Tariffs have long been a significant tool in the U.S. government’s economic arsenal. They help protect domestic industries, generate revenue, and influence foreign trade relationships. Tariffs function by imposing taxes on imported goods, thereby making foreign products more expensive and encouraging the consumption of domestically produced alternatives. While their primary focus is often on manufacturing and international commerce, tariffs can have profound ripple effects on various sectors. That includes the housing market.

Understanding the historical impact of U.S. tariffs on housing costs, construction materials, supply chains, and market trends is crucial. This knowledge helps industry stakeholders anticipate market shifts, develop effective pricing strategies, and advocate for policies that promote stable and affordable housing. By examining past tariff implementations and their consequences, we can gain valuable insights into how current and future trade policies might shape the housing landscape.

What Is a Tariff?

A tariff is essentially a tax imposed by a government on imported goods and services. This tax increases the cost of foreign products, making domestic alternatives more competitive. Tariffs can influence entire industries, shifting the dynamics of supply and demand, production costs, and consumer pricing. In the context of the housing market, tariffs on construction materials such as lumber, steel, and aluminum can lead to higher costs for builders, which are often passed down to homebuyers. This ripple effect can result in increased housing prices, reduced construction activity, and altered affordability conditions for prospective buyers.

Types of Tariffs

Tariffs can be categorized into several types, each with unique implications for trade and industry economics.

- Ad Valorem. These tariffs are calculated as a percentage of the value of the imported good. For example, a 10% ad valorem tariff on $1,000 worth of imported steel would add $100 to the cost. This type of tariff fluctuates with the price of goods, making it sensitive to market changes.

- Specific. A fixed fee based on the quantity of goods imported, regardless of their value. For instance, a tariff of $50 per ton of imported lumber applies uniformly, whether the market price of lumber rises or falls. Specific tariffs provide predictable revenue but may not account for price volatility in the market.

- Protective. Designed primarily to shield domestic industries from foreign competition by making imported goods more expensive. This can help local producers maintain market share. However, it often leads to higher prices for consumers, including those purchasing homes or undertaking construction projects.

- Retaliatory. Imposed in response to trade barriers set by another country. These tariffs are often part of trade disputes and can escalate tensions between trading partners. In the housing sector, retaliatory tariffs on key materials can disrupt supply chains and inflate costs unexpectedly.

- Revenue. Imposed mainly to generate income for the government rather than to protect domestic industries. While less common today in developed economies, revenue tariffs can still affect housing by increasing the overall cost of imported building materials.

How Tariffs Impact the Housing Market: The Mechanism

The mechanism through which tariffs impact the housing market involves several steps.

- The added cost from tariffs increases the price of raw materials essential for construction. Builders facing higher input costs may reduce their profit margins, delay projects, or pass these costs onto homebuyers.

- As home prices rise, demand may decrease, especially in price-sensitive markets, potentially slowing down the housing sector.

- Broader economic effects, such as reduced international trade and strained supplier relationships, can indirectly influence housing market stability and growth.

Understanding these mechanisms is critical for stakeholders in the housing industry to anticipate changes in market conditions, adjust pricing strategies, and advocate for policies that support housing affordability.

