Both USDA and VA loans offer no down payment and favorable terms, so your clients might be confused about which one to choose. However, these two programs serve very different categories of borrowers, which makes the dilemma “USDA loan vs. VA loan” less complicated.

For brokers, understanding this difference saves time in finding the program that fits your client’s profile and securing better terms.

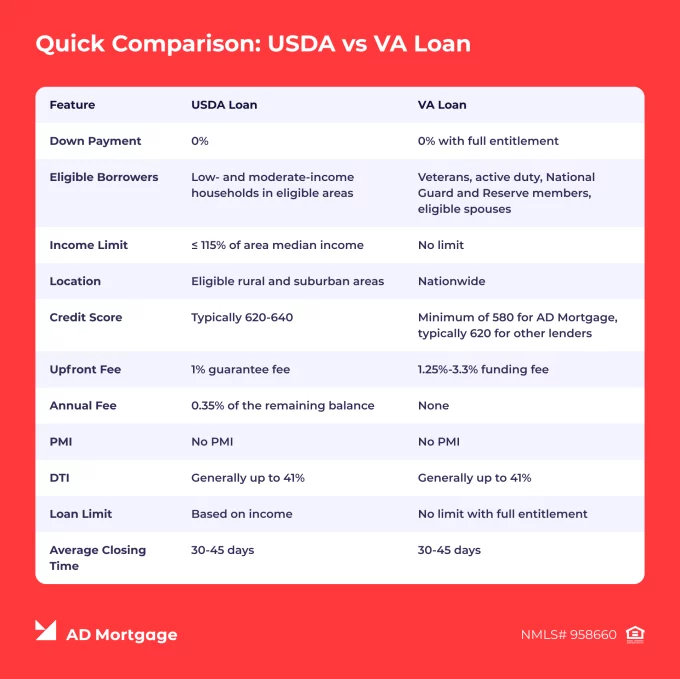

Quick Comparison: USDA vs VA Loan Chart

In the following table, we compare USDA and VA loans across their key features. At first sight, many features seem similar or even the same – such as no down payment, no PMI, and comparable closing times. However, differences also can be seen clearly – particularly in eligible borrower categories and locations.

USDA vs VA Eligibility and Borrower Profile

The two programs support different borrower categories:

- USDA loans, backed by the U.S. Department of Agriculture, offer accessible housing in eligible rural and suburban areas for low- and moderate-income borrowers. Therefore, if your client meets income limits and wants to purchase a rural residential property, a USDA loan is an ideal option.

- VA loans, guaranteed by the U.S. Department of Veterans Affairs, require a valid Certificate of Eligibility (COE) and support military members and qualified spouses in achieving homeownership. If your client is an eligible veteran looking to purchase an owner-occupied property anywhere in the U.S., then a VA loan is the first thing to offer them.

USDA vs VA Loan Fees and Overall Cost

Both programs require no down payment and no private mortgage insurance (PMI), thereby providing more affordable terms, compared with conventional loans. However, they come with their own costs:

- To mitigate lender risks, the USDA charges a guarantee fee which is paid upfront and annually. An upfront fee of 1% of the purchase price is paid at closing and can be financed into the loan. The annual fee of 0.35% of the remaining balance is paid monthly, together with other mortgage payments.

- The VA charges a one-time funding fee at closing and does not require any annual fees. The VA funding fee size depends on the loan type, whether it is the borrower’s first time using the benefit, and other factors, and typically falls within the 1.25% to 3.3% range.

Over 4 to 5 years, cost differences can narrow depending on the loan size and whether the borrower qualifies for a VA loan exemption.

Property and Geography

The occupancy rules are the same for both loan types, meaning that only primary residences are allowed. Yet, geographic restrictions vary.

While VA-eligible properties can be located anywhere in the country, USDA loans permit only properties that are located within designated rural and certain suburban areas. To check whether the address fits the criteria, use the USDA Eligibility Map.

Credit Score and DTI Flexibility

Credit score and DTI requirements are set by lenders, not the USDA or the VA. Therefore, the rules might vary, though the most common are the following:

- USDA loans. Typically, the minimum credit score is 620-640. A standard DTI benchmark is 41%, but slightly higher ratios can sometimes be accepted with strong compensating factors.

- VA loans. Most lenders prefer a credit score of at least 620, but AD Mortgage accepts FICO scores starting at 580. A DTI ratio of up to 50% is allowed if strong residual income is demonstrated.

AD Mortgage’s experienced underwriters efficiently handle borderline files, helping brokers serve clients who might be declined by other lenders.

USDA vs VA Closing Time and Process

The VA loan closing process requires only lender approval and, therefore, is quick and straightforward. USDA loans, on the other hand, involve a two-step approval process – by the lender and the USDA office. When handled efficiently, VA loans typically close faster than USDA loans, and the timeline is comparable to conventional loans.

AD Mortgage ensures that file reviews are completed on time, without delays, thanks to AI-enhanced underwriting. Additionally, prequalification is streamlined with 30-minute scenario feedback, helping brokers choose the program that best fits the borrower’s needs.

When to Choose Each

If your client does not fully understand the difference between USDA and VA loans and/or is unsure which program to choose, here is a short explanation:

- USDA loans work for non-military borrowers with low to moderate income who are looking to purchase housing in eligible rural and suburban areas.

- VA loans are typically the best fit for eligible veterans and active-duty clients, without location limits.

For brokers, working with both programs expands your potential market and helps serve your clients more efficiently.

FAQ: VA Loan vs USDA Loan – Which is Better

Which Loan Closes Faster – USDA or VA?

VA loans generally close faster, as they require only lender approval. USDA loans involve a two-step approval process – by the lender and the USDA – which adds time to closing.

Can Borrowers Qualify for Both USDA and VA Loans?

Yes, some borrowers might qualify for both loans, but they need to choose one loan per property.

Which Loan Has Lower Fees Overall?

VA loans are often cheaper because they require only a one-time funding fee, while USDA loans charge both an upfront and annual guarantee fee.

Are There Income Limits for VA Loans?

No. Borrowers of all income ranges are eligible for VA loans. USDA loans are available only to low- and moderate-income borrowers.

Conclusion

With no down payment and favorable interest rates, both USDA and VA loans offer borrowers affordable pathways to homeownership. To match borrowers with the right program faster, brokers should clearly understand the differences between the two offerings and know their benefits and limitations.

AD Mortgage, a leading mortgage lender, provides more than 20 loan products, including VA Standard and VA IRRRL programs. Become our partner to expand your pipeline and offer your clients tailored home financing solutions.