USDA loans are an excellent opportunity for low- and moderate-income borrowers to purchase a house at affordable prices, with no down payment or monthly PMI. However, these mortgages come with USDA loan closing costs associated with finalizing the deal.

This article clarifies how these costs are structured and the ways they differ from FHA and conventional closing costs. We also provide an easy-to-understand comparison table of two types of USDA end-of-sale expenses.

Typical USDA Loan Closing Costs

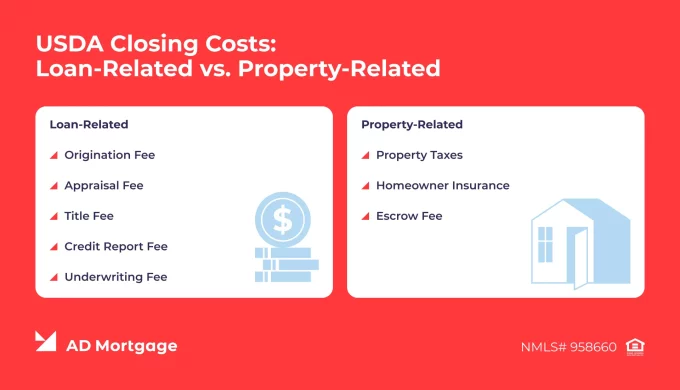

On average, the closing costs range from 2% to 6% of the home purchase price. These expenses are divided into two categories – loan-related costs and property-related costs.

Loan-related closing costs are charged by the lender and typically include:

- Origination Fee. It covers the lender’s expenses for opening and structuring a loan, ensuring the lender can manage all steps of the loan process

- Appraisal Fee. Confirms the home is worth the purchase price and protects both the borrower and the lender from overpayment

- Title Fee. It protects the lender against title claims or liens and makes sure that the borrower receives full legal ownership

- Credit Report Fee. Covers costs of pulling the borrower’s credit report

- Underwriting Fee. covers lender’s expenses for reviewing the application to qualify the borrower in terms of credit and income requirements

Property-related closing costs are typically charged by third-party organizations and may include:

- Property Taxes. They cover a part of home’s property taxes, collected upfront at closing

- Homeowner Insurance. It protects the borrower against property loss, liability, and/or damage

- Escrow Fee. It covers the costs of handling funds and documents by the escrow company

USDA Guarantee Fee

While the mentioned fees are common across all mortgage types, the guarantee fee is specifically designed for USDA loans. This fee keeps the program running and protects the lenders from losses in case the borrower defaults. It can be compared to private mortgage insurance (PMI), but the guarantee fee is usually more affordable and structured differently:

- 1% USDA upfront fee is paid at closing, and often financed into the loan

- 0.35% USDA annual fee is added to monthly payments

USDA Loan Rates in 2025

The U.S. government backs USDA loans, meaning the USDA covers part of a lender’s losses if a borrower fails to meet loan obligations. With reduced risk, lenders can offer more favorable terms and lower interest rates.

Generally, USDA loans are more affordable than FHA and conventional loans because they do not require a down payment and have lower ongoing costs.

How Borrowers Can Pay USDA Closing Costs

The program provides flexibility in covering closing costs, offering borrowers several ways:

- Out-of-Pocket. The borrower can pay closing costs in cash directly from their savings.

- Seller Concessions. The seller can contribute toward closing costs, but only up to 6% of the home purchase price.

- Lender Credits. The mortgage lender might cover part of the closing costs in exchange for a bit higher interest rate.

- Gift Funds. USDA allows gift funds from family or friends to cover the costs.

- Financing. If the home’s appraised value exceeds the purchase price, borrowers can roll costs into the loan up to the appraised amount.

FAQ: USDA Loan Rates 2025

How much are USDA loan closing costs in 2025?

USDA loan closing costs typically range from 2% to 6% of the home purchase price and include loan-related and property-related expenses.

Can closing costs be rolled into a USDA loan?

In some cases. The borrower can roll closing costs into a USDA loan up to the appraised amount if the appraised value is higher than the purchase price.

What’s the USDA Guarantee Fee?

Lenders charge a guarantee fee to offset potential losses if a borrower defaults. Borrowers pay it in two parts: an upfront fee (which they can roll into the loan amount) and an annual fee (included in the monthly mortgage payments).

Do USDA Loans Require PMI?

No. As USDA loans do not require private mortgage insurance (PMI) like conventional loans.

How Do USDA Costs Compare to FHA or Conventional?

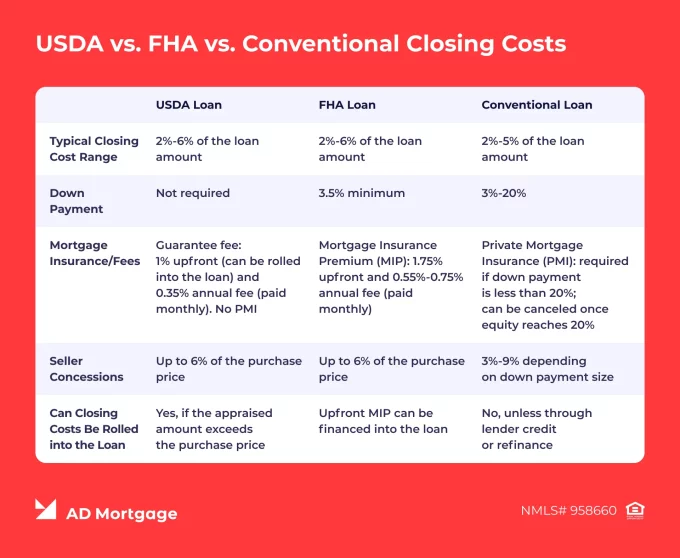

Compared to traditional loans, USDA loans offer more favorable conditions, thanks to no down payment, lower annual fees, and competitive interest rates. For eligible borrowers, USDA loans are usually a preferred option, providing the most affordable terms.

Key Takeaways

- USDA loans generally require no down payment but come with closing costs, typically ranging from 2% to 6% of the purchase price.

- To support the program and mitigate the lenders’ risks, USDA loans include a guarantee fee, paid both at closing and with monthly payments. The upfront fee is 1% of the loan amount and can be rolled into the loan. The annual fee is 0.35% of the remaining balance and is paid monthly together with other payments.

- Adding USDA loans to the portfolio helps brokers provide their clients with favorable loan conditions.

Conclusion

In 2025, borrowers can often get USDA loans with no down payment, while closing costs typically range from 2% to 6%, depending on their profile and the lender’s requirements. Compared to traditional mortgages, these terms are more affordable, making USDA loans a preferable option for eligible borrowers and properties.

Brokers can streamline their workflow and close deals faster with AD Mortgage services. Start by submitting a loan scenario and receive a solution tailored to your client’s needs in 30 minutes.