Conventional financing remains one of the most popular options for borrowers seeking a home loan, offering competitive rates and flexibility. However, it’s not always the right fit for every borrower, and navigating Fannie Mae and Freddie Mac guidelines can be a challenge for brokers. From determining if a Conventional loan is the best option for your client to leveraging the latest technology tools, Lori Welton, Senior Account Executive, walks us through the key steps to ensure success in this episode of Market Digest.

Key Highlights

Get the ADvantage

with our loyalty program

Earn and redeem points for valuable benefits for you and your clients

Unlock Rewards- Ways to determine if Conventional financing is the right fit for your clients

- Conventional guidelines for condos, investment properties, and occupancy nuances

- Tools and technology to streamline the Conventional loan process

- The importance of staying updated on agency guideline changes

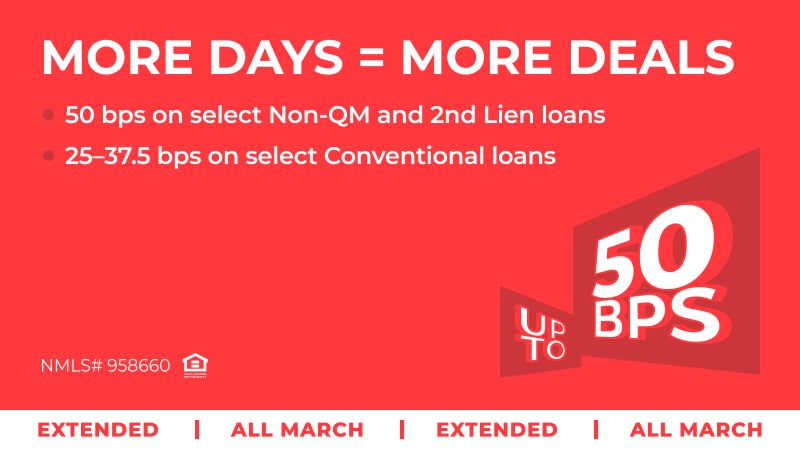

- A&D’s exclusive offer for Conventional loans

- Strategies to help borderline Conventional borrowers qualify

Tune in to this episode of A&D Market Digest to gain valuable insights that will help you better serve your clients and close more deals!

Mortgage News

- NMP – Is Havoc For Home Insurance, Mortgage Rates Ahead?. As scores of climate change-denying Republican lawmakers prepare to take control of Congress and the Senate, an insurance affordability and availability crisis catches the eye of regulators, and large lenders work to assess portfolio exposures to accelerating climate change, a big “IF” hangs over mortgage professionals and homeowners next year.

- HousingWire – Home insurance premiums could soon stabilize. Home insurance premiums continue to rise, but the severity of the increases have cooled in recent months. It suggests that a semblance of stability is returning to the market. But this doesn’t negate the reality of other turbulent risk factors — including extreme weather events stemming from climate change or potential regulatory challenges.

- Scotsman Guide – DU update changes risk assessments for student loans, first-time buyers, more. Fannie Mae has announced upcoming changes to its widely used Desktop Underwriter (DU) system. It helps lenders determine a mortgage’s eligibility for sale to the government-sponsored enterprise (GSE).

Enhanced Broker Portal

that makes your job easier

- All operations at your fingertips

- Easy-to-use intuitive interface

- Integrated AI technology

Thank you, you're successfully subscribed! Please confirm your subscription in your email.

Thank you, you're successfully subscribed! Please confirm your subscription in your email.