VA loans are a powerful benefit that allows borrowers to achieve homeownership without a down payment. However, a common question that brokers hear consistently is, “Can I use a VA loan for investment property?”

The answer is nuanced. Today, we explore this topic in detail and break down the rules, strategies, and AD Mortgage programs brokers can use when advising clients.

Can You Use a VA Loan for Investment Property?

The VA supports eligible borrowers in purchasing primary residences. Therefore, VA benefits generally cannot be used for investment or commercial properties.

Occupying the purchased property is one of the program’s key requirements. The borrower must certify that they intend to occupy the house and then move into it, generally within 60 days after closing. It is important to note that occupancy means living on the property most of the year, not visiting it occasionally.

However, there is an exception. Eligible borrowers are allowed to use VA benefits to buy up to 4-unit multifamily properties, as long as they live in one of the units.

This way, non-owner-occupied units can provide rental income and offer investment potential.

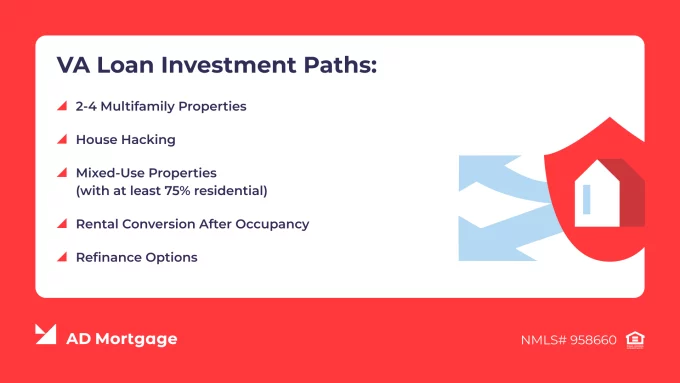

VA Loan Investment Scenarios Brokers Should Know

Although VA loans cannot be used directly for investment properties, there are several creative strategies borrowers can use to build wealth while following the program rules.

VA ‘House Hacking’

While the veteran lives in the house, there are no restrictions on how to use spare bedrooms. Therefore, renting out extra rooms in a single-family home is an option.

2-4 Multifamily Property

If purchasing duplexes, triplexes, or fourplexes, the units – except for the one the veteran lives in – can be rented. Additionally, the rental income can help the borrower to qualify for the loan.

Mixed-Use Properties

The VA allows veterans to purchase mixed-use housing if at least 75% of the property is residential and 25% or less is commercial.

Rental After Occupancy

After 12 months of occupancy or due to PCS orders, borrowers can often rent out the home. While the VA doesn’t restrict renting after a considerable time of occupancy, lenders or HOAs might impose their own regulations.

Refinance Options

Refinancing helps borrowers lower costs, improve loan terms, or build equity for future opportunities.

- IRRRL. The VA Streamline Refinance (IRRRL) requires the borrower to certify they previously occupied the property as their primary residence. Therefore, if the borrower moves, for example, due to PCS orders, they can use the IRRRL and then rent out the formal residential property.

- Cash-Out Refinance. A veteran can refinance the loan on the property they live in to use the cash for any purpose, including buying investment property. In this case, the purchase cannot be financed with a VA loan. Instead, the borrower needs to apply for a conventional or Non-QM loan.

VA Loans for Investment Properties: What’s Not Allowed

Although VA loan terms are flexible and offer borrowers a variety of options, there are restrictions that brokers need to educate their clients about. VA occupancy rules require that the borrower lives on the property most of the year, so the following types of purchases are not allowed:

- Pure investment properties

- Secondary residences, such as seasonal or vacation homes

- Fix-and-flip projects

- Timeshares

- Non-residential properties

VA Loan Entitlement and Rental Income

VA loan terms and down payment requirements depend on the type of entitlement the borrower has. Full entitlement allows the borrower to secure a loan within the FHFA conforming loan limits without a down payment. Partial entitlement requires a down payment and can limit the loan amount.

Brokers need to verify a borrower’s entitlement status using their Certificate of Eligibility (COE). In case of partial entitlement, they should start the process of restoring the entitlement before applying for a new VA loan.

Regarding potential rental income, it can be used to help qualify for a VA loan. However, this depends on lender guidelines and might require additional reserves and documentation, typically 2 years of landlord experience history. Additionally, lenders might allow projected rental income to offset the borrower’s DTI ratio, but often at a discounted rate.

How Brokers Should Position VA Loan Investment Potential

Explain to your clients that, although VA loans are not for investment purposes, they can be used to build equity and create passive income legally. Stress these three considerations:

- A VA multifamily loan for a 2-4-unit property or ‘house hacking’ are the most common ways to achieve both homeownership and rental income. Additionally, the projected income can count toward the DTI ratio, increasing the maximum loan amount for the borrower.

- Complying with occupancy rules is a must. The borrower needs to certify their intent to move into the property within 60 days after closing and live there permanently. Brokers should document this intent to avoid issues during the underwriting process.

- A VA loan can be a borrower’s first step in building their well-being and financial stability. It should be considered as part of a long-term strategy, rather than a tool for immediate investment profits.

AD Mortgage VA Programs

AD Mortgage offers two VA programs to help veterans achieve homeownership and build equity:

- VA Standard: Eligible borrowers can get loans up to $2 million with no down payment. The minimum FICO score is 580.

- VA IRRRL: Refinance existing VA loans up to $1.5 million with no appraisal required. The minimum FICO score is 580.

FAQ: VA Loan Strategies

Can I Buy a Duplex with a VA Loan and Rent One Side?

Yes. The VA allows eligible veterans to purchase 2-4-unit properties, as long as the borrower occupies one unit.

Does the VA Allow Airbnb or Short-Term Rentals?

The VA requires owner-occupied property. However, for 2-4-unit houses or ‘house hacking’, extra units or bedrooms can be rented out.

How Long Do I Need to Live in the Property before Renting It?

The VA requires that the borrower moves into the house within 60 days of closing and then occupies the property permanently. However, lenders and HOAs may impose their rules, often requiring the borrower to live in the house for at least 12 months before renting it out.

Can Rental Income Help Qualify for a VA Loan?

Depending on the lender’s requirements, rental income can sometimes help a borrower qualify for a VA loan. Many lenders count it at a discounted rate and require 2 years of landlord experience verification.

What’s the Difference between VA loan Rental Strategies and Using a DSCR Loan?

VA loans are for eligible borrowers who want to purchase a primary residence with no down payment. Using rental strategies, borrowers can generate VA loan rental income, but investment is not the primary purpose of the benefit.

A DSCR loan, on the other hand, is specifically designed for real estate investors and mainly focuses on the property’s income.

Key Takeaways

- Although VA loans are for primary residences, smart use (multifamily, ‘house hacking’, renting after occupancy) creates investment potential.

- Brokers should guide their clients on VA entitlement, investment options, and the rules for staying compliant with the program.

- AD Mortgage offers VA Standard and VA IRRRL programs that support both homeownership and strategic planning.

Conclusion

Receiving rental income from VA-loan-funded property is possible, though challenging. Brokers need to educate their clients on how to legally and efficiently rent out their property.

AD Mortgage offers VA programs to support veterans in achieving homeownership and building wealth. Additionally, there are 20+ other programs we provide, including conventional and Non-QM products. Explore the list of AD Mortgage loan programs to match your client’s needs with the best option.