The shift to remote and hybrid work models has revolutionized the way people think about homeownership. Freed from the necessity of living near their workplaces, many individuals are moving away from urban centers to suburban or rural areas where homes are more affordable and spacious. This change is reshaping the housing market, creating both opportunities and challenges for mortgage brokers. Brokers now have the chance to assist clients with unique priorities—such as the need for home offices or larger outdoor spaces—while navigating the complexities of verifying non-traditional income streams and appraising properties in less populated areas. This blog explores the ways remote and hybrid work are transforming homebuying decisions. The article provides insights on mortgage options to meet the needs of this evolving workforce.

The Impact of Remote Work on Homebuying Decisions

Remote work has fundamentally transformed the dynamics of homebuying. It offered individuals the flexibility to choose their living environments without the constraint of proximity to an office. This newfound freedom is driving several significant trends that are reshaping the housing market.

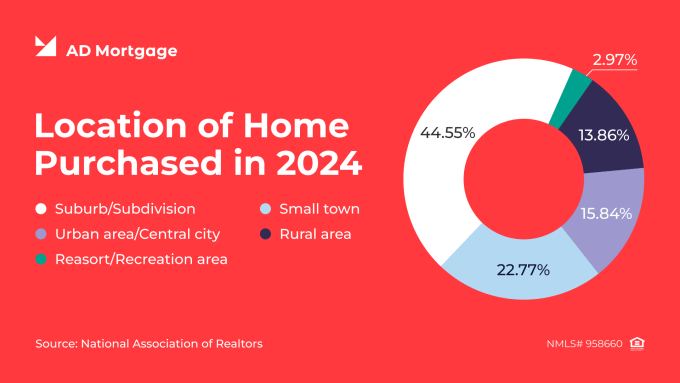

- Expanded Geographic Flexibility. With the ability to work from virtually anywhere, many remote workers are migrating away from expensive urban centers to suburban or rural areas. These regions often provide more affordable housing options and larger properties, appealing to buyers seeking better value for their money. This trend is particularly evident in smaller towns and rural communities, which are experiencing population growth fueled by remote workers.

- Focus on Home Features. As homes double as workplaces, buyers are prioritizing features that accommodate their professional and personal lives. Dedicated home offices, high-speed internet connectivity, larger living areas, and outdoor amenities like patios or gardens have become highly desirable. These features cater to the lifestyle needs of remote workers who spend extended periods at home.

- Affordability Considerations. Relocating to less densely populated areas allows buyers to stretch their budgets further. Many remote workers are leveraging this opportunity to purchase homes that offer more space and amenities at lower costs compared to urban housing markets. This shift also enables first-time buyers to enter the market in regions where homeownership was previously unattainable.

- Community Preferences. Remote workers are increasingly seeking neighborhoods with strong community ties, lower crime rates, and access to nature. These factors contribute to improved quality of life, making suburban and rural areas more attractive than ever.

Mortgage Options for Remote and Hybrid Workers

The rise of remote and hybrid work has introduced new dynamics in the homebuying process. As clients explore opportunities in areas that align with their new work environments, mortgage brokers play a crucial role in connecting them with the right financial solutions. Here are some key mortgage options tailored to remote and hybrid workers.

Conventional Loans

Conventional loans remain a go-to option for remote workers, particularly those with steady employment and excellent credit histories. These loans offer competitive interest rates and are widely accepted for traditional property purchases. Remote workers with strong financial profiles often find conventional loans to be a seamless fit for their needs.

Jumbo Loans

As remote work enables buyers to consider more luxurious properties or relocate to high-cost markets, jumbo loans provide the additional financing required for homes that exceed conventional loan limits. These loans are particularly valuable for clients seeking larger properties with space for home offices and outdoor amenities.

Non-QM Loans

Non-Qualified Mortgage (Non-QM) loans are an essential resource for remote workers with unconventional income structures, such as freelancers, entrepreneurs, and self-employed professionals. These loans offer flexibility in income verification methods, accommodating borrowers whose earnings fluctuate or do not align with traditional lending criteria. Instead of relying solely on W-2 forms or pay stubs, Non-QM lenders may accept alternative documentation such as bank statements, asset depletion strategies, or profit-and-loss statements to verify a borrower’s financial stability.

DSCR loans:

Grow your portfolio!

- DSCR as low as 0

- No income and no employment needed

- Fast turn times

For remote workers who often navigate income irregularities or seasonal revenue patterns, Non-QM loans provide a practical pathway to homeownership. For instance, a freelance graphic designer with significant monthly income variations could leverage their annualized earnings or cash flow statements to qualify for a mortgage. Similarly, entrepreneurs reinvesting in their businesses can demonstrate financial viability through detailed asset documentation rather than taxable income alone.

Another advantage of Non-QM loans is their potential to offer competitive interest rates and loan terms that suit unique borrower needs. While these loans may sometimes carry slightly higher rates than conventional products, they remain an attractive option for borrowers seeking greater flexibility without compromising their ability to secure financing. Non-QM lenders also frequently provide customizable solutions, including interest-only loans or loans with higher debt-to-income ratios, catering to the specific demands of remote workers.

With Non-QM loans, remote workers can access financing that aligns with their financial realities, empowering them to purchase homes that meet their professional and personal needs. Mortgage brokers familiar with these loans can provide invaluable guidance, helping clients navigate the documentation process and secure tailored solutions that traditional lending might overlook.

