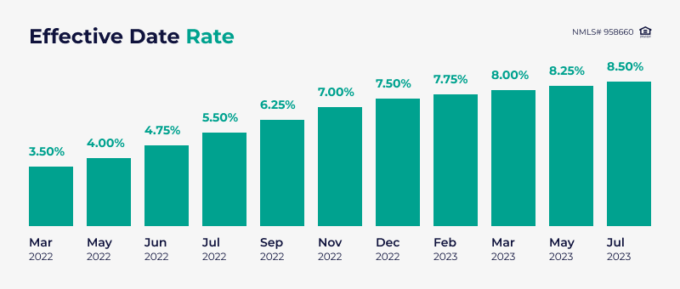

With the recent Federal Reserve hike in interest rates, you and your clients might be concerned about the impact on Home Equity Lines of Credit (HELOC) and other adjustable-rate products.

However, we have fantastic news that can set you apart from the competition and provide your clients with the stability and peace of mind they deserve. Introducing A&D Mortgage’s Fixed-Rate Second Mortgages!

Struggling with a loan scenario?

Get a solution in 30 minutes!Fill out the short form and get a call from our AE

Submit a ScenarioWhy Choose A&D Mortgages’ Fixed-Rate Second Mortgages?

- 🔒 Rate Stability: While other lenders’ HELOC rates may be subject to market fluctuations, A&D Mortgage’s second mortgage rates are FIXED. This means your clients can enjoy steady, predictable payments without worrying about sudden rate increases.

- 🏡 Protect Your Clients’ Finances: With A&D Mortgage, your clients can confidently plan their financial future without the uncertainty of rising interest rates. This stable financial foundation can help them achieve their homeownership goals and build long-term wealth.

- 🌟 Stand Out from the Competition: As a mortgage broker, you know the value of offering unique and attractive products to your clients. With A&D Mortgage’s fixed-rate second mortgages, you can provide a valuable solution that your clients won’t easily find elsewhere, strengthening your position in the market.

- 🏦 Wide Range of Loan Options: At A&D Mortgage, we offer flexible terms and competitive rates to suit your clients’ diverse needs. From home renovations to debt consolidation, our second mortgages empower your clients to achieve their dreams without compromising on stability.

How to Help Your Clients Secure Stability Today

By partnering with A&D Mortgages, you can empower your clients with a secure financial future. Here’s how you can get started:

- Discuss Their Goals: Talk to your clients about their homeownership goals, financial objectives, and potential concerns with rising interest rates.

- Present the Advantage: Explain the unique benefits of A&D Mortgage’s fixed-rate second mortgages and how they can safeguard your clients’ finances in the face of potential rate increases.

- Provide Personalized Solutions: Our dedicated team is here to assist you in finding the best fixed-rate second mortgage solutions for each client, tailored to their specific needs.

- Seize the Opportunity: Act quickly to capitalize on the Fed’s announcement and promote the advantages of A&D Mortgage’s fixed-rate second mortgages to your clients.

Partner with A&D Mortgage Today

Don’t wait to offer your clients the stability and peace of mind they deserve! Partner with A&D Mortgage and showcase your commitment to providing unique and valuable solutions in the face of changing market conditions.

Reach out to us today to explore how A&D Mortgage’s fixed-rate second mortgages can make a difference for your clients and your business.

Secure their financial future with A&D Mortgage – where stability meets opportunity!