Are you feeling frustrated seeing homebuyers walk away because of their less-than-perfect credit scores? Since the pandemic, many Americans have found it increasingly challenging to maintain strong credit due to high inflation, rising costs of living, and lingering financial strains. A strong credit score remains the golden ticket to securing the best possible mortgage terms, often translating into lower interest rates, reduced down payments, and a smoother loan approval process. By learning how to help improve credit score for your clients, you’ll not only increase their chances of getting approved for a loan but also position yourself as a trusted expert, strengthening your reputation and client relationships. Credit improvement doesn’t just benefit clients—it opens doors to significant savings and improved financial stability.

In this guide, we’ll explore how you can make credit improvement a core part of your client services. From understanding the basic concepts of credit scores and credit reports to identifying the specific factors that affect scores and implementing tailored improvement strategies, this resource will equip you with the tools to help your clients take control of their credit. Together, you can navigate this challenging financial landscape and give homebuyers a better chance at achieving their dream of homeownership.

Understanding Credit Scores

What is a Credit Score?

A credit score is a number that depicts a consumer’s creditworthiness. In essence, it’s a free-digit figure (typically ranging from 300 to 850) that reflects an individual’s financial history and reliability when it comes to managing credit. It’s a critical number that determines how much interest a borrower will have to pay on loans, as well as the types of loans and terms they will qualify for.

The concept of credit scoring as we know it today has roots that date back over a century. Credit scores emerged from a need to standardize the way lenders evaluated borrowers. “In 1841, the Mercantile Agency solicited information from correspondents throughout the country in order to systemize a borrower’s “character and assets”. In the end, this data was considered to be too subjective.” In 1899, the Retail Credit Company (now Equifax) became one of the first credit reporting agencies to centralize credit data to make lending decisions more systematic. However, this early system often lacked objectivity and fairness.

Get the ADvantage

with our loyalty program

Earn and redeem points for valuable benefits for you and your clients

Unlock Rewards

The transition to numerical credit scores began in the mid-20th century. In the 1950s, Fair Isaac Corporation (FICO) introduced its first scoring system, which gained traction in the 1970s as lenders sought more consistent methods for assessing credit risk. This led to the widespread use of the FICO score, first adopted by major credit reporting agencies like Equifax in 1989. According to Finance Strategists, “the FICO score rapidly gained popularity and adoption among lenders and institutions. Its widespread acceptance made it the dominant credit scoring model not only in the United States but also internationally.”

Credit Score Ranges

The most common credit score, FICO, typically falls into five main categories, with a range from 300 to 850. Here’s a breakdown of the ranges and what they mean:

- Excellent (800-850). This is the top tier of credit scores. People with excellent credit scores have a long history of responsible borrowing and timely payments. Individuals with this score are likely to qualify for the best interest rates and loan terms.

- Very Good (740-799). A very good credit score indicates a solid financial track record. These borrowers qualify for competitive mortgage rates.

- Good (670-739). A good credit score is generally acceptable to most lenders but with room for improvement. However, individuals with this score may not qualify for favorable loan offers.

- Fair (580-669). A fair credit score can make it more difficult to qualify for loans, especially those with favorable terms. Lenders may require a larger down payment or higher interest rates.

- Poor (300-579): A poor credit score significantly limits borrowing options.

Factors Affecting Credit Scores

As a mortgage professional, understanding what affects a credit score can help you guide clients in improving theirs. There are typically five main components that make up a credit score, each with a different degree of influence.

Payment History (35%)

Payment history carries the most weight, accounting for 35% of the score. Missed or late payments on credit cards, loans, and other debts can be a major hurdle.

Amounts Owed/Credit Utilization (30%)

Credit utilization, which makes up 30% of the score, is another significant factor. This refers to the amount of credit a person uses compared to their total credit limit. Keeping credit balances low – ideally below 30% of the limit – can have a positive impact.

Length of Credit History (15%)

A longer, established credit history generally indicates a more stable financial history.

Credit Mix (10%)

A healthy balance of credit cards, loans, and other accounts shows the ability to manage different types of credit.

New Credit/Inquiries (10%)

New credit accounts and recent inquiries also contribute to credit scoring. Too many inquiries or opening multiple accounts in a short time can negatively affect a score, signaling financial stress or a higher risk of default.

