Bill and Allison were realizing their dreams. They had saved money, built their credit scores, and finally bought a home of their own at a price they could afford. One year later, Bill and Allison received a notice that their house payment was increasing by $1200 a month.

Of course, Bill and Allison had the same response many of us would of had. ‘We have a fixed rate mortgage, this must be a mistake!’ They immediately called their loan servicer to inform them of the error. What they discovered shocked them.

A Nationwide Problem

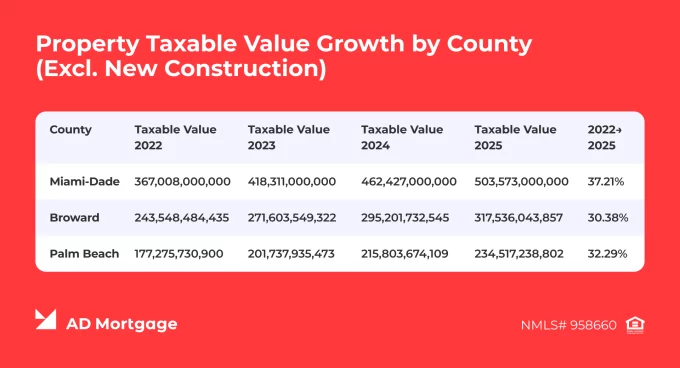

What’s even more shocking is that they aren’t alone. This is happening across the nation and in some states much more than others.

So, how does this happen? Why are lenders changing the payments? The short answer is that the lenders and loan servicing companies aren’t behind the payment changes, but they are tasked by law to implement them. The reason lies with local tax assessment authorities that do valuations of the properties in their jurisdictions. Increased valuations mean property tax increases.

We spoke with Orlando Diaz, President of the Florida Association of Mortgage Professionals (FAMP) and Metro Fund Inc, about this issue and his insights were illuminating. Diaz noted, ‘this issue has been a recurring challenge for decades. The importance of educating homeowners about escrow and payment adjustments can’t be stressed enough, as many are unaware of how property valuations and payments work.’

Periodic valuations are done in order to determine property taxes for homeowners and other property in the area. Consequently, if a home sees a huge jump in value, the property taxes and insurance for that property are going to increase. The county or other local authority doesn’t need to change the tax rate for a property tax increase since these taxes are a percentage of the value.

Additionally, insurance companies will need to adjust premiums if the value of the insured property increases significantly. This means the homeowners can be hit with a massive increase in mortgage payments.

The following graph shows how property valuations have skyrocketed over the last few years in Miami-Dade, Broward, and Palm Beach counties in Florida.

Why Lenders and Servicers Adjust Escrow Payments

We spoke to Marina Osipova, an Escrow Specialist at AD Mortgage. She explained why monthly escrow payments can change from year to year and how they calculate those changes.

‘Monthly payment adjustments may occur after a yearly escrow account recalculation. By law, an escrow account needs to be analyzed at least once per year. It is done to assess how many disbursements were made in the year and to project the funds needed for the following year’s disbursements. If the projected tax disbursement amount has been changed compared to the previous year, the monthly payment will need to be adjusted.’

Marina also shared the formula used for setting escrow payment amounts.

How Your Escrow Monthly Payment is Calculated

The total amount of projected disbursements is divided by 12 (months), but the escrow account, according to law, should not fall below the ‘cushion amount’. The cushion amount is 1/6 of the total projected disbursement amount. In other words, it is two monthly escrow payments. When the total amount of disbursements increases from year to year, the cushion required also increases.

For example:

Your escrow portion of your monthly payment is $300 because your total projected taxes and insurance is $3600 for the year. When the county increases the assessed value of your property, insurance companies often raise your rates to compensate for the extra value.

Your home loan servicer does your yearly escrow analysis and calculates your new annual escrow payments. Using this formula, they determine your new monthly escrow payment will be $450 a month ($5400 a year). In this case, the homeowner must pay the additional amount ($150) each month to cover taxes and insurance.

