They say time is the soul of business. That’s why it’s important to be precise and make quick decisions. The mortgage industry is all about details you can’t miss out on. How can you boost customer relationships while meeting mortgage market demands? How can you tame the chaos connected to the mortgage process efficiently while building your business network?

One of the most popular ways to increase productivity is a Customer Relationship Managment program. This tool helps professionals control their business by keeping all the essential information in one place. CRMs help manage tasks, keep connected, build networks, track progress, and more.

Unfortunately, CRM software can be costly, especially for small operations or those just starting out. However, the costs can soar as well for companies with many individual users since many CRM programs charge based on user count. What is more is that these programs aren’t tailored specifically for mortgage professionals, which limits their usefulness or forces companies to pay for features that they don’t really need.

A&D Mortgage clearly understood the importance of such a tool as well as the specific needs of the mortgage industry. So, they built their own system called the LEADer CRM Program to assist their partners. Even better is that the mortgage lender provides it to broker partners for free.

Let’s dive deeper to find out more about this excellent tool and how partners can benefit from it.

An All-in-One Tool for Made for Brokers

To put it simply, this CRM system is a crucial tool for mortgage brokers. It contains a comprehensive dashboard with all the details on your leads, loans, companies, and contacts. Additionally, you can plan email campaigns and create tasks directly in the system.

Let’s gradually explore the features to get completely comfortable using the system.

A&D’s LEADer CRM Program: Main Features

1. Manage Your Leads

With the LEADer program, you can create, acquire, import, and score your leads. Take care of all aspects of your leads in one place without hopping between windows and apps.

2. Create Email Campaigns

You can set up automated email campaigns to grow leads, educate your clients, or send them reminders for loan renewals or exclusive offers. A&D Mortgage even provides marketing materials that can be customized, printed, or mailed. Again – for free.

3. Use Advanced Marketing Tool

Mortgage specialists can use LEADer to track their performance, including conversion rates, loan closures, and client satisfaction. Reports can highlight gaps where improvements are needed. LEADer helps to analyze client data such as:

- borrowing patterns

- preferences

- past interactions

All this enables mortgage specialists to offer tailored approaches, advice, or opportunities for cross-selling additional financial products, insurance, and refinancing.

4. Track Loan Progress

Mortgage specialists can use LEADer and the AIM Partner Portal to track where clients are in the loan approval process. From initial inquiry to loan closing, LEADer visualizes the pipeline and identifies bottlenecks or areas demanding more attention.

5. Comprehensive Client Management

Mortgage professionals need to monitor many clients at a time. Each has a unique financial situation, mortgage needs, and at different points in the application process. LEADer stores and organizes client data such as:

- contact information

- financial details

- loan applications

- interaction history

The mortgage process can take weeks or even months, so CRMs help specialists set reminders to follow up with clients at the right times, notifications of missing documents, next steps, or updates on loan status.

6. Lead Generation

The LEADer is built to capture leads from various sources such as web forms, social media, phone calls, and emails. It automatically orders and tracks leads through the sales funnel.

A&D Mortgage’s LEADer CRM uses lead scoring systems to help mortgage specialists prioritize leads based on their likelihood to convert, ensuring that high-potential leads are followed up promptly.

Leads can be automatically assigned to specific mortgage specialists or teams based on geography, loan type, or workload balance.

7. Automated Emails

Tailor and send emails, reminders, and updates to clients, keeping them informed throughout the entire loan process. Automation frees up time and energy to spend on other tasks.

8. Task and Calendar Integration

Mortgage specialists can create tasks for themselves or team members, with reminders for follow-up actions. For example, reminders to call a client, request documents, or update the loan status.

These can be set up for key milestones, such as when clients need to submit financial documents or when it is time to check in on a loan application’s progress.

9. User-Friendly Tool

The platform is highly intuitive and user-friendly, even for those who might not be tech-savvy, with a neat interface.

10. One-Click Access and Integration

The LEADer CRM can integrate with loan origination systems, ensuring that information flows effortlessly between the CRM and the mortgage specialist’s primary platform.

