In a market flooded with options, how can you make your mortgage brokerage stand out? With over 20,780 businesses vying for a slice of the $26.6 billion US market (according to IBISWorld), the mortgage industry has become extremely competitive. This rapid growth, fueled by a 10.3% annual growth rate since 2019, has created a challenging environment for mortgage professionals. To succeed, you’ll need a strong and effective mortgage broker marketing strategy.

How to market mortgage services to attract the right clients and build a thriving practice? This article will help you out. We will explore the best practices for mortgage broker marketing, focusing on strategies that go beyond the ordinary. You’ll learn about digital marketing, local marketing strategies, and personal branding. We’ll also show you how to track your marketing efforts so you can understand what’s working and what’s not. Whether you’re just starting out or looking to enhance your existing efforts, these mortgage marketing ideas will help you boost mortgage lead generation, close more deals, and achieve greater success in the competitive mortgage market.

Why Marketing Matters for Mortgage Brokers

The mortgage industry is crowded, and borrowers have more choices than ever. With over 40,000 mortgage professionals in the United States (by SmartScrapers), simply offering competitive rates isn’t enough to stand out. You need a mortgage broker marketing strategy that helps you cut through the noise and attract qualified leads – one that doesn’t just reach people but resonates with them and drives action.

Implementing such a strategy will elevate your mortgage lead generation efforts. It will help you get your name out there and reach prospects who are actively searching for mortgage services. Whether it’s through online advertising, social media campaigns, or local community outreach, marketing efforts put your brokerage in front of the right people at the right time.

Choose a top nationwide lender that cares about your growth!

Get Started

Additionally, consistent marketing builds brand recognition. When potential clients see your name repeatedly – on social media, in local publications, or through referrals – they’re more likely to remember you when they’re ready to apply for a mortgage. This visibility establishes your brokerage as a trusted and reliable source for home financing.

Finally, effective marketing helps build client trust. By sharing valuable content like blog posts, videos, or informative guides, you position yourself as an expert in the mortgage industry. This demonstrates your knowledge and expertise, building trust with potential clients and making them more likely to choose your services over the competition.

Mortgage broker marketing today is no longer an option – it’s a necessity. By investing in a well-defined marketing strategy, you can increase your visibility, generate more leads, build strong client relationships, and ultimately achieve greater success in your business.

Digital Marketing Essentials

According to HousingWire, “97% of consumers search for local businesses online, and 78% of marketers report that digital marketing significantly increases business revenue. If you’re not leveraging digital marketing in today’s mortgage landscape, you’re missing out on a significant opportunity.” To help you seize this opportunity, here’s a breakdown of the top digital marketing practices for mortgage brokers.

Website Optimization

Your website is like your online storefront – a place where your potential clients learn about your services, get to know you, and decide if they want to work with you.

A professional and mobile-friendly website is undoubtedly essential. Consider this: a staggering 80% (according to Aidium) of local searches are conducted on mobile phones. If your website isn’t easy to navigate and view on a smartphone, you’re missing out on a huge chunk of potential clients.

To improve your website’s visibility in search results (SEO), focus on on-page optimization. This involves using relevant keywords throughout your website content, such as “mortgage rates,” “home loans,” and “first-time homebuyers.” Make sure your website is easy to navigate, loads quickly (according to Google, “for every second delay in mobile page load, conversions can fall by up to 20%”), and provides valuable information to potential clients.

Don’t forget the importance of lead capture forms. These forms allow you to collect contact information from interested visitors, such as their name, phone number, and email address. Make sure your forms are short, easy to fill out, and offer a clear incentive for visitors to submit their information, such as a free guide or a consultation.

Social Media & Content Marketing

Social media is another powerful tool for mortgage broker marketing, helping you connect with potential clients and build your brand. The key is to focus on the platforms where your audience is most active. For instance, LinkedIn is a great platform for B2B connections, meaning building relationships with other professionals, real estate agents, or financial advisors. Facebook and Instagram, on the other hand, are better suited for B2C, which means reaching individuals like potential homebuyers and homeowners. Once you’ve chosen the right platforms, consistency is critical. Create engaging content that resonates with your audience. Share informative blog posts and short videos, design eye-catching infographics, and showcase client testimonials. Offer valuable insights on the mortgage process, local market trends, and tips for homebuyers.

