The process of traditional and Non-QM mortgages differ, which might confuse borrowers and even inexperienced brokers. However, different structures do not mean there are no regulations. We have created this straightforward guide on the Non-QM loan process to help brokers better understand the details and educate their clients on how these mortgages work.

A Non-QM loan works by evaluating a borrower’s ability-to-repay (ATR) using flexible underwriting guidelines rather than strict qualified mortgage rules. The process still includes application, documentation review, manual underwriting, approval, and closing – but with more emphasis on scenario analysis and compensating factors.

What Makes the Non-QM Process Different from QM?

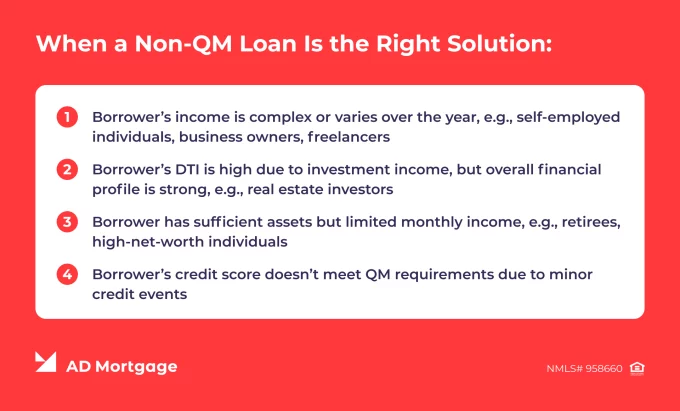

When comparing Qualified vs Non-Qualified Mortgage, there are four key differences to mention:

- Manual vs. Automated Underwriting. Conventional loans are mostly reviewed automatically, following strict rules. Non-QM loans offer more flexibility because of manual review – this individual approach provides a more realistic evaluation of a borrower’s financial situation.

- Flexible Documentation Review. While QM requires traditional documentation like W-2s, pay stubs, or tax returns, Non-QM can accept alternative documentation, including bank statements, profit and loss statements, and asset depletion.

- Scenario-Driven Approval. Traditional mortgages evaluate whether the borrower fits the guidelines, rather than focusing on the overall financial situation. Non-QM loans, on the other hand, review the profile as a whole to determine whether the borrower can afford the mortgage.

- Private Capital vs Agency Execution. QM loans are government- or agency-backed, whereas Non-QM loans are often funded by private lenders, such as AD Mortgage.

Step-by-Step: The Non-QM Loan Process

The Non-QM mortgage process consists of six steps. Understanding these stages is crucial for brokers to set realistic expectations and provide a smooth closing experience for their clients.

Step 1. Scenario Review

The broker should start by reviewing the borrower profile and evaluating whether it fits into available Non-QM program guidelines. At this stage, it is important to choose the right documentation strategy and loan structure to avoid delays or issues in the future.

Step 2. Application and Initial Disclosure

This stage is similar to traditional loans – the borrower fills out the loan application and receives an initial disclosure from the lender. It provides a transparent overview of the loan terms, including interest rates, payment sizes, and closing costs, setting clear expectations.

Step 3. Documentation Review

The lender reviews assets, income, and credit documentation, focusing on consistency and repayment capacity. Alternative documentation is typically accepted, serving as an additional method of verification of borrower’s financial profile.

Step 4. Manual Underwriting

The underwriter evaluates the complete financial picture and considers compensating factors, such as assets, down payment size, credit history, and potential earnings, instead of relying solely on strict automated guidelines.

Step 5. Conditional Approval

The lender provides conditional approval – these are mostly clarification requests, not denials. Timing is crucial at this step, and the broker must proactively communicate with the mortgage lender and the borrower to resolve any issues.

Step 6. Final Approval and Closing

The last stage is similar to traditional mortgages – the documents are signed, funds are disbursed, and ownership is transferred. Clear structure and a well-maintained process throughout the previous Non-QM loan steps ensure a smoother closing experience.

Non-QM Loans Process: Brief Description Table

What Brokers Should Expect During the Process

When working with Non-QM solutions, be prepared for a slightly different experience compared to traditional mortgages:

- More Upfront Communication. Brokers need to set realistic expectations and thoroughly discuss the Non-QM loan process with the borrower, preventing surprises about terms and timelines.

- More Explanation, Rather than Increased Risks. Manual underwriting requires more detailed income and documentation verification, not lower standards or higher risk.

- Stronger Collaboration with Lender. Successful Non-QM closings do not depend solely on automated systems and require proactive communication with the lender’s team.

Common Misconceptions About the Non-QM Process

Due to confusing naming and associations with pre-2008 lending, Non-Qualified Mortgages can sometimes be perceived incorrectly. Let’s unravel common misconceptions about Non-QM mortgages:

- ‘No Doc’ Myth. Non-QM loans require strong proof of the Ability-to-Repay (ATR) but allow the use of different verification methods, such as alternative documentation and compensating factors.

- ‘Faster = Riskier’ Myth. Speed comes from better preparation. Partnering with experienced lenders, such as AD Mortgage, helps to streamline the process without reducing underwriting standards.

- ‘No Rules’ Myth. Non-QM loans are fully regulated and must comply with the ATR rule.

How AD Mortgage Supports Brokers Through the Non-QM Process

The role of the lender in the Non-QM process is difficult to overstate. Experienced lenders ensure a smooth and timely workflow, maintain strong compliance standards, and reduce the risks of delays. Partnering with AD Mortgage allows brokers to close deals more efficiently.

With over 20 years in the industry, AD Mortgage is a respected Non-QM lender. Review our Non-QM loan programs and match your client’s scenario with the solution that best fits their situation.

Broker Talking Points

- ‘Non-QM loans still follow a structured process – though it is less strict than traditional mortgages.’

- ‘Manual underwriting offers more flexibility, not higher risks. It means that your full profile is thoroughly reviewed using more flexible qualification standards.’

- ‘To close smoothly, we need to prepare in advance and have clear expectations about the process. Do not hesitate to ask questions, as understanding the workflow is very important.’

FAQ: Non-Qualified Mortgage Process

How Does a Non-QM Loan Work?

Unlike traditional mortgages, Non-QM loans focus on reviewing the borrower’s scenario as a whole, considering alternative documentation and compensating factors. However, these loans do not follow looser standards – they still require ATR compliance and a strong financial profile.

Is the Non-QM Process Longer than QM?

Due to manual underwriting, Non-QM loans typically take longer to close than traditional mortgages, often between 30 and 60 days.

Are Non-QM Loans Underwritten Manually?

Yes. Non-QM loans are reviewed manually, allowing borrowers who do not fit the rigid criteria of traditional mortgages – but can afford the loan – to qualify.

Is the Ability-to-Repay Still Verified?

Yes. While requirements and terms may be more flexible, lenders must still verify the borrower’s capacity to repay the mortgage.

Can Borrowers Refinance out of a Non-QM Loan?

Yes. The borrower can refinance into a traditional mortgage when meeting the requirements – this usually allows them to obtain lower interest rates or better terms.

Do Brokers Need Different Documentation?

Depending on lender requirements, Non-QM loans often accept alternative documentation, including bank statements and paycheck stubs.

Choose among 20+ programs and getLooking for a suitable loan program?

a detailed loan calculation