Government-Backed Loans

Programs like FHA, VA, and USDA loans cater to specific borrower groups and address unique needs. For example:

- FHA Loans. These loans are ideal for buyers with lower credit scores or limited down payment resources, often helping first-time homebuyers.

- VA Loans. Targeted at eligible veterans and active-duty military personnel, VA loans offer attractive benefits like zero down payment and competitive interest rates.

- USDA Loans. Designed for rural homebuyers, these loans help remote workers moving to less populated areas benefit from low or zero down payment options.

For remote and hybrid workers, finding the right mortgage product is a vital step toward realizing their homeownership dreams. Brokers equipped with this knowledge can confidently address the unique challenges and opportunities presented by this growing segment of buyers.

Challenges in Remote and Hybrid Work Brokers Should Be Aware Of

While the shift to remote and hybrid work has opened doors for many, it also presents challenges that brokers must address to effectively serve their clients.

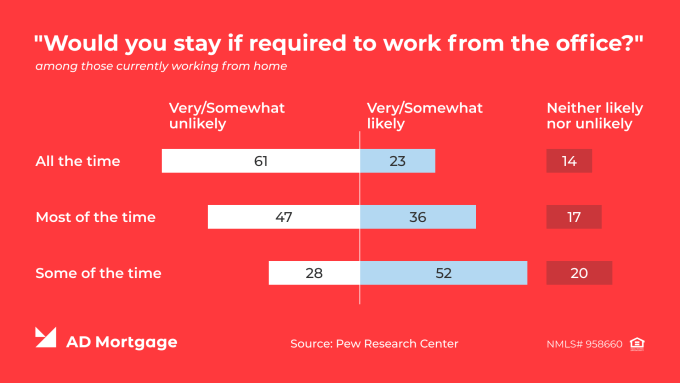

- Verification of Employment Status. As remote work becomes more prevalent, lenders must confirm whether a borrower’s work arrangement is stable and permanent. This process can involve additional documentation from employers, particularly for hybrid roles that combine in-office and remote work. Brokers should guide clients in preparing these materials to ensure a smooth approval process.

- Income Stability. Many remote workers are freelancers or self-employed, making their income less predictable. Lenders often require detailed records, such as tax returns and profit-and-loss statements, to verify earnings. Brokers must educate clients on the importance of maintaining clear and consistent financial documentation to overcome these hurdles.

- Appraisal Challenges. Rural and suburban areas, which are increasingly popular among remote workers, often have fewer comparable sales, complicating property appraisals. This can lead to discrepancies in valuation and potential loan delays. Brokers should work with appraisers familiar with these markets to ensure accurate property assessments.

- Buyer Expectations. Remote workers often prioritize features like home offices and outdoor spaces but may overlook trade-offs such as longer commutes to urban amenities or limited public transportation. Brokers should help clients set realistic expectations, balancing their desires with practical considerations of their chosen locations.

By addressing these challenges proactively, brokers can provide invaluable support to remote and hybrid workers navigating the complexities of the mortgage process. Understanding these obstacles and equipping clients with the tools to overcome them enhances trust and fosters successful transactions.

Tips for Mortgage Brokers

Serving remote and hybrid workers effectively requires a strategic approach. Here are detailed tips to help brokers connect with this growing segment.

- Understand Remote Worker Needs. Remote workers prioritize affordability, flexibility, and functionality in their home choices. This includes properties with dedicated office spaces, larger living areas, and access to high-speed internet. Brokers should actively listen to their clients to identify these specific needs and recommend properties that align with their priorities.

- Offer Tailored Products. Not all loan options are one-size-fits-all, especially for remote workers. Highlight flexible options like Non-QM loans for self-employed individuals or freelancers, and government-backed loans like USDA for those moving to rural areas. Demonstrating a deep understanding of these products builds trust and credibility with clients.

- Expand Your Network. Collaborating with real estate agents who specialize in suburban and rural markets can give brokers a competitive edge. These partnerships can provide valuable insights into local property trends and help identify homes that meet remote workers’ unique preferences.

- Stay Updated on Trends. The remote work landscape is evolving rapidly, influencing housing preferences in real-time. Brokers should stay informed about these changes, such as the growing demand for homes with sustainable energy features or properties near recreational amenities. This knowledge positions brokers as experts who can navigate clients through emerging trends.

- Educate Clients. Many remote workers may not fully understand how their employment type impacts mortgage options. Take the time to explain income verification requirements, loan eligibility criteria, and potential challenges they may face. By offering transparent advice, brokers can guide clients through the complexities of securing a mortgage.

- Leverage Technology. Utilize tools like virtual home tours and online mortgage calculators to make the home-buying process seamless for remote clients. Technology not only enhances client convenience but also broadens your reach to serve clients in distant locations.

Conclusion

The rise of remote and hybrid work models has fundamentally transformed the housing market. However, it presented both opportunities and challenges for the mortgage industry. As more individuals seek homes that align with their new work realities, the demand for tailored mortgage solutions has grown significantly. Brokers who adapt to these changes can not only meet the needs of this evolving clientele but also position themselves as essential partners in their homeownership journeys.

In this era of transformation, mortgage brokers have the chance to redefine their role by becoming trusted advisors who offer solutions that address both traditional and modern challenges. By equipping themselves with the knowledge and tools to serve remote and hybrid workers, brokers can create long-lasting relationships and drive success in this dynamic market.

Discover how A&D Mortgage’s flexible loan products can help you empower remote and hybrid workers on their path to homeownership. Contact us today to learn more!