“What is the difference between these two options – a USDA loan vs. conventional loan?” – a common question borrowers ask brokers. This article compares these mortgages in detail, highlighting key differences in requirements, terms, and costs.

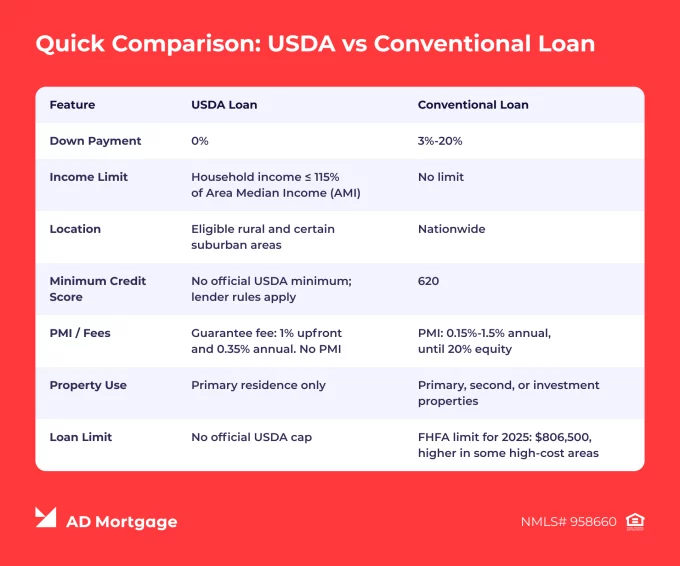

Quick Comparison: USDA vs Conventional Loan

These two options differ significantly in several ways, starting with the organization that backs them. Conventional loans are not guaranteed by the government and are offered by private lenders. USDA loans, on the other hand, are backed by the U.S. Department of Agriculture.

The table below demonstrates the difference between USDA and conventional loans side by side.

Why Brokers Choose USDA Loans for Eligible Clients

USDA loans can offer more favorable terms compared with conventional loans. If a borrower meets household income limits and the property qualifies under the location requirements, USDA loans can be the primary option to consider. Here are the key benefits of this mortgage program:

- No Down Payment Requirement. Thanks to 100% financing, borrowers do not need to have sufficient savings to purchase a home.

- Backed by the Government. This reduces lender risks, allowing them to offer competitive interest rates.

- Broader FICO Acceptance. When comparing USDA loan vs. conventional loan credit score requirements, USDA loans generally allow lower minimum scores, offering more affordable conditions. The USDA does not cap credit scores, but mortgage lenders can set their own limits.

- No PMI. USDA loans do not require Private Mortgage Insurance (PMI). Instead, borrowers pay a guarantee fee of 1% upfront and of 0.35% annually. Typically, a guarantee fee is lower than the PMI costs for conventional loans.

When a Conventional Loan is the Right Fit

As USDA loans have specific income and location requirements, they may not suit every borrower. Conventional loans are a great option in many cases, including the following:

- Home purchases in urban areas

- Borrowers with higher incomes

- Financing for second homes or investment properties

- Cancellation of PMI after 20% equity is reached

- Higher loan limits, with amounts up to $1.2 million available in certain high-cost counties

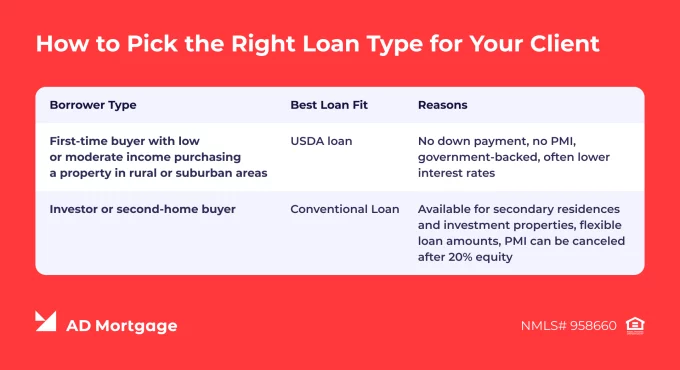

Broker Tip: Match Clients by Profile

While USDA loans are perfect for eligible borrowers, they cannot be used to purchase secondary or investment properties. Conventional loans, on the other hand, have their own advantages and limitations – they offer higher loan limits but require a down payment.

To match each borrower with the most suitable loan option, brokers can use the table below as a quick reference guide.

USDA vs. Conventional Loan Closing Time: Speed and Experience

Conventional loans typically close faster, within 30-40 days, because they require approval only from the lender. USDA loans generally take more time to close – usually 35-45 days but can take up to 60 days during busy periods – due to a two-step approval process. In addition to the lender, the USDA office also needs to approve the file.

AD Mortgage accelerates this process with AI-assisted underwriting in the AIM Partner Portal. The platform offers a variety of helpful tools for daily use, allowing brokers to receive status updates in real time, upload documents directly from the app, and earn and redeem points in the Loyalty Program. Overall, the Partner Portal streamlines workflow, ensuring efficient management of the loan progress. Become a partner today.

FAQ: USDA vs Conventional Loan Requirements

Which Loan Closes Faster – USDA or Conventional?

Compared to USDA loans that require a two-step approval process, conventional loans close faster, typically within 30-40 days.

Can Borrowers Refinance from USDA to Conventional?

Yes. However, it requires the borrower to meet the lender’s guidelines for conventional loans, which may include higher credit scores and tighter DTI ratios.

Does USDA Require Mortgage Insurance?

While USDA loans do not require Private Mortgage Insurance (PMI), they include a guarantee fee. It is charged both at closing and annually. An upfront guarantee fee of 1% can be financed into the loan, and an annual fee of 0.35% is paid monthly with other mortgage payments.

Are Income Limits Strict for USDA Loans?

Income limits for USDA loans vary by property location and are calculated based on the Area Median Income (AMI). Household income cannot exceed 115% of the AMI.