client through the details. Compare interest rates, fees, and repayment terms from different lenders to find the most appropriate deal. Once they’ve chosen a loan, the final step is closing. This is when they’ll sign the paperwork and pay any closing costs. Make sure they understand the terms and what they’re agreeing to before they sign.

By walking clients through these steps, you can make the home equity loan process feel less overwhelming.

Comparisons & Alternatives

Home equity loans are a popular way for homeowners to access cash, but they’re not the only option. As a mortgage professional, it’s important to understand how they stack up against other financing tools so you can guide your clients to the best fit for their situation. Let’s take a look at how home equity loans compare to cash-out refinances and HELOCs.

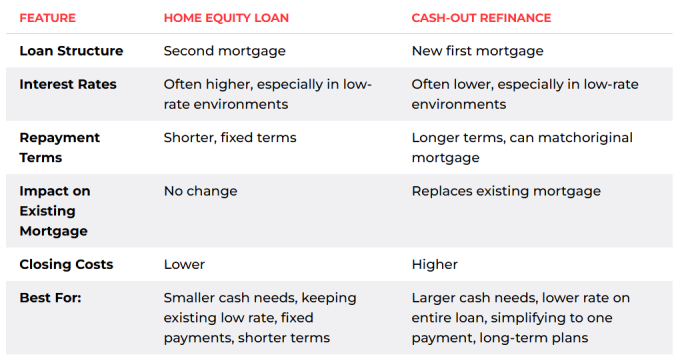

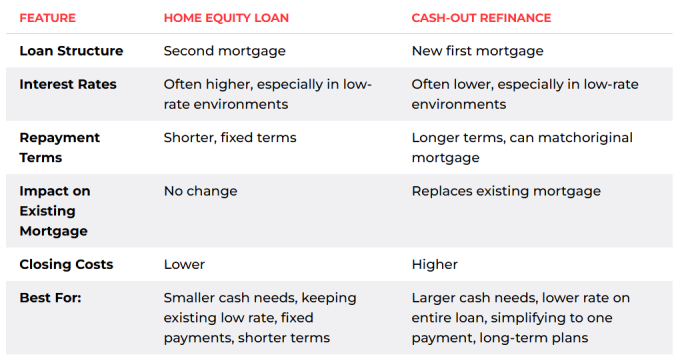

Home Equity Loans vs. Cash-Out Refinances

Both home equity loans and cash-out refinances allow homeowners to tap into their equity. However, they differ significantly. First, a home equity loan is a second mortgage, meaning a borrower keeps their existing first mortgage and adds a new loan on top of it. A cash-out refinance replaces their existing mortgage with a new, larger loan, potentially lowering the rate while providing cash. The difference between the new loan amount and their old loan balance is the cash they receive.

Second, home equity loans often have higher interest rates than cash-out refinances, especially in times of low interest rates. This is because they are considered a higher risk for lenders.

Third, home equity loans typically have shorter, fixed repayment terms. Cash-out refinances can have longer terms, sometimes matching the length of the original mortgage.

Fourth, a home equity loan doesn’t affect the existing mortgage, while a cash-out refinance replaces the existing mortgage, potentially changing the interest rate and monthly payment on the original loan amount.

Finally, closing costs can be higher for cash-out refinances because a new first mortgage is being created.

Here’s a summary comparison of home equity loans and cash-out refinances:

Home Equity Loans vs. Home Equity Lines of Credit (HELOCs)

A HELOC is a revolving line of credit secured by a borrower’s home equity. Unlike a home equity loan, which provides a lump sum upfront, a HELOC allows your client to borrow and repay funds as needed, up to a pre-approved limit.

Home equity loans typically have fixed interest rates. HELOCs, on the other hand, usually have variable interest rates, meaning they can fluctuate with market conditions. Home equity loans have fixed monthly payments over a set term, while HELOCs often have a draw period where your client can borrow funds and make interest-only payments, followed by a repayment period where they repay the principal and interest. Overall, HELOCs are more flexible, allowing for borrowing and repaying as needed.

Here’s a quick comparison of home equity loans and HELOCs:

| Feature | Home Equity Loan | HELOC |

|---|

| Loan Structure | Lump-sum loan | Revolving line of credit |

| Interest Rates | Fixed | Variable |

| Repayment Terms | Fixed monthly payments over the same term | Draw period (interest-only), then repayment period (principal & interest) |

| Flexible | Less flexible | More flexible |

| Best For: | Specific cash amount, one-time expense, fixed rate, predictable payments, structured repayment | Ongoing expenses, flexible borrowing/repayment, comfortable with variable rate |

When to Recommend Each Option

Home Equity Loans

These are ideal for clients who need a predictable, one-time lump sum. For example, a client planning a major home renovation or consolidating high-interest debt might benefit from the fixed rates and set repayment schedule.

Cash-Out Refinance

This option works best for clients who want to access equity while also lowering their mortgage rate. For instance, if current rates are significantly lower than their existing mortgage rate, a cash-out refinance could save them money in the long run.

HELOCs

HELOCs are great for clients who need flexibility. If a client is unsure how much they’ll need or expects ongoing expenses (like funding a child’s education or covering medical bills), a HELOC allows them to borrow only what they need, when they need it.

Frequently Asked Questions (FAQs)

How does a home equity loan differ from a HELOC?

- Home Equity Loan is a lump-sum loan with a fixed interest rate and fixed monthly payments over a set term (usually 5-30 years). Best for one-time expenses like renovations or debt consolidation.

- HELOC is a revolving line of credit with a variable interest rate. Borrowers can draw funds as needed during the draw period (usually 5-10 years) and repay during the repayment period. Best for ongoing or unpredictable expenses.

What factors affect the interest rate?

Several factors influence your interest rate:

- Credit Score. Higher scores typically qualify for lower rates.

- Loan-to-Value (LTV) Ratio. Lower LTV ratios (more equity) often result in better rates.

- Debt-to-Income (DTI) Ratio. Lower DTI ratios show better financial stability and can secure lower rates.

- Market Conditions. Interest rates fluctuate based on broader economic trends.

How can brokers advise clients on repayment planning?

Brokers can guide clients in several ways:

- Budgeting. Help clients calculate how the new payment fits into their monthly budget.

- Extra Payments. Suggest making extra payments to reduce interest costs and pay off the loan faster.

- Emergency Fund. Encourage clients to maintain savings to cover payments during financial setbacks.

- Refinancing Options. Discuss refinancing if rates drop significantly or their financial situation improves.

Conclusion

We’ve walked through the key pieces of the home equity loan puzzle. By now, you should have a clearer picture of how these loans work, their benefits and drawbacks, and how they stack up against other options like cash-out refinances and HELOCs. But more importantly, you can feel more confident advising your clients about their options.

Remember, you’re not just pushing loans; you’re offering solutions. You’re helping people reach their financial goals, whether it’s sprucing up their homes, getting a handle on debt, or making a big life event happen. Your clients trust you to guide them toward what’s right for them. That means really listening to their needs, explaining the ins and outs of each option in plain English, and helping them weigh the pros and cons. It’s about building trust and showing them you’re the expert. When you do that, you’re not only helping them; you’re building a thriving business for yourself.

But you don’t have to do it alone. At AD Mortgage, we’re committed to being more than just another mortgage lender. We want to be your go-to partner, providing the resources, expertise, and support to help you grow.