Accurately calculating monthly mortgage payments is one of the most critical tasks that mortgage brokers can assist their clients with. For borrowers, understanding their monthly payment is essential for effective financial planning and ensuring that they can comfortably manage their mortgage over the long term. However, the calculation isn’t as straightforward as simply dividing the loan amount by the number of payments. It involves several components—principal, interest, property taxes, insurance, and potentially other fees—that all contribute to the total monthly payment.

Get the ADvantage

with our loyalty program

Earn and redeem points for valuable benefits for you and your clients

Unlock Rewards

As a mortgage broker, being well-versed in these calculations allows you to provide clear and accurate information to your clients, helping them to make informed decisions about their mortgage options. Whether you’re guiding first-time homebuyers or experienced investors, having a solid grasp of how to calculate monthly mortgage payments is invaluable. Moreover, the ability to explain these calculations in simple terms can build trust and confidence with your clients, ultimately enhancing your professional reputation. In this article, we’ll delve into the details of monthly mortgage payment components, explore the formula used to calculate these payments, and discuss how to effectively use mortgage calculators to streamline the process for both you and your clients.

Components of a Monthly Mortgage Payment

Understanding the components of a monthly mortgage payment is essential for both mortgage brokers and borrowers. A mortgage payment is not just a simple sum that a borrower pays each month; it’s a combination of several different elements, each contributing to the total amount. Here’s a detailed breakdown of these components:

Principal

The principal is the amount of money that the borrower originally borrows from the mortgage lender. It’s the base amount on which interest is calculated. Over the life of the loan, the borrower gradually repays this principal amount. Initially, a larger portion of the monthly payment goes towards paying off the interest, with a smaller portion reducing the principal. However, as the loan term progresses, the balance shifts, with more of the payment going towards reducing the principal. This gradual reduction in the principal amount is a key feature of most mortgage loans and is critical in determining the total cost of the mortgage over its lifetime.

Interest

Interest is the cost of borrowing money, expressed as a percentage of the principal. It is essentially the fee that the lender charges for providing the loan. The interest rate can be fixed or variable, depending on the type of mortgage. A fixed-rate mortgage has the same interest rate for the entire loan term, while a variable-rate mortgage may have an interest rate that changes periodically based on market conditions.

The interest rate significantly affects the monthly payment amount. A higher interest rate results in a higher monthly payment, as more money is required to cover the interest. Conversely, a lower interest rate will reduce the monthly payment. Mortgage brokers play a crucial role in helping clients understand how different interest rates will impact their monthly payments and overall loan cost.

Property Taxes

Property taxes are a significant component of the monthly mortgage payment. These taxes are assessed by local governments and are based on the value of the property. The amount can vary significantly depending on the location and the property’s assessed value. In most cases, lenders collect property taxes as part of the monthly mortgage payment and hold them in an escrow account until they are due.

Including property taxes in the monthly payment ensures that they are paid on time and that the borrower doesn’t face a large lump-sum payment at tax time. For brokers, it’s important to help clients understand that property taxes can fluctuate over time as property values and tax rates change, which can subsequently affect their monthly payments.

Homeowners’ Insurance

Homeowners insurance is another critical component of the monthly mortgage payment. This insurance protects the borrower’s property against potential risks, such as fire, theft, or natural disasters. Lenders usually require homeowners’ insurance as part of the mortgage agreement because it protects their investment in the property.

The cost of homeowners insurance varies based on the value of the home, the coverage amount, and the location. Similar to property taxes, the insurance premium is often included in the monthly mortgage payment and held in escrow by the lender until it’s due. Brokers should ensure that their clients understand the importance of maintaining adequate homeowners’ insurance coverage, as it is essential not only for protecting their investment but also for fulfilling the requirements of their mortgage.

Private Mortgage Insurance (PMI)

Private Mortgage Insurance (PMI) is typically required if the borrower makes a down payment of less than 20% of the home’s purchase price. PMI protects the lender in case the borrower defaults on the loan. The cost of PMI is added to the monthly mortgage payment, and it remains in place until the borrower has built up enough equity in the home, usually 20% or more, at which point they can request to have it removed.

PMI can add a significant amount to the monthly mortgage payment, so brokers need to educate clients on how this cost impacts their payments. Additionally, brokers can help clients explore options for avoiding PMI, such as making a larger down payment or considering a piggyback loan.

