The U.S. Department of Veterans Affairs (VA) offers VA loans for military members. These mortgages are typically used for purchasing single-family homes, but can they cover condos or land? The short answer is ‘yes’, but only condos in VA-approved projects or land with a plan to build a house on it. Land-only loans are not permitted.

Read on as we explain VA loans for condos and land, share broker checklists, and provide guidance on moving a land client forward and clearing condo approvals quickly.

VA Loan for Land: What’s Actually Allowed?

Qualified veterans can use VA loans for buying land, but certain requirements must be met.

Land-Only: Not Eligible

VA loans are for funding purchases of primary residences and require the borrower to live permanently on the property. Therefore, the borrower must plan to build a house on the land and live there. Buying only the bare land without a construction plan is not allowed.

Common Land Paths

When purchasing land with VA loans, the borrower has several viable options:

- VA construction loans. These allow borrowers to combine the costs of land and home construction into one mortgage and postpone mortgage payments until the house is built.

- Standard VA purchase loans. In case the land already has a livable dwelling – even small or modest – that meets the VA Minimum Property Requirements (MPRs), it may qualify for a standard VA loan.

- Other loan options. Borrowers can purchase land and build a house with other funding – cash or non-VA loans – and then, after the construction is finished, use a VA Cash-Out Refinance. This allows them to roll land and construction costs into one VA loan.

VA Condos: When the VA Loan Works Best

Condominiums may be a better fit for some military members who live alone or with a small family. Condos typically come with amenities such as a gym, community spaces, and/or security.

The VA allows veterans to use their benefit for purchasing condos if certain conditions are met.

VA-Approved Condo Projects

To receive a VA loan, the condo must be on the VA-approved list or submitted for approval. The condo might be approved if the project aligns with the following requirements:

- The homeowners association (HOA) must demonstrate financial health and stability and show sufficient reserves.

- The rules and procedures must be clearly defined, and there must be no unfair restrictions on owners.

- Sufficient insurance must be provided, including hazard and liability coverage and flood insurance in required areas.

- The condo must meet general VA MPRs and occupancy requirements, being suitable for residential usage.

- There must be no disqualifying restrictions, such as burdensome transfer fees, single-investor ownership, or pending litigation.

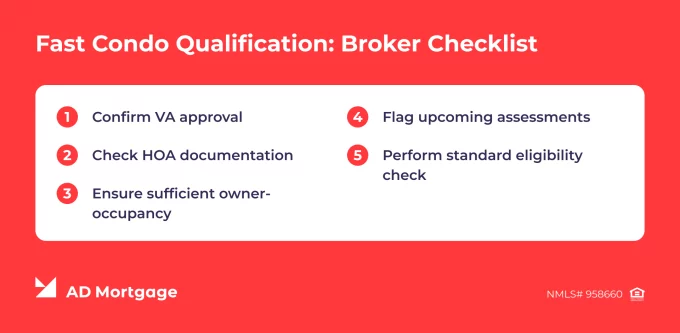

Fast Condo Qualification: Broker Checklist

Five simple steps will help brokers quickly file a VA loan application:

- Confirm VA approval. If the project name and ID are not in the VA’s database, notify the borrower and adjust their expectations.

- Check HOA documentation. The association must demonstrate their budget, reserves, insurance, declarations, and any existing litigations.

- Ensure sufficient owner-occupancy. A higher number of owner-occupied units shows project stability. Also, check for restrictions that conflict with VA or AD Mortgage overlays.

- Flag upcoming assessments. They can affect both the borrower’s ability to purchase the condo and the project eligibility.

- Perform standard eligibility check. For VA loans on condos, the standard VA requirements apply. This includes verification of COE, income, employment, credit, etc.

Broker Tip: If the project is not approved, set the borrower’s expectations that approval will take time. Additionally, you can offer your clients a backup VA-approved condo option while pursuing project approval.

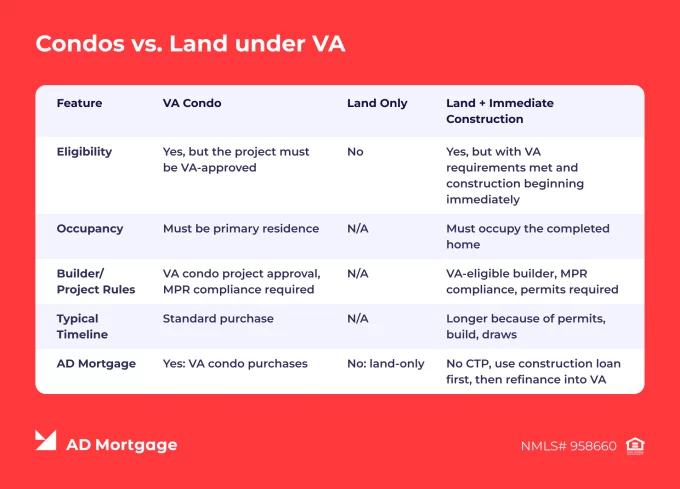

Quick Comparison: Condos vs. Land under VA

When comparing the purchase of a condo and land with VA loans, borrowers often have questions: Which option is quicker? What are the occupancy requirements? What rules apply to builders? This side-by-side comparison table will help you address your client concerns.