The CRM system seamlessly connects with other tools commonly used in the mortgage industry, such as credit reporting services, document management systems, and marketing platforms.

How to Get Started with LEADer CRM Program

A&D Mortgage believed that it was crucial to make an easy-to-use tool for their partners, and it takes only a series of clicks to get onboard.

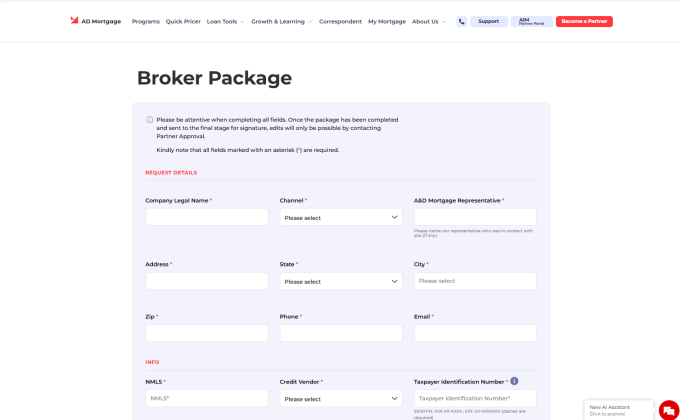

STEP 1

Become an Approved Partner by completing a short form.

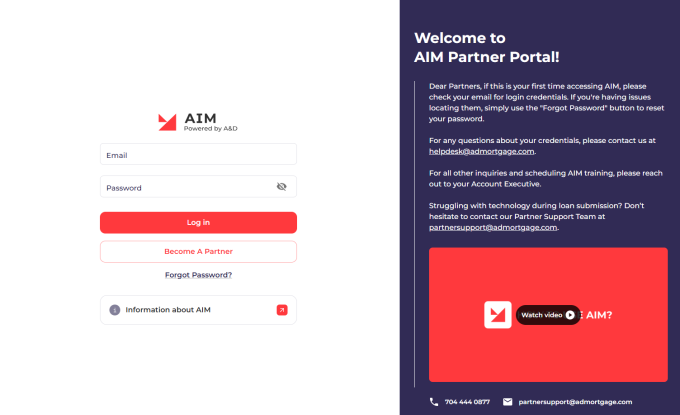

STEP 2

Sign into your account with just one click.

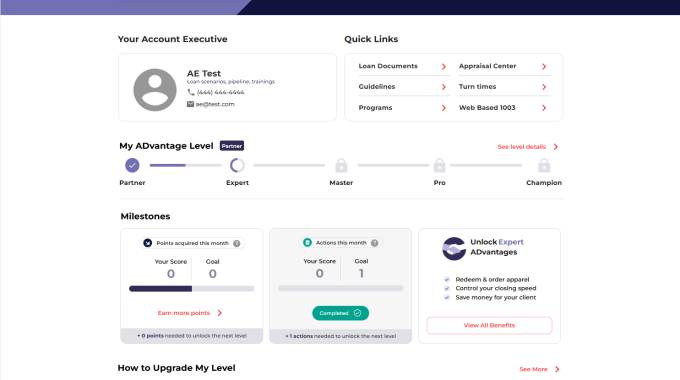

STEP 3

Start using your free LEADer CRM and grow your business.

Ready to Explore LEADer CRM?

Once you’re an A&D Mortgage Approved Partner, you’ll have access to our award-winning AIM Partner portal. If not, it is high time to take your business to the next level and become a partner right now.

Enhanced Broker Portal

that makes your job easier

- All operations at your fingertips

- Easy-to-use intuitive interface

- Integrated AI technology

Final Thoughts

Overall, A&D’s LEADer CRM Program was created to enhance operational efficiency, improve communication with clients, automate routine tasks, and streamline the mortgage application process.

By integrating these features, it helps mortgage specialists focus on providing personalized service and helping brokers outperform others in a highly competitive industry.