Homeowners Association (HOA) Fees

For properties located within communities governed by a Homeowners Association (HOA), monthly HOA fees may be required. These fees cover the maintenance and upkeep of common areas, such as landscaping, pools, and recreational facilities. HOA fees can vary widely depending on the community and the amenities offered.

While HOA fees are not always included in the mortgage payment, they are an essential part of the overall cost of homeownership and should be considered when calculating total monthly housing expenses. Brokers should inform clients about the potential for these fees and how they can impact the affordability of a home.

By breaking down each element—principal, interest, property taxes, homeowners insurance, PMI, and HOA fees—brokers can provide clear and comprehensive guidance to their clients, helping them make informed financial decisions and ensuring they fully understand the true cost of their mortgage. This knowledge not only helps in choosing the right loan but also in managing payments effectively over the life of the loan.

The Mortgage Payment Formula

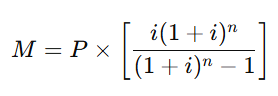

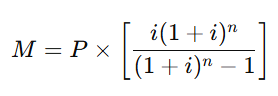

Calculating a monthly mortgage payment involves more than just dividing the loan amount by the number of months in the loan term. The standard mortgage payment formula accounts for the principal, interest, and amortization of the loan over time. The formula is as follows:

Where:

- M = Monthly payment

- P = Principal loan amount

- i = Monthly interest rate (annual rate divided by 12)

- n = Number of payments (loan term in months)

This formula provides an accurate calculation of the monthly payment by considering the compounding effect of interest over time. Let’s break it down:

- Principal (P). The total amount borrowed, which is the base of the calculation.

- Monthly Interest Rate (i). The annual interest rate divided by 12. For example, if the annual rate is 4%, the monthly rate is 0.04/12, or approximately 0.0033.

- Number of Payments (n). The total number of monthly payments across the loan term. For a 30-year mortgage, this would be 360 months.

The formula calculates the monthly payment by ensuring the borrower pays off both the interest and the principal over the specified term, with the interest component being higher in the initial payments and gradually decreasing as the principal is paid down. Understanding this formula is crucial for mortgage brokers, as it allows them to accurately determine and explain monthly payments to their clients, helping them make informed decisions about their mortgage options.

Using a Mortgage Payment Calculator

A mortgage payment calculator is an invaluable tool for both mortgage brokers and borrowers. It simplifies the process of determining monthly payments, allowing for quick and accurate calculations that take into account various loan factors. Here’s why using a mortgage payment calculator is essential and how to make the most of it.

Advantages of Using a Mortgage Calculator

One of the main benefits of a mortgage calculator is its ability to perform complex calculations quickly and accurately. Instead of manually working through the mortgage payment formula, which can be time-consuming and prone to errors, a mortgage calculator can instantly provide results by simply entering a few key details. This speed and accuracy are especially important when brokers need to present various scenarios to clients, such as changes in interest rates or loan terms.

Enhanced Broker Portal

that makes your job easier

- All operations at your fingertips

- Easy-to-use intuitive interface

- Integrated AI technology

Show Me How

Additionally, mortgage calculators help in exploring different loan options. By adjusting the inputs—like the loan amount, interest rate, and loan term—brokers can demonstrate how these changes affect the monthly payment, helping clients understand the financial implications of different mortgage choices. This feature is particularly useful when clients are comparing fixed-rate versus adjustable-rate mortgages or considering whether to make a larger down payment.

Step-by-Step Guide to Using a Mortgage Payment Calculator

Using a mortgage calculator is straightforward. Here’s a step-by-step guide:

- Input the Principal Amount. Enter the total amount of money borrowed or the loan amount the client is considering. This is the starting point for the calculation.

- Enter the Interest Rate. Input the annual interest rate for the mortgage. The calculator will automatically adjust this to a monthly rate for the calculation.

- Specify the Loan Term. Enter the duration of the loan, typically in years. The calculator will convert this into the total number of payments (e.g., 30 years equals 360 payments).

- Add Property Taxes, Insurance, and PMI (if applicable). Some calculators allow you to include additional costs such as property taxes, homeowners insurance, and Private Mortgage Insurance (PMI), giving a more comprehensive estimate of the total monthly payment.

- Calculate. Once all the details are entered, simply click the calculate button. The calculator will provide the monthly payment amount, breaking down how much of it goes towards the principal and how much towards interest.

