Currently, only a few mortgage programs require no down payment, and USDA loans remain one of the few options that do so. Approval for these loans generally depends on two main factors – credit score and debt-to-income (DTI) ratio. Therefore, understanding USDA credit score requirements and USDA DTI limits is crucial.

Brokers need this precise knowledge to set client expectations and close deals efficiently. This article breaks down calculations for these two key parameters, helping brokers guide their clients through the process.

USDA Loan Credit Score Requirements

The USDA doesn’t set a minimum credit score, which some borrowers interpret as guaranteed approval. However, this is a common misunderstanding.

While the USDA does not specify an exact score threshold, it requires lenders to check borrowers’ credit history according to the criteria outlined in Chapter 10 of the USDA Handbook for Guaranteed Loans.

Most lenders set their own credit score requirements – usually between 620 and 640 – to ensure that the borrower shows their financial responsibility.

Additionally, lenders may consider compensating factors:

- Significant cash reserves

- Stable employment and income history

- Low housing expense and low debt-to-income ratio

- Strong rental or utility payment history

Beyond these features, a borrower’s credit history might be taken into consideration if recent financial responsibility has been verified.

USDA Debt-to-Income Limits Explained

For automated approvals, USDA loans use standard DTI baselines. The front-end ratio (also known as PITI, which stands for Principal, Interest, Taxes, and Insurance) is typically required to be 29% or less. The back-end ratio (or total DTI, which includes all monthly debts and housing costs) should be 41% or less.

While meeting these standard limitations, the borrower is most likely to receive an “Accept” recommendation through the USDA’s automated underwriting system (GUS). Higher ratios typically require compensating factors and might trigger manual underwriting.

With manual underwriting, DTIs up to 44% – and sometimes slightly higher – are often approved if the borrower provides strong compensating factors. However, even in such cases, the front-end ratio should not exceed 34%.

Compared to other mortgages, USDA loan DTI limits are considered rather strict. For FHA loans, the front-end to back-end ratio limits are 31% and 43%, respectively. Conventional loans allow DTIs of up to 50%, while VA loans typically cap a back-end ratio at 41%.

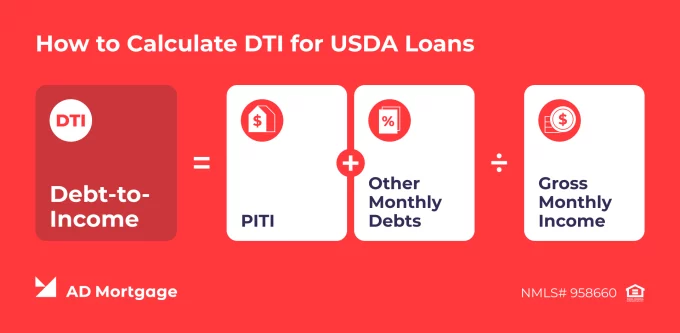

How to Calculate DTI for USDA Loans

To determine whether a borrower fits within DTI thresholds, brokers can use this simple formula:

DTI = (PITI + Other Monthly Debts) / Gross Monthly Income

Let’s break down how to calculate a borrower’s DTI step by step:

- Confirm the borrower’s gross monthly income. This can be done by dividing annual pre-tax earnings by 12 months. Note that all sources of stable, verifiable income should be considered.

- Combine proposed housing cost (PITI) with all recurring monthly debts. These include student loan debts, auto loans, credit-card minimum payments, child support, and all other recurring obligations.

- Divide total monthly debts by gross monthly income. This is the back-end ratio, or total DTI. Then, compare it to USDA guidelines, and check for compensating factors if DTI is higher than the program’s limits.

To illustrate how calculation works, here is an example. Note that this is a hypothetical situation for educational purposes only.

Imagine that the borrower’s gross monthly income is $6,000. The proposed housing costs are $1,800. At the same time, the borrower has other monthly obligations, which are a car payment of $300, a student loan payment of $150, and credit-card minimums of $100.

To calculate the DTI ratio, the broker should first add all other monthly debts: $300 + $150 + $100 = $550.

Then, add PITI and other debts: $1,800 + $550 = $2,350.

The last step is to divide total debts by gross monthly income: $2,350 / $6,000 = 0.3917 = 39.17%.

In this example, the DTI of 39.17% meets the USDA loan max DTI requirements and, therefore, the borrower profile will most likely receive an “Accept” status through GUS.

When High DTI or Low Credit Still Works

With a DTI exceeding the standard threshold or credit score below the lender’s requirements for GUS, the lender might still approve the loan through manual underwriting. For that, strong compensating factors, such as verified cash reserves, stable employment history, and strong on-time payment history, should be provided.

With at least one compensating factor, the borrower can qualify for a DTI waiver, allowing an increase in the maximum DTI from standard 41% to 44%, provided that the front-end ratio does not exceed 34%. To check whether the borrower is eligible for a DTI waiver, the broker should consider:

- GUS Result. The recommendation should be a “Refer”, and the overall profile should have strong compensating factors.

- Credit Score. It should be at least 580 and fit into the lender’s minimum requirements for manual underwriting.

- Payment History. The borrower should have a stable and continuous history of on-time payments without delinquencies in the last 12 months.

- Non-Traditional Payments. Consistent payments for rent, utilities, or insurance can also be used to verify borrower creditworthiness.

For brokers working with borderline cases, the following tips can improve approval results:

- Collect needed documentation early to avoid delays during underwriting.

- Calculate preliminary DTI and review credit before submitting the application.

- Use non-traditional payment records, when possible, to demonstrate the borrower’s ability to pay on time.

- Emphasize stability, since consistency in payments and/or employment can make a difference.

- Educate your clients on how manual underwriting works and how compensating factors can strengthen their overall profile.

FAQ: USDA Credit Score Requirements and DTI Limits

What is the USDA Loan Minimum Credit Score?

The USDA does not set a minimum credit score for its loan program. However, lenders often have their own requirements.

What is the Maximum DTI Ratio for USDA Loans?

For automated underwriting, the standard USDA loan debt-to-income ratio requirements are as follows: the front-end ratio shouldn’t exceed 29%, and the back-end ratio shouldn’t exceed 41%. However, even with slightly higher ratios, it is possible to get approval through manual underwriting if strong compensating factors are present.

Can Borrowers Qualify with DTI over 41%?

Yes. If the borrower demonstrates strong compensating factors, such as a stable payment history or sufficient cash reserves, they can qualify with DTI over 41%. The application is most likely to be reviewed through manual underwriting.

Do Student Loans Count Toward USDA DTI?

Yes. When calculating the back-end DTI, student loan debts, as well as other recurring obligations, are included in total monthly debts.

How Can Brokers Help Clients Lower DTI?

Paying down or refinancing existing debt or increasing income will help lower the borrower’s DTI. Brokers should guide their clients on different ways to improve this ratio and help them build a long-term financial strategy.

Conclusion

USDA loan approvals hinge on two key factors – credit score and the DTI ratio. However, the thresholds are flexible, and expert brokers can efficiently guide their clients to approval.

Understanding how credit score and DTI guidelines work help brokers close more loans. AD Mortgage provides advanced tools and expert education to support brokers at each step of their workflow.

Work with AD Mortgage to qualify your clients today: Become a Partner