Understanding debt metrics is crucial for both mortgage brokers and potential homebuyers. Among these metrics, the Total Debt Service (TDS) ratio stands out as a vital indicator of a borrower’s financial health and ability to manage debt. In this article, we’ll dive deep into what the total debt service ratio is, how to calculate it, and why it plays a significant role in mortgage lending decisions.

What Is Total Debt Service (TDS)?

The Total Debt Service (TDS) ratio is a key financial metric that mortgage lenders use to assess a borrower’s ability to manage their debt obligations. It represents the percentage of a borrower’s gross monthly income that goes toward paying their monthly debt obligations, including both housing-related costs and other debts. The TDS ratio provides a clear picture of how much of a borrower’s income is already committed to debt payments and helps determine their capacity to take on additional debt, such as a mortgage.

Lenders rely on the TDS ratio as part of the mortgage approval process because it offers insight into a borrower’s financial health. A lower TDS ratio indicates that the borrower has a manageable level of debt relative to their income, making them less risky in the eyes of lenders. On the other hand, a higher TDS ratio suggests that the borrower may be overextended, which could increase the likelihood of financial difficulties and potential default.

Understanding the TDS ratio is crucial for mortgage brokers because it directly impacts the loan approval process. Brokers can better serve their clients by helping them understand how their TDS ratio affects their mortgage eligibility and offering strategies to manage and improve it. By guiding clients to maintain a healthy TDS ratio, brokers can increase their chances of securing mortgage approvals and help them achieve their homeownership goals.

Components of Total Debt Service

Understanding the components that make up the Total Debt Service (TDS) ratio is crucial for mortgage brokers and borrowers alike. The TDS ratio is an aggregate measure that includes all of a borrower’s monthly debt obligations. These obligations are categorized into two main types: housing expenses and non-housing expenses.

Get the ADvantage

with our loyalty program

Earn and redeem points for valuable benefits for you and your clients

Unlock Rewards

Housing Expenses

The first major component of the TDS ratio is housing expenses, which are typically the most significant monthly financial commitments for borrowers. These expenses include:

- Mortgage Payments. This includes both the principal and interest payments on the mortgage loan. For most borrowers, this is the largest component of their monthly debt obligations.

- Property Taxes. Property taxes, often paid annually, are divided into monthly amounts to be included in the TDS ratio. These taxes are mandatory and vary based on the property’s assessed value and local tax rates.

- Homeowners Insurance. Lenders require homeowners insurance to protect the property, and the cost of this insurance is a factor in the TDS calculation.

- HOA Fees. If the property is part of a Homeowners Association (HOA), the monthly fees associated with it are also included in the TDS ratio.

Non-Housing Expenses

In addition to housing costs, the TDS ratio includes non-housing expenses, which represent other recurring monthly debts a borrower must pay. These include:

- Auto Loans. Monthly payments on any car loans or leases.

- Student Loans. Payments made toward any outstanding student loan debt.

- Credit Card Payments. This typically includes the minimum required payments on any credit card balances.

- Child Support/Alimony. Any legal obligations to pay child support or alimony are also included in the TDS ratio.

Total Debt Service vs. Gross Debt Service (GDS) Ratios

It’s important to note the difference between the TDS ratio and the Gross Debt Service (GDS) ratio. While the TDS ratio includes all debt obligations (both housing and non-housing), the GDS ratio only considers housing-related expenses. The GDS ratio provides a more limited view of a borrower’s financial commitments, making the TDS ratio a more comprehensive tool for assessing overall debt levels. This distinction is vital for mortgage brokers when advising clients and making lending decisions, as the TDS ratio gives a fuller picture of a borrower’s financial situation.

