Your clients might not be familiar with the concept of escrow and may be scared of the idea of transferring money to third parties. As their broker, you should educate the buyers and describe escrow in simple terms. This article provides you with short and clear explanations of escrow, ways to request an escrow waiver, and a shortage call script.

Escrow is a financial arrangement in which money or assets are transferred to a neutral party on behalf of two or more other parties to ensure that the conditions of their agreement are met.

What is Escrow?

Escrow is a legal concept that ensures deals are safe and secure for all parties. During the escrow process, funds are set aside in an escrow account and managed by a third party, also called an escrow agent.

This approach provides transparency as the funds are released when the obligations are met by both the borrower and lender.

How Escrow Works

Once the loan is approved and the deal is at its final stage, the lender opens an escrow account. The borrower makes an earnest money escrow deposit (also known as a good faith deposit). Generally, assets held under escrow can include property and documents. However, in real estate transactions, escrow typically holds money.

This system has several crucial benefits for all parties involved:

- Security. Since assets are held by a neutral party, both the borrower’s and the lender’s interests are protected. The money will be released only after all obligations have been fulfilled. In the event that the deal falls through, the money is returned to the borrower, without any disputes.

- Transparency. With an independent bank account, all transactions are documented and visible to all parties. It provides more control over the process and additional peace of mind during this usually stressful time.

- Simplicity and convenience. After closing, the homeowner does not need to pay taxes and insurance separately. As these payments are included in mortgage payments, the lender can cover these expenses straight through the escrow account.

Understanding how escrow works in real estate and how it makes the transaction safer helps the borrower make confident, informed decisions. Therefore, the broker shall educate their clients about escrow accounts and their advantages, while also warning them about potential risks.

Two Types of Escrow in a Mortgage: Escrow vs Impound

The role of escrow accounts in mortgage deals is crucial. Depending on their purpose, escrow accounts can be of two main types.

Earnest Money Holding

Escrow accounts hold earnest money deposits, showing the buyer’s intent to purchase the house. Additionally, while the funds are secured in the accounts, the seller can conduct required inspections, title checks, and other procedures.

This kind of escrow provides transparency and ensures the commitment of both parties to finalize the deal.

Ongoing Tax & Insurance Impounds

After the deal is closed, the escrow account, also called an impound account, is used to distribute ongoing payments such as property taxes and homeowners’ insurance. Part of the mortgage payments goes to this account, and the lender distributes these funds, ensuring that these essential payments are made on time.

Why Escrow Shortages Happen and How to Pre-Warn Clients

An escrow shortage is the risk that borrowers need to be aware of in advance. The shortage happens when the account balance is insufficient to cover expected payments, such as taxes or insurance.

The lender performs an annual escrow analysis comparing the predicted costs with actual expenses. The procedure helps to detect shortages and adapt the payments.

The most common reasons for shortages are:

- Increases in local property taxes

- Increases in homeowner insurance

- Switching to another insurance policy

- Missed mortgage payments

- Underestimated costs at closing

Therefore, a shortage might happen due to the homeowner’s failure to make mortgage payments on time or for reasons beyond their control. So, the borrower needs to consider these risks and ideally have an additional budget to cover any unexpected expenses.

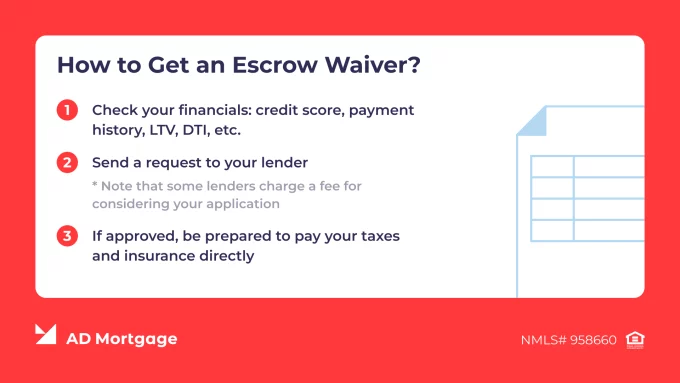

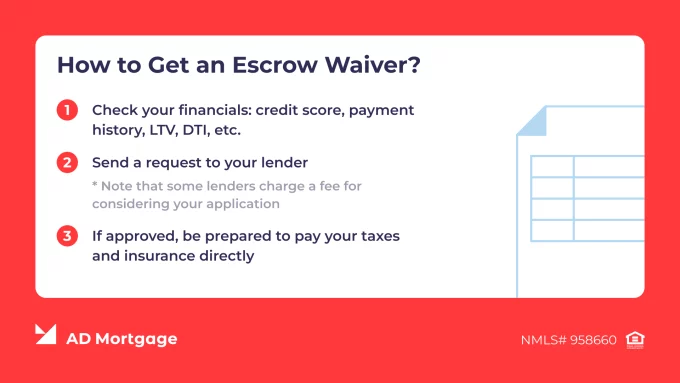

Opting Out: When & How to Request an Escrow Waiver

Until the mortgage is paid off, the lender is at risk of losing the money in case the homeowner skips tax or insurance payments. To mitigate these risks, lenders usually require opening an escrow account as it allows them to cover these costs on behalf of the homeowner.

