VA loans are an attractive option for military members thanks to their no down payment and lower interest rates. However, it’s crucial to understand the VA loan funding fee, which can add thousands of dollars to closing costs.

We have created a single, easy-to-use table with all 2025 funding fee rates and a list of exemptions. Keep reading to discover the most efficient ways to cover these costs and to see whether your client is eligible to avoid them altogether.

The VA Funding Fee & Why It Exists

The VA loan funding fee is a one-time payment that is charged at closing by the U.S. Department of Veterans Affairs. The fee helps cover the costs of the VA loan program, allowing eligible borrowers to access a loan without having to make a down payment.

Besides keeping the program self-sustaining, the VA funding fee reduces other costs. Thanks to this charge, the loans do not require monthly mortgage insurance (MI).

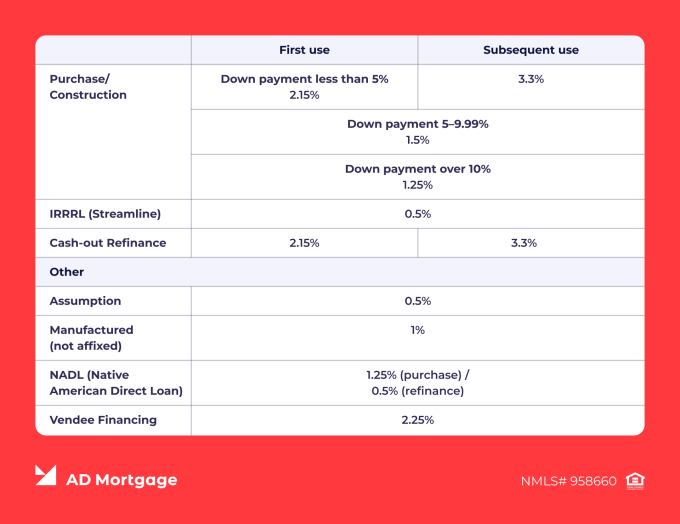

2025 Funding Fee Rates: Table

VA funding fee rates vary depending on the loan type and the loan amount. Other factors for some loan types, such as whether it’s the first or subsequent use of a VA loan and the size of the down payment, might affect the fee rate.

Exemptions and How Refunds Work

The fees are mandatory unless the borrower meets one of the following conditions for VA funding fee exemption:

- An individual receives compensation for a service-related disability or has received a proposed or memorandum rating confirming eligibility for compensation

- An individual receives retirement or active-duty pay, while being eligible for compensation for a service-related disability

- A surviving spouse of a veteran who receives Dependency and Indemnity Compensation (DIC)

- An active-duty member who was awarded the Purple Heart

However, it is possible to get a VA loan funding fee refund if the person is awarded compensation for a service-related disability. Note that refunds apply if the date of compensation is retroactive to before the closing date.

Broker Tip: Always check the Certificate of Eligibility (COE) for exemption status early. If the borrower has a pending disability claim, it may be better to postpone closing so they can avoid paying the fee upfront instead of paying it and later filing for a refund.

How to Pay the Fee and Lower the Impact

As a general rule, the funding fee must be paid as part of VA loan closing costs. However, there are several ways to avoid paying them upfront and out-of-pocket:

- Finance the funding fee into the loan. Then, you will be repaying it over the life of the loan with interest. Note that it is only possible to roll the funding fee into the loan, not other closing costs.

- Lower the size of the fee by making a down payment. If the down payment is over 5% of the loan amount, then the funding fee drops to 1.5%. With a 10% down payment or more, the cost is reduced to 1.25% in funding fees.

- Ask the seller to cover the fees. Seller concessions for a VA loan are limited to 4% of the loan amount but can cover various closing costs, including the funding fee.

FAQ: VA Loan Funding Fee

What is the VA funding fee?

VA funding fees are charged by the U.S. Department of Veterans Affairs to support the VA loan program and keep it running. This one-time payment must be made on the closing date.

What’s my rate in 2025 for purchase, cash-out, or IRRRL?

The rates vary depending on the loan type, loan amount, down payment size, and whether it’s the borrower’s first time using a VA loan benefit. For exact rates, please see the table above.

Who is exempt and how do I obtain an exemption?

Some borrowers, such as those who receive compensation for a service-related disability or active-duty members awarded a Purple Heart, might be exempt from paying the funding fee. To confirm the status, check the COE.

Can I get a refund if my disability rating changes after closing?

The borrower might be eligible for a refund if the VA disability compensation is awarded retroactively to a date before closing.

Can the seller pay the fee and does it count toward the 4%?

Yes, the seller can cover up to 4% of closing costs, including the funding fee.

Key Takeaways

- VA loan funding fees are typically 0.5%-3.3%, depending on the loan type, down payment size, and other factors. The VA IRRRL funding fee is lower – just 0.5%.

- It is possible to qualify for an exemption. To see whether the borrower is eligible, review their COE.

- Making a down payment is a way to reduce the funding fee. Also, up to 4% of closing costs can be covered through seller concessions.

- The borrower can pay the funding fee upfront at closing or roll the fees into the loan and pay it together with the interest.

Conclusion

Overall, VA funding fees are a relatively small cost compared to the numerous benefits VA loans provide. However, it’s important to understand the details of these fees and explain them to your borrowers in simple terms.

A&D Mortgage offers Quick Pricer, a free tool for calculating loan terms. It helps brokers deliver efficient service to their clients quickly. Try Quick Pricer to check interest rates and monthly payments for VA loans and other programs.