Credit Scoring Models

Apart from the FICO score, another credit scoring model that is gaining traction is VantageScore. Developed by Experian, TransUnion, and Equifax, it was designed “to compete with FICO Score. One of the bureaus, Experian, even went so far as to stop offering FICO score information to consumers on credit reports.”

While both FICO and VantageScore serve the same purpose – to assess creditworthiness – they differ in their methodologies, weightings, and acceptance in the mortgage industry. Let’s break down these differences and explore how they impact mortgage lending.

1. Scoring Criteria and Weighting

Both models assess similar credit factors but assign different weights to each.

| Credit Factor |

FICO |

VantageScore |

| Payment History |

Most significant factor (35%) |

Most significant factor |

| Credit Utilization |

High impact (30%) |

High impact |

| Length of Credit History |

Significant (15%) |

Moderate impact |

| Credit Mix |

Moderate impact (10%) |

Less emphasized |

| New Credit/Hard Inquiries |

Moderate impact (10%) |

Less significant |

FICO places more weight on the length of credit history, while VantageScore is more flexible for those with shorter credit histories.

2. Time Frame for Scoring

FICO requires at least six months of credit history and a reported account in the past six months.

VantageScore can generate a score with just one month of credit history and one reported account, making it more inclusive for individuals with limited credit activity.

3. Treatment of Late Payments

FICO considers how recently and frequently late payments occurred.

VantageScore focuses more on patterns of behavior, giving weight to recent late payments over older ones.

4. Hard Inquiries

FICO groups multiple inquiries for the same type of credit (e.g., mortgages) within a 45-day window as a single inquiry.

VantageScore uses a shorter window of 14 days to group multiple inquiries.

5. Popularity in Mortgage Lending

FICO is the dominant model for mortgage underwriting. Fannie Mae and Freddie Mac require FICO scores for conforming loans, making it the go-to model for most lenders.

While gaining traction in other industries, VantageScore is rarely used for mortgage lending due to underwriting requirements set by government-sponsored enterprises (GSEs).

As a mortgage professional, you should understand the differences between FICO and VantageScore. Although lenders primarily use FICO scores, some may refer to VantageScore for prequalification or supplementary analysis. Borrowers, on the other hand, often encounter VantageScores through free platforms. These values can differ, so understanding the distinctions will help you accurately assess creditworthiness, explain discrepancies, and guide your clients effectively through the mortgage process.

Why Credit Scores Matter in Mortgages

Credit scores play an important role in mortgages. Lenders use this number to evaluate a borrower’s creditworthiness and determine the level of risk associated with lending to them. A higher credit score indicates a lower risk to the lender. Borrowers with good credit scores are more likely to repay their loans on time, making them more attractive to lenders. As a result, borrowers with good credit scores often qualify for lower interest rates, better loan terms, and a wider range of loan products, saving borrowers thousands of dollars over the life of a loan.

Choose a top nationwide lender that cares about your growth!

Get Started

Conversely, a lower credit score indicates a higher risk to the mortgage lender. Borrowers with poor credit scores may have a history of late payments, defaults, or bankruptcies. Lenders may be reluctant to lend to these borrowers or may offer them less favorable terms, such as higher interest rates and stricter qualification requirements.

For example, according to Zillow, “buyers with “fair” credit could be paying up to $288 more on their monthly mortgage payment and nearly $103,626 in interest over the life of a 30-year fixed loan than those with “excellent” credit.”

The Broker’s Role in Credit Improvement

Your role as a mortgage professional goes beyond selecting mortgage options and facilitating loan applications for your clients. Each step of the loan process requires your clarity, expertise, and commitment to your clients’ success. A critical aspect of your job is to educate clients about the importance of credit scores and their improvement, as well as their overall impact on mortgages.

To make the most of this important role, here are some tips to follow.

Acting as an Advisor

Many clients may not fully understand how credit scores influence interest rates, loan terms, or eligibility for certain mortgage programs. Taking the time to break down these concepts can simplify the process for your clients, empowering them to take actionable steps toward improvement. Clear, accessible explanations of the factors that influence credit scores – such as payment history, credit utilization, and the length of credit history – can lay the groundwork for a productive credit repair strategy.

