As a mortgage professional, you know how essential it is to establish relationships with your clients. But have you ever stopped to think about how important it is to build connections with other professionals in the industry? When it comes to choosing a mortgage broker, most homebuyers turn to trusted sources for recommendations. Studies show that a large percentage of borrowers rely on referrals when choosing a mortgage lender. For instance, a Freddie Mac report highlights that 76% of clients often choose their mortgage provider based on recommendations from their real estate agent. This demonstrates the power of trusted relationships in the homebuying process. In a competitive market, forming relationships with mortgage referral partners – like real estate agents, financial advisors, attorneys, and others – can help you significantly grow your broker network.

So, how can you create strategic partnerships in the mortgage industry that drive results? Let this article serve as your guide. From the importance of building a referral network and ways to identify the most valuable mortgage referral partners to measuring the success of your referral efforts and adjusting your approach as needed, we’ll cover everything you need to know.

Why Strategic Partnerships Matter for Mortgage Brokers

While many mortgage professionals focus on direct outreach to clients, those who cultivate strategic partnerships in mortgage gain an edge that sets them apart. Let’s explore the value of referrals and how partnering with complementary professionals can help you stand out in the market.

The Value of Referrals

Did you know that word-of-mouth is the most effective way for consumers to make decisions? As Exploding Topics points out, “Over 9 in 10 consumers trust referrals from friends and family over anything else (Nielson).” Why? Because referrals come with an implicit stamp of approval. When someone you trust recommends a service, it instantly builds credibility and confidence. You’re not just dealing with an advertisement; you’re dealing with someone whose judgment you value.

This trust, in turn, translates into higher conversion rates. Finances Online notes that “Leads from referrals have a 30% higher conversion rate than the leads generated from other marketing channels.” Referred leads often move through the sales process faster, as they’ve likely already discussed their needs with the referring party, making initial conversations more productive.

Additionally, mortgage broker referrals help lower your marketing costs. They act as a form of free advertising, reducing the need for expensive campaigns like online ads or direct mail.

As ReferMe IQ highlights, “Referral marketing is often cost-effective. The Wharton School of Business found that the cost of acquiring a new customer through referral marketing is often lower than through traditional advertising.”

Differentiating in a Crowded Market

Strategic partnerships in mortgage go beyond just increasing conversions – they’re also key to standing out in a crowded market.

By partnering with complementary professionals like real estate agents, financial advisors, and home inspectors, you can expand your reach and increase your visibility within your target market. For example, real estate agents have access to a constant stream of potential homebuyers. By cultivating strong relationships with these agents, you position yourself as the go-to mortgage expert for their clients. This generates consistent, high-quality leads while establishing your reputation as a trusted authority in your local market.

Identifying Potential Referral Partners

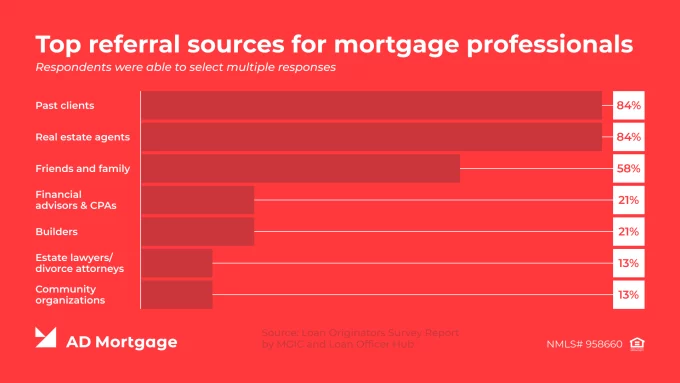

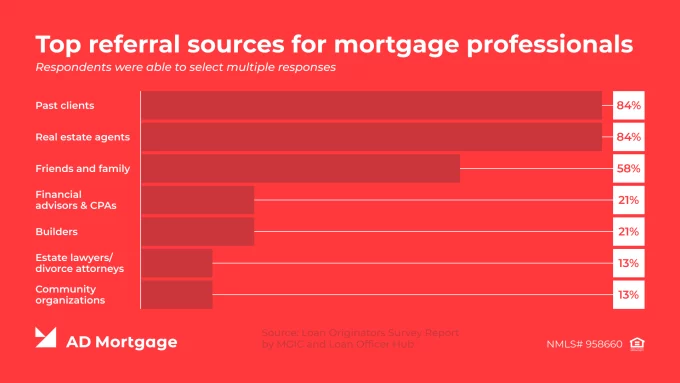

If you want to grow your broker network and keep your pipeline full, you need to focus on finding the right referral partners. Building strong connections with professionals who regularly interact with potential borrowers can open doors to consistent, high-quality leads. The top five referral sources are past clients, real estate agents (both at 84%), friends and family (58%), financial advisors and CPAs (21%), and builders (21%). Here’s why these relationships matter and where to focus your efforts.

