Rate sheets are essential tools used by mortgage lenders to determine the pricing of loans. Daily updates reflect current market conditions, guaranteeing lenders and borrowers access to the most competitive rates. For mortgage brokers, understanding how to read a rate sheet is fundamental to their role.

Brokers need to interpret these sheets accurately to advise their clients on the best mortgage products. Mastering rate sheets is crucial for brokers to elevate service quality and gain a competitive advantage in the market, boosting their performance and client satisfaction.

Borrowers benefit significantly when their brokers are proficient in reading rate sheets. An informed mortgage broker can navigate through complex rate information to find the most cost-effective and suitable mortgage options. Therefore, the knowledge on how to read a rate sheet and interpreting it skillfully is valuable in the mortgage industry, benefiting both brokers and their clients by ensuring transparency, suitability, and financial optimization of mortgage deals.

What Are Mortgage Rate Sheets

DSCR loans:

Grow your portfolio!

- DSCR as low as 0

- No income and no employment needed

- Fast turn times

Rate sheets are a fundamental resource in the mortgage industry. They provide brokers and clients with information on how various factors such as loan duration, FICO scores, and loan-to-value (LTV) ratios impact the cost of a loan. Lenders create these sheets daily to ensure that the pricing of mortgage loans reflects the current market conditions. This practice allows for accurate and competitive lending.

Definition and Purpose

A mortgage rate sheet is essentially a complex grid that lists the rates available for different mortgage products on any given day. These sheets help brokers determine the most cost-effective and appropriate mortgage options for their clients by outlining how changes in market conditions and borrower qualifications affect loan pricing. They are instrumental in crafting tailored loan offers that align with a borrower’s financial goals and market opportunities.

Basic Structure

- Loan Programs and Terms. Rate sheets typically detail various loan programs, including FHA loans, VA loans, and conventional loans. Each program comes with specific rates that can vary depending on the term of the loan, such as 15-year or 30-year fixed rates. Understanding these differences is crucial for brokers as they advise clients on the best loan type for their long-term financial plans.

- Interest Rates and Pricing Tiers. Lenders divide the rates on a mortgage rate sheet into pricing tiers based on the lock-in period, as they are not one-size-fits-all. These periods could be as short as 15 days or as long as 60 days or more. Shorter lock-in periods typically feature lower interest rates, reflecting the reduced risk of rate changes over a shorter time. Brokers must understand how these tiers affect the overall cost of the loan to guide their clients effectively.

- Loan-level Price Adjustments (LLPA). LLPAs are critical components of rate sheets. They are adjustments made based on specific borrower characteristics and loan features, including credit scores, property type (e.g., single-family home, condo), occupancy (primary residence, investment property), and more. For instance, a lower credit score or a high LTV ratio might increase the loan’s cost due to higher perceived risk. Brokers need to factor in these adjustments to provide accurate cost estimates to their clients.

In essence, understanding mortgage rate sheets involves comprehending how different loan characteristics and borrower-specific factors influence the pricing. This knowledge is indispensable for mortgage brokers aiming to offer optimal loan solutions that align with their clients’ financial situations and market conditions.

Key Elements of a Mortgage Rate Sheet

To master mortgage rate sheets and enhance mortgage lending effectiveness, brokers must grasp the key components influencing loan costs. The rate sheet comprises vital details shaping borrowing expenses. Profound comprehension of these elements is pivotal for precise loan cost evaluation. Through rate sheet analysis, brokers can help borrowers can confidently choose optimal solutions.

Loan Programs & Terms

Mortgage rate sheets list various loan programs each tailored to meet different borrower needs. The main types include:

- Conventional Loans. These are not insured or guaranteed by federal agencies and typically require higher credit scores and lower debt-to-income ratios.

- FHA Loans. Insured by the Federal Housing Administration, these loans are more accessible to borrowers with lower credit scores and offer down payments as low as 3.5%.

- VA Loans. Guaranteed by the Veterans Affairs and offered to veterans and service members, these loans often do not require a down payment or private mortgage insurance.

- USDA Loans. Aimed at rural property buyers, these loans offer 100% financing with no down payment.

- Note: At this time, AD Mortgage does not offer USDA or VA loans.

Each program has its rate variations based on the loan term—typically 15, 20, or 30 years. Longer terms generally have higher rates due to the increased risk of interest rate fluctuations over time, but they offer lower monthly payments.

Interest Rates and Par Pricing

Rate sheets often list interest rates in relation to ‘par pricing,’ a benchmark where the loan does not cost nor yield extra money for the lender when sold on the secondary market. Rates express in basis points (where 1 basis point = 0.01%), which quantify the cost or credit for specific rates. A rate above 100% means the borrower can pay points to get a lower rate. A rate below 100% means no upfront costs but a higher rate.