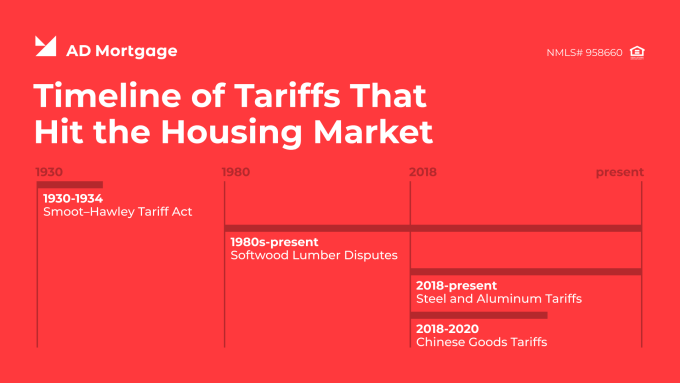

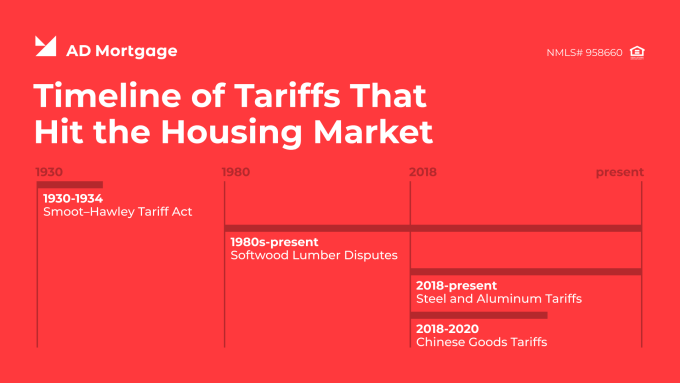

Historical Timeline of Key Tariffs Affecting the Housing Market

Tariffs have played a significant role in shaping the economic landscape of the United States. Their influence included housing. Over the years, several key tariff policies have directly or indirectly impacted the housing market through increased construction costs, supply chain disruptions, and shifts in housing affordability. This timeline highlights some of the most notable tariffs and trade disputes that have affected the housing sector, illustrating the complex relationship between trade policy and real estate economics.

Smoot-Hawley Tariff Act of 1930

Enacted during the Great Depression, this legislation imposed high tariffs on over 20,000 imported goods, with the intention of protecting American jobs and industries. However, it backfired spectacularly, as many countries retaliated with their own tariffs. This led to a collapse in international trade. While its direct impact on the housing market was limited, the broader economic downturn it exacerbated had profound effects on housing development and sales. Unemployment skyrocketed, consumer confidence plummeted, and financial institutions faced instability, resulting in reduced access to credit for homebuyers and builders. This economic contraction led to a dramatic slowdown in new housing construction and a sharp decline in property values during the 1930s.

Softwood Lumber Disputes (1980s–Present)

The U.S. has had ongoing trade disputes with Canada over softwood lumber, a critical material for homebuilding. The U.S. government has periodically imposed tariffs and duties on Canadian lumber, arguing that Canadian producers benefit from unfair government subsidies. These tariffs have significantly increased the cost of lumber during key periods, notably impacting housing affordability. During the 2000s and in the late 2010s, tariffs contributed to price spikes in lumber. As a result, they raised construction costs for single-family homes and multifamily developments. The effects were especially pronounced during the COVID-19 pandemic when supply chain disruptions combined with existing tariffs to push lumber prices to record highs. It severely impacted the cost of new homes and renovations.

Steel and Aluminum Tariffs (2018)

Under the Trump administration, the U.S. imposed a 25% tariff on steel and a 10% tariff on aluminum imports, citing national security concerns under Section 232 of the Trade Expansion Act. These materials are essential for residential construction, used in framing, roofing, appliances, HVAC systems, and structural reinforcements. The tariffs led to a significant increase in construction costs, as domestic producers raised their prices in response to reduced foreign competition. Builders reported a surge in expenses, particularly for large-scale projects, infrastructure, and multifamily housing developments. The increased costs were often passed on to homebuyers, contributing to higher home prices during an already tight housing market. Additionally, the tariffs created uncertainty in the construction industry. It led to project delays and revised budgets, further complicating housing supply dynamics.

Chinese Goods Tariffs (2018–2020)

As part of the broader U.S.-China trade war, the U.S. imposed tariffs on hundreds of billions of dollars’ worth of Chinese goods. These included a wide range of construction materials such as lighting fixtures, flooring, cabinetry, and countertops. These tariffs disrupted supply chains and increased costs for builders, remodelers, and consumers alike. The housing sector experienced cost increases not only for raw materials but also for finished products essential to interior design and home functionality. This added pressure to an already challenging affordability landscape, particularly in urban markets where construction costs were already high.

These historical tariffs illustrate how trade policies, while often aimed at protecting domestic industries or addressing geopolitical issues, can have far-reaching consequences for the housing market. Whether through direct material cost increases, supply chain disruptions, or broader economic downturns, tariffs have repeatedly shaped the landscape of housing affordability, construction trends, and market stability.