However, in some cases, the borrower may be granted an escrow waiver which allows them to make the payments directly. Besides more control over finances, it allows the borrower to have less money on hand at closing and to place the money in an interest-generating account.

Guidelines for an Escrow Waiver

- LTV limits. For conventional loans, lenders typically require a loan-to-value (LTV) ratio of 80% or lower. However, sometimes higher LTV might be acceptable when other conditions – such as low debt-to-income (DTI) ratio and high credit scores – are met.

- State and loan program restrictions. Some programs (like FHA and USDA loans) require an escrow account so getting an escrow waiver isn’t allowed under any circumstances. For conventional and VA loans, waivers might be granted depending on the lender’s criteria.

- Strong credit score. Typically, lenders require the borrower to have a 700+ credit score to be approved.

- Clear mortgage payment history. Consistent on-time payments show that the borrower is financially responsible, so the lender’s risks of late payments are reduced.

- Cash reserves. Sometimes, the borrower needs to show their cash balance proving they have enough money on hand to cover property tax and insurance directly.

- Property type. Generally, escrow waivers are granted on primary residence and are rare for investment properties or secondary residences, due to higher risks.

Note that the lender might have flexible conditions, allowing exceptions for borrowers with strong financial profiles. Therefore, borrowers can apply for the escrow waiver even if not all requirements are met, and the lender will make a decision based on their own criteria.

Ideally, the borrower should apply for an escrow waiver when the loan is not finalized such as during the underwriting process or when filling out the loan application. If the borrower hasn’t applied before the closing, they can request it after one year of consistent on-time payments.

Escrow Fees 2025

Escrow services come with associated fees which are commonly split equally between the seller and the buyer. However, these conditions are negotiable.

In 2025, mortgage escrow payments are around 1%-2% of the property value, which usually results in $2,000-$6,000. Fees depend on the purchase price, state regulations, and the lender’s services.

For post-closing escrow accounts, there is no single-time fee. Instead, the related costs can be included in monthly payments, but major lenders do not charge fees for managing the accounts.

Broker Scripts & Tools

To help brokers easily discuss escrow-related issues with borrowers, we created two email templates. Feel free to use them in your communication.

Escrow Waiver Option

“Hello,

Based on your financial profile, you might be eligible for an escrow waiver. This feature allows you to control your tax and insurance payments directly, without having to transfer money to an escrow account.

An escrow waiver has the following benefits:

- Manage money independently and keep it in an interest-generating account

- Lower closing costs

Note that the final decision on whether to grant an escrow waiver is up to the lender and depends on your credit score, payment history, and other factors. If you are interested in receiving the waiver, I can find out whether you are eligible for this feature.

Let me know, I’m happy to help!”

Shortage Call Script

“Hello,

I have recently received the results of your latest escrow analysis and want to guide you through them.

During the review, the lender discovered a shortage. It means that there is not enough money in the escrow account to cover the monthly tax and insurance payments.

The reason for this shortage is the increase in payments/underestimated expenses/changes in insurance policies.

You have two main options to manage the situation:

- Make a one-time payment covering the shortage amount

- Split the shortage costs over the following year of monthly payments

Please let me know which option works best for you. Although an escrow shortage is an unpleasant experience, I will help you manage it effectively and stress-free.”

FAQs

What Does Escrow Mean for a House?

An escrow account is an instrument that helps make home buying safe and transparent. Instead of transferring money directly from the buyer to the seller, they are held in an escrow account managed by a third party. The money is released only after all obligations are fulfilled.

Are My Property Taxes Paid by Escrow?

Escrow can be used for paying property taxes and homeowner insurance after closing. Then, part of the monthly mortgage payments goes to an escrow account and the lender manages these expenses on the borrower’s behalf.

Can I Remove My Home Insurance from Escrow?

Yes, removing homeowner’s insurance from escrow is possible but requires the lender’s approval.

Can I Remove Escrow from My Mortgage?

Generally, lenders require the borrower to have an escrow account as it reduces the risks of late tax and insurance payments. However, the borrower can apply for a waiver that is granted to people with excellent financial histories.

Why Do I Suddenly Have an Escrow Shortage?

Escrow shortages typically happen because property taxes or insurance increase. Another possible reason is that these expenses were underestimated at closing.

Is It Better to Have Escrow or Not?

The decision to use an escrow account or not depends on personal preferences, lender’s requirements, and the financial situation. However, it provides significant benefits in terms of safety and convenience, while slightly limiting the homeowner’s control over payments.

Conclusion

Overall, an escrow account is a trustworthy instrument that ensures transparent and secure deals. It helps all parties – the borrower, the lender, and the seller – to efficiently move through the mortgage process.

Despite numerous benefits, there are risks and drawbacks that the borrower needs to take into consideration. The broker needs to explain the whole process in simple words and answer the borrower’s questions helping to form a clear understanding of this instrument.

To help calculate interest rates and monthly payments and find the best loan terms for your client, use our Quick Pricer tool. Explore how it works and reach out to us in case you have any questions!