Rate Lock Periods

The rate lock period is a crucial timeframe in mortgage deals. It’s when the lender promises a fixed rate, shielding you from market rate changes. Rate sheets display prices for lock periods, like 15, 30, 45, and 60 days. Shorter lock periods usually offer lower rates due to limited market shifts, reducing lender risks. Picking the right lock period strategically can cut costs for borrowers, especially in volatile markets.

Loan-Level Price Adjustments (LLPA)

LLPAs are adjustments to the base interest rate on the mortgage rate sheet based on loan-associated risk factors. These adjustments can include but not limited to:

- Credit Score. Lower scores generally result in higher rates due to higher perceived risk.

- Loan-to-Value Ratio (LTV). Higher LTV ratios increase the rate because they increase the lender’s risk if the borrower defaults.

- Property Type. Investments properties or multi-unit homes might carry higher rates than single-family homes.

- Occupancy. Primary residences often have lower rates compared to second homes or investment properties.

Brokers must calculate these adjustments to determine the final rate offered to the borrower, ensuring that all risk factors are adequately accounted for in the loan pricing.

Pricing Hits & Credits

Mortgage pricing hits are additional costs applied to the base rate due to various risk factors, such as a low credit score or a high LTV ratio. Conversely, credits are incentives that reduce the cost of a loan under favorable conditions like a high credit score or a low debt-to-income ratio. Understanding how these are applied is crucial for brokers to accurately explain to borrowers how their financial profiles affect their mortgage rates.

A mortgage rate sheet is a dynamic tool that requires careful interpretation. Each element—from loan programs to pricing adjustments—plays a significant role in determining the cost of a loan. For mortgage brokers, mastering the knowledge on how to read a rate sheet means they can offer advice that aligns with their clients’ financial goals.

So… How to Read a Rate Sheet and Interpret It?

Looking for a suitable loan program?

Choose among 20+ programs and get

a detailed loan calculation

Reading a mortgage rate sheet accurately is crucial for mortgage brokers as it enables them to provide precise and beneficial financial advice to their clients. Here’s a step-by-step guide on how to interpret these documents, using a real example from the AD Mortgage LLC Conventional Rate Sheet.

Step-by-Step Guide

- Select the Loan Program and Term. Start by identifying the loan program that best fits the client’s needs, whether it be a conventional loan, FHA, VA, or another type. Consider the term of the loan as well, as this will affect both the interest rate and the monthly payments. For instance, 30-year terms generally have higher interest rates but lower monthly payments compared to 15-year terms.

- Identify Pricing. Locate the base rate for the selected loan program and term. The base rate is often listed in relation to par pricing. If the rate is above par, the borrower can typically buy down the rate by paying points upfront. Conversely, if the rate is below par, the borrower might avoid upfront costs but will have a higher interest rate.

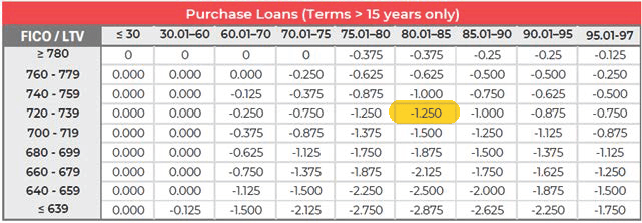

- Account for LLPAs. Loan-Level Price Adjustments (LLPA) are then applied based on the borrower’s specific circumstances. Factors such as credit score, loan-to-value ratio (LTV), property type, and occupancy status can all influence the adjustments. For instance, a lower credit score or higher LTV can result in a higher interest rate due to increased risk.

- Consider Lock-In Period. Decide on a lock-in period. Rate sheets will often list different prices for different lock durations (e.g., 15, 30, 45, 60 days). Shorter lock-in periods typically have lower rates because they carry less risk of interest rate fluctuations.

Example Breakdown

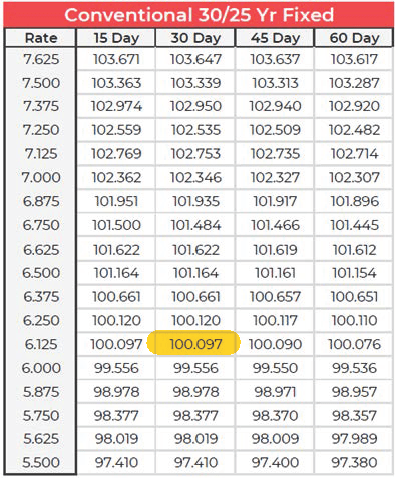

Using a recent rate sheet data from AD Mortgage LLC, let’s walk through a practical example of how a mortgage broker would use this information to determine the best available rate for a client seeking a Conventional 30-year fixed-rate mortgage.

Scenario. The client has a credit score of 720 and seeks a loan with an 85% loan-to-value (LTV) ratio.