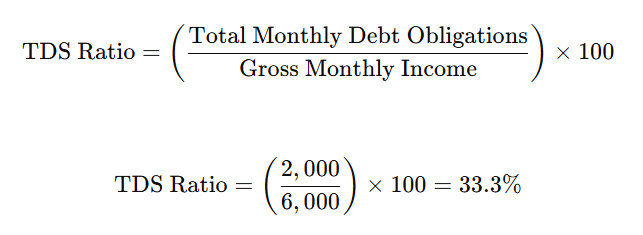

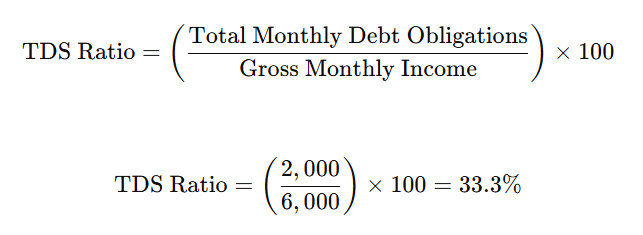

How to Calculate Total Debt Service (TDS) Ratio

Calculating the Total Debt Service (TDS) ratio is a straightforward but essential process for determining a borrower’s financial capacity to take on a mortgage. The TDS ratio represents the percentage of a borrower’s gross monthly income that goes toward servicing their total monthly debt obligations, both housing-related and non-housing.

Step-by-Step Calculation

- Add Up All Monthly Debt Obligations. Begin by totaling all the borrower’s monthly debt payments. This includes housing expenses like mortgage payments, property taxes, homeowners insurance, and HOA fees, as well as non-housing debts such as auto loans, student loans, credit card payments, and any alimony or child support obligations.

- Divide by Gross Monthly Income. Once you have the total monthly debt obligations, divide this figure by the borrower’s gross monthly income. Gross income refers to the total income before taxes and other deductions.

- Convert to a Percentage. Multiply the result by 100 to convert it into a percentage. This percentage is the TDS ratio.

Example Calculation

For example, if a borrower has total monthly debt obligations of $2,000 and a gross monthly income of $6,000, the TDS ratio formula goes as follows:

Acceptable Total Debt Service Ratio Ranges

Lenders typically prefer a TDS ratio of 36% or lower, as it indicates a borrower’s manageable debt load. Ratios up to 43% may still be acceptable depending on other factors like credit score and down payment size, but a TDS ratio above 43% is often seen as a red flag, signaling potential difficulty in managing additional debt.

Significance of Total Debt Service in Mortgage Lending

The Total Debt Service (TDS) ratio is a critical metric in mortgage lending. It is a key indicator of a borrower’s financial health and ability to manage debt. Lenders use the TDS ratio to evaluate whether a borrower can afford the mortgage. A lower TDS ratio suggests that a borrower has a manageable debt load relative to their income, which makes them less risky in the eyes of lenders.

Impact of High Total Debt Service Ratio on Mortgage Approval

A high TDS ratio indicates that a significant portion of the borrower’s income is already committed to servicing debt. This can raise concerns for lenders, as it suggests that the borrower may struggle to handle additional financial burdens, such as a new mortgage. As a result, borrowers with high TDS ratios may find it more challenging to secure mortgage approval, or they may be offered less favorable terms, such as higher interest rates or smaller loan amounts.

Enhanced Broker Portal

that makes your job easier

- All operations at your fingertips

- Easy-to-use intuitive interface

- Integrated AI technology

Show Me How

Comparison with Other Financial Metrics

While the TDS ratio is crucial, it is not the only metric lenders consider. Other factors like the debt-to-income (DTI) ratio and credit score also play significant roles in the mortgage approval process. However, the TDS ratio provides a more comprehensive view of a borrower’s overall debt burden, as it includes both housing and non-housing expenses, making it a more holistic measure of financial stability.

For mortgage brokers, understanding and effectively communicating the importance of the TDS ratio can help clients better navigate the mortgage approval process.

Practical Applications and Examples

The Total Debt Service (TDS) ratio plays a pivotal role in real-life mortgage lending scenarios, directly influencing whether a borrower is approved or denied for a loan. Understanding how this ratio works can provide valuable insights for both mortgage brokers and their clients.

Example 1: Mortgage Approval with a Low Total Debt Service Ratio

Consider a borrower with a TDS ratio of 32%. This lower ratio suggests that only a manageable portion of their income goes to debt payments, making them an attractive candidate for lenders. As a result, they are more likely to secure mortgage approval, often with favorable terms like lower interest rates.