Providing Resources

Once your clients understand the basics, it’s time to equip them with the right tools. Credit monitoring tools (e.g., Experian Credit Monitoring, Credit Karma, Credit Sesame, MyFICO, etc.) can be invaluable in tracking their progress. You can recommend reliable services that provide real-time updates on their credit scores and identify potential issues. By staying informed, your clients can take proactive steps to address any red flags.

Customized Action Plans

Every client’s financial situation is unique. A one-size-fits-all approach to credit improvement won’t yield optimal results. That’s why creating customized action plans is crucial. For example, some clients may need to address late payments, while others may benefit from reducing high credit card balances. By analyzing each client’s individual needs, you can develop a tailored strategy that maximizes their chances of success.

Legal and Ethical Considerations

While it’s important to provide guidance and support, it’s equally important to adhere to legal and ethical standards. Credit score improvement depends on various factors, some of which are beyond your control. So avoid making promises or guarantees about specific outcomes. Instead, focus on providing accurate information and practical advice. Adhering to relevant regulations will ensure that you provide honest, transparent assistance without straying into areas that are best handled by licensed credit repair professionals.

Remember that improving a credit score takes time and effort. By providing education, resources, and personalized strategies, you can make a positive impact on your clients’ financial health.

Step-by-Step Credit Improvement Plan for Clients

So now that you’ve gotten a grasp on your vital role in credit improvement, it’s time to explore practical steps on how to help improve credit score for your borrower. Here’s a step-by-step credit improvement plan to guide your clients toward better financial standing.

Step 1: Obtain and Review Credit Reports

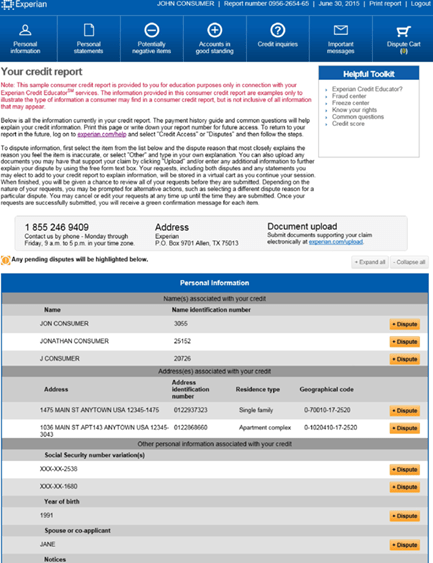

Requesting a Credit Report

The first step to improving a credit score is like peeking under the hood of a car – it’s essential to understand what’s happening beneath the surface. That’s where credit reports come in.

A credit report is essentially a financial report card, summarizing an individual’s history of borrowing and repayment. It includes details such as payment history, credit card balances, and any loans a borrower has taken out. These reports are compiled by the three major credit bureaus: Experian, Equifax, and TransUnion. Your clients can access their free credit reports annually through AnnualCreditReport.com, the only federally authorized site. This platform provides a convenient way to obtain reports from all three bureaus, saving time and effort.

Here’s a simple guide you can share with your clients to help them navigate the process:

- Visiting the Website. Go to the official website: https://www.annualcreditreport.com/

- Starting the Request Process. On the homepage, click “Request your free credit reports”. This will lead to a secure form where personal information must be entered.

- Entering Personal Information. Applicants will need to provide details like full name, current and previous addresses (if moved recently), Social Security number, and date of birth. These details help the system verify the identity.

- Selecting Credit Bureaus. It’s possible to request reports from one, two, or all three major credit bureaus. For a comprehensive view of the credit, requesting reports from all three is recommended.

- Verifying Identity. To ensure security, the site will ask a series of identity verification questions based on their credit history. These may include inquiries about specific loans, credit cards, or previous addresses. Correct answers are necessary to proceed.

- Accessing or Download Reports. Once verified, the credit reports will be available for viewing and downloading.

