In today’s digital age, social media has become a powerful tool for sharing knowledge and connecting with audiences. From fashion tips to financial advice, influencers became go-to sources for a wide array of information. The mortgage industry is no exception. Platforms like TikTok, Instagram, and YouTube are buzzing with creators who simplify complex mortgage concepts and offer guidance to their followers. These influencers use creative, engaging, and often humorous content to demystify topics such as credit scores, down payments, and refinancing. However, the widespread consumption of advice raises critical questions about its reliability. Are social media influencers providing accurate, well-rounded information? Or are they unintentionally (or sometimes intentionally) oversimplifying key details that borrowers need to know?

The Emergence of Social Media Influencers in Mortgage Education

Social media influencers are individuals who build large online followings by creating engaging and informative content. In the mortgage sector, these influencers often cater to first-time homebuyers or younger audiences seeking clarity on what can be a confusing process. Platforms like TikTok, Instagram, and YouTube are popular spaces where influencers simplify intricate topics like down payments, credit scores, refinancing, and even less common concepts such as loan-to-value ratios or equity.

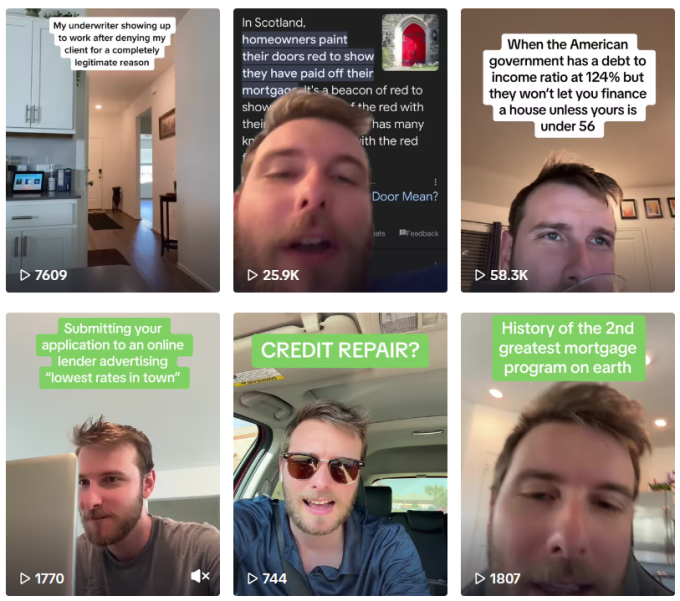

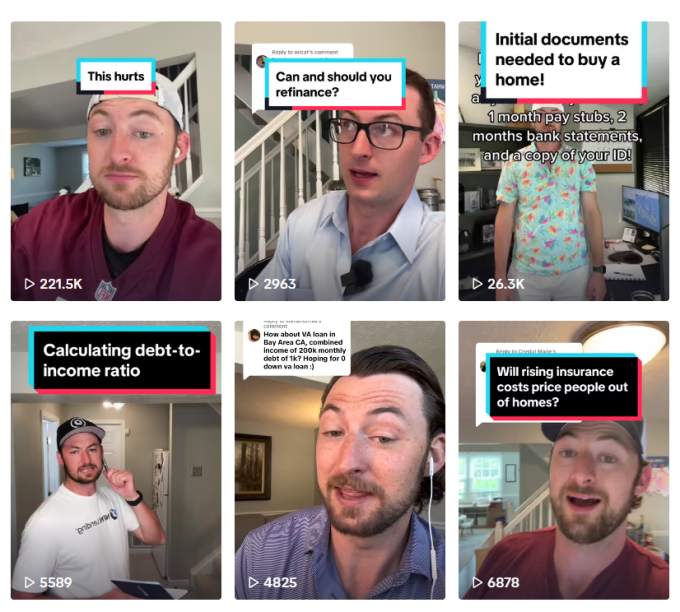

One of the key reasons influencers resonate with Millennials and Gen Z is their ability to distill complex information into short, relatable content. For instance, a TikTok influencer might use animations, trending sounds, or storytelling to explain how to improve a credit score, making the learning process entertaining and accessible. Instagram posts might feature visually appealing infographics that break down mortgage myths. YouTube videos allow for more in-depth discussions and walkthroughs of the home-buying journey.

