Despite a year filled with volatility, pessimistic forecasts, and political noise, the U.S. economy in 2025 proved more resilient than many expected. Markets adjusted to higher interest rates, shifting monetary policy, geopolitical pressure, and new trade dynamics, yet avoided the recession many predicted.

AD Mortgage analysts reviewed the key economic data from 2025 and what it signals for brokers as we move into 2026. You can also check out our video report here: U.S. Economy 2025 Recap & 2026 Outlook: Mortgage Rates, GDP, Inflation, Jobs, Housing

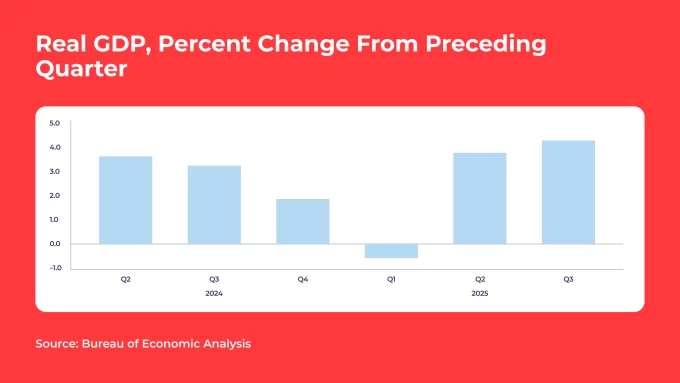

Economic Growth: Slower Start, Stronger Finish

According to data from the Bureau of Economic Analysis, U.S. GDP declined in the first quarter of 2025 but rebounded sharply in the second and third quarters, accelerating at an average annual rate of about 4%.

Growth was driven primarily by:

- Consumer spending

- Government expenditures

- Exports

At the same time, imports and private investment declined, reflecting tighter financial conditions earlier in the year.

Based on the most recent data, analysts now estimate full-year GDP growth of approximately 2.8–3.3%. This is a notable outcome given how frequently recession odds were cited at 50–70% earlier in the year.

Broker takeaway: Economic momentum didn’t disappear, but it did rotate. Borrower demand remained intact, even as affordability and underwriting sensitivity increased.

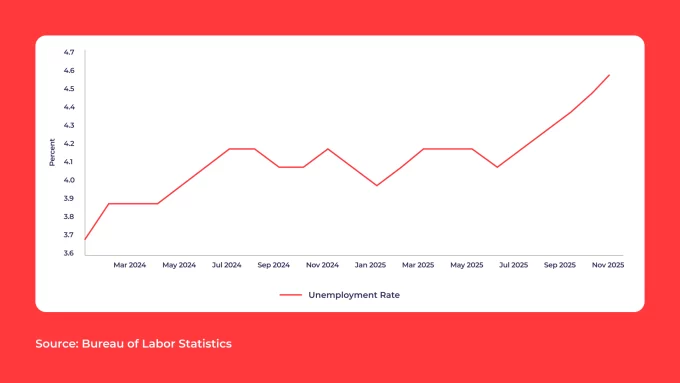

Labor Market: Cooling, Not Collapsing

The labor market softened in the second half of 2025, becoming a key factor behind the Federal Reserve’s policy shift.

The latest report from the Bureau of Labor Statistics showed:

- Unemployment rising to 4.6%

- Slower job growth in non-farm sectors

- Job gains concentrated in healthcare and construction

- Continued job losses at the federal government level

Although employment weakened, the data pointed more toward normalization than distress.

Broker takeaway: Borrowers may feel slightly more cautious, but employment remains stable enough to support ongoing purchase and refinance activity with improved rates.

Inflation: Still Above Target, Still Complicated

Inflation remained above the Federal Reserve’s 2% target throughout 2025.

According to the U.S. Department of Labor:

- The Consumer Price Index rose 2.7% YOY

- Much of the pressure stemmed from renewed tariff policies

Analysts note that the average effective tariff on U.S. imports increased from 2% to 18%, the highest level since the 1930s. While the immediate economic damage was less severe than initially forecasted, many of the highest tariffs have been delayed and could still affect prices going forward.

Broker takeaway: Inflation isn’t gone, it’s just quieter. Expect continued borrower sensitivity to monthly payments and pricing, especially for first-time and payment-constrained clients.

Federal Reserve: A Clear Policy Pivot

Over the past 12 months, the Federal Reserve cut the federal funds rate multiple times, bringing it down to 3.75%, which is the lowest level in three years.

The Fed has openly shifted focus from inflation control towards labor market stability.

Officials acknowledge that rate cuts may allow inflation to tick slightly higher but believe employment conditions could improve as financial pressure eases.

Broker takeaway: Rate relief is real–even if it’s gradual. Brokers who stay proactive and educated are better positioned to act quickly as borrower windows reopen.

Housing Market: Rates Down, Inventory Up

Housing was one of the clearest beneficiaries of easing monetary policy.

The Mortgage Bankers Association (MBA) shared the following key data for the year:

- The average 30-year mortgage rate fell from 6.97% to 6.31% in 2025

- Mortgage applications jumped 71% YOY

- Both purchase and refinance activity increased meaningfully

At the same time, housing inventory expanded, reducing price pressure. Data from the Federal Housing Finance Agency showed that home price growth slowed from 4.5% to 1.7% over the last 13 months.

Broker takeaway: More inventory and slower price appreciation create better conversations. This is especially true for buyers who were previously sidelined by affordability.

Looking Ahead to 2026: What to Expect

AD Mortgage analysts expect most 2025 trends to continue into 2026:

- Economic growth may slow modestly

- Inflation and unemployment could rise slightly

- The Fed is expected to continue rate cuts

For housing, easing rates combined with healthier inventory levels may support sustained, but more balanced, market activity.

How this impacts brokers: 2026 is shaping up to be a market that rewards speed, product knowledge, and adaptability. Borrowers will need guidance, clarity, and access to flexible loan solutions as conditions continue to evolve.

Final Thought

The story of 2025 wasn’t ‘collapse’ as many outlets predicted. Instead, it was ‘adjustment,’ and for brokers, adjustment creates opportunity.

Staying informed, aligned with the right lender, and being ready to move as conditions shift will matter more than ever in the year ahead.

Are you prepared for 2026? Regardless of your answer, AD Mortgage is here with the resources, programs, and services to make the most of the coming year.