Borrowers can refinance a VA loan through an IRRRL, or VA Streamline. This program helps eligible veterans improve the terms of their existing VA loan, for example, by lowering interest rates or reducing monthly payments.

For brokers, this process is usually quick and straightforward. To ensure you offer efficient service to your clients, it is helpful to have a concise, compliance-ready playbook on hand. This article provides brokers with simple explanations of IRRRL rules, workflow, and best practices.

IRRRL Explained: What it is & Why it’s Used

The Interest Rate Reduction Refinance Loan (IRRRL) is an option to replace an existing VA loan with a new one with better terms. Typically, the IRRRL is used to reduce monthly payments or replace adjustable rates with fixed-rate loans.

One-Minute IRRRL

Refinancing a VA loan with the one-minute IRRRL is quick and easy:

- It doesn’t require the borrower to live in the property now, but prior occupancy must be proven.

- An IRRRL is not a cash-out and only allows to change the loan terms.

- An appraisal is typically not required.

- Necessary documentation is very limited. Generally, income and employment verification are not required.

Core Rules Brokers Must Check

To help your clients apply for an IRRRL, brokers need to keep in mind these rules:

- Seasoning. The IRRRL can be used after at least 210 days from the due date of the first mortgage payment and after six consecutive payments have been made.

- Net Tangible Benefit (NTB). The financial benefits – such as lower interest rates or rate stability – for the borrower must be clearly stated and documented.

- Recoupment. Any fees charged during the IRRRL must be offset by money saved thanks to the refinance – often within 36 months.

- Funding Fee. The VA charges a 0.5% funding fee that can be rolled into the loan. Remember that some borrowers might be exempt, so check the COE in advance.

- Occupancy. Unlike new VA loans, prior occupancy is sufficient, so the borrower doesn’t have to live in the property currently.

- Subordinate Liens. The VA loan is required to stay in the first lien position, and lenders of other liens must agree to subordinate it.

Broker Tip. To save time and avoid underwriter conditions, use a pre-filled NTB memo template. It should include before-and-after P&I, rate type, and a breakeven calculation.

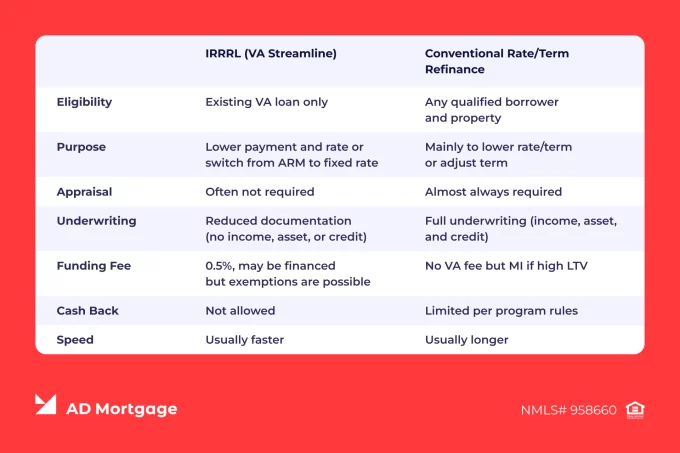

IRRRL vs. Conventional Rate/Term: Quick Comparison

Unlike conventional rate/term refinancing, an IRRRL offers a streamlined and simple process without an appraisal and with reduced documentation. However, the funding fee of 0.5% applies, and cash back is not permitted.

To highlight the differences between IRRRL and conventional rate/term refinancing, we have created a quick comparison table.

Broker Tip. For borrowers with an existing VA loan who don’t need cash out, an IRRRL is usually the faster and more cost-efficient option.

Cost, Savings, and Breakeven

An IRRRL comes with its own costs, which typically include:

- Lender fees charged for originating, processing, underwriting, etc.

- Third-party fees, such as those for title services, settlement, and credit reporting.

- VA funding fee of 0.5% if not exempt. It can be rolled into the loan.

However, the savings from the refinance must exceed these costs within a reasonable timeframe. To check that, a breakeven formula is used:

Breakeven Point (Months) = Total Refinance Costs / Monthly Payment Savings

The shorter the breakeven period the better. Typically, the VA requires borrowers to reach it within 36 months. If the borrower is planning to move again and the breakeven exceeds the expected time-at-home, then the IRRRL is likely to be inefficient. In such cases, it is better to wait or consider other pricing alternatives.

The 6-Step Broker Workflow: IRRRL

To guide your clients through the IRRRL process, follow these steps:

- Check eligibility. The borrower must have an existing VA loan, the seasoning 210-day rule must be satisfied, and there must be no late payments within the last 30 days.