Real Estate Agents & Builders

Real estate agents are one of the most valuable sources of mortgage broker referrals. They are in constant contact with potential homebuyers, making them an ideal conduit for your services. The National Association of Realtors (NAR) reports that “88% of home purchases were made through a real estate agent or broker,” demonstrating the enormous potential of working closely with these professionals. To develop effective real estate agent collaborations, attend industry events, sponsor local real estate associations, and offer personalized presentations that showcase how your mortgage programs can benefit their clients.

Home builders and developers are another key group to consider. They consistently work with pre-qualified buyers who need financing solutions, making them excellent mortgage referral partners. You can tap into a valuable lead source by building relationships, demonstrating the value of your mortgage programs for both builders and buyers, and providing excellent service. These partnerships allow you to share leads and ensure that their clients have a smooth experience, benefiting everyone involved.

Financial Advisors, CPAs, & Attorneys

Financial advisors, CPAs, and estate attorneys often work with high-net-worth individuals and small business owners – clients who are prime candidates for your mortgage services. These professionals understand the complexities of financial planning and can identify clients with specific mortgage needs, such as investment property financing or jumbo loans.

These strategic partnerships in mortgage can create opportunities for cross-referrals. For example, in financial advisor partnerships, a wealth management client could be referred to you for mortgage advice. In return, you can refer your clients to them for services like tax planning or estate advice, creating a win-win relationship.

Joining local business organizations like the Chamber of Commerce, industry-specific associations, and networking groups like BNI (Business Network International) can significantly expand your reach. These resources provide valuable opportunities to connect with other professionals, build personal relationships, and establish yourself as a trusted member of the local business community.

Remember, identifying the right partners isn’t just about getting leads; it’s about creating lasting, mutually beneficial relationships that make your work easier and your results stronger.

Creating Win-Win Relationships

As Bob Burg, the bestselling co-author of the “Go-Giver” book series, wisely said, “Networking is simply the cultivating of mutually beneficial, give-and-take, win-win relationships. It works best, however, when emphasizing the ‘give’ part.” With this mindset, let’s explore how to create a mutually beneficial ecosystem that prioritizes providing value to your partners.

Offering Valuable Resources & Co-Marketing

The foundation of any successful relationship with mortgage referral partners lies in providing value. One effective way to do this is by offering co-marketing opportunities and valuable resources that benefit both parties. For example, hosting co-branded seminars, workshops, or webinars on topics like “First-Time Homebuyer Strategies” or “Navigating the Mortgage Process” not only educates potential clients but also positions you and your partner as trusted industry experts. When you collaborate on marketing efforts with your mortgage referral partners, you not only share costs but also increase the reach of your efforts. Co-branded materials, like flyers, social media campaigns, or email newsletters, allow both parties to engage a larger audience without doubling expenses.

Referral Fees & Compliance

When it comes to building win-win strategic partnerships in the mortgage industry, it’s essential to remain compliant and transparent. For example, offering referral fees can be a valuable incentive for your partners, but it’s crucial to navigate this carefully. Ensure your agreements comply with the Real Estate Settlement Procedures Act (RESPA) to avoid any legal issues. Make sure all parties are clear about how referral fees are structured and always provide written disclosures to avoid any misunderstandings.

Tailoring Your Approach to Each Partner

It’s important to understand that not all partners have the same needs or clientele. Therefore, it is important to tailor your approach to each individual partner. For instance, if you work with a real estate agent who specializes in first-time homebuyers, focus on providing educational content about the mortgage process. And if you partner with a financial advisor who focuses on high-net-worth clients, consider offering insights into the luxury housing market or investments.

By focusing on creating win-win relationships, offering valuable resources, and tailoring approach to each partner, you can build a robust referral network that drives sustainable growth for your mortgage business.

Maintaining and Growing Your Referral Network

Now that you know how to create win-win relationships, it’s necessary to understand how to maintain and grow these connections. Building a referral network is an ongoing process, not a one-time event. Here’s how to do just that.