Direct Impact of Tariffs on Housing Costs

Tariffs have a direct and immediate effect on housing costs, primarily through their influence on the price of construction materials. When tariffs are imposed on key building materials such as lumber, steel, aluminum, and other imported goods, the additional costs are often transferred down the supply chain to developers, contractors, and ultimately, homebuyers. This section delves into the specific ways in which tariffs directly impact housing costs.

Increased Cost of Construction Materials

- Lumber. Tariffs on Canadian softwood lumber, for instance, have historically led to significant price spikes in the U.S. housing market. Lumber is a critical component for framing residential properties. That’s why higher prices can substantially raise the cost of building new homes. For example, during the 2018 lumber tariff period, average new home prices increased by thousands of dollars due to the surge in material costs.

- Steel and Aluminum. These materials are essential for structural components, roofing, appliances, and HVAC systems. The 2018 tariffs on steel (25%) and aluminum (10%) resulted in notable price hikes, increasing the cost of both residential and commercial construction projects.

Higher Home Prices

Builders typically pass increased material costs onto buyers to maintain profit margins. This results in higher listing prices for new homes. Therefore, it is more challenging for first-time buyers to enter the market and reducing overall housing affordability.

Impact on Renovation and Remodeling Costs

Tariffs also affect homeowners planning renovations or remodels. Higher prices for materials like lumber, metal fixtures, and imported tiles mean that renovation projects become more expensive, potentially delaying or downsizing planned improvements.

Reduced Construction Activity

Elevated costs can deter developers from starting new projects, particularly in markets where profit margins are already thin. This reduction in new housing supply can exacerbate housing shortages, driving prices even higher due to increased demand relative to limited availability.

Inflationary Pressures

Tariffs contribute to overall inflation by increasing the cost of goods and services related to housing. This can indirectly affect mortgage interest rates, as central banks may adjust rates to manage inflation, further increasing the cost of homeownership.

Tariffs directly impact housing costs through higher material prices, increased home prices, and reduced construction activity. These effects ripple throughout the housing market, influencing affordability, supply, and demand dynamics.

Indirect Effects on the Housing Market

Tariffs have a clear and immediate direct impact on housing costs through material price increases. Still, their indirect effects on the broader housing market are equally significant. These indirect effects often ripple through the economy, influencing various factors such as supply chain stability, labor markets, consumer confidence, and financial conditions. This section explores the key indirect ways tariffs affect the housing market.

Looking for a suitable loan program?

Choose among 20+ programs and get

a detailed loan calculation

Loan Calculator

Programs

Supply Chain Disruptions

Tariffs can lead to significant disruptions in global supply chains, especially when imposed on countries that are major suppliers of construction materials. These disruptions may result in delays in the availability of essential materials, causing construction project slowdowns or halts. Delays increase holding costs for developers. This can lead to higher final prices for homebuyers. Additionally, unpredictable supply timelines can deter investors and builders from initiating new projects, tightening the housing supply.

Labor Market Impacts

The construction industry relies heavily on skilled labor, and tariffs can indirectly affect employment levels. As project costs rise due to material tariffs, some developers may cut back on hiring or reduce labor hours to manage expenses. This can lead to job losses or wage stagnation in the construction sector. As a result, it affects household incomes and reducing the purchasing power of potential homebuyers.

Decreased Housing Affordability

Indirectly, tariffs contribute to decreased housing affordability. They do this not just through higher home prices but also via increased costs in other areas. For example, tariffs on imported goods used in everyday life can lead to higher living expenses overall, reducing the disposable income available for housing. This makes it harder for individuals and families to save for down payments or qualify for mortgages.

Impact on Interest Rates

Tariffs can influence macroeconomic conditions such as inflation and economic growth. Higher costs for goods and services due to tariffs can fuel inflation, prompting central banks like the Federal Reserve to raise interest rates to control price growth. Higher interest rates increase borrowing costs. It affects mortgage rates and makes home loans more expensive for buyers, thereby dampening housing demand.

Investor Uncertainty and Market Volatility

Tariff-related trade tensions can create economic uncertainty, causing fluctuations in financial markets. This volatility can affect investor confidence, leading to reduced investment in real estate development projects. Uncertainty also makes it challenging for developers to plan long-term projects, potentially slowing the pace of new housing supply entering the market.