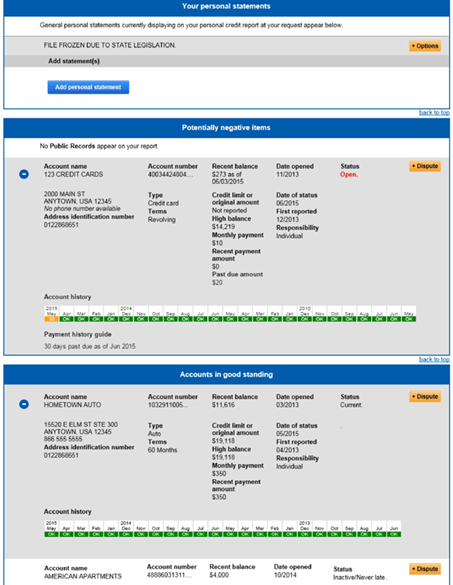

Reviewing a Credit Report for Errors and Inaccuracies

Just like any report, errors can creep in. According to the Consumer Financial Protection Bureau (CFPB), “one in five people have an error on at least one of their credit reports.” This is why reviewing the information meticulously is crucial. Some common errors include incorrect personal data, accounts that don’t belong to the applicant, and incorrect payment statuses. Therefore, it’s crucial for your clients to look for any inconsistencies in their personal details – names, addresses, and Social Security numbers. Even minor discrepancies here could indicate a deeper issue, such as identity theft or misattributed accounts.

Next, it’s important to scan for unfamiliar accounts included in the report. Encourage your clients to look out for accounts that do not belong to them. These could result from errors by the credit bureau or cases of fraud. Spotting them early is vital to prevent financial damage.

Finally, it’s essential to check the payment history. Late or missed payments may appear even if your client has consistently paid on time. These errors can severely impact credit scores, so they must be disputed promptly.

When it comes to obtaining and reviewing credit reports, your expertise as a mortgage professional plays a crucial role. Your responsibility extends beyond helping clients request the report and pointing out errors. It’s essential to clarify each section of the report, explain its significance, and discuss the implications of any inaccuracies.

Take the time to outline the potential impact of various entries on their credit score and guide clients toward resolving issues effectively. Identify patterns or behaviors that might negatively affect their credit standing and emphasize the importance of taking proactive and timely action.

Additionally, encourage clients to reach out to the credit bureau with any questions or concerns they may have to ensure their report is accurate and up-to-date.

Identifying Discrepancies

If your client has discovered an error or discrepancy in their report, don’t let them get discouraged. The credit bureaus have a dispute resolution process in place. It is also important to note that the Fair Credit Reporting Act (FCRA) guarantees the right to dispute information on credit reports “without incurring any cost”.

So the first step is to identify the nature of the discrepancy – whether it’s an incorrect late payment or an unrecognized account. Once identified, the next step is to initiate the dispute process.

Dispute Process

You can assist by guiding clients on how to contact the credit bureaus. Each bureau has its own process, but disputes can generally be filed online, by mail, or by phone. To support the dispute, encourage your client to gather documentation such as bank statements, payment receipts, canceled checks, or correspondence from creditors. The more evidence they can provide, the better their chances of success. A clear, concise dispute letter that explains the error and provides evidence is often the most effective way to start a dispute.

Follow-Up

Once your client has filed a dispute, it’s important to monitor its progress. Encourage them to monitor the status of their disputes through online portals provided by the bureaus or by checking for written updates. Keeping track of deadlines is critical because “federal law requires the bureau to complete an investigation within 30 to 45 days.” Once the investigation is complete, a bureau must notify an applicant “of the outcome and any action it has taken within five business days.”

If they find the information to be inaccurate, they’ll remove it from the applicant’s credit report. Your clients should review their updated reports to confirm that the errors have been corrected.

However, if the credit bureau determines that the information is accurate, your client can request a reinvestigation or consider filing a complaint with the Consumer Financial Protection Bureau (CFPB).

To provide maximum support and make the dispute process much easier for your clients, you can offer CFPB instructions as a guide or template letters tailored to common errors.

Remember that the dispute process can take time, so the faster these errors are identified and corrected, the sooner your client’s credit score can reflect their true financial standing.

