The FHA Streamline Refinance program is designed to help borrowers who have a current FHA-insured loan. It's an easy way to potentially lower interest rates and reduce monthly payments. This refinance option requires minimal paperwork, making the process faster and easier.

Program features

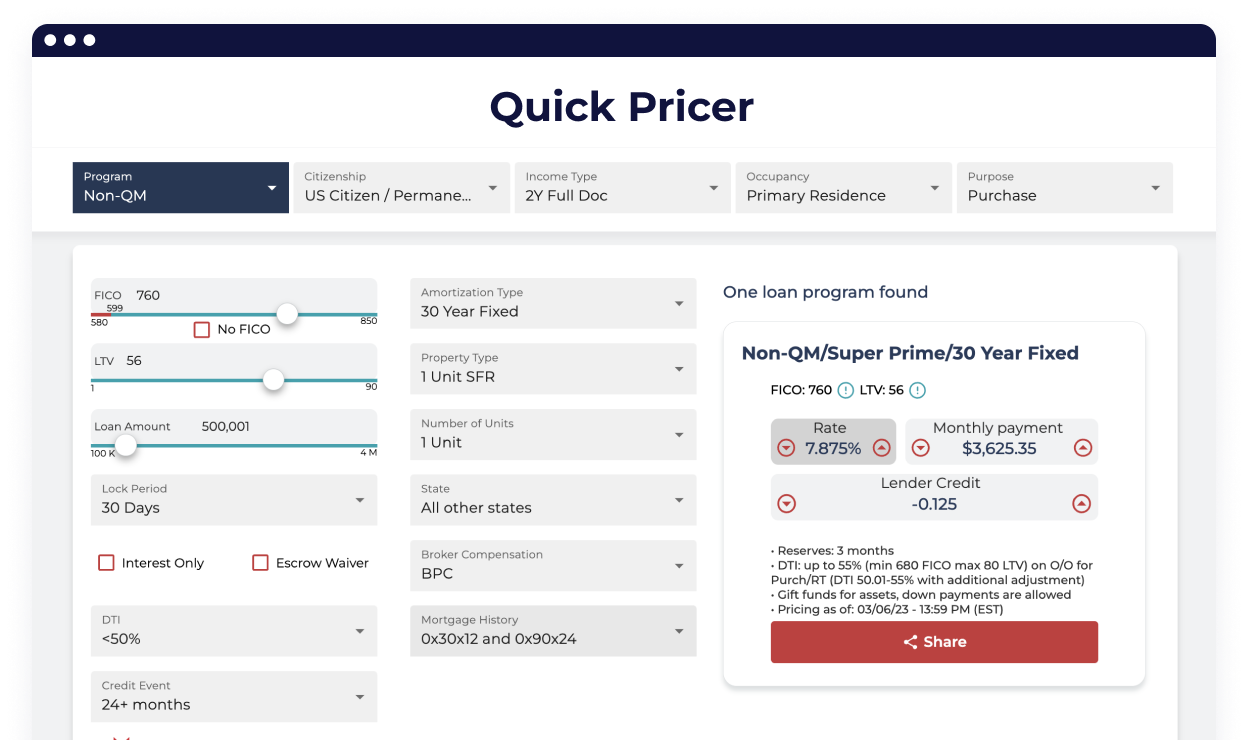

Struggling with a loan scenario? Push the button and get a solution in 30 minutes!

Write to us, we will contact you within 30 minutes.

24 hours

24 hours

24 hours

The FHA created the FHA Streamlined Refinance program over 25 years ago to make it simple and fast for anyone with an FHA loan to lower their interest rates. They do this through a “streamlined” process that utilizes the already existing paperwork from the borrower’s original loan to serve as the foundation of the process.

Besides the original loan is an FHA loan, the only other real requirement is that your client’s mortgage payment must not have been more than 30 days late in the last 12 months.

No, they are not permitted to take any cash out with the FHA Streamline Refinance loan program.

No, there is no credit check required for FHA Streamline Refinance. This is part of the streamlined process.

No, we do not require an appraisal for an FHA Streamline Refinance.

The FHA Streamline Refinance loan requires no proof of income like W2s or tax returns. Most other types of loans require the lender must determine the borrower’s ability to afford the new monthly payments. The FHA Streamline Refinance eliminates this requirement.

FHA Streamline Refinance does not remove PMI. PMI is the mortgage insurance borrower’s purchase for Conventional loan programs. Mortgage insurance premium (MIP) is the insurance borrower’s purchase for FHA loans. MIP will not be waived throughout the life of an FHA loan.

FHA does not have a minimum credit score requirement since it does not require a credit report for FHA Streamline Refinance. However, most lenders will require a credit report and a score of at least 620.

UFMIP is the acronym for Upfront Mortgage Insurance Premium. It is the fee that FHA charges on about every FHA loan to defray the costs of the program. As of April 2013, the fee is typically 1.75% of the full loan amount. So, if your client opens a $200,000 mortgage, their final FHA loan amount will be $203,500.

For FHA Streamline Refinance, this fee can be wrapped into the new loan and does not have to be paid out of pocket. If your client wants, they have the option to pay it out of pocket, which reduces their loan amount. Most FHA borrowers finance it into the new loan.

They are eligible to apply for an FHA Streamline Refinance every 210 days.