As a broker, you have probably heard this question from your cautious clients: “Are Non-QM loans risky?” Generally, this depends on how the risk is defined. The broker’s role is to set the context and guide their clients, explaining potential advantages and disadvantages of these mortgage tools.

Quick Direct Answer: Non-QM loans are not inherently risky. However, there are risks associated with the underwriting quality, borrower fit, and loan structure. Partnering with the right lender is key to closing Non-QM loans efficiently.

Why Non-QM Loans are Often Perceived as ‘Risky’

Typically, Non-QM loans are perceived as risky because of a lack of understanding and incorrect assumptions:

- Association with Pre-2008 Lending. The stigma from the 2008 crisis and mortgage practices before it can cause confusion. Some borrowers misunderstand Non-QM loans and mistakenly associate them with subprime loans.

- Confusing Wording. ‘Non-Qualified Mortgage’ may sound like ‘unqualified’ and create wrong assumptions about the underwriting process.

- Misunderstanding of Alternative Documentation. Some might see the greater flexibility offered by Non-QM loans as a lack of standards or as speculative income verification.

- Interpreting Higher Rates as Higher Risk. When borrowers are not familiar with the mortgage process and associated costs, higher rates might be considered a sign of greater risk.

However, these misunderstandings can be easily addressed. Educating borrowers about the risks and helpingьthem avoid unfounded assumptions is one of the key roles of a broker.

What ‘Risk’ Actually Means in Non-QM Lending

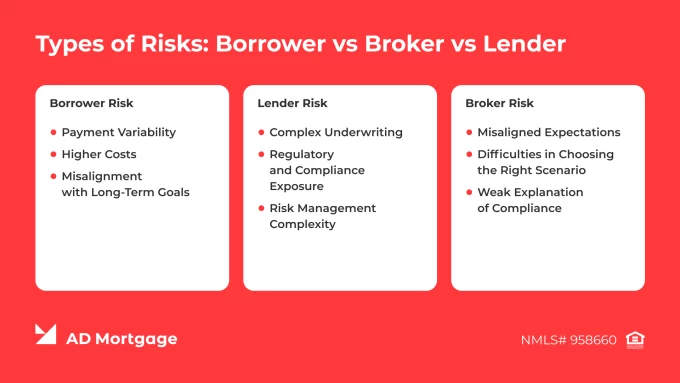

Non-QM loans have their unique features and limitations that can be disadvantages for some borrowers and advantages for others. Below, we look at Non-QM loans from three perspectives, encouraging brokers to consider these as specific features or challenges, rather than inherent risks.

Borrower Risk

- Payment Variability. Borrowers must be informed about how Non-QM loans are structured. Under some loan conditions, payments may change over time. For example, ARM adjustments or interest-only periods, which can pose challenges for the borrower.

- Higher Costs. Typically, Non-QM loans include higher interest rates and payments. This can be problematic if the loan structure does not match the borrower’s cash flow and overall financial situation. Planning and approaching the loan strategically are essential to avoiding unnecessary or unintended costs.

- Misalignment with Long-Term Goals. A Non-QM loan should be part of the borrower’s long-term plan. Otherwise, even if the loan performs as intended, the borrower might still fail to meet their personal expectations.

Lender Risk

- Complex Underwriting. Non-QM underwriting relies greatly on documentation interpretation and accurate assessment of the borrower’s overall financial profile. Reviewing alternative documents and compensating factors requires time and expertise.

- Regulatory and Compliance Exposure. Unlike QM loans, Non-QM solutions do not provide ‘safe harbor’ or ‘rebuttable presumption’ protections. Mistakes in evaluating borrowers’ Ability-to-Repay (ATR) may result in legal or financial consequences.

- Risk Management Complexity. To mitigate these risks, lenders must carefully coordinate pricing, reserves, borrower equity, and underwriting standards. Errors or inconsistencies in managing these factors can lead to higher credit losses, operational challenges, or regulatory exposure.

Broker Risk

- Misaligned Expectations. Brokers must educate borrowers on the loan structure and set realistic expectations regarding timelines and loan conditions. Otherwise, borrowers may be dissatisfied, potentially harming professional relationships.

- Difficulties in Choosing the Right Scenario. Non-QM loans are variable and adaptable to different borrower profiles, and it is the broker’s responsibility to select the appropriate solution. Submit a Scenario Request Form on the AD Mortgage website to receive a tailored loan product within 30 minutes.

- Weak Explanation of Compliance. Brokers need to document and justify why a Non-QM loan is the right choice for their client. Poor documentation can result in loan delays, compliance questions, or other issues.

Non-QM Risk: Myth vs Reality

In the following table, we address the common misconceptions about Non-QM mortgage risks. Use it to educate your clients on how the loans are actually structured and quickly dispel myths.

| Myth | Reality |

|---|---|

| Non-QM means no verification | Assets, income, employment history, reserves, and other factors are carefully examined using alternative documentation methods, ensuring that the borrower has the ability to repay the loan |

| Non-QM loans equal subprime | Unlike high-risk subprime loans, Non-QM solutions follow strict guidelines and require the borrower to demonstrate financial stability and repayment capacity |

| Non-QM always leads to default | Default rates for Non-QM loans are typically low, around 3.8%. Performance depends on borrower fit, loan structure, and lender underwriting |

| Non-QM loans have unreasonably high costs | Although rates are higher than QM loans, Non-QM loans offer greater flexibility that may be worth higher costs in certain borrower scenarios |

| Non-QM loans take longer to close | With experienced lenders, such as AD Mortgage, closing timelines are predictable – typically within 30-60 days |

| Non-QM has no regulations | Non-QM must comply with the Ability-to-Repay rule and other regulatory standards |

How Non-QM Risk is Managed in Practice

Non-QM loans require thorough underwriting, and these key points help to understand how this process works:

- Ability-to-Repay is still the main focus. The difference is in the way it is examined, not in whether it is considered at all.

