A great opportunity to earn a good income while helping people become a homeowner, a perfect career where your income directly reflects the effort you put in… This is what mortgage brokerage can look like from the outside. As a mortgage broker, you connect homebuyers with the perfect loan, celebrate their achievement of homeownership, and – here’s the exciting part – earn a commission based on the loan amount. The bigger the loan, the bigger your paycheck. However, there’s more to the story. Building a strong client base takes dedication and hustle. You face long hours and competition, but the rewards can be substantial. Your earning potential is as great as the houses you help finance. It all boils down to your skills, the market you work in, the mortgage lender you work with, and the number of successful closings you rack up. So, how much does a mortgage broker make, and how can you make the most of this earning potential to become a mortgage broker rock star? Let’s explore together!

How Much Does a Mortgage Broker Make?

Struggling with a loan scenario?

Get a solution in 30 minutes!

Fill out the short form and get your personal offer

Submit a Scenario

Understanding how you get paid is as important as knowing how the gas gauge works when you drive a car. It allows you to choose what works best for your situation and focus on what pays. Broker compensation isn’t a one-size-fits-all situation or a straight one-to-one ratio. How exactly that money rolls in depends on your compensation plan. The two most common compensation models for mortgage brokers are salary plus commission and commission-only.

Salary Plus Commission Model

A salary plus commission model is more common at larger mortgage companies and banks. It offers a base salary, providing a safety net while you build your client base. A base salary is usually lower than what you would earn under a commission-only model. But on top of that, you’ll earn commissions on every loan you close. The commission rate can vary depending on the lender and the loan amount, but it typically ranges from 0.5% to 2% of the loan amount. The commission rate may also be higher for more complex or higher-risk loans. This can be a good option if you’re new to the game, offering some stability as you get your feet wet.

Commission-Only Model

A commission-only model is a gold-digger’s way–your income hinges entirely on the number of loans you close. It requires a strong work ethic and a good network, but the potential rewards can be much higher. This model is more common among independent brokers or small brokerage firms. It can be more lucrative for experienced brokers who have a strong client base and can close a high volume of loans. However, it can also be more challenging for those who are just starting in the industry or who have not yet built a strong client base. Regardless of the compensation model, the commission structure for mortgage brokers is typically based on the loan size. For example, if a mortgage broker closes a loan for $200,000 and the commission rate is 1%, they would earn $2,000 in commission. The mortgage broker’s commission rate may vary depending on the lender and the loan program, as well as state regulations. Some lenders may offer higher commission rates for certain loan programs, such as jumbo loans or government-backed loans.

Factors That Influence Earnings

With an understanding of mortgage broker commission models comes the natural question: what exactly determines how much mortgage brokers make? So, let’s break down the key factors that affect your earning potential.

Location

As with real estate, your geographic location plays a big role. Housing markets with higher average loan sizes naturally offer the potential for higher commissions. Therefore, brokers in urban areas tend to earn more than those in rural areas due to the higher demand for their services. This is because urban areas have a higher population density, which translates into more homebuyers and a larger number of potential clients.

Experience

As with most professions, experience is a valuable asset. Brokers with more experience tend to earn more than those who are just starting. This is because experienced brokers have built up a strong client base and have established relationships with lenders, which makes it easier for them to close deals and earn higher commissions.

Housing Market

The overall health of the housing market has a significant impact on your earnings. A booming market with high demand and rising prices translates into more loan opportunities and potentially higher commission rates. Conversely, in a weak housing market, there are fewer deals and more competition for them, potentially affecting your income.

The Size of the Loan

Since your commission is usually a percentage of the loan amount, the size of the loan also affects your mortgage broker’s salary. Larger loans generally mean larger commissions. For example, helping a client secure a jumbo loan will result in a higher paycheck compared to a smaller loan.

Broker Reputation

Broker reputation is another factor that plays a role in determining the amount of broker fees. Building a strong reputation as a reliable and knowledgeable broker goes a long way. Satisfied clients become your biggest cheerleaders, referring you to their network and boosting your credibility. This translates into a steady stream of clients and the potential to negotiate better commission rates due to your established reputation. Like a brand name, a well-respected broker’s name carries weight and can command a premium.

Network

Your network is your net worth, as the saying goes. The size and quality of your client base directly impact your income. Having a loyal base of repeat clients and a strong referral network ensures a consistent flow of business, which is the foundation for a healthy mortgage broker income.

Efficiency

As with most businesses, the mortgage business is all about efficiency and productivity. The faster you can process loans and close deals, the more opportunities you’ll have to generate income.

Negotiation Skills

Your negotiation skills can also be a deciding factor. The ability to effectively negotiate commission rates with lenders can make a big difference in your overall earnings.

Overall, brokers who are in urban areas, have more experience, work in a strong housing market, close larger loans, have a good reputation, and have a large and diverse client base are more likely to earn higher incomes. However, it’s important to remember that being successful as a mortgage broker requires hard work, dedication, and an understanding of the industry.

Average Earnings and Industry Benchmarks

Looking for a suitable loan program?

