The landscape of homeownership is evolving with the emergence of Generation Z, the generation born between the mid-1990s and early 2010s. As a mortgage broker, understanding the unique characteristics, preferences, and challenges of Generation Z homebuyers is essential to provide effective guidance. In this article, we’ll delve into comprehensive strategies for advising Generation Z individuals in their journey towards homeownership, including insights into their preferences, housing trends, and practical tips to facilitate their homebuying process.

Looking for a suitable loan program?

Choose among 20+ programs and get

a detailed loan calculation

Generation Z Characteristics

- Digital Natives and Information Seekers: Generation Z is characterized by their fluency with technology. They are accustomed to researching extensively online, making it crucial to provide them with digital resources and tools during their homebuying process.

- Financial Pragmatism: Having grown up during economic uncertainties, Generation Z tends to be financially prudent. They prioritize stability, savings, and have a cautious approach to financial commitments.

- Entrepreneurial Mindset: Many in Generation Z have an entrepreneurial spirit. This mindset influences their career choices and financial decisions, making it important to tailor advice to their unique income streams and aspirations.

Generation Z Homeownership Misconceptions

Here are some common misconceptions Generation Z may have about owning a home:

- Misconception: You Need a Perfect Credit Score: Generation Z might assume that a flawless credit score is necessary to qualify for a mortgage. While a good credit score is important, there are mortgage options available for a range of credit scores. Brokers should educate them about the variety of loan programs suited to different credit levels.

- Misconception: A High Income is Essential: Generation Z may believe that a high income is a prerequisite for homeownership. While a higher income can make the process smoother, there are affordable loan programs and down payment assistance options that cater to individuals with varying income levels.

- Misconception: You Need a Large Down Payment: Another misconception is that a substantial down payment is required to buy a home. While a larger down payment can lead to better terms, there are low down payment options available, especially for first-time homebuyers. Brokers should clarify the down payment requirements for different types of mortgages.

- Misconception: Renting is Always More Affordable: Generation Z might assume that renting is always cheaper than owning a home due to the upfront costs associated with homeownership. However, mortgage payments can often be comparable to or even lower than monthly rent, especially considering potential tax benefits and the opportunity to build equity.

- Misconception: Homeownership is Only for Older People: Some in Generation Z might believe that homeownership is a goal to be pursued later in life, underestimating their ability to enter the market at a younger age. Brokers should emphasize that becoming a homeowner is achievable even for younger individuals with proper planning.

- Misconception: Home Maintenance is Overwhelming: Generation Z might fear the responsibilities associated with home maintenance and repairs. While homeownership does require upkeep, brokers should help them understand that proper budgeting and regular maintenance can prevent major issues and costs.

- Misconception: Home Prices Will Only Go Up: There’s a misconception that home prices will always increase. While real estate can appreciate over time, it’s important to educate Generation Z about market fluctuations and the possibility of short-term price declines.

- Misconception: Student Loan Debt Disqualifies You: Some Generation Z individuals might believe that having student loan debt makes them ineligible for a mortgage. Brokers should explain that while debt is a factor, lenders consider the debt-to-income ratio and other factors in assessing eligibility.

Understanding and addressing the misconceptions that Generation Z has about owning a home is a crucial part of advising them effectively. By providing accurate information, clarifying common misconceptions, and offering guidance tailored to their specific circumstances, mortgage brokers can empower Generation Z to make informed decisions and confidently embark on the journey to homeownership.

Housing Trends Shaping Advising Strategies

- Urban Living Preferences: Contrary to previous trends, Generation Z is showing a preference for urban living. They seek convenience, access to amenities, and job opportunities that cities offer, which impacts their location choices.

- Sustainability and Technology Integration: Generation Z is environmentally conscious and values energy efficiency. They also prioritize smart home technology that enhances security and convenience.

- Delayed Life Milestones: Generation Z often prioritizes higher education and financial stability before making significant life decisions, including purchasing a home. Understanding their timelines is crucial for effective advising.

Advising Generation Z Homebuyers

- Educational Workshops: Host workshops or webinars that address Generation Z’s unique concerns, such as managing student loan debt while planning for homeownership, navigating the mortgage process, and understanding the benefits of homeownership.

- Digital Engagement: Leverage digital tools such as virtual consultations, online calculators, and interactive resources to engage Generation Z in a manner that aligns with their tech-savvy nature.

- Financial Planning for Entrepreneurs: Given their entrepreneurial mindset, provide tailored financial planning advice that considers irregular income streams, potential business expenses, and investment opportunities.

- Sustainability Discussions: Engage in conversations about sustainable home options, energy-efficient features, and the long-term financial benefits of such choices to resonate with Generation Z’s values.

Effective Marketing Strategies

- Authentic Social Media Presence: Generation Z values authenticity. Utilize platforms like Instagram, TikTok, and YouTube to share real stories, insights, and educational content about the homebuying journey.

- Short-Form Content: Create concise content like short videos, infographics, and quick tips that cater to Generation Z’s shorter attention spans. These formats are ideal for delivering valuable information efficiently.

- Mobile Optimization: Ensure your website and tools are mobile-friendly, as Generation Z primarily uses smartphones to access information.

- Interactive Content: Incorporate interactive content such as quizzes, polls, and Q&A sessions to enhance engagement and provide valuable insights.

- Educational Blog Posts: Write informative blog posts addressing Generation Z’s concerns, such as “Navigating the Mortgage Process as a Young Entrepreneur” or “Sustainable Homeownership: A Guide for Generation Z.”

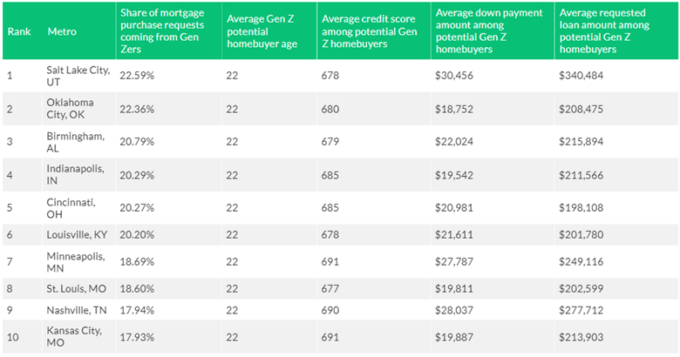

Top 10 Markets for Gen Z Buyers

(source: Lending Tree)

Choose a top nationwide lender that cares about your growth!

Get StartedConclusion

Advising Generation Z homebuyers requires a deep understanding of their distinct characteristics, preferences, and challenges. By tailoring your approach to their digital inclinations, financial pragmatism, and entrepreneurial mindset, you can provide invaluable guidance in their quest for homeownership. Utilizing digital tools, hosting educational workshops, and engaging with them authentically through social media are key strategies to connect with and support Generation Z on their journey towards owning their dream homes. As the next wave of homeowners, Generation Z represents an exciting opportunity for mortgage brokers to make a meaningful impact in the evolving landscape of homeownership.

As a mortgage broker, your clients rely on your expertise to find them the best deals. Our Quick Pricer tool can be an invaluable asset in your quest to secure the most advantageous mortgage rates. Be sure to explore our Programs section for additional resources tailored to your needs. If you have specific scenarios in mind, don’t hesitate to request them; we’re here to assist you. And if you’re interested in joining forces to provide even more value to your clients, consider becoming a partner with us. Together, we can empower individuals and families to achieve their dreams of homeownership.