Your client doesn’t have to be a U.S. citizen to buy a home in the United States. Thanks to ITIN mortgage programs, more people have an opportunity to obtain a primary residence or investment property.

Today, we discover the current requirements for an ITIN loan, compare different down payment strategies, and explore rates and fees in 2025.

Individual Taxpayer Identification Number (ITIN) loans are programs that support individuals without a Social Security Number (SSN) in achieving homeownership. Eligible borrowers are typically non-resident citizens and foreign nationals residing in the U.S.

What is an ITIN Mortgage & Who Qualifies in 2025

ITIN loan programs are designed to support those who pay taxes in the U.S. but do not qualify for an SSN. Both residents and non-residents are eligible for these loans, as well as spouses of these individuals.

Most commonly, the following types of borrowers qualify for ITIN loans in case they don’t have SSNs and file taxes using an ITIN:

- Self-employed individuals such as entrepreneurs and freelancers

- International students

- Foreign investors

- Spouses or dependents of U.S. citizens, who are typically part of mixed-status families

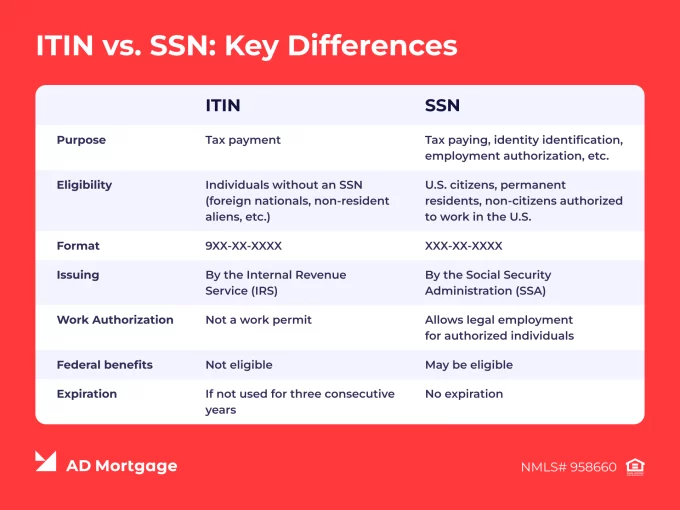

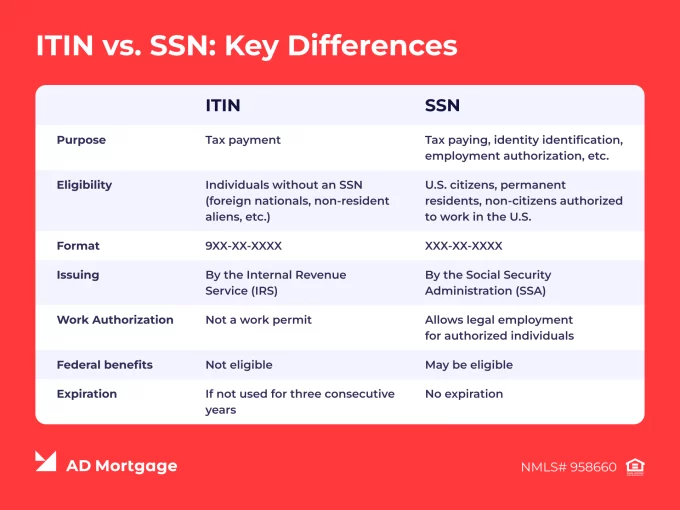

ITIN vs SSN: 7 Key Differences

Both an ITIN and an SSN are individual identification numbers that can be used for tax reporting. However, they have more differences than similarities.

- Purpose. An ITIN is used exclusively for tax-related purposes. It allows people who don’t qualify for an SSN to file taxes in accordance with U.S. law. An SSN is used for a wider range of purposes, including employment authorization and benefit tracking in addition to tax reporting.

- Eligibility. ITINs are designed exclusively for people who don’t have SSNs, such as foreign nationals or non-resident aliens. SSNs are issued to U.S. citizens, permanent residents, and those non-citizens who are authorized to work in the U.S.

- Format. Although both are nine-digit numbers following the format XXX-XX-XXXX, an ITIN always starts with a nine.

- Issuance. An ITIN is issued by the Internal Revenue Service (IRS). An SSN is issued by the Social Security Administration (SSA).

- Work Authorization. An ITIN cannot be used to obtain a legal employment in the U.S. An SSN is required for legally working but the individual in also required to have a work authorization.

- Federal Benefits. An SSN is required to obtain governmental benefits such as health and life insurance. Without an SSN, individuals are not eligible for these benefits even if they obtain an ITIN.