Choose among 20+ programs and get

a detailed loan calculation

Loan Calculator

Programs

Other natural questions that may remain at this point are what are the average earnings of mortgage brokers, and what do the statistics say about it? We are here to provide the national and regional earnings landscape for mortgage brokers along with comparisons to other professions in the real estate and financial sectors.

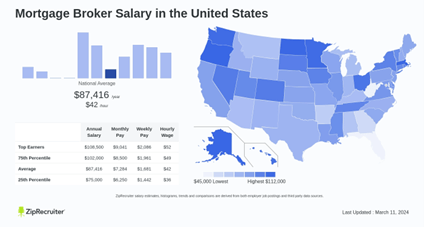

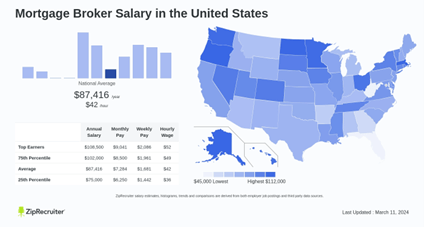

As open sources show, the average mortgage broker’s earnings nationally range from $57,349 to $172,132 per year. Salary.com emphasizes that “salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession.”

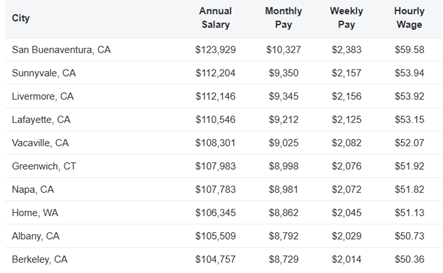

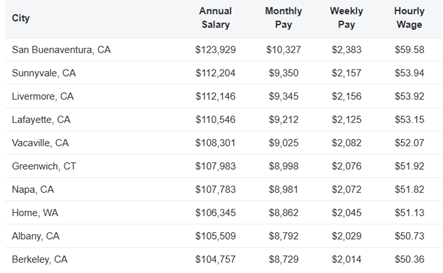

As we mentioned earlier, location, especially areas with high housing costs, can play a major role in your income. For instance, according to the ZipRecruiter’s Top 10 Highest Paying Cities for Mortgage Broker list, San Buenaventura, CA ($123,929), with Sunnyvale, CA ($112,204) and Livermore, CA ($112,146), close behind, take the top positions, while Santa Rosa, CA ($103,717), Costa Mesa, CA ($101,775), Long Beach, CA ($101,104), bottom the list.

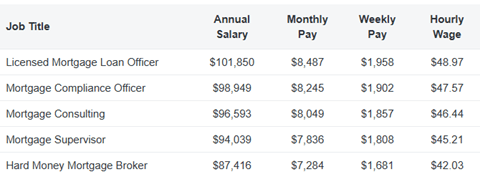

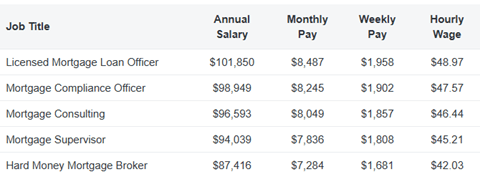

Additionally, ZipRecruiter mentions 5 mortgage broker-related roles that pay more than a typical mortgage broker salary: “Top examples of these roles include: Senior Mortgage Advisor, Mortgage Master, and Licensed Mortgage Loan Officer. Importantly, all of these jobs are paid between $9,177 (10.5%) and $42,973 (49.2%) more than the average Mortgage Broker salary of $87,416.”

Based on reported salaries, Indeed says that the highest paying cities for mortgage brokers are Southfield, MI ($171,501), Miami, FL ($167,223), Charlotte, NC ($117,828), Tampa, FL ($100,721), Los Angeles, CA ($94,869), New York, NY ($94,647), Boca Raton, FL ($91,463), Philadelphia, PA ($89,443), and Houston, TX ($83,447).

But keep in mind that these are all medians, meaning that half of the brokers make more and half make less.

Mortgage Broker Earnings to Related Professions in Real Estate

Wondering how you stack up against other players in the real estate and financial sectors? Let’s peek at some ballpark figures. The median annual wage for real estate brokers and sales agents is $56,620 as of May 2023, according to the Bureau of Labor Statistics. Financial analysts typically earn a median of $99,890 as of May 2023, according to the Bureau of Labor Statistics.

When comparing mortgage broker earnings to related professions in the real estate and financial sectors, it’s important to consider the level of education and training required for each profession, as well as any licensing requirements. Real estate agents, for example, typically need a high school diploma or equivalent and must pass a state licensing exam. Mortgage brokers typically need to complete pre-licensing education and pass a national exam to obtain a mortgage broker license. It’s important to note that for brokers who work with owner-occupied mortgages, a license is typically mandatory, while in some states, a mortgage broker license may not be required for brokers who solely work with investment loans. In contrast, financial analysts typically need at least a bachelor’s degree in finance or a related field. Keep in mind that these figures are for the broader professions and may not reflect the earnings of professionals working specifically in the mortgage industry.

