Not all military members are eligible for VA loans, and a bad credit score often makes getting approved more challenging. For brokers, understanding how underwriting low-credit profiles works is crucial as it helps set realistic expectations for borrowers. Although the Department of Veteran Affairs (VA) doesn’t set a minimum credit score for VA loans, most lenders require a FICO score of at least 620 for these benefits. However, approvals with scores below 620 are also possible under certain conditions.

In this article, we compare automatic and manual approval plans, highlight quick credit wins that brokers can control, and explore the ways to structure “bad credit” scenarios. Also, we share how AD Mortgage supports VA purchases and IRRRL.

What’s the Minimum Credit Score for a VA Loan?

According to the official VA rules, there is no minimum score set for VA loans. Instead, the program is focused on evaluating residual income and the borrower’s ability to repay.

However, each loan comes with risks and, to mitigate them, lenders create their own requirements. Typically, lenders target 620, because Automatic Underwriting System (AUS) results are more favorable. Some lenders allow credit scores as low as 580, but then stronger compensating factors are expected. In such cases, Manual Underwriting (UW) is possible.

Lenders might set different requirements, based on:

- Outcome of the AUS

- Loan size

- Reserves available after closing

- Payment shock

- Recent credit behavior

- Lender overlays

Approval Paths: AUS vs. Manual Underwriting

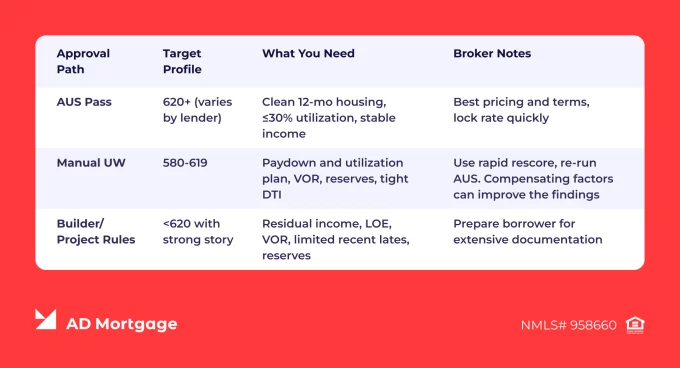

Based on the borrower’s financial profile, underwriting follows one of two paths. The AUS findings might be sufficient to approve the loan or can trigger manual underwriting.

AUS Approve/Eligible

Before the mortgage lender pulls tri-merge credit, the borrower should resolve disputes and manage utilization. This can help immediately raise the credit score by several points.

Although the middle score matters most in approving the borrower, compensating factors – strong reserves, lower DTI, stable income, and Verification of Rent (VOR) – are considered additional benefits.

Generally, AUS approvals take less time and require fewer conditions.

Refer/Eligible to Manual UW

If the loan application is downgraded to manual underwriting, more extensive documentation will be required. The borrower will likely need to provide a 12-month rental or mortgage history without late payments. In cases of negative events like missed payments or charge-offs, the borrower must provide a clear Letter of Explanation (LOE).

Additionally, borrowers should expect to demonstrate tighter DTI and verify the residual income based on region and household size. Compensating factors can improve the chances for approval.

Fast Credit Wins Brokers Can Control

If your client has a lower credit score, guide them through small actions to strengthen their loan file. These practices can deliver results in the short term, within 30-45 days, by improving AUS findings and avoiding red-flags during the review process.

- Utilization paydowns. Revolving credit card balance drastically influences the credit score. To increase the score by 20 to 40 points, suggest the borrower drop utilization below 10% of the limit.

- Rapid rescore. After confirmed updates – such as corrected errors or paid balances – the broker can request the lender perform a rapid rescore. This will trigger a credit score update within 3-7 days, without the need to wait until the next cycle.

- Resolved disputes. Before running AUS, the borrower should resolve disputes, especially on credit cards and auto loans, to ensure cleaner results.

- Non-traditional file. The VA allows including non-traditional documents, such as verified rent or utility payments, to strengthen the borrower’s profile.

- 12-month VOR. This is one of the strongest compensating factors. The borrower can provide it even if the landlord doesn’t report to credit bureaus: cancelled checks or bank statements also prove timely rent history.

- No new inquiries or loans. During the underwriting process, borrowers are better off avoiding making big purchases. Recent inquiries or newly opened accounts can lower the credit score.

Mini-Case: From Refer to Approve within 10 Days

Let’s demonstrate how to strengthen a borrower profile with an example. Note that this scenario is hypothetical and is for illustrative purposes only.

The borrower had a middle score of 598 and high utilization: two credit cards at 78% of their limits. AUS findings showed Refer/Eligible, which could require manual underwriting. The broker suggested the following steps:

- Pay down balances so that both credit cards were at less than 10% of their utilization.