Step 3: Establish Payment Reminders and Automate Payments

The next step in the credit improvement plan is ensuring consistent on-time payments. As you may recall, payment history is the most significant factor in determining a credit score, accounting for 35% of the total score. Even a single missed payment can have a lasting impact, especially for clients trying to build or rebuild their credit. Paying all bills – credit cards, utilities, or loans – on or before the due date is crucial for maintaining a strong credit profile.

To help your clients stay organized, recommend tools and strategies that simplify payment management. Calendar reminders, such as those available on Google Calendar or Microsoft Outlook Calendar, are effective for keeping track of due dates. Encourage clients to set notifications a few days before each bill is due, so they have time to ensure sufficient funds are available.

Another reliable solution is automating payments. Platforms like Stripe Billing, YNAB, or Helcim make it easy to set up automatic payments for recurring bills. Additionally, most utility providers, internet companies, and subscription services offer autopay options through their online accounts. By enabling this feature, clients can reduce the risk of missed payments without added effort.

Introduce your clients to financial apps that integrate reminders, payment tracking, and budgeting tools. Apps like Mint or PocketGuard can provide tailored alerts and simplify bill management. Educate them on the significant impact of on-time payments on their credit scores, emphasizing that even small late payments can be detrimental.

As a mortgage professional, take time to understand your clients’ financial situations. If they’re struggling to pay bills on time, suggest strategies such as setting realistic budgets or exploring debt consolidation to reduce financial pressure. By providing personalized advice and highlighting the value of consistent payments, you can empower clients to stay on track and see meaningful improvements in their credit over time.

Step 4: Develop a Debt Reduction Plan

An effective step in improving your client’s credit score can be creating a solid debt reduction plan. This involves a thorough assessment of their current financial situation and the implementation of effective debt repayment strategies.

Assessing Current Debts

First, it is crucial to identify all of your client’s outstanding debts, including credit card balances and personal loans. This will give you a clear picture of their financial obligations. It’s essential to prioritize debts based on interest rates and minimum payments.

Strategies to Reduce Balances

Once the debts are assessed, it’s time to explore effective strategies to reduce balances. Two popular methods are the debt snowball method and the debt avalanche method.

- Debt Snowball Method. This method focuses on paying off smaller debts first, regardless of interest rates. By quickly eliminating smaller debts, your clients can gain momentum and motivation to tackle larger ones. This approach can be psychologically rewarding, as it provides a sense of accomplishment and progress.

- Debt Avalanche Method. This method prioritizes debts with the highest interest rates. By paying off high-interest debts first, your clients can save money on interest charges in the long run. This strategy is mathematically sound and can lead to significant savings over time.

Balance Transfer Options

Balance transfer credit cards can be a useful tool for debt reduction. These cards offer low introductory interest rates, allowing your clients to transfer high-interest balances and save on interest charges. However, it’s important to consider the potential drawbacks, such as balance transfer fees and the risk of incurring new debt.

As a mortgage professional, you play a vital role in helping clients select the best debt reduction strategy. By reviewing their income, expenses, and debt obligations – and considering factors such as financial goals, risk tolerance, and capacity for extra payments – you can identify the most suitable approach. By explaining the pros and cons of each strategy, you help clients understand the impact of interest rates and minimum payments on their overall debt burden. Maintaining regular communication, tracking their progress toward debt reduction goals, and adjusting the strategy as needed ensures that you provide the encouragement and support they need to succeed.

Step 5: Advise on Credit Utilization Management

Credit utilization accounts for 30% of a credit score, making it another key metric to manage. It represents the percentage of available credit a borrower uses. For example, if your client has a credit card limit of $10,000 and charges $5,000, their utilization rate is 50% ($5,000 / $10,000 x 100%).

Those with high utilization rates can see their credit scores drop even if they pay their bills on time. Educating your clients about managing this aspect can lead to meaningful improvements in a relatively short period.

Credit bureaus view high utilization rates as a risk. It suggests that a borrower may be financially overextended. The ideal utilization rate is less than 30%, but it is better to aim for less than 10%.

Many clients aren’t aware of these thresholds, so emphasizing this target can be a game changer in their journey to better credit.

So how to practically help your clients improve credit scores by lowering their credit utilization? You can offer them some practical techniques:

Timing Payments

Most credit card companies determine a monthly balance on a specific date, known as the statement closing date. By making payments before this date, your client will reduce the balance reported to the credit bureaus.