This trend reflects a significant shift in how younger generations consume financial education. They gravitate towards influencers who speak in plain, relatable language and share personal anecdotes that make intimidating topics feel more approachable. Many influencers further build trust by engaging with their audiences through comments and direct messages, fostering a sense of community and accessibility that traditional financial institutions often lack.

However, this rise in influencer-driven mortgage education also underscores the importance of vetting the advice being shared. These platforms can serve as excellent entry points for understanding mortgage basics. Yet, they rarely offer the depth or personalized insight that a professional mortgage broker can provide. Brokers can connect with younger clients, either by creating their own content or by collaborating with trusted influencers to bridge the gap between accessibility and expertise.

Benefits of Influencers in Mortgage Education

The rise of mortgage influencers brings several advantages to the table, transforming the way mortgage education is delivered and consumed. These influencers have found innovative ways to break down intricate topics into accessible, engaging formats that appeal to a wide range of audiences. Here are some of the key benefits they bring:

- Increased Accessibility. Influencers simplify complex terms and processes, making mortgage education approachable for individuals who might otherwise find the topic overwhelming. Whether it’s explaining the nuances of adjustable-rate mortgages or the importance of maintaining a good credit score, their content demystifies the mortgage journey.

- Wide Reach. Social media influencers can engage with audiences who may not seek advice through traditional financial channels. Younger generations, in particular, gravitate toward platforms like TikTok and Instagram, where influencers share digestible content that resonates with their interests and needs. This broad reach allows influencers to connect with individuals at various stages of their home-buying journey.

- Engagement and Inspiration. The dynamic nature of influencer content—often incorporating storytelling, humor, or interactive elements—keeps audiences engaged. For mortgage brokers, this offers inspiration for crafting their own online presence. Influencers set a blueprint for connecting with tech-savvy clients by emphasizing creativity, clarity, and relatability in their messaging.

Additionally, influencers’ ability to foster a sense of community among their followers cannot be understated. By creating a welcoming space for discussions about homeownership, they help normalize conversations about finances.

For mortgage brokers, these benefits highlight opportunities to harness similar techniques. By adopting strategies like personalized content and leveraging social media’s interactive nature, brokers can enhance their engagement with prospective clients. Moreover, collaborating with credible influencers can amplify brokers’ reach and reinforce their role as trusted experts in the industry.

Challenges and Risks of Influencer Mortgage Advice

While influencers can be beneficial, their advice isn’t without risks, and borrowers should approach it with caution:

- Accuracy of Information. Not all influencers possess a deep understanding of the complexities of mortgage lending. Inaccurate or incomplete advice can lead borrowers astray, resulting in unrealistic expectations or poor financial decisions.

- Lack of Credentials. Many influencers lack formal training or professional experience in the mortgage industry. This raises significant concerns about their authority to dispense financial advice, particularly on intricate matters like loan terms or refinancing strategies.

- Oversimplification. Social media’s fast-paced, concise formats often oversimplify mortgage concepts, leaving out critical nuances. For instance, a 60-second TikTok video may omit important factors like creditworthiness or debt-to-income ratios, which are crucial to loan approval.

- Legal and Ethical Concerns. Misrepresentation of mortgage programs or failure to comply with financial regulations can create serious repercussions for borrowers. This can range from misinformation about eligibility criteria to promoting unethical practices, which may put borrowers and brokers at legal risk.

Can You Trust Mortgage Advice from TikTok Influencers?