Regional Disparities

The impact of tariffs is not uniform across the country. Regions that rely heavily on imported construction materials or have a strong manufacturing base tied to affected industries may experience more severe housing market disruptions. Conversely, areas with robust local supply chains or diversified economies might be more resilient to tariff-related shocks.

In conclusion, the indirect effects of tariffs on the housing market extend beyond material costs. They influence labor markets, interest rates, supply chains, and consumer confidence. These factors interact in complex ways, shaping housing affordability, availability, and overall market stability.

Case Studies

Examining specific case studies helps to illustrate the real-world impact of tariffs on the housing market. These examples highlight how different types of tariffs have influenced construction costs, housing supply, and market trends in recent years.

2018 Steel and Aluminum Tariffs

In 2018, the U.S. government imposed a 25% tariff on steel and a 10% tariff on aluminum imports under Section 232 of the Trade Expansion Act, citing national security concerns. These tariffs significantly affected the construction industry since steel and aluminum are critical materials for building infrastructure, residential properties, and appliances. As a direct consequence, builders reported a sharp increase in material costs, which translated into higher construction expenses. For example, large-scale housing projects faced budget overruns, forcing developers to either pass on the costs to homebuyers through higher prices or scale back on project sizes. The National Association of Home Builders (NAHB) estimated that these tariffs added thousands of dollars to the cost of an average new home, making it less affordable for many potential buyers.

Softwood Lumber Disputes (1980s–Present)

The U.S.-Canada softwood lumber dispute is one of the longest-running trade conflicts, with tariffs and duties periodically imposed on Canadian lumber exports to the U.S.

Softwood lumber is a primary material for residential construction. So, fluctuations in its price due to tariffs have a significant impact on housing costs. During the 2020–2021 period, a combination of high tariffs and supply chain disruptions caused by the COVID-19 pandemic led to record-high lumber prices. The surge added nearly $36,000 to the cost of building a typical single-family home, according to the NAHB. This sharp increase not only affected new home prices but also slowed down construction activity, exacerbating housing shortages in many regions.

Economic Theories and Expert Insights

Understanding the broader economic implications of tariffs on the housing market requires an exploration of key economic theories and expert analyses. Tariffs were designed to protect domestic industries and generate government revenue. Still, they often have unintended consequences that ripple through various sectors, including real estate.

Supply and Demand Theory

One of the most fundamental economic principles affected by tariffs is the law of supply and demand. When tariffs increase the cost of imported construction materials, the supply of affordable materials decreases. At the same time, demand remains constant or even rises due to ongoing housing needs. This imbalance leads to higher prices for new homes and renovation projects, reducing affordability for consumers. Experts argue that inelastic demand for housing exacerbates the price hikes because people cannot easily forgo the need for shelter.

Cost-Push Inflation

Tariffs contribute to cost-push inflation, where increased production costs lead to higher prices for goods and services. In the housing sector, tariffs on raw materials like steel, aluminum, and lumber raise construction expenses, which are passed down to consumers. Economists highlight that this form of inflation affects housing prices. Moreover, it can also lead to broader economic inflation, influencing interest rates and the overall cost of living.

Protectionism vs. Free Trade

The debate between protectionist policies (like tariffs) and free trade is central to understanding their economic impact. Protectionists argue that tariffs safeguard domestic industries from unfair foreign competition, preserving jobs and promoting local growth. However, free trade advocates contend that tariffs disrupt global supply chains, increase costs, and reduce market efficiency. In the context of housing, experts often find that the negative effects of higher material costs outweigh the intended benefits of protecting domestic producers.

Elasticity of Demand in Housing

The concept of price elasticity of demand explains how sensitive the demand for a good is to changes in price. Housing demand is generally considered inelastic because it fulfills a basic human need. However, when tariffs significantly raise construction costs, the demand for new homes may become more elastic, especially among first-time buyers and middle-income families who are more price-sensitive. This shift can lead to a slowdown in the housing market, affecting builders, real estate agents, and mortgage lenders.

Expert Insights

Housing market analysts and economists often emphasize that the cumulative impact of tariffs extends beyond immediate price increases. Experts from organizations like the National Association of Home Builders (NAHB) and the Urban Institute suggest that tariffs create uncertainty in the market, discouraging investment in new housing projects. This uncertainty can lead to reduced housing supply, longer project timelines, and increased volatility in housing prices.