Maximizing Your Earnings as a Mortgage Broker

Mortgage broker income can sometimes seem as unpredictable and unstable as the housing market. Or sometimes you may feel like you are running on a hamster wheel, originating loans but not getting the income you deserve. But the good news is that there are ways to break out of that wheel and strategies you can use to increase your income and make the most of your career. Here are a few tips that can help.

Specialize in niche markets

One way to increase your income as a mortgage broker is to specialize in niche markets. This means focusing on specific types of borrowers or properties. For example, you could become an expert in helping first-time homebuyers, self-employed borrowers, investors, or even veterans. Become the undisputed expert in your chosen niche. Deep knowledge attracts a loyal following, allows you to charge higher fees, and positions you as the ultimate “go-to” resource.

Improve your negotiation skills

Negotiation is a critical skill for mortgage brokers. You need to be able to negotiate with lenders to get the best possible rates and terms for your clients. Sharpen your negotiation skills by enrolling in workshops or online courses, practicing with colleagues, or reading books on the subject. Mastering the art of negotiation means not only securing killer rates for your clients but also ensuring a healthy commission for yourself. It’s a win-win every time.

Expand your network

And here comes that ‘your network is your net worth’ adage again. Networking is essential for mortgage brokers. So, build rock-solid relationships with realtors, financial advisors, and even past clients. Host informative workshops on homeownership – become the local mentor of all things mortgage. Social media is your playground – connect with potential clients on LinkedIn. Don’t be a wallflower – actively participate in industry events and online forums. The more people you know, the more business you can generate and the more income you can earn.

Seek continuing education and certification

The mortgage landscape is constantly changing. Regulations and industry trends change, and new loan products appear. To stay current, you need to keep learning. Attend dedicated webinars and participate in training sessions (AD Learning Center). Consider earning some certifications that can help boost your career prospects and earnings, including the Certified Mortgage Planning Specialist (CMPS) designation and the National Association of Mortgage Brokers (NAMB) certification. This will showcase your dedication and expertise, potentially translating into a higher salary.

Challenges and Considerations

The mortgage industry is unpredictable. High loan volumes can quickly turn into economic downturns or fierce competition. These peaks and valleys can directly impact your paycheck, leaving you scrambling for solutions. But fear not, savvy mortgage brokers can overcome these challenges with a little planning and perseverance.

Let’s face the first challenge – economic downturns. When the economy sputters, potential homeowners tighten their belts, leading to fewer loan applications. The market dips, loan applications dry up – it’s enough to make any broker sweat. To survive these tough times, try to diversify your client base. Look for opportunities with first-time homebuyers seeking government-backed loans, which are often less affected by economic fluctuations. You might also consider offering additional services like credit counseling or financial planning. This shows that you’re a one-stop shop for clients, increasing value and boosting your earning potential even in a slowdown.

Now, let’s tackle the increased competition. The mortgage market is a crowded space, with new brokers popping up every day. An increase in competition can make it harder for you to stand out in the market and win clients. To compete, build strong relationships with your clients. Providing excellent customer service and maintaining strong relationships with your clients can help you win new clients through referrals. Make sure to follow up with your clients regularly and provide them with valuable information and advice. And don’t forget to keep up with the trends, learning and sharpening your skills to become the go-to expert for clients and colleagues alike.

Remember, challenges are inevitable, but they don’t have to define your income, it’s all in your hands.

Conclusion

Mortgage brokerage offers the exciting prospect of high earnings and the satisfaction of helping people achieve their dream of homeownership. But mortgage broker compensation is not a one-size-fits-all situation, and income isn’t a fixed number. Rather, it’s a reflection of your dedication, skills, and strategic approach.

We’ve tried to give you valuable insight. You’ve found the answer to the question, ‘How much does a mortgage broker make?’ and learned how compensation structures work, average earnings and statistics, the factors and challenges impacting your earnings, and even how you can maximize your income. You’ve found out that success as a mortgage broker requires hard work, dedication, continuous learning, and an understanding of the industry. We’ve tried to build a strong knowledge base for you to succeed. The rest is up to you – you are the master of your own business and prosperity!

FAQ

How do mortgage brokers get paid?

Mortgage brokers can get paid through a combination of salary and commission, or by commission only which, is based on the loan amount.

What are the two most common compensation models for mortgage brokers?

The two most common compensation models for mortgage brokers are salary plus commission and commission-only.

What factors influence earnings for mortgage brokers?

Factors that influence earnings for mortgage brokers include geographic location, experience, housing market health, loan size, reputation, network, efficiency, and negotiation skills.

What are the average earnings of a mortgage broker?

The average earnings of a mortgage broker range from $57,349 to $172,132 per year nationally

What are some ways to maximize earnings as a mortgage broker?

Some ways to maximize earnings as a mortgage broker include specializing in niche markets, improving negotiation skills, expanding your network, and seeking continuing education and certification.

What are some challenges faced by mortgage brokers?

Some challenges faced by mortgage brokers include economic downturns and increased competition.

Looking for more mortgage industry insights? Subscribe to AD Mortgage and stay on top of the latest news and trends.