- Compensating factors, such as down payment size, reserves, and assets, help evaluate the borrower profile realistically.

- Manual underwriting relies on human judgment, not less careful examination.

- Higher loan costs are not a sign of unsafe or risky lending – they are a control mechanism that encourages responsible mortgage practices and prevents overextension.

When Non-QM Becomes Risky

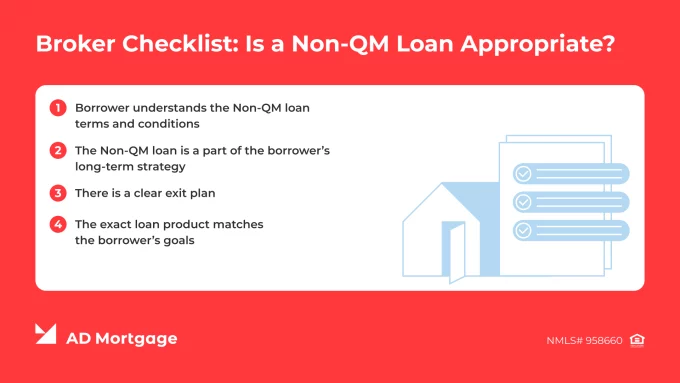

While most Non-QM mortgage risks are myths debunked above, real risks can appear if:

- Borrower misunderstands terms, including payment structures (such as interest-only, balloon payments, adjustable rates), timelines, refinance options, or prepayment penalties.

- The loan is used as a long-term solution, and there is no exit plan. The borrower should have a clear plan for payoff, refinance, or rate resets, – otherwise, exiting might be challenging.

- Broker skips proper scenario vetting and chooses the wrong product for their client’s case.

When Non-QM is a Smart, Responsible Option

When non-qualified mortgage risks are understood and borrowers are educated about them, many clients might benefit from using Non-QM loans.

So, who do Non-QM loans fit best?

- Borrowers who have real repayment capacity but do not fit strict QM requirements, such as self-employed individuals, gig workers, or real estate investors

- Transitional scenarios, which include Non-QM loans as a short-term solution before refinancing into a QM loan

- Borrowers with strong overall profiles but non-standard documentation

Broker Talking Points

To communicate key Non-QM points clearly and efficiently to your clients, you might want to use the following phrases:

- ‘Non-QM loans are not inherently risky – they are specific solutions designed for borrowers who don’t fit traditional lending guidelines.’

- ‘The real risk comes from a mismatch between the loan structure and the borrower’s profile, not the loan type.’

- ‘Structure and expectations are what really matter. If the loan fits your goals and cash flow, Non-QM may be a strong option to consider.’

How AD Mortgage Helps Brokers Manage Non-QM Risk

AD Mortgage is a leading wholesale Non-QM mortgage lender with over 20 years of experience. Non-QM programs tailored to your clients’ needs help your business grow by serving a wider range of borrowers.

AD Mortgage’s Non-QM loan programs include:

- DSCR – Solution for new and experienced real estate investors. DSCR as low as 0, cash-out available up to 75% LTV, gift funds allowed.

- 12/24 Month Bank Statement – Solution for self-employed individuals. Minimum FICO of 620 or no score, up to $4 million purchase, and up to $3 million cash-out.

- ITIN – Solution for individuals who have an ITIN but do not have an SSN. Loan amounts up to $1.5 million, DTI up to 50%, minimum FICO of 660, and up to 70% CLTV for Super Prime.

To choose the program that will help your client achieve their goals, submit a loan scenario. Our experts will contact you within 30 minutes with a tailored solution.

FAQ: Risks of Non-QM Loans

Are Non-QM Loans Risky?

No. Non-QM loans are not inherently risky. They help borrowers who don’t fit traditional guidelines achieve homeownership. Risks appear only if they are poorly structured or do not match the borrower’s financial profile and goals.

Is a Non-QM Loan Safe for a Borrower?

Yes. Working with a responsible broker and an experienced lender such as AD Mortgage, borrowers can safely use a Non-QM loan if it is properly structured and aligned with their financial situation.

How Do Non-QM Loans Manage the Ability to Repay?

Lenders review the borrower’s profile as a whole, allowing alternative income documentation and considering compensating factors such as down payment size, reserves, and assets. This approach helps to evaluate the borrower’s financial stability and repayment capability.

Why Do Non-QM Loans Cost More?

Non-QM loans are not government-backed and therefore typically have higher interest rates. In addition, because underwriting is more complex and borrowers often have non-traditional income, lenders use risk-based pricing to set rates and fees.

Are Non-QM Loans Regulated in the U.S.?

Yes. Non-QM loans must comply with federal rules, including the Ability-to-Repay (ATR) rule, Truth in Lending Act (TILA), Real Estate Settlement Procedures Act (RESPA), and other regulations.

Can Borrowers Refinance Out of a Non-QM Loan?

Yes. Borrowers can refinance out of a Non-QM loan into a QM loan or another mortgage, if they meet the requirements of the new loan.

How Can Brokers Reduce Non-QM Risk?

To reduce risks, partner with expert lenders like AD Mortgage who offer a seamless workflow, quick underwriting, and full-time support.

Fill out the short form and get a call from our AE

Struggling with a loan scenario?

Get a solution in 30 minutes!