Looking for a suitable loan program?

Choose among 20+ programs and get

a detailed loan calculation

Loan Calculator

Programs

Example Scenarios

To illustrate, consider a borrower looking at a $300,000 mortgage with a 4% interest rate over 30 years. By inputting these figures into the calculator, it quickly shows that the monthly payment would be approximately $1,432. If the interest rate were to rise to 5%, the calculator would adjust the payment to around $1,610, clearly showing the impact of interest rate changes.

Benefits for Mortgage Brokers

For mortgage brokers, the ability to use a mortgage calculator effectively can significantly enhance client interactions. By providing real-time, accurate information, brokers can help clients understand the affordability of different mortgage options and make informed decisions. Additionally, demonstrating various scenarios helps build trust and positions the broker as a knowledgeable and reliable advisor.

Mortgage calculators are also valuable for ongoing client relationships. Brokers can use them to assist clients in exploring refinancing options, understanding the impact of additional payments, or planning for changes in interest rates. This proactive approach not only helps clients manage their mortgages better but also strengthens the broker-client relationship over time.

In summary, mortgage payment calculators are essential tools that streamline the mortgage process for both brokers and borrowers. By leveraging these calculators, brokers can offer accurate, efficient, and tailored advice that meets each client’s unique financial situation and goals.

Types of Mortgage Calculators

Mortgage calculators come in various forms, each designed to meet specific needs, helping both brokers and borrowers make informed decisions.

Purchase Calculators

Purchase calculators are used to determine how much a borrower can afford based on their income, debts, and down payment. By inputting the loan amount, interest rate, and loan term, brokers can quickly show clients their potential monthly payments and how different loan terms affect affordability. This tool is essential for first-time homebuyers who need a clear understanding of their financial capabilities.

Refinance Calculators

Refinance calculators help borrowers assess whether refinancing their mortgage is a wise financial decision. These calculators allow users to input their current loan details and compare them with new terms to see potential savings, new monthly payments, and the break-even point. This tool is particularly useful for clients looking to lower their interest rate or change their loan term.

Amortization Calculators

Amortization calculators break down each monthly payment into principal and interest components over the life of the loan. This tool helps borrowers visualize how their payments will reduce the loan balance over time, offering insight into the long-term cost of the mortgage. Brokers can use these calculators to explain the benefits of making additional payments or choosing a shorter loan term.

Looking for a suitable loan program?

Choose among 20+ programs and get

a detailed loan calculation

Loan Calculator

Programs

Practical Tips for Brokers

As a mortgage broker, your expertise is invaluable in guiding clients through the mortgage process. Here are some practical tips to enhance your service:

- Explain Each Payment Component. Clearly break down the elements of the monthly mortgage payment—principal, interest, taxes, insurance, and PMI. Use simple language to ensure clients fully understand how each component affects their overall payment.

- Customize Loan Terms. Help clients select the best loan terms based on their financial situation. Discuss the pros and cons of different loan options, such as fixed-rate versus adjustable-rate mortgages, and how these choices impact their monthly payments and long-term costs.

- Use Calculators for Scenarios. Leverage mortgage calculators to demonstrate different scenarios. Show how varying interest rates, loan terms, or down payments can change the monthly payment. This visual approach helps clients see the impact of their decisions in real-time.

- Educate on the Benefits of Extra Payments. Explain how making additional payments can reduce the loan term and save on interest. This strategy can be a powerful tool for clients looking to pay off their mortgage faster.

By providing clear explanations and personalized advice, you can build trust and help clients make well-informed decisions, enhancing your reputation as a reliable and knowledgeable broker.

Conclusion

Accurately calculating monthly mortgage payments is a vital skill for mortgage brokers, enabling them to provide valuable guidance to their clients. By understanding the key components—principal, interest, taxes, insurance, PMI, and HOA fees—brokers can offer precise and insightful advice that helps clients make informed financial decisions. Utilizing mortgage calculators further streamlines this process, allowing brokers to quickly demonstrate different scenarios and outcomes tailored to each client’s unique situation.

As a broker, your ability to simplify complex calculations and present them clearly builds trust and positions you as a knowledgeable resource. By mastering these tools and techniques, you not only enhance your service but also empower your clients to make confident decisions about their mortgages. Encourage your clients to explore the various mortgage calculators available and consider reaching out to AD Mortgage for additional resources and support.