Additionally, instead of making one large payment, encourage your client to consider making smaller payments throughout the month. This can significantly reduce their overall balance and, consequently, their utilization rate.

Requesting Credit Limit Increases

While it may seem counterintuitive, a higher credit limit can actually improve your client’s credit score. By increasing their available credit, their utilization rate will decrease. It’s best to request a credit limit increase after they’ve demonstrated responsible credit behavior. Consistent on-time payments and low utilization rates can strengthen their case.

Understanding Reported Balances

Educate clients that the balance reported to credit bureaus is often the one shown on their credit card statement, not necessarily the balance after the due date. Paying early can reduce the balance that’s reported and further improve their utilization ratio.

By understanding and managing credit utilization, your clients can make meaningful progress in improving their credit scores in a relatively short time.

Step 6: Encourage Limited New Credit Applications

One of the most significant factors affecting a credit score is the number of hard inquiries on a credit report. A hard inquiry occurs when a lender pulls a borrower’s credit report to assess their creditworthiness. While it’s normal to have a few hard inquiries, too many can negatively impact your client’s score.

Credit bureaus view multiple hard inquiries within a short period as a sign of potential financial risk. This may raise concerns about the applicant’s financial stability, as it suggests they may be applying for several lines of credit simultaneously. Consequently, this can temporarily lower their credit score.

As a mortgage professional, you can play a crucial role in educating your clients about the impact of hard inquiries on their credit scores. First, advise them to refrain from applying for new credit cards or loans unless absolutely necessary. Each new application will result in a hard inquiry, which can potentially lower their credit score.

Also, if your client is shopping for the best rates on a mortgage or other loan, encourage them to consolidate their rate shopping into a short timeframe. Most credit bureaus group multiple inquiries from the same type of lender (e.g., mortgage lenders) into a single inquiry if they occur within a specific period. This practice can help minimize the negative impact on their credit score.

By proactively limiting the number of hard inquiries on their credit report, your clients can improve their credit scores and increase their chances of securing favorable loan terms.

Step 7: Leverage Positive Credit Activities

To further help your clients improve their credit scores, it’s important to guide them toward positive credit activities. These activities not only improve their credit score but also demonstrate financial responsibility to lenders, helping them qualify for better mortgage rates. With the right strategies in place, your clients can achieve significant improvements in their scores, bringing them closer to homeownership.

The Authorized User Strategy

One underutilized yet potent strategy is becoming an authorized user on a trusted individual’s credit card account. When your client is added as an authorized user, their credit report will typically include the account’s positive payment history. This can be a quick way to establish or boost their credit history, particularly if they are new to the credit world.

Secured Credit Cards

Secured credit cards are a viable option for individuals with limited or damaged credit. Unlike traditional credit cards, secured cards require a security deposit that acts as a credit limit. By using the card responsibly and making timely payments, your client can build a positive credit history. Over time, their reliability may qualify them for a transition to an unsecured credit card, expanding their financial opportunities.

Credit-Builder Loans

Credit builder loans are another effective way to help your clients improve their credit scores. These loans are designed specifically for individuals looking to establish or repair their credit. Payments are typically held in a savings account, and the funds become available after all payments have been made. While the interest rates may be higher than those of other loan types, the primary benefit is the positive impact on your client’s credit report. Regular, on-time payments demonstrate responsible borrowing and can lead to substantial credit score improvements.

As a mortgage professional, your ability to recommend and explain these positive credit activities can make a significant difference in your clients’ financial futures. By assessing each client’s unique circumstances and considering factors such as their current credit history, financial goals, and risk tolerance, you can tailor recommendations to suit their needs and select the most appropriate credit-building strategy. Encouraging responsible credit use not only helps them improve their credit scores but also positions them for long-term financial success.

Step 8: Monitor Progress Regularly

Once you and your clients have implemented a credit improvement plan, it’s essential to monitor progress regularly. This proactive approach allows you to identify any potential roadblocks and make necessary adjustments to the plan before they become bigger issues.