- Run a rapid rescore.

Within 7 days, the borrower’s score increased to 630, and an AUS re-run changed status to Approve/Eligible. This helped to avoid manual underwriting, saving several weeks of processing time.

The VA Credit Ladder: What Typically Works

To understand which approval path matches a borrower’s profile and what actions the broker should take, use this comparison table. It highlights the documentation required for each underwriting type, from AUS Pass to Manual UW, and includes Broker Notes to help you efficiently support your client through the approval process.

Common “Bad Credit” Scenarios & How to Structure Them

Credit issues are common, and many of them can be managed with the right approach. The following steps can help your clients achieve smoother approvals and faster closing:

- Recent 30-day late (non-mortgage). To mitigate late payments, it is better to let the issue age 3-6 months and pay down revolving balances. Then, the borrower should prepare an LOE and increase reserves as a compensating factor. After all the improvements, re-run AUS.

- High utilization (80-95%). Even if the borrower makes credit card payments on time, high utilization still lowers the credit score. Drop the utilization of 2-3 largest cards to under 30% (but ideally under 10%) and then run rapid rescore. Pay attention to statement cycles: advise your client to make payments before the statement closing date.

- Thin file or no score. If the borrower has limited credit history, use non-traditional credit (rent, utilities, insurance) and be prepared for manual underwriting.

- Seasoned bankruptcies or foreclosures. The borrower should demonstrate consecutive on-time payments for 12-24 months as proof of re-established credit. Additionally, they should provide clean housing history and residual income buffers sufficient to cover mortgage payments and that meet regional VA requirements.

- Multiple disputes. It is better to resolve disputes before running AUS and provide the underwriter with documented corrections. Once updated, re-pull the credit report.

AD Mortgage: What We Offer

Military members can benefit from AD Mortgage programs with flexible conditions, suitable even for borrowers with lower credit scores:

- VA Standard allows loans up to $2 million to veterans with FICO scores starting at 580. No down payment is required.

- VA IRRRL allows refinancing up to $1.5 million with a minimum FICO score of 580. No appraisal is required, making refinance quicker and simpler.

Costs & Documents: Only What Matters for Credit Files

VA loans come with specific requirements in terms of associated costs and documentation. When applying for a loan while having a lower credit score, standard closing costs apply. Additionally, borrowers should expect to pay the VA funding fee unless exempt, which can be financed into the loan amount.

The documents should be staged early to prevent underwriting delays, which is especially important when working with VA borrowers with low credit scores. Required documents typically include:

- Certificate of Eligibility (COE)

- 12-month Verification of Rent (VOR)

- Letters of Explanation (LOEs)

- Proof of Paydowns

- Updated Creditor Letters

- Two Months Bank Statements

- Rent Receipts (if private landlord)

FAQ for VA Loan Bad Credit

What is the Minimum Credit Score for a VA Loan?

The VA doesn’t state a minimum credit score for these benefits, but lenders typically require borrowers to have a FICO score of at least 620.

Can You Get a VA Loan Below 620 FICO?

Yes, getting a VA loan with a credit score as low as 580 is possible, but then manual underwriting and compensating factors like strong reserves or lower DTI are required.

Does the VA Allow Manual Underwriting?

Yes, the VA allows manual underwriting. It is typically required if AUS findings don’t provide a clear approval.

What Compensating Factors Help a Low Score File?

Strong compensating factors for a low-score VA file include stable residual income, a lower DTI ratio, VOR, long-term employment, and minimal payment shock.

Can I Use Non-Traditional Credit for VA?

Yes, the VA allows the inclusion of non-traditional documents such as verified rent, insurance, or utility payments.

Does AD Mortgage offer IRRRL with Less-Than-Perfect Credit?

Yes, AD Mortgage offers the VA IRRRL program. Borrowers with a minimum FICO score of 580 are eligible.

Key Takeaways

- There is no minimum credit score for VA loan, but lenders often apply VA overlays.

- Lenders typically require a credit score of at least 620, though lower-score files can be approved if compensating factors are provided.

- Always run the AUS first. Then, if the borrower is not eligible, consider manual underwriting with compensating factors, including residual income and VOR.

- Several small actions can strengthen a borrower’s profile in 30-45 days, including managing utilization, resolving disputes, and performing a rapid rescore.

- AD Mortgage supports VA purchase and IRRRL. Submit your scenario now to define the terms based on your client’s profile.

Conclusion

Getting an approval for a VA loan is possible even if the borrower’s credit score is low. Keep in mind that the VA doesn’t set a minimum FICO score for their benefits, but lenders typically require a score over 620.

If your client wants to apply for a VA standard purchase or VA IRRRL, fill out the scenario form to calculate the loan terms and conditions.