Select the Loan Program and Term

- Loan Program. Conventional 30-year fixed-rate mortgage.

- Term. 30 years.

Account for LLPAs (Loan-Level Price Adjustments)

- Credit Score. 720 falls into a certain range on the LLPA chart.

- LTV. 85% LTV.

According to the rate sheet, for a credit score of 720 and an LTV of 85%, the adjustments are as follows.

- FICO 720-739 / LTV 80.01-85. -1.250 (This represents a discount point adjustment).

Identify Pricing

The base rate listed on the rate sheet for a 30-day lock-in period is 6.125% at par (found directly on the rate sheet).

Consider Lock-In Period

- Chosen Lock-In Period. 30 days.

Since the rate for a 30-day lock-in period at par is provided, no further adjustments for the lock-in period are necessary beyond those already included in the LLPA.Calculating the Final Interest Rate

The base rate adjusted by the LLPAs would slightly reduce either the interest rate or the upfront costs.

In this example, the broker would advise the client that they qualify for a competitive rate below the base rate of 6.125%, adjusted based on their credit score and LTV ratio, which positively impacts their borrowing costs. This detailed breakdown allows the client to understand how their financial profile affects their mortgage options and encourages transparent communication about how rates are derived.

Learning how to read a rate sheet also involves a detailed understanding of various loan programs, an ability to interpret pricing adjustments, and the skill to apply specific borrower characteristics to find the most accurate and favorable loan rates. This comprehensive approach ensures that clients receive personalized and financially sound advice when selecting their mortgage options.

Practical Tips for Brokers

Struggling with a loan scenario?

Get a solution in 30 minutes!Fill out the short form and get your personal offer

Submit a ScenarioMortgage brokers play a crucial role in helping clients navigate the complexities of securing a mortgage. Utilizing the insights from rate sheets can significantly enhance a broker’s ability to negotiate better terms, customize loan options to fit individual financial situations, and stay competitive in the market. Here are some practical tips for brokers:

Negotiating and Customizing

- Leverage Rate Sheets for Better Terms. Understand the details of the rate sheet to identify negotiation points. For instance, if a rate sheet shows lower rates for shorter lock-in periods, advise clients who can afford faster closings to opt for these to save on interest costs.

- Customize Loan Offers. Use the rate adjustments (LLPAs) to tailor loans to the financial reality of the client. For a client with a high credit score, emphasize how this reduces their rate adjustments, possibly making a more aggressive loan term feasible.

Communicating Adjustments

- Simplify the Explanation. Break down the rate sheet into understandable components. Explain what base rates, LLPAs, and lock-in periods mean in layman’s terms and how each affects the overall loan cost.

- Visual Aids. Use charts or tables to visually represent how different factors like credit scores or LTV ratios impact interest rates. Visuals can help demystify the complexities of mortgage pricing for clients.

Competitive Analysis

- Benchmark Against Competitors. Regularly review and compare your rate sheets with those from other lenders. This will help you understand your position in the market and provide competitive options to your clients.

- Highlight Competitive Advantages. If your rates are more favorable, or you offer more flexible terms than your competitors, make these benefits clear to potential clients. Use this information as a key selling point in your client discussions.

By mastering these aspects, brokers can not only enhance their service offering but also build trust and credibility with their clients, leading to more successful outcomes and sustained business growth.

Conclusion

Understanding how to read a rate sheet is an essential skill for any mortgage broker. This guide has provided a comprehensive overview of how to effectively look through these documents. Here are the major points we’ve covered:

- Understanding Rate Sheets. We’ve detailed how rate sheets are structured, including the various loan programs, terms, and the specifics of par pricing. Recognizing how these elements interact allows brokers to identify the best mortgage products for their clients.

- Interpreting Key Elements. The breakdown of loan-level price adjustments, interest rates, and lock-in periods shows the dynamic nature of mortgage pricing. Understanding these components is crucial for tailoring loans that meet clients’ needs while managing risks.

- Practical Application. Through a step-by-step approach, we demonstrated how to apply the information on rate sheets in real-world scenarios, helping clients understand how different factors like credit score and LTV ratio affect their mortgage rates.

- Broker Strategies. Tips on negotiating, customizing loan offers, communicating complex information clearly, and using competitive analysis ensure that brokers can offer superior advice and service.

To excel in the competitive mortgage industry, brokers must fully understand how to read a rate sheet and interpret them. Regular practice will deepen your understanding of market trends and pricing strategies, enhancing your advisory capabilities. Stay updated with the latest lending standards and economic factors that influence rate changes. By doing so, you can provide clients with accurate, relevant, and timely advice, helping them make informed decisions about their mortgage options.

Embrace the complexity of rate sheets as an opportunity to distinguish your services and build trust with your clients. Your expertise in this area will be a significant asset in guiding clients through one of the most important financial decisions they will make.