In a fast-paced mortgage industry, time is money—and AD Mortgage is here to help brokers save both. We’re excited to introduce our latest innovation, the Self-Disclosure feature, now available in the AIM Partner Portal. This new tool is designed to streamline the initial disclosure process, providing brokers with a faster, more efficient way to create disclosure packages, while still offering the classic, full-service option through our Disclosure Team.

This article dives into how our Self-Disclosure feature can help you manage your workflow, save time, and empower your clients, with benefits that are both practical and impactful.

What Is the Self-Disclosure Feature?

The Self-Disclosure feature is a cutting-edge 24/7 addition to the AIM Partner Portal, allowing brokers to create disclosure packages for clients in just one minute. This feature enables you to handle disclosures directly, giving you full control over package generation, review, and delivery.

Enhanced Broker Portal

that makes your job easier

- All operations at your fingertips

- Easy-to-use intuitive interface

- Integrated AI technology

Key Benefits of Self-Disclosure

This feature is designed to address common challenges brokers face during the initial disclosure process. Here are some of the ways Self-Disclosure can help:

1. Rapid Document Creation in 1 Minute

Generate state-compliant disclosure packages in just one minute, allowing you to respond quickly to clients and keep the application moving seamlessly.

2. Pre-Delivery Audit for Error-Free Documents

This pre-delivery check helps avoid costly mistakes, provides peace of mind, and lets you focus on closing deals instead of revisiting errors.

3. Streamlined E-Signature Process

After reviewing the package, clients can e-sign the documents with a single click, ensuring a smooth and intuitive experience.

4. Early Compliance Checks for QM and High-Cost Loans

Running compliance checks early is a huge time-saver. The Self-Disclosure feature allows you to conduct Qualified Mortgage (QM) and High-Cost checks at the beginning of the process, helping you avoid compliance issues and ensuring that loans meet necessary standards right from the start.

5. 24/7 Availability for Multiple Loan Types

It is available anytime you need it, whether you’re working on a Conventional, Non-QM, or FHA loan.

How Self-Disclosure Empowers Brokers

For mortgage brokers who want to maintain control over their disclosure process, Self-Disclosure offers a unique advantage. Unlike other lenders, which may only provide one method of disclosure processing, AD Mortgage gives brokers the option to choose. You can take full ownership of the initial package or opt for our Disclosure Team’s assistance. This choice offers flexibility to fit different broker needs and workflows, empowering you to work in the way that best suits you and your clients.

Choose a top nationwide lender that cares about your growth!

Get StartedWhy Choose Self-Disclosure?

Experienced brokers have specific needs—speed, flexibility, and control. The Self-Disclosure feature is built to help you maximize each of these areas, allowing you to:

- Save Time and Reduce Waiting. The entire disclosure package is generated in one minute, cutting down on delays and helping you meet client expectations.

- Enhance Client Satisfaction. Faster document processing means clients can review, sign, and proceed more quickly, creating a smooth, hassle-free experience.

- Increase Your Productivity. By taking control of the disclosure process, you can handle more applications and keep your workflow moving at a high pace.

This feature was designed with broker feedback in mind, specifically to cater to professionals who value time and independence. You asked, we delivered—a solution that gives you more control and more time to focus on what you do best: closing loans.

Getting Started with Self-Disclosure

To begin using the feature, log in to the AIM Partner Portal and start the loan submission process. As you progress, you’ll encounter the Self-Disclosure step, where the intuitive interface simplifies the workflow:

Initiate Document Creation. Start by selecting the type of loan (Conventional, Non-QM, or FHA) and follow the prompts to generate the disclosure package. Initiate the self-disclosure process by clicking “Disclose & Submit.”

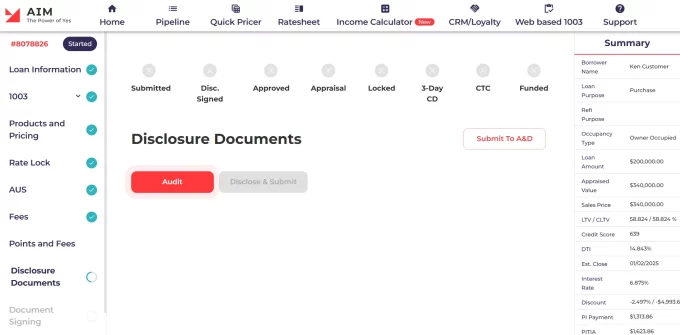

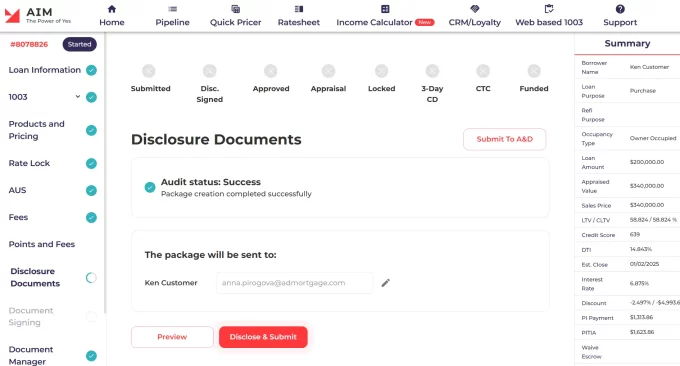

Audit: Navigate to the “Disclosure Documents” page and click the ‘Audit’ button to launch the loan audit process. The system will verify loan parameters and flag any errors. If there are issues, review the errors, make corrections, and re-run the audit until it’s successful.

Client E-Signature. Click “Disclose & Submit” to generate and send the disclosure package instantly to yourself and the borrowers. Your client can complete this process from any device, at their convenience. Optionally, preview the generated disclosure package by clicking the ‘Preview’ button, which opens the package as a PDF in a new tab.

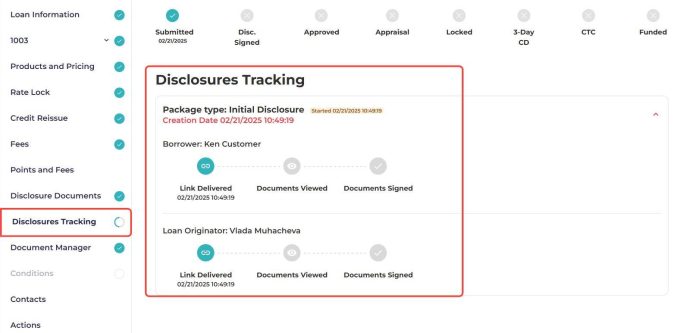

Monitor Status. Track the status of your package in real-time, making it easy to follow up and keep the process on schedule.

Whether you choose Self-Disclosure or prefer our classic process, the AIM Partner Portal provides a comprehensive suite of tools to support your business needs.

Final Thoughts

At AD Mortgage, we understand that Partners value efficiency and independence. The new Self-Disclosure feature aims to give you the best of both, saving time and providing a flexible solution that fits the pace of your business. By enabling rapid, state-compliant disclosures, our Self-Disclosure tool empowers brokers to manage their workflows more effectively and deliver a seamless experience to clients.

Explore Self-Disclosure in the AIM Partner Portal today and discover how this feature can make a difference in your daily operations. For more information or assistance, reach out to your AD Mortgage representative.

With Self-Disclosure, you get the speed and control you need, backed by AD Mortgage’s commitment to supporting your success. Take the next step in streamlining your business—choose Self-Disclosure and experience faster, simpler, and more efficient disclosures.