In the sea of mortgage documents, mortgage statements often get lost in the shuffle. But beneath its unassuming exterior lies a treasure trove of financial information. The mortgage statement is like a financial report card for your client’s loan. It outlines their payment history, outstanding balance, interest accrued, and other key details. By understanding these details and becoming proficient at reading mortgage statements, you can identify potential issues or discrepancies early on and provide more accurate advice. For example, if you notice that your client’s escrow payments are increasing, you can investigate the cause in a timely manner. Whether it’s due to rising property taxes or insurance premiums, you can proactively address these issues and help your clients avoid unexpected costs.

In this guide, we’ll break down mortgage statements into its individual components, explaining each in clear and concise terms. From the principal balance to the escrow account, we’ll cover everything you need to know to confidently guide your clients.

What Is a Mortgage Statement?

What is a mortgage statement all about? It’s a monthly or quarterly financial report on the current status of a loan, detailing a borrower’s payment history, outstanding balance, accrued interest, and other important details. Simply put, it shows you how well your client is doing with their payments, how much they have paid, and how much they still owe.

Get the ADvantage

with our loyalty program

Earn and redeem points for valuable benefits for you and your clients

Unlock RewardsThe law “requires creditors, assignees, or servicers to send the borrower a periodic statement for each billing cycle.” The Consumer Financial Protection Bureau defines “Timing of the periodic statement” as follows: “The periodic statement must be delivered or placed in the mail within a reasonably prompt time after the payment due date or the end of any courtesy period provided for the previous billing cycle.” Therefore, mortgage statements are typically issued monthly, but some lenders may send them quarterly.

Mortgage statements aren’t just about a formality or a legal requirement; they’re also a valuable tool for borrowers. The primary purpose of a mortgage statement is to keep a borrower informed about the health of their loan. It serves as a reference point for understanding their financial obligations and tracking their progress toward paying off the mortgage.

By carefully reviewing mortgage statements on a regular basis, borrowers can ensure that their payments are being applied correctly. Mortgage statements can reveal signs of trouble or concern, such as late payments or rising interest rates. For example, if your client notices that their interest rate has increased, they may want to explore refinancing options. Or, if they are having difficulty making their payments, they may want to contact the mortgage lender to discuss possible solutions.

Components of a Mortgage Statement

Now that you’ve learned the basic concept of a mortgage statement and its purpose, it’s essential to get a grasp on the structure of this document. A clear understanding of the key elements of a mortgage statement will help you effectively guide your clients in interpreting their documents, take appropriate action when problems arise, and ensure smooth communication with lenders or loan servicers.

Overview of the Key Components of a Mortgage Statement

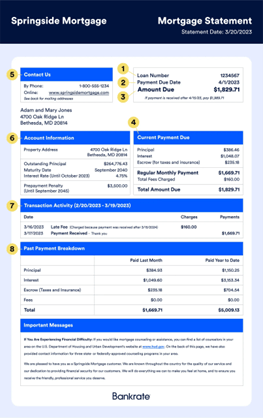

According to the Consumer Financial Protection Bureau, the Dodd-Frank Wall Street Reform and Consumer Protection Act made significant changes to the Truth in Lending Act, including provisions that require certain items to be included in periodic statements for residential mortgage loans in order to make the form of a mortgage statement more or less standardized. Thus, the Act requires the following items to be included on a mortgage statement:

- Account/loan number

- Payment due date

- Amount due

- Current payment due

- Contact information for the servicer

- Account information

- Transaction activity

- Past payment breakdown

Image source https://www.bankrate.com/mortgages/mortgage-statement/

Each of these components plays a critical role in understanding the financial status of the mortgage. So let’s take a closer look at each one separately.

Detailed Explanation of Each Component

1. Account/Loan Number

The Account/Loan Number is a unique identifier for your client’s loan. It’s important for a borrower to have it on hand and refer to it in all communications with the loan servicer to ensure their account is properly identified and handled.

2. Payment Due Date

The Payment Due Date is the deadline for receiving your client’s monthly payment. If the payment is not received by this date, the loan servicer may charge a late fee or report the late payment to credit bureaus, which can negatively affect your client’s credit score.

3. Amount Due

The Amount Due is the total amount your client must pay for the current month. This includes the principal, which is the portion of the loan to repay, the interest, which is the cost of borrowing the money, the escrow, which is a reserve account for funds that go for property taxes and insurance, and any applicable fees.

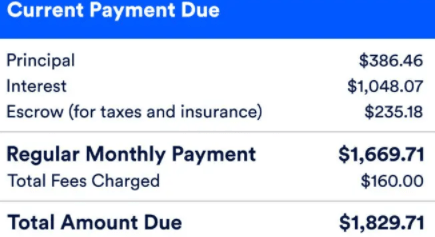

4. Current Payment Due

This section breaks down the amount due into its individual components. It shows how much of the current month’s payment is going to principal, interest, escrow, and fees. This information can help your client understand how their payments are allocated.

5. Contact Information

The loan servicer’s contact information is crucial for contacting them with any questions, concerns, or requests. It’s important to have this information readily available to ensure prompt assistance.

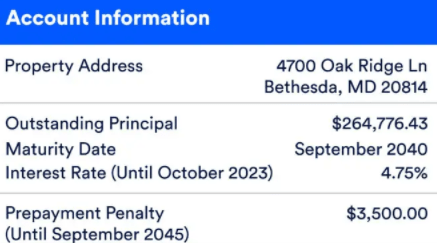

6. Account Information

This section provides an overview of your client’s loan. It includes the outstanding loan balance, which is the amount of money your client still owes on the loan, the interest rate, which is the percentage of the loan balance your client has to pay as interest, and the loan maturity date, which is the date your client should pay the loan in full. The section may also include a prepayment penalty, which is a fee that borrower has to pay if they pay off the loan earlier.