- Expiration. While an SSN is valid permanently, an ITIN can expire if not used for three years. Then, it needs to be renewed with a W-7 form.

Current ITIN Mortgage Requirements

To apply for an ITIN loan, the borrower must fit into the criteria of their lender. We have collected the most common current Non-QM ITIN mortgage requirements in one easy-to-use table:

| |

|---|

| Valid ITIN | An ITIN needs to be active and valid. Additionally, the lender might require other documents for borrower’s identification. |

| Income | To prove consistent income sufficient for paying off the loan, the borrower needs to provide verification documents such as tax returns, P&L statements, or bank statements. |

| Down payment | Typically, an ITIN loan down payment is higher than for conventional loans. Borrowers should expect to have about 20% as a down payment, although the exact percentage depends on the lender’s criteria and borrower’s overall financial status. |

| Residency status | The borrower needs to prove their residency with rental agreements, utility bills, or other accepted documents. Note that the ITIN home loan programs are not residency-based so this status doesn’t affect eligibility. |

| Debt-to-Income ratio (DTI) | Lenders check the DTI ratio to ensure that the borrower will be able to cover all their obligations from the expected income. Generally, the lower the ratio the better but a DTI up to 50% can be accepted for ITIN loans. |

| Credit score | In terms of credit score, the requirements are flexible and can be adjusted based on other parameters. A&D Mortgage requires a minimum FICO of 660 and up to 70% CLTV for the Super Prime ITIN mortgage program or a minimum FICO of 700 and up to 70% CLTV for the DSCR program. |

Although the terms of ITIN loans are flexible, they are stricter than for conventional loans. Typically, they have higher interest rates and require larger down payments, extensive documentation, and some additional rules. Nevertheless, ITIN loans open a path to homeownership for people without SSNs who might otherwise be unable to purchase a home.

Step-by-Step Broker Playbook

Enhanced Broker Portal

that makes your job easier

- All operations at your fingertips

- Easy-to-use intuitive interface

- Integrated AI technology

Show Me How

A broker’s job is to help their clients through the tough journey of the loan application. In addition to loan requirements, you will need to warn your clients about other aspects of the process, including pre-qualification with an alternative credit score, asset seasoning, and compensating factors for loans with low FICO scores.

Pre-Qual with Alternative Credit

Some lenders can pre-qualify the borrower based on alternative credit history in case the borrower doesn’t have a traditional credit score. These alternative sources typically include:

- Long-term rental payments

- Utility bills

- Other recurring obligations

- Bank account history

When obligations are covered on time without missing or late payments, the chances of loan pre-approval increase significantly. Preparing needed documentation early helps speed up alt-doc underwriting and doesn’t affect the borrower’s credit score.

Asset Seasoning & Cash Reserves

As many borrowers lack traditional credit scores, ITIN mortgage lenders require bigger cash reserves to demonstrate financial independence and stability.

Asset seasoning means that funds must be held in the borrower’s account for a certain period of time, typically for 60 to 90 days, before the loan application. It helps verify that the money actually belongs to the borrower and is not a recent deposit.

Besides, the borrower must show cash reserves that often include up to 12 months of PITI (principal, interest, taxes, and insurance), depending on the lender’s requirements.

Compensating Factors for Low FICO

Even with low credit scores, it is possible to obtain an ITIN home loan by demonstrating the strength of other factors, including:

- Larger down payment

- Stable income history

- Larger cash reserves

- Lower DTI ratio

An additional benefit is purchasing a low-risk property, that is in good condition and has strong resale potential. This reassures the lender of the security of the loan.

Down-Payment Strategies: Gift, 401(k), Community Seconds

It might be challenging for a borrower to save up for a larger down payment required for ITIN loans. Guide your client on the most common strategies for creating a down payment. Note that lenders usually allow borrowers to combine several approaches while each source of cash is verified and clear.

Gift Funds

Gift funds are the money given by someone – typically a relative or friend – for the purpose of using them as a down payment. The donor must sign a gift letter, verifying that these funds are gifted and will not be returned.

Sometimes, the lender might request proof of the money’s origin and its transfer to the borrower’s account.

401(k) Loan or Withdrawal

Some ITIN holders who are employed in the U.S. may be eligible to participate in a 401(k), a retirement savings plan sponsored by an employer. Funds from this account can be used to cover the down payment in two ways: borrowing against a 401(k) balance or withdrawing the funds permanently.

Although the loan comes with an interest rate, it is paid back to your account, and there are no early withdrawal penalties. On the other hand, withdrawing your 401(k) savings might be subject to tax and penalties if done before age 59½.