- Quote options and prepare NTB memo. After comparing refinancing scenarios, the benefits of the selected one must be documented. The NTB memo must include the breakeven calculation and a before-and-after loan terms comparison.

- Provide disclosures and the COE. The borrower’s COE must be pulled from the VA portal.

- Process underwriting. A lender performs underwriting, and usually there is less documentation required compared to conventional refinancing. Generally, no appraisal is needed.

- Secure subordination consent. If the property has junior liens, then other lien holding lenders must agree to subordinate them to the VA loan. This step might be time-consuming, so it is better to start early.

- Close the loan. It is important to note that there must be no recent late payments. Before closing, the broker completes the funding process and prepares the loan documents. The first payment date is then set.

Broker Tip: Subordination affects the timeline a lot so it’s better to start with this process as soon as disclosures go out.

AD Mortgage IRRRL Program

AD Mortgage offers a VA IRRRL program that requires only ownership certification – no credit, income, or employment verification is needed. This program allows borrowers to quickly improve their VA loan terms with minimal paperwork.

Program details:

- Loan amounts up to $1.5 million

- Minimum FICO score of 580

- Up to 110% LTV

- No appraisal or credit underwriting required

- High balance loans allowed

Compliance & Pitfalls: What Trips Up Files

Mistakes might cause delays or even denials in the IRRRL process so brokers should be aware of these common issues:

- Missing seasoning proof. The VA requires that the loan has passed two tests: at least 210 days from the first mortgage payment date and over six payments made consecutively.

- Weak NTB. The financial benefit of refinancing must be clearly documented with a ‘before-and-after’ loan terms comparison and a breakeven calculation.

- Late mortgage payments. Recent late payments (usually within 30 days) can trip up underwriting and cause delays in IRRRL approval.

- Subordination delays. Receiving a lien holding lender’s consent on lien subordination takes time. Home Equity Line of Credit (HELOC) lenders in particular might have slow workflows and service-level agreements (SLAs).

- Over-financed discount points. Lenders set limits on how many discount points can be financed into a VA loan. Exceeding this limit may block approval.

- Cash-back expectations. Borrowers need to understand clearly that IRRRL terms do not allow cash-out. If receiving cash is important for the borrower, then it is better to explore other options.

Broker Tip. Include the breakeven calculations into the first quote email to the borrower. This will both answer borrower’s questions about whether the IRRRL will be worth it and provide a base for the future NTB memo.

FAQs on VA Loan Refinance

Can You Refinance a VA Loan with an IRRRL?

Yes, the Interest Rate Reduction Refinance Loan (IRRRL) is a program specifically designed for borrowers with an existing VA loan who want to improve its terms.

What are the IRRRL Seasoning Rules?

Before your client can refinance a VA loan, 210 days from the date of the first mortgage payment must pass, and they must make six consecutive payments.

Do I Need an Appraisal for an IRRRL?

In most cases, you don’t need an appraisal – a significant benefit of the overall IRRRL process. However, always check the exact loan requirements with the lender.

What is the IRRRL Funding Fee?

The IRRRL funding fee is 0.5% of the total loan amount. The fee can be financed into the loan.

What Counts as a Net Tangible Benefit?

A Net Tangible Benefit is a clear financial benefit that the borrower receives with the refinance. Typically, it includes a lower interest rate, switching from ARM to fixed rate, or a P&I reduction.

Can I Switch from ARM to Fixed with IRRRL?

Yes. Switching from an adjustable-rate mortgage to a fixed-rate mortgage ensures stability and reduces rate-related risks.

Can I Get Cash Back on an IRRRL?

No. You cannot get cash back on IRRRLs.

Key Takeaways

- Your client can use IRRRL to refinance VA loans for lower payments and rate stability.

- When applying for an IRRRL, remember to check seasoning (210-day rule and six-payment rule), NTB, and breakeven calculations.

- An IRRRL usually requires minimal documentation and often does not need an appraisal. VA IRRRL funding fee is 0.5% of the total loan amount.

- If there is a junior lien, start the subordination early – this process might take a lot of time.

- Use AD Mortgage tools – Quick Pricer and Scenario Desk – to calculate loan terms and lock in the speed and structure.

Conclusion

An IRRRL is the most efficient and fastest way for existing VA borrowers to improve repayment stability and lower interest rates.

With AD Mortgage’s solutions, brokers can quickly price an IRRRL, run breakeven calculations, or submit a loan scenario. These tools will make the daily workflow more efficient and help you deliver the best-quality service to your clients.