Email Marketing

Email marketing is another effective digital marketing tool for mortgage brokers to nurture relationships with existing and potential clients. The first step is to build an email list. You can do this by offering valuable incentives for visitors to subscribe to your newsletter, such as free resources, exclusive offers, or early access to new programs. Then, it’s necessary to segment your email list to target specific groups, such as first-time homebuyers, homeowners looking to refinance, or investors. This allows you to tailor your messages to their specific needs and interests. When you get down to sending out your emails, don’t forget about the importance of having a compelling and attention-grabbing subject line to get your emails opened. Keep your newsletters concise, informative, and visually appealing. For even better results, consider using automation tools like drip campaigns and nurture sequences. These allow you to send a series of automated emails to leads at specific intervals to keep them interested and guide them through the mortgage process.

By implementing these digital marketing essentials, you can effectively reach your target audience, generate more leads, and build a strong online presence for your mortgage brokerage.

Local Marketing Strategies

To build trust with the people most likely to use your services, you need to find ways to stand out right where your potential clients live – in your own community. That’s where local marketing comes in. Here’s how to create effective local marketing strategies.

Getting involved in your community is one of the best ways to market mortgage services locally. Consider sponsoring local charities, participating in local community events, or running educational seminars on topics like first-time homebuyer programs or improving credit scores. These efforts not only boost your reputation but also give you a chance to meet potential clients and build lasting relationships with them. People are more likely to trust someone they’ve interacted with in their own neighborhood.

Local SEO & Google Business Profile

Optimizing your online presence for local searches is essential for getting found by potential clients in your area. Ensure your name, address, and phone number (NAP) are consistent across all online platforms, including your website, social media profiles, and online directories. Claim and optimize your Google Business Profile. This free platform allows you to showcase your business information, respond to customer reviews, and share updates. Encourage satisfied clients to leave positive reviews on platforms like Google, Yelp, and other relevant platforms. Positive reviews build trust and credibility, and they also help improve your local search rankings.

Networking with Local Professionals

Building strong relationships with other local professionals can significantly increase your referral network. Focus on building relationships with real estate agents, financial advisors, and certified public accountants (CPAs). These professionals often work with potential homebuyers and can be valuable sources of referrals. Meet them at local events, invite them for coffee, or host casual networking meetups to strengthen these connections. Staying in touch regularly ensures your services are top-of-mind when they meet clients who need help financing their homes.

This way, you can effectively reach potential clients in your community, build trust, and establish your brokerage as the go-to choice for home financing needs.

Measuring Marketing ROI: Metrics That Matter

Are your marketing dollars working as hard as you are? For mortgage brokers, every dollar spent on marketing should contribute to attracting high-quality leads and converting them into clients. But how can you be sure your efforts are truly paying off? That’s where measuring your marketing ROI (Return on Investment) comes in.

Tracking marketing ROI is essential for brokers because it ensures that your budget is driving measurable results, helping you identify the most profitable marketing channels and optimize the ones that need improvement. According to HubSpot, marketers who measure ROI are 12 times more likely to see greater year-over-year returns.

Let’s explore the key areas to focus on to ensure your marketing efforts deliver maximum impact.

Tracking Lead Sources

To get started, it’s crucial to understand where your leads are coming from. By tracking lead sources, you can pinpoint which marketing channels and campaigns are generating the most qualified leads. With this knowledge, you can allocate your budget and resources more effectively and double down on what works. Tools like customer relationship management (CRM) software and Google Analytics can help you track the source of each lead, whether it’s from your website, social media, email marketing, referrals, or paid advertising. With these insights, you can refine your marketing strategies, improve website performance, and ultimately attract more qualified leads to grow your business.

Conversion Rates & Cost-Per-Acquisition

Another critical metric is your conversion rate. This measures how many of your marketing leads turn into paying clients. Understanding this helps you gauge the effectiveness of your campaigns. Additionally, calculating your cost-per-acquisition (CPA) reveals how much you’re spending to acquire each new client. If one channel consistently delivers more clients at a lower cost, it’s a clear signal to invest more in that area.

Once you’ve collected and analyzed your data, the next step is to act on it. Use performance insights to identify underperforming and top-performing channels and adjust your strategy accordingly. For example, if your email marketing campaigns aren’t generating the desired results, you might refine your email lists, test different subject lines, or experiment with new call-to-action formats. On the other hand, if your social media campaigns are consistently driving results, consider increasing your investment in those channels to maximize returns.

Regularly reviewing and tweaking your strategies will ensure that you’re always optimizing your marketing efforts. Remember, it’s not just about spending less, it’s about spending smarter.