It’s common to see TikTok influencers sharing tips like “how to pay off your mortgage faster” or “why you should consider house hacking.” These bite-sized pieces of advice often gain traction due to their simplicity and relatability. But can their advice be trusted? Some influencers provide valuable insights grounded in sound financial principles. Others may oversimplify or present advice that doesn’t apply universally, potentially leading to confusion or unrealistic expectations.

For instance, influencers offering good advice might focus on practical steps, such as explaining how maintaining a high credit score can secure favorable mortgage terms. They might provide actionable tips like setting up automatic payments or keeping credit utilization low. This can resonate with viewers and lead to positive outcomes.

On the other hand, some influencers may share bad advice. This includes suggesting that anyone can qualify for a mortgage loan regardless of their financial situation. This type of oversimplification ignores critical factors like debt-to-income ratios, employment history, and the stringent criteria mortgage lenders use during underwriting. Such advice, though appealing, can mislead borrowers and cause unnecessary frustration.

This trend is especially relevant for Gen Z, who predictably turn to social media for information. According to the Gen Z Home Buyer Report by Clever Real Estate, about 38% of Gen Z receive home-buying information from TikTok. However, more than 1 in 7 homeowners (15%) report that the advice they got from TikTok and other social media platforms was bad.

Borrowers should be cautious when consuming mortgage advice on social media. Not every influencer has the expertise to address the nuances of mortgage lending. This is where mortgage brokers play a vital role—by offering accurate, personalized guidance to counterbalance generalized social media content.

How Mortgage Brokers Can Leverage Social Media

Rather than viewing influencers as competitors, brokers can use social media by adopting strategies that position them as trusted experts:

- Establish Credibility. Brokers can create and share high-quality content that addresses common misconceptions, explains mortgage processes in detail, and provides accurate, professional advice. This builds trust and positions brokers as reliable sources of information. For instance, posting videos that break down the step-by-step process of applying for a mortgage or explaining complex terms like loan-to-value ratios can help demystify these concepts for potential clients.

- Collaborate with Influencers. Partnering with reputable influencers can significantly expand a broker’s reach. By collaborating with influencers who have established credibility and a loyal following, brokers can tap into new audiences. For example, an influencer might host a Q&A session with a broker. Influencers can also feature brokers in content discussing real-life mortgage scenarios. This collaboration can enhance trust and highlight the broker’s expertise.

- Engage Clients. Social media platforms provide an excellent opportunity for brokers to directly interact with potential borrowers. By answering questions in the comments section, hosting live sessions, or responding to direct messages, brokers can build relationships and demonstrate their willingness to assist clients personally. Additionally, sharing client success stories or testimonials can help humanize their brand and create a stronger connection with their audience.

By implementing these strategies, brokers can compete with the rising influence of social media personalities and carve out their own space as authoritative voices in mortgage education. Engaging with audiences in a relatable manner ensures that borrowers receive the trustworthy guidance they need.

Conclusion

The influence of social media personalities in mortgage education is undeniable. They have brought valuable attention to a topic that often feels overwhelming for many borrowers. With engaging content, influencers can simplify complex mortgage concepts and make the information accessible to a broader audience. However, the accuracy and applicability of their advice vary widely, creating both challenges and opportunities for mortgage brokers.

Choose a top nationwide lender that cares about your growth!

Get StartedSocial media influencers often thrive on relatability and quick explanations, but this can sometimes lead to oversimplification or incomplete guidance. This is where mortgage brokers have a unique advantage. By stepping in as reliable sources of accurate and personalized information, brokers can address the gaps left by influencer-driven content.

Mortgage brokers can use social media to not only connect with potential clients but also actively correct misinformation. By sharing their expertise through videos, posts, or live Q&A sessions, brokers can position themselves as trusted authorities.

When digital influence is growing, brokers have to ensure that borrowers receive the trustworthy guidance. By embracing the digital space, brokers can enhance their reach and reinforce their role in the mortgage process.