VA loans provide military members and their families with affordable opportunities to become homeowners. Established by the U.S. Department of Veterans Affairs (VA), this program offers appealing conditions, including no down payment or private mortgage insurance (PMI) required and interest rates are typically lower. Additionally, the VA loan requirements are more flexible in terms of income and credit score.

This article explores the VA loan eligibility requirements and its limitations and provides you with a simple checklist to evaluate a client’s suitability for this type of mortgage. Follow along!

Who Qualifies for a VA Loan in 2025?

To apply for a VA loan in 2025, the borrower must provide a Certificate of Eligibility (COE). This document verifies that the service history and duty status fit into the loan criteria.

To become eligible and receive the COE, borrowers must meet at least one of the following conditions:

- Active-duty service members: Served 181 days during peacetime or 90 consecutive days during wartime. For veterans, the minimum requirements depend on the time they served.

- National Guard and Reserve members: Served six credited years or 90 days under Title 32 with at least 30 days of service consecutively.

- Discharged veterans: May be qualified, if discharged for hardship, convenience of the government, medical condition, or one of the other exceptions.

Moreover, spouses can also obtain the COE, if at least one of the conditions below is true:

- The veteran is an active-duty service member who is missing in action (MIA) or a prisoner of war (POW)

- The veteran died from a service-connected disability, and the spouse didn’t remarry (exceptions apply for those who remarried after age 57 or after December 16, 2003.

- The veteran was totally disabled from a service-connected disability, even if the disability hadn’t caused death (with some exceptions).

Broker Tip: Visit the VA.gov website to request the COE and receive it automatically online.

Credit Score and Income Guidelines 2025

In addition to meeting the military service requirements, there are mortgage lender rules the borrower needs to follow. The criteria might differ depending on VA loan programs, but here are the typical requirements:

Credit Score

The credit score required is typically above 600, but A&D Mortgage offers a more appealing condition. The minimum FICO required for VA loans is 580.

Income and Employment

The borrower must have consistent and reliable income and a clear employment history. Additionally, lenders consider Debt-to-Income (DTI) ratio. For VA loan approval, the DTI should be 41% or less preferably.

Broker Tip: If the borrower doesn’t meet the requirements, paying off or refinancing debts and increasing existing income will help lower the DTI.

VA Entitlement and Loan Limits Simplified

The Department of Veterans Affairs offers VA entitlement to guarantee that the loan will be repaid to the lender if the borrower defaults. With this support, eligible veterans can obtain a loan without a down payment.

A basic entitlement of $36,000 is provided for loans up to $144,000 and can cover up to 25% of the loan amount. For larger loans, additional entitlement (Tier 2) can be offered. In such cases, the loan amount might be limited based on the county loan limit. Then, a down payment might be required to ensure that at least 25% of the loan is covered.

If the borrower hasn’t used a VA loan before, or has used one, repaid the loan in full and sold the property, then they can be eligible for the full entitlement. It guarantees 25% coverage no matter the size of the loan. There are no loan limits for eligible borrowers with full entitlement.

Broker Tip: For loans over $144,000 without full entitlement, remember to check the county loan limits. This can be done here.

Property and Occupancy Rules

VA loans have limitations on property types and ways it will be occupied. However, all funded property must align with the VA’s Minimum Property Requirements (MPRs), ensuring that the home is safe, structurally sound, and sanitary.

Property Requirements

VA loans can only be used as primary residences, meaning that they cannot be utilized for investment properties or secondary residences.

There are several property types eligible for VA loans including:

- Single family residences with up to four units

- Condo, but only in VA-approved projects

- Manufactured homes, but only in VA-approved projects

- Townhomes

- Modular homes

Occupancy Requirements

For VA loans, the general rules for occupying primary residences apply. Therefore, the borrower must move into the new home within 60 days of the closing date and then live there continuously, occupying it for a major part of the year.

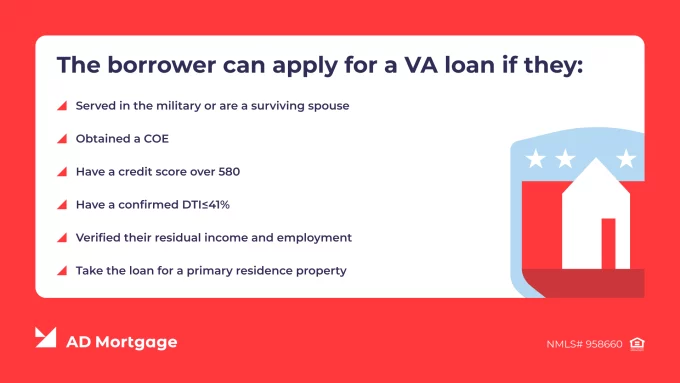

Simple VA Loan Eligibility Checklist

To check whether the borrower is qualified for a VA loan, use our simple eligibility checklist.

The borrower can apply for a VA loan, if they:

- Served in the military or are a surviving spouse

- Obtained a COE

- Have a credit score over 580

- Have a confirmed DTI≤41%

- Verified their residual income and employment

- Take the loan for a primary residence property

VA Loan Requirements: FAQs

What are the VA loan eligibility requirements for 2025?

The requirements include military service experience, a Certificate of Eligibility (COE), verified residual income, and other factors. Use our simple tool to check whether your client is qualified for a VA loan.

What is the minimum credit score needed in 2025 for a VA loan?

At A&D Mortgage, the VA loan credit score required is 580.

Can spouses qualify for a VA loan?

Yes, a surviving spouse can qualify for a loan, if their active-duty spouse is missing in action (MIA) or a prisoner of war (POW) or if the veteran died in service from a service-connected disability, and the spouse didn’t remarry.

How do you get a Certificate of Eligibility (COE)?

The borrower must comply with the requirements for the term and type of service. Then, apply for the certificate at VA.gov.

Are VA loans only for first-time homebuyers?

No, the borrower might have bought a house before and even received a VA loan – but then repaid it in full and resold the property.

Conclusion

VA loans are a great opportunity for military members to buy a home at an affordable price.

If your client is interested in applying for a VA loan, you can quickly check whether they are qualified for this funding. Follow the link to the easy-to-use A&D VA loan eligibility tool.