Additionally, the homeowner will also need to bring the minimum balance of their escrow account up to $900, which is two months of escrow payments (the cushion). The difference between the new and existing cushion amount is then divided by 12 and added to the monthly payment.

Significant Budget Impact for Many Families

Many families feel blindsided by the increased monthly payments from property tax increases. After all, they bought their homes with a budget in mind and these increases can create an untenable financial situation for them.

Of course, lenders and loan servicers send notifications by mail and email to borrowers, but these are often overlooked. People commonly don’t look at monthly statements, especially if they use online or automatic payments. Furthermore, emails sent to the borrowers can end up in Spam or Junk folders.

Delayed awareness of the situation can exacerbate the problem, including the depletion of escrow accounts and subsequent insurance issues. Ultimately, responsibility falls on the borrowers, but that doesn’t reduce the impact on families due to oversight. Sharp increases in a short period of time like those illustrated above are a challenge for most families no matter how much notice they have. It doesn’t matter that you can see the train coming if you can’t get off the tracks.

What Borrowers Can Do About Increased Valuations and Costs

Borrowers encountering increases are somewhat limited in effective options to counter them. Orlando Diaz noted that while there are policies for contesting property tax assessments in Florida, such efforts are often unsuccessful.

However, there is good news, at least in Florida. Diaz explained that the Florida legislature is reviewing several bills that would alter the way property taxes are assessed and collected. Some of the reforms even include removing property taxes on primary residences altogether. Once a bill is approved, it will be decided by voters statewide.

Until changes are made in any state, borrowers should stay out in front of the issue. Here are a few suggestions on how to do that:

- Read all your mail and email from your lender or loan servicer, paying special attention to escrow payments and annual escrow analysis.

- Keep in touch with your mortgage broker and realtor about home prices and values in your area.

- Pay attention to your local assessment authority about any changes that affect property owners. Explore options on how to contest any changes if necessary.

What Brokers Can Do to Help

Brokers, realtors, and mortgage professionals can help prepare borrowers for potential changes BEFORE they close. It is important to stress the need to read statements from loan servicers while keeping an eye on county valuation changes.

Brokers taking the initiative to notify clients when valuation changes occur can be a huge help to borrowers. Also, it provides a great reason for reaching out and maintaining relationships clients. Doing a ‘mortgage review’ with the client may also indicate some opportunities for borrowers faced with increased escrow payments. The extra effort will likely earn additional trust and gratitude from the homeowner.

AD Mortgage’s Detailed Proactive Practices

AD Mortgage prefers to get ahead of difficult escrow situations and property tax increases. They inform borrowers promptly when payment amounts are changed and educate them on the process. To help alleviate challenges for homeowners, the AD Mortgage Servicing team has implemented a thorough system of updating information online, sending out notifications and following up with borrowers.

Payment changes following escrow analysis are updated immediately into the loan system and accessible to borrowers. The goal is to update the customer quickly since the changes typically take place in about 45 days. This gives the borrower a chance to review changes for accuracy and dispute any issues before the change takes effect.

Additionally, a paper notification and statement are sent by mail to the borrower following the escrow analysis. AD Mortgage uses regular mail for this since notification must officially arrive within 30 days of escrow analysis as required by regulations.

AD Mortgage simultaneously begins an email notification campaign informing the borrower of the upcoming changes. Customer service agents are trained to explain escrow changes to borrowers. This training is then enhanced by a Quality Assurance team that monitors calls for accuracy.

Conclusion

Increasing property values obviously aren’t going away. The taxes and insurance costs associated with them will also continue to be an issue for homeowners. However, borrowers can arm themselves with information and awareness to reduce stress. Proper planning can alleviate some or all of the headaches that accompany these issues.

As with many pain points in the mortgage industry, the best solution is for borrowers, brokers, and lenders to work together to improve the system. At the very least, they help each other navigate the challenges.