Consistent Communication

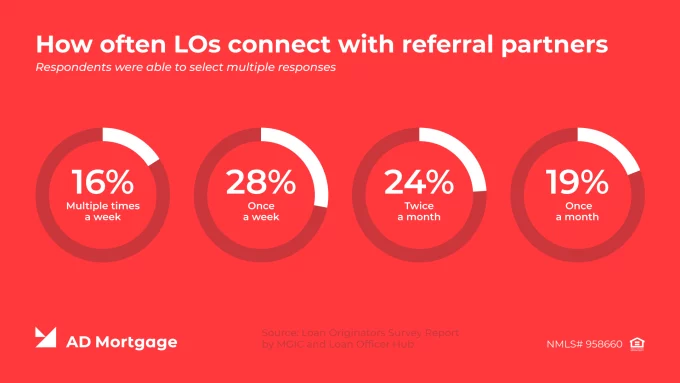

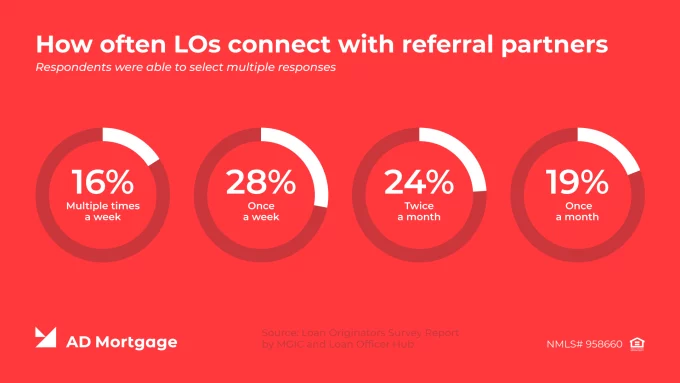

Schedule regular check-ins with your partners – whether it’s a quick phone call, a brief email, or a more in-depth meeting. Consistency is key to staying top-of-mind. According to MGIC’s Loan Originators Survey Report, 28% of LO s stay in touch with their best referral partners once a week, making it the most common frequency.

This data highlights the importance of frequent, meaningful communication. Stay top-of-mind by sharing relevant market insights, such as interest rate updates, local market trends, and any new mortgage programs or initiatives.

Providing Ongoing Value

Share valuable content, such as informative blog posts, insightful articles, or even short video clips that your partners can share with their clients. Consider co-hosting events or producing joint content, such as social media videos or informative webinars.

Tracking Referrals & Expressing Appreciation

Track your mortgage referral partners and express your appreciation. A simple CRM or spreadsheet can help you track which partners are sending the most referrals and the success rate of those referrals.

Get the ADvantage

with our loyalty program

Earn and redeem points for valuable benefits for you and your clients

Unlock Rewards

Show your gratitude by sending personalized thank-you notes or small tokens of appreciation. A handwritten card, a small gift basket, or even a referral bonus can go a long way in strengthening your relationships.

Measuring Success & ROI

Building a strong referral network is an investment. To ensure you’re getting a good return on that investment, it’s crucial to track your success and measure your results.

Key Metrics

Key metrics to monitor include the number of leads generated from each partner, the conversion rates of those leads into closed loans, and the overall volume of referrals received. By tracking these numbers, you can identify which partnerships are most productive and which may need some attention.

Adjusting Your Strategy

Regularly analyze your data to identify top-performing partnerships. These are the relationships that consistently deliver high-quality leads and contribute significantly to your business growth. Conversely, identify partnerships that aren’t generating a significant return on investment. This may require some honest self-reflection. Are you providing enough value to these partners? Are your marketing efforts aligned with their target audience? Based on your analysis, adjust your strategy accordingly. Shift your focus towards building stronger relationships with your top-performing partners. Explore new co-marketing opportunities, offer exclusive incentives, and go the extra mile to exceed their expectations.

For partnerships that aren’t yielding the desired results, consider refining your collaboration methods. You may need to adjust your messaging, offer more tailored solutions, or explore different avenues for generating referrals.

Tracking your results and making data-driven adjustments to your strategy will enable you to optimize your referral network, maximize your return on investment, and build a sustainable and profitable mortgage business.

Conclusion

Building a thriving mortgage business goes beyond just finding clients. It’s about building a strong network of relationships that will fuel your success. Referrals are like word-of-mouth endorsements from people your clients already trust. When a real estate agent, financial advisor, or even a trusted friend recommends you, it instantly builds credibility and trust.

By cultivating strategic partnerships in the mortgage industry with other professionals, you can tap into their networks, expand your reach, and ultimately, simplify your client acquisition process. You’ll enjoy a steady stream of high-quality leads, reduce the need for costly marketing campaigns, and build a reputation as the go-to mortgage expert in your community.

At AD Mortgage, we understand the power of these partnerships. We’re here to support you with valuable resources and guidance to help you build and maintain these important relationships. Contact us today to start unlocking your opportunities!