Example 2: Mortgage Rejection Due to High TDS Ratio

In contrast, a borrower with a TDS ratio of 45% may struggle to obtain a mortgage. This high ratio signals that a significant portion of their income is already tied up in debt, increasing the risk for lenders. Even if approved, this borrower might face higher interest rates or stricter loan conditions.

For mortgage brokers, these examples highlight the importance of guiding clients to maintain a healthy TDS ratio, improving their chances of securing a mortgage and achieving their homeownership goals.

Total Debt Service Ratio vs. Debt Service Coverage Ratio (DSCR)

While the Total Debt Service (TDS) ratio is a critical metric in residential mortgage lending, the Debt Service Coverage Ratio (DSCR) is more common in commercial lending. Both ratios assess a borrower’s ability to manage debt, but they apply to different contexts and serve distinct purposes.

What Is Debt Service Coverage Ratio (DSCR)?

The DSCR measures the ability of an income-generating property to cover its debt obligations. Specifically, it compares the property’s net operating income (NOI) to its total debt service, including principal and interest payments. A DSCR above 1 indicates that the property generates more income than is obligatory to cover its debt, making it a safer investment for lenders. Conversely, a Debt Service Coverage Ratio below 1 suggests that the property’s income is insufficient to meet its debt obligations, signaling higher risk.

Comparison Between TDS and DSCR

The key difference between the TDS ratio and DSCR lies in their application. The TDS ratio is used primarily in residential mortgage lending to evaluate a borrower’s personal debt burden relative to their income. In contrast, the DSCR is used in commercial lending to assess the financial viability of income-producing properties.

For mortgage brokers, understanding both ratios is essential, especially when working with clients in different lending scenarios. While TDS is crucial for residential borrowers, the DSCR becomes relevant when dealing with commercial properties or investment opportunities, offering a broader perspective on debt management across various types of loans.

Strategies for Managing Total Debt Service Ratio

Maintaining a healthy Total Debt Service (TDS) ratio is crucial for borrowers seeking mortgage approval. For mortgage brokers, providing clients with practical strategies to manage and improve their TDS ratio can make a significant difference in their ability to secure favorable loan terms.

Tips for Reducing Existing Debt

One of the most effective ways to lower the TDS ratio is by reducing existing debt. Encourage clients to focus on paying down high-interest debts, such as credit cards and personal loans. This not only lowers their monthly obligations but also improves their overall financial health, making them more attractive to lenders.

Increasing Income

Another strategy is to increase income. Clients might consider taking on a part-time job, freelancing, or negotiating a raise at their current job. Any additional income can help lower the TDS ratio by improving the income-to-debt balance.

Making Larger Down Payments

Advising clients to make a larger down payment can also positively impact the TDS ratio. A higher down payment reduces the loan amount, leading to lower monthly mortgage payments, which in turn lowers the TDS ratio.

Managing Non-Housing Expenses

Finally, help clients manage non-housing expenses by cutting unnecessary costs. Streamlining their budget can reduce the overall monthly debt load, helping to keep the TDS ratio within acceptable limits.

Conclusion

The Total Debt Service (TDS) ratio is a fundamental metric in mortgage lending. It provides a clear picture of a borrower’s ability to manage debt relative to their income. For mortgage brokers, understanding the intricacies of the TDS ratio is essential for guiding clients through mortgage approval. A well-managed TDS ratio improves a borrower’s chances of securing a mortgage and ensures they are financially stable enough.

Educating clients on the importance of maintaining a healthy TDS ratio can make a significant difference in their homebuying journey. By helping them reduce existing debt, increase their income, make larger down payments, and manage non-housing expenses, brokers can position their clients for success.

At A&D Mortgage, we support brokers with the resources and expertise to help clients achieve homeownership. Whether you’re advising a first-time homebuyer or an experienced investor, understanding the TDS ratio is crucial.

For more guidance and support on managing TDS ratios and other critical mortgage metrics, reach out to A&D Mortgage today. Our team is here to help you and your clients succeed.