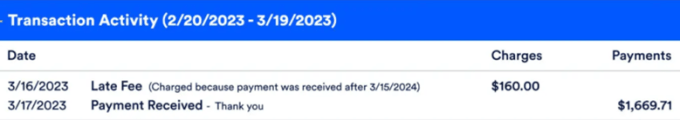

7. Transaction Activity

This section shows a record of recent transactions on your client’s account. This includes payments, fees, and any adjustments made to the loan. By reviewing this section, you can track your client’s payment history and identify any potential issues.

8. Past Payment Breakdown

This section provides a breakdown of your client’s payment history for the past month and year-to-date. This information can help you identify any trends or patterns in your client’s payment behavior. For example, if your client has a history of late payments, this may indicate financial difficulties.

By knowing and explaining these elements, you can help borrowers get a clear picture of their mortgage obligations and prevent them from falling behind on payments or facing unexpected fees.

How to Review a Mortgage Statement

As we’ve mentioned before, it’s important for a borrower to review their mortgage statements on a regular basis. This can help identify errors, ensure accurate payments, and prevent financial problems. And it’s a mortgage broker who can make this review process more efficient.

Here are some key steps to follow in the process:

1. Checking the Balance and Interest Rate

- The current balance should be compared to the previous month’s balance to make sure that the principal is being reduced as expected.

- The interest rate being charged must align with the agreed-upon rate.

2. Reviewing Escrow Payments and Any Changes

- The escrow payments must be allocated appropriately to cover property taxes and insurance. If there are any increases or decreases in the escrow payments, it’s necessary to find out the reasons behind these adjustments.

3. Identifying and Addressing Any Fees or Discrepancies

- It’s important to review the statement for any unexpected fees or charges. If there are any discrepancies, it’s necessary to contact the loan servicer immediately to resolve the issue.

4. Monitoring for Delinquency Notices and Taking Action if Necessary

- Keeping an eye out for any delinquency notices or late payment warnings is essential. If there is a delinquency notice, you should help your client take immediate action to address the issue. This may involve making a late payment or setting up a payment plan.

This proactive approach is essential to maintaining a transparent and trustworthy client-broker relationship while promoting financial security and stability.

Common Issues with Mortgage Statements and How to Resolve Them

As a mortgage broker, it’s important to be aware of common issues that can arise with mortgage statements and how to effectively address them. That way, you can help your clients avoid financial hardship and maintain healthy mortgage relationships.

Enhanced Broker Portal

that makes your job easier

- All operations at your fingertips

- Easy-to-use intuitive interface

- Integrated AI technology

One of the most common issues encountered with mortgage statements is incorrect payments or fees. This can be due to payment processing errors, interest rate changes, or other factors. It’s crucial to carefully review your client’s statements to identify any inconsistencies or discrepancies.

If you find discrepancies on your client’s mortgage loan statement, it’s necessary to take immediate action. First, ask your client to gather any relevant documentation, such as canceled checks, bank statements, and previous mortgage statements.

Then it’s necessary to contact the loan servicer to report the problem. When contacting the loan servicer, your client should be ready to provide the following information:

- Loan account number

- Your client’s contact information, including name, address, and phone number

- A clear and concise explanation of the discrepancy or problem

- Any relevant documents that may help substantiate the claim

Make sure your client asks the servicer to investigate the matter and make any necessary corrections to the statement.

If there is no timely response or resolution, encourage your client to follow up with the servicer to ensure that the issue is being addressed.

Note that it’s very important for a borrower to maintain accurate records and documentation in order to resolve mortgage statement issues. By keeping copies of payments, statements, and correspondence with the loan servicer, they can provide evidence to support their claims and expedite the resolution process.

Tips for Brokers to Assist Clients

Helping your clients understand and effectively manage their mortgage statements is a valuable service you can provide as a broker. How can you do this effectively? Here are some actionable tips:

- Explain the key components of a mortgage statement in simple terms, focusing on the most relevant information for your client’s financial situation.

- Emphasize the importance of reviewing statements regularly to identify errors, track payment history, and monitor escrow accounts. Refer clients to resources such as the Consumer Financial Protection Bureau (CFPB)’s “How do I manage my monthly mortgage payment?” and its accompanying checklist.

- Recommend user-friendly online tools or apps that can help clients track their finances, create a budget, and monitor their mortgage payments (e.g., Quicken, Mortgage Coach, Goodbudget).

- Walk your clients through the steps of contacting their loan servicer to report issues or request information. Encourage them to reach out to the servicer with any questions or concerns.

Conclusion

Now that you’ve learned all the ins and outs of mortgage statements, it’s time to share your expertise with your clients. Take some time to sit down with them and walk them through their mortgage statements, explaining the key components in plain English. Encourage them to review their statements regularly. Recommend some online tools that make tracking payments and creating budgets a breeze. Be their financial coach when problems arise. Guide them through the process of contacting their loan servicer, ensuring they have the information they need and a clear plan of action. That way, your clients will appreciate your guidance and expertise, knowing they’re in good hands and on the path to financial success.

If you’re still in doubt that you have a clear understanding of mortgage statements or have any other mortgage-related questions, don’t hesitate to reach out to AD Mortgage for expert advice and resources.