Closing is the last step in a mortgage transaction, when all documents are reviewed and signed, funds are transferred, and ownership passes to the buyer. “How long does a USDA loan take to close?” is a common question among borrowers.

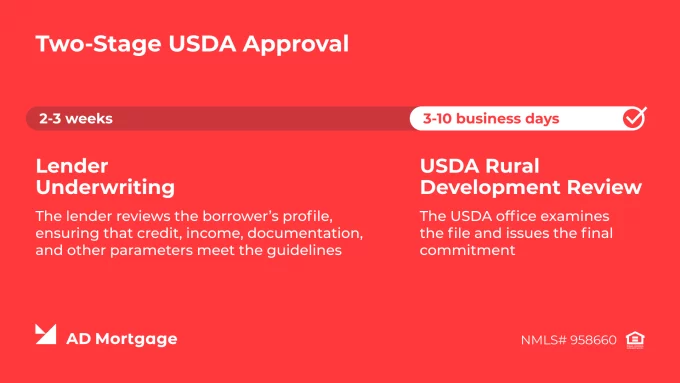

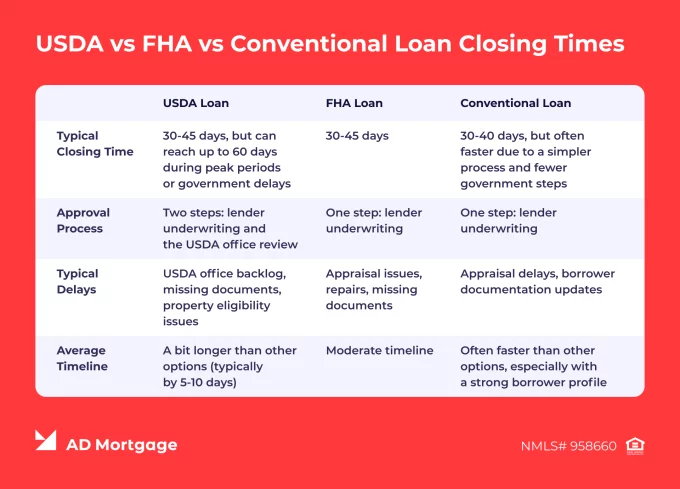

USDA loans require a two-step approval process, meaning that both the lender and the USDA Rural Development office must approve the loan before it can close. On average, USDA loan approval time is 30 to 45 days.

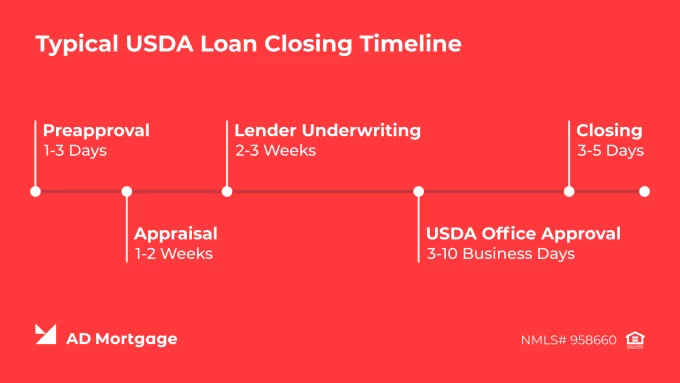

Typical USDA Loan Closing Timeline

While typical closing time for USDA loans is 30-45 days, it might take longer – up to 60 days – during busy periods. Two-step approvals usually take about 3 to 5 weeks:

- Lender Underwriting. In 2-3 weeks, the lender reviews the borrower’s profile, ensuring that credit, income, documentation, and other parameters meet the guidelines. The USDA Handbooks explain this process and its requirements in detail.

- USDA Rural Development Review. In 3-10 business days, the USDA office examines the file and issues the final commitment.

Step-by-Step: USDA Loan Process

The USDA loan process is similar to other mortgage programs, except for the additional USDA office approval. Here are the USDA loan process steps:

- Preapproval (1-3 Days). The broker collects borrower information, including credit score, income, debts, and assets, to check eligibility for a USDA benefit. Then, the mortgage lender issues a pre-approval letter stating whether the borrower qualifies and the maximum loan amount.

- Appraisal and Property Eligibility (1-2 Weeks). The lender orders an appraisal to check whether the home is USDA-eligible and to determine its market value.