Encourage your clients to check their credit reports on a regular basis. This will help them track changes, such as improvements in credit utilization, resolution of past-due accounts, or unexpected negative entries. You can also suggest that they use a credit monitoring service that can alert them to significant changes.

As your client’s financial situation changes, so can their credit improvement plan. For example, if they experience a sudden job loss or unexpected expense, they may need to adjust their budget or payment schedule. That’s why it’s important to stay flexible and be willing to make changes as needed.

To keep your clients motivated and on track, schedule regular check-ins. These meetings give you the opportunity to discuss their progress, answer any questions, and offer additional support.

During these check-ins, you can review their credit reports, discuss any challenges they may be facing, and make adjustments to their plan as needed. You can also provide encouragement and celebrate their successes, no matter how small.

By guiding your clients through these regular assessments, you’ll not only show them how to help improve their credit score but also build a strong, supportive relationship that sets them up for long-term success.

Additional Tips for Brokers

In addition to the core strategies on how to help improve credit scores, there are a few more steps you can take to further assist clients in their credit repair efforts.

Educate Clients on Financial Literacy

One of the most effective ways to help your clients improve their credit scores is to educate them on financial literacy. By understanding the factors that impact their credit score, such as payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries, your clients can get a clearer picture of their financial behavior.

Enhanced Broker Portal

that makes your job easier

- All operations at your fingertips

- Easy-to-use intuitive interface

- Integrated AI technology

Show Me How

Consider offering workshops or webinars on topics such as budgeting, debt management, and credit score basics. These sessions can provide valuable information and help clients develop healthy financial habits.

Provide Resources

To help your clients take control of their financial future, provide them with the necessary resources. Credit score simulators (e.g., myFICO Free FICO Score Estimator, TransUnion Score Simulator, WalletHub Free Credit Score Simulator) can help them visualize the impact of different financial behaviors on their score. Educational materials, such as articles, infographics, and videos, can provide additional insights and tips.

Build Relationships with Credit Counseling Agencies

While you can provide valuable guidance and support, there may be times when your clients need more specialized assistance. Building relationships with credit counseling agencies can be beneficial. These agencies can offer personalized advice and help clients develop customized debt management plans.

If your client is struggling with significant debt or experiencing financial hardship, referring them to a credit counseling agency can be a compassionate and effective solution.

The credit industry doesn’t stay still, with new regulations and scoring models being introduced regularly. To provide accurate and up-to-date advice, it’s essential to stay informed on the latest developments.

Keep an eye on changes to FICO scoring models and other credit-related regulations. Staying knowledgeable also helps you address any misconceptions clients may have and sets you apart as an expert in how to help improve credit scores effectively.

Ethical Considerations

While it’s important to be optimistic and encouraging, it’s crucial to avoid making unrealistic promises about credit score improvements. It’s essential to set realistic expectations and communicate honestly about the time it takes to see significant results.

Remember, credit improvement is a gradual process, not an instant fix. Consistent effort is key, and it often takes up to six months to see meaningful changes in a credit score. According to Nerdwallet, “building a credit score from scratch can take anywhere from a month or two to six months, depending on the type of credit score.” By framing this timeline realistically, you help clients understand the commitment involved and prepare them for the process ahead. This approach fosters trust and ensures they stay focused on sustainable financial habits.

Conclusion

You’ve seen it firsthand – the disappointment when a dream home slips away from your clients’ hands due to a credit score that falls short. As a mortgage professional, you now have the power to do more than just guide your clients through the loan process. You can equip them with the knowledge and tools to improve their credit, opening up new possibilities for homeownership.

Now is the time to start implementing these strategies with your clients. Whether it’s recommending a credit report review and disputing inaccuracies, or helping clients manage credit utilization and create a debt reduction plan, you have the expertise to make a meaningful difference. Every small step you take can lead to noticeable improvements in their credit scores. As they begin to see positive changes, they will feel more confident and better prepared for homeownership.

If you’re unsure about the details of credit repair, don’t worry – our team is here to answer your questions and provide you with the most accurate, up-to-date information. By partnering with A&D Mortgage, you’re doing more than helping clients secure a mortgage; you’re setting them up for long-term financial success. Contact A&D Mortgage today and let’s work together to open up a world of possibilities for your clients!