Globalization and Trade Dependencies

In an increasingly interconnected global economy, the housing market is heavily influenced by international trade dynamics. Tariffs can strain relationships with key trading partners, leading to retaliatory measures that further disrupt supply chains. Economists argue that such disruptions affect material costs and hinder the flow of capital and labor necessary for a robust housing sector.

In summary, economic theories and expert insights reveal that tariffs, while intended to protect domestic industries, often have complex and far-reaching effects. From driving up costs through supply chain disruptions to influencing macroeconomic factors like inflation and interest rates, tariffs play a significant role in shaping housing affordability and market stability.

Recent Developments and Future Outlook

Tariffs remain a dynamic element of U.S. trade policy. Recent developments are poised to have significant implications for the housing market. New tariffs introduced by the Trump Administration are set to go into effect, targeting imports from China, Mexico, and Canada. These tariffs are expected to affect a broad range of goods. Those include critical construction materials such as steel, aluminum, lumber, and manufactured components used in residential building.

New Tariffs on China, Mexico, and Canada (2025)

The newly announced tariffs aim to address ongoing trade imbalances and protect U.S. manufacturing industries. However, these measures are likely to result in increased costs for imported construction materials. For example, China supplies various manufactured goods used in homebuilding, from fixtures to flooring materials. Similarly, Mexico is a key exporter of cement, tiles, and construction equipment. Canada remains the largest supplier of softwood lumber to the U.S.

Housing experts predict that these tariffs will lead to higher material costs. They will potentially add thousands of dollars to the price of new homes.

Impact on Construction Costs and Housing Affordability

As material costs rise, builders will face increased expenses that are likely to be passed on to consumers. This could exacerbate housing affordability challenges, especially in markets already struggling with high prices and limited inventory. The National Association of Home Builders (NAHB) has expressed concerns that the new tariffs could slow down new construction projects, reduce housing supply, and widen the affordability gap.

Potential for Supply Chain Disruptions

The global supply chain is still recovering from disruptions caused by the COVID-19 pandemic and previous trade tensions. The new tariffs could create additional bottlenecks, delaying the delivery of essential materials and increasing construction timelines. Builders may need to find alternative suppliers, which could further inflate costs and contribute to project delays.

Retaliatory Tariffs and Trade Tensions

There is also the potential for retaliatory tariffs from China, Mexico, and Canada. This could escalate trade tensions and create broader economic uncertainty. Such uncertainty may deter investment in new housing projects and negatively impact market confidence, leading to reduced construction activity and slower growth in the housing sector.

Long-Term Outlook

The long-term impact of these new tariffs will depend on several factors. Those include the duration of the trade measures, potential policy changes following future elections, and the ability of the housing industry to adapt. Some experts suggest that domestic production of construction materials could expand in response to the tariffs, potentially stabilizing prices over time. However, this transition would likely take years, leaving short- to medium-term pressures on housing costs.

Struggling with

a loan scenario?

Get a solution in 30 minutes! Fill out

the short form and get your personal offer

Submit a Scenario

The new tariffs set to take effect in 2025 are expected to create significant challenges for the housing market. Higher material costs, supply chain disruptions, and economic uncertainty could exacerbate existing affordability issues and slow down the pace of new construction. Housing industry stakeholders will need to closely monitor these developments and adapt their strategies to navigate the evolving trade landscape.

Conclusion

In conclusion, the impact of U.S. tariffs on the housing market is multifaceted. They influence everything from the cost of raw materials to broader economic conditions that shape housing affordability and availability. Historically, tariffs have shown that trade policies can significantly disrupt the housing sector. These disruptions manifest through increased construction costs, reduced housing supply, and heightened market volatility.

Ultimately, while tariffs are intended to protect domestic industries, their unintended consequences often extend far beyond their immediate targets. In the housing market, these consequences highlight the complex interplay between global trade policies and local economic realities. As the U.S. navigates its evolving trade relationships, the housing industry must remain adaptable and proactive in addressing the challenges posed by shifting tariff landscapes.