- Loan Application and Underwriting (2-3 Weeks). The lender reviews the full documentation, including credit, income, assets, and debt-to-income (DTI) ratio, ensuring they meet the USDA requirements.

- USDA Final Approval (3-10 Business Days). After underwriting, the lender submits the approved file to the USDA Rural Development office for final commitment.

- Closing (3-5 Days). The lender prepares the Closing Disclosure and sends it to the borrower for final review. Then, the documents are signed, funds are disbursed, and ownership is transferred to the borrower.

What Can Delay USDA Loan Closings

USDA turn times might take longer than expected due to one of the following reasons:

- Missing or Incomplete Documentation. This is one of the most common reasons for underwriting delays. Brokers should collect all necessary documentation in advance and submit it at once to avoid issues.

- Appraisal or Property Condition Issues. The home must meet the USDA requirements in terms of safety, security, and livability. Otherwise, repairs or renegotiating the price can add extra time.

- USDA Office Backlog. Processing time varies depending on the workload at the USDA state office. Generally, the timeline is longer during peak seasons like spring and summer.

- Credit or Employment Verification Delays. Job changes, big purchases, or new debts may require additional documentation, and the lender’s reverification can take more time.

- Borrower-Initiated Changes before Closing. Changes in loan terms or borrower information can trigger re-underwriting or require additional verification.

Broker Tip: Submitting a complete loan file upfront can cut USDA approval time by up to a week.

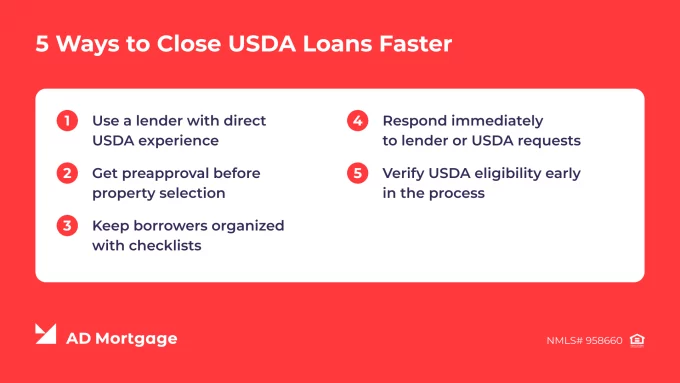

How Brokers Can Speed Up USDA Closings

These five steps can streamline the process and help brokers close the deal faster:

- Use a lender with direct USDA experience. Lenders who often handle USDA loans typically close faster than those who rarely do.

- Get preapproval before property selection. This helps to avoid delays after signing the purchase agreement.

- Keep borrowers organized with checklists. To simplify the process for your clients, offer them a list of required documentation. Lenders report that submitting a complete file makes the process move 30%-40% faster than submitting incomplete files.

- Respond immediately to lender or USDA requests. They might request additional documentation, and back-and-forth communication may extend the timeline.

- Verify USDA eligibility early in the process. Checking that the property meets the location and condition requirements, and the household income aligns with USDA limits, helps avoid rejected files or issues that may delay closing.

FAQ: USDA Underwriting Time

How Fast Can a USDA Loan Close in 2025?

On average, USDA loans close within 30-45 days, but lender’s expert guidance can make the file move faster.

Why Does the USDA Approval Step Add Extra Time?

USDA loans require a two-step approval process, adding the USDA office approval to standard lender underwriting. This step typically takes 3 to 10 business days. During busy periods and peak seasons, the review might take longer, adding extra time to the overall process.

Can I Close Faster with a Broker?

Yes. A broker guides the borrower through the loan process, organizes the timeline, and ensures that all needed documentation is submitted upfront, preventing delays.

How Can I Avoid Delays in USDA Closing?

Brokers can streamline the process by partnering with an experienced lender getting preapproval before property selection and verifying USDA eligibility early in the process.

Conclusion

While on average, the USDA loan timeline is 30-45 days, experienced brokers and efficient lenders can reduce closing time significantly.

AD Mortgage supports brokers through the entire loan process and offers helpful tools such as in-house underwriting and the LEADer CRM system for digital document flow.

To match your client with the mortgage program that covers their needs perfectly, submit a loan scenario. Our mortgage experts will contact you within 30 minutes during working hours to provide a tailored solution.