Buyers might be confused by VA loan closing costs and unsure what to expect on closing day. We make it easy to calculate these expenses, so your clients know exactly how much money they need to have on hand.

The article explores VA loan closing costs in 2025 and offers a simple checklist to help you prepare borrowers for the closing date.

What are VA Loan Closing Costs?

VA loans, established by the U.S. Department of Veterans Affairs (VA), are an opportunity for service members and their families to become homeowners at affordable prices. Typically, these loans offer lower interest rates and do not require a down payment.

Like other loans, VA loans come with closing costs that are essential for finalizing a mortgage. The expenses may vary, but usually the standard VA loan fees include:

- VA funding fees

- Lender fees (originating, processing, underwriting fees, etc.)

- Appraisal fee

- Title and insurance fees

- Taxes and prepaid expenses

VA Closing Costs in 2025

Closing costs for VA loans vary depending on the loan amount, lender fees, and the borrower’s mortgage history. Typically, VA closing costs range from 3% to 6% of the loan amount.

For example, taking out a VA loan of $350,000 will require between $10,500 and $21,000 in closing costs.

Broker Tip: Advise clients to expect closing fees of 3-6% of the loan amount. However, the down payment will significantly lower these expenses due to lower funding fees.

Breakdown of Key VA Loan Closing Costs

- VA funding fee. This charge is specific to VA loans and is paid directly to the Department of Veterans Affairs. It supports the mortgage program by partly offsetting the expense of these low-cost loans. The funding fee depends on the loan amount and type, whether the borrower makes a down payment or has had a VA loan before. While varying from 0.5% to 3.3%, the funding fee for first-time homebuyers is typically 2.15% of the amount borrowed.

- VA origination fee. The lender charges this fee to cover the costs of underwriting and loan processing. However, for VA loans, the origination fee limit is 1% of the total loan amount.

- VA appraisal fee. To ensure that the loan amount matches the home market value, a third-party appraisal is required. The cost of the appraisal depends on the type of house, its location, and other factors, and typically varies between $500 and $1,500.

- Title and insurance fees. During title search, the public records are checked to ensure that homeownership is legal and there are no liens or disputes. But in case such issues arise, the insurance protects the lender and covers the expenses on legal actions.

- Taxes and prepaid expenses. These costs are covered on closing day and held in an escrow account. Prepaid expenses typically include property taxes, prepaid interest, and insurance.

Who Pays VA Loan Closing Costs?

Generally, the borrower pays most of the closing costs. But during negotiations, the costs can be allocated differently between the buyer, seller, and lender.

Buyer Responsibilities

On closing day, the borrower pays the down payment, if it’s required by the loan terms. Additionally, they cover the funding fee, appraisal fee, credit report fee, origination fee, title insurance, and prepaid expenses.

Seller Concession

The VA loan rules allow for the seller to cover part of the closing costs for the borrower. However, the VA seller concessions cannot exceed 4% of the loan amount.

Lender Credits

The lender can offer lender credits. In this way, the borrower pays lower closing costs upfront, but the interest rate is slightly higher.

Broker Tip: Negotiating with the seller to cover the closing costs is a way to lower out-of-pocket costs for the borrower. Typically, the seller covers the pest inspection costs and agent commissions.

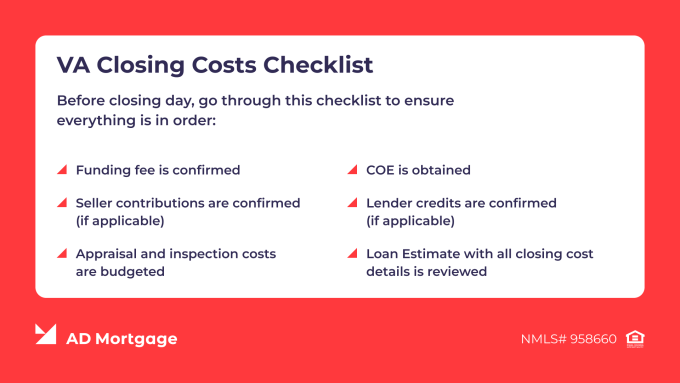

VA Closing Costs Checklist

Before closing day, go through this checklist to ensure everything is in order:

- Funding fee confirmed

- COE obtained

- Appraisal and inspection costs budgeted

- Seller contributions confirmed (if applicable)

- Lender credits confirmed (if applicable)

- Loan Estimate with all closing cost details reviewed

FAQs: VA Loan Closing Costs

What are VA Loan Closing Costs?

Closing costs are fees and expenses that must be paid to finalize the mortgage. They include the VA funding fee, origination fee, appraisal fee, title insurance, and other charges.

How Much are Typical VA Closing Costs?

Typically, closing costs are between 3% and 6% of the total loan amount.

Can You Roll VA Closing Costs into Your Loan?

Some of the closing costs can be included in a loan, so that a borrower needs less cash at the closing date. For example, the funding fee can be rolled into the loan, while lender fees, appraisal fees, and title fees must be paid at closing.

Who Pays Closing Costs on a VA Loan?

Closing costs are covered by the borrower. However, the rules are flexible and allow lender concessions and lender credits.

What VA Loan Fees are Buyers Not Allowed to Pay?

Generally, buyers are obliged to pay all closing costs. Still, there are seller concessions and lender credits that help to reduce the amount of cash that borrower needs to have on hand on the closing day.

Key Takeaways

- VA loan closing fees are typically 3-6% of the total loan amount.

- The VA funding fee goes to the U.S. Department of Veterans Affairs to keep the program running and cover part of its costs. The amount of the fee depends on several factors but usually ranges from 0.5% to 3.3% of the loan amount.

- Seller concessions can partly offset costs, but they cannot exceed 4% of the loan amount.

- The borrower needs to clearly understand the amount of closing costs and have enough cash on hand on the closing date.

- Both seller and lender can negotiate closing costs, so that the borrower needs to pay less upfront on closing day.

Conclusion

For your client, calculating costs might be confusing. Responsible planning and clear communication are what will help you handle the situation easily. With A&D Mortgage, you will stay informed and ready for the closing date – with no surprises.

Want to know the total amount of closing costs your client needs to pay? Talk to our VA loan specialist today!