AD Mortgage: What We Offer

To choose the best loan path for your clients, explore what AD Mortgage provides to eligible borrowers:

- What we do offer: Standard VA loans (single-family residences, VA-approved condos, PUDs) and VA IRRRL (streamline) loans.

- What we don’t offer: Land-only loans and one-time-close construction-to-perm (CTP) loans.

- Alternative option: If the borrower finances construction with cash or another product, and the completed home meets VA requirements, then AD Mortgage can review a VA cash-out refinance option.

Costs, Funding Fee & Documentation

VA loans come with specific costs and requirements. While exact conditions vary by lender and individual cases, this high-level overview provides brokers with general guidelines.

- Funding fee applies per VA requirements, but there are exemptions.

- Closing costs are standard. Seller concessions are allowed, but they must not exceed 4% of the total loan amount.

- Ongoing costs might include condo HOA dues and assessments, where applicable.

- The Certificate of Eligibility (COE) is required for all VA loans.

- Per lender requirements, various documentation might be needed: income, employment, and credit verification. Property documents for condos include condo docs, HOA budget, and insurance certificates. For land-and-build paths, builder credentials, permits, and construction contracts are typically required.

Common Roadblocks & How to Clear Them

Struggling with

a loan scenario?

Get a solution in 30 minutes! Fill out

the short form and get your personal offer

When filing a VA loan for a condo or land, brokers might face common issues. We have compiled a list of these problems along with potential solutions:

- Condo not VA-approved → Submit the project for approval and set client expectations about the time this process will take. In addition, offer a backup VA-approved condo property.

- Project litigation and weak financials → Pending litigation or insufficient reserves may block approval. Communicate the risks to your client and evaluate potential overlays.

- Borrower expects land-only VA → The VA does not allow land-only loans, so brokers need to reset borrower expectations. Additionally, present them with an alternative roadmap – first use interim construction financing, then, once the house is built, refinance into a VA loan through a cash-out option.

- Unrealistic timing expectations for permits and construction → Communicate a realistic milestone plan to the borrower – including permits, inspections, completion, and lender requirements.

FAQs on VA Loans for Condos and Land

Does the VA Loan Cover Condos?

Yes, but only in VA-approved projects.

Can I Use a VA Loan for Land Only?

No. Borrower can purchase land with VA loans if they are planning to build a house on that land immediately.

How Do I Check if a Condo is VA-Approved?

Use the tool on the VA website and search by project name or ID.

Can I Buy Land and Build with a VA Loan?

VA Construction Loans allow borrowers to finance land and building a house. There are also alternative paths: purchase land with a livable dwelling or use interim financing and, once the construction is complete, refinance via VA Cash-Out option.

What is NADL and Who Qualifies?

Native American Direct Loan (NADL) is a VA benefit for eligible Native American veterans, provided they have a Memorandum of Understanding (MOU) with the VA.

Can AD Mortgage Finance Land-Only or One-Time-Close Construction?

No. The borrower can use a construction loan first, then refinance into a VA loan. Submit a scenario to check the terms and conditions.

What Documents Do Brokers Need for a VA Condo File?

The list of required documents varies by lender but typically includes standard borrower documents (COE, income, employment, and credit verification, etc.) and condo-specific documents (condo approval packet, HOA budget and reserves, insurance certificates, etc.)

Key Takeaways

- AD Mortgage supports VA condo and SFR purchases, and VA IRRRL – submit your scenario to choose the best path.

- VA loans can fund condos only in VA-approved projects.

- Land-only loans are not permitted. Purchasing land and building a house immediately is possible, but most lenders don’t offer CTP.

- The most efficient land path is to first use interim financing on purchasing land and building a house, and when the construction is complete, to refinance with VA cash-out option.

- To avoid delays, submit condo docs and check VA approval on day one.

Conclusion

Purchasing land and condos with VA loans is possible, but one has to meet certain conditions. Brokers can easily guide their clients through this process with the help of the AIM Partner Portal by AD Mortgage. Become an approved partner to benefit from an industry-specific CRM, self-disclosure tools, loan income calculator, and other features.