The Power of Personal Branding

In a competitive market, trust and credibility are essential to attracting and retaining clients. It’s personal branding that can set you apart by demonstrating expertise, reliability, and a unique approach. A well-crafted personal brand can significantly enhance client trust, strengthen relationships, and drive mortgage lead generation.

Establishing Credibility

Credibility forms the foundation of personal branding for brokers. According to Forbes, “social proof, reputation, and authority have emerged as the cornerstones of trust… potential clients place their trust in brands that exude credibility.”

One of the most effective ways to build credibility is to position yourself as a thought leader. Share your knowledge and expertise by writing informative LinkedIn articles on topics like first-time homebuyer tips, navigating the mortgage process, or understanding different loan programs. Create short and engaging YouTube tutorials explaining complex mortgage concepts in a simple and easy-to-understand manner. These videos can be a valuable resource for potential clients and help establish you as a knowledgeable and approachable expert.

Showcasing Testimonials & Success Stories

Client success stories further enhance your credibility. As WiserNotify points out, “72% of customers trust a business more after reading positive reviews and testimonials.”

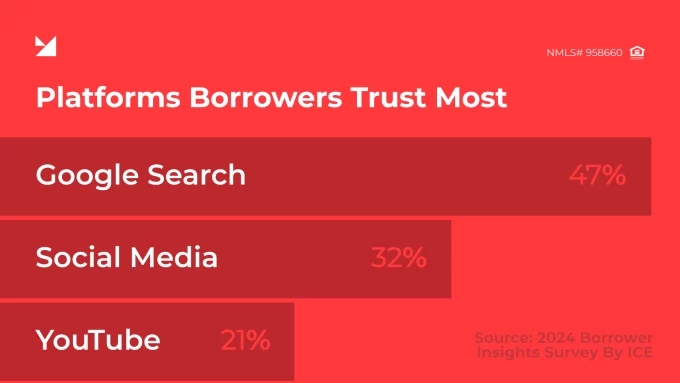

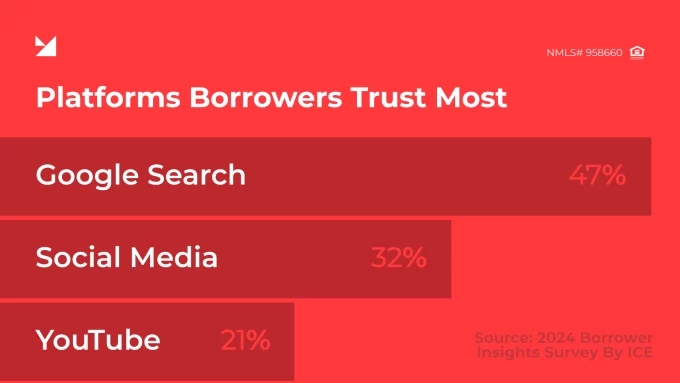

Similarly, the 2024 Borrower Insights Survey by ICE shows that borrowers trust:

- Google Search (47%)

- Social Media (32%)

- YouTube (21%)

To make an impression, feature testimonials across your website, social profiles, and marketing content. You can also use short video testimonials to add a personal touch and build stronger connections with potential clients. Make it easy for your clients to provide feedback. Include a brief survey at the end of the loan process, or simply ask satisfied clients to write a short testimonial.

Maintaining a Consistent Brand Voice

Consistency is key to effective personal branding. According to Forbes, “A report by Lucidpress shows that consistent brand presentation across all platforms can increase revenues by up to 23%.” So make sure your messaging, tone, and visuals are consistent across social media, email campaigns, and client interactions. Whether you’re posting an Instagram story or crafting an email newsletter, your brand should speak with a clear, cohesive voice.

Building a personal brand takes time, but the rewards are worth it. By positioning yourself as a trusted advisor and thought leader, you’ll not only strengthen client relationships but also generate referrals.

Conclusion

Standing out in a crowded market can feel like a challenge, but the right mortgage broker marketing strategy makes all the difference. Whether it’s building a strong online presence, connecting with your local community, or staying consistent with your personal branding, the key is to focus on what works and stay adaptable. A professional website, engaging social media content, and regular outreach through email can all help you generate more leads and build trust with potential clients.

If you’re ready to take your marketing efforts to the next level, AD Mortgage is here to help. We offer tools, resources, and expert support to make your job easier and more effective. Want to learn more? Contact our specialists, sign up for our newsletter to learn industry insights and best practices, or explore our services today. Together, we can help you attract more clients and grow your business.