To help a borrower cover the down payment, nonprofit or government organizations can offer secondary loans or grants, also called community seconds. Their terms vary widely and may involve no interest rates, deferred payments, or loan forgiveness.

Community seconds are designed to support the purchase of property in specific geographic areas and are usually provided to those who have already lived in this area for a certain time.

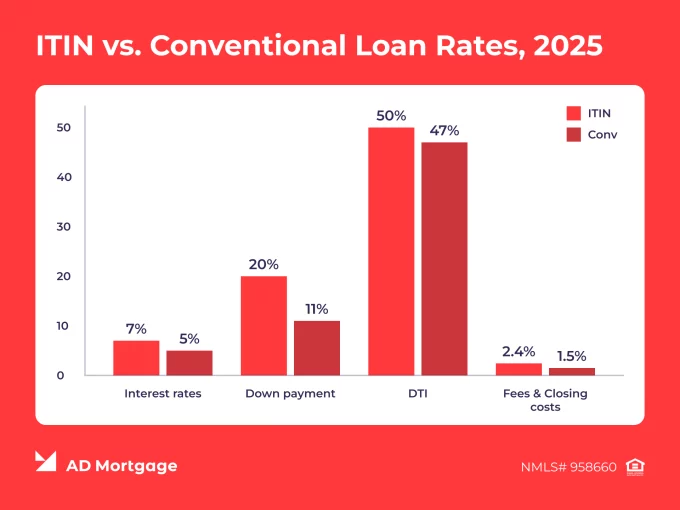

Rate & Fee Outlook 2025

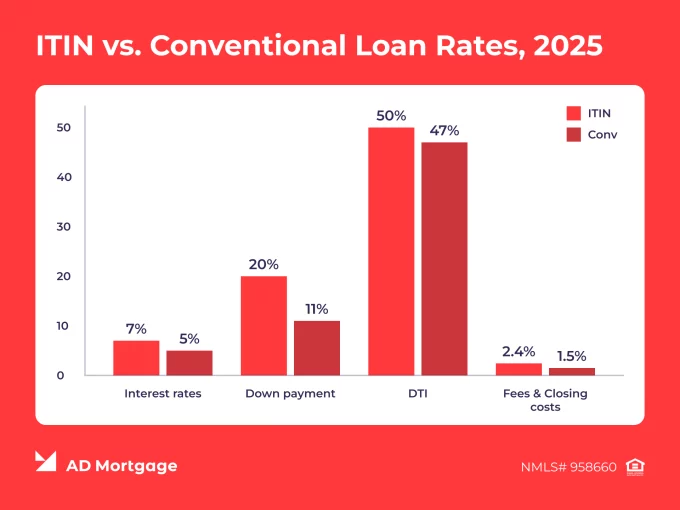

Generally, ITIN mortgage rates are 0.5%-2% higher than those for conventional loans due to higher potential risks. Additionally, the rates depend on the lender’s guidelines, macroeconomic factors, market conditions, and other aspects.

Look at the comparison chart of mortgage rates for ITIN and conventional loans in 2025. Note that the figures here are approximate and average. For exact numbers, contact the lending institution.

Compliance & Fair-Lending Do’s/Don’ts

As ITIN loans are mainly designed for individuals without U.S. citizenship and can involve vulnerable groups of borrowers, brokers must be aware of specific laws and regulations that apply in this area.

Compliance & Fair-Lending Do’s

ITIN loans must comply with the laws of fair lending:

- FHA (Fair Housing Act) prohibits discrimination in housing-related transactions based on race, color, national origin, religion, sex, familial status, or disability.

- Equal Credit Opportunity Act (ECOA) prohibits discrimination in lending and credit transactions.

- Home Mortgage Disclosure Act (HMDA) requires lenders to report on their mortgage practices, promoting transparency and accountability.

Therefore, the eligibility criteria must be standardized for all applicants.

The broker’s role is to explain loan details, including terms, fees, and risks, so that the borrower can understand them. Additionally, educate your clients about the mortgage process, their rights, and available options.

Compliance & Fair-Lending Don’ts

Besides government laws, there are state regulations that protect non-traditional borrowers. Brokers must follow both federal and local rules.

Keep in mind that charging higher rates or fees without documented, risk-based reasons might be seen as discriminatory. Violating the fair-lending requirements can lead to legal consequences.

Case Study: Closing a 680-FICO Contractor in 21 Days

To showcase how ITIN loans work in practice, we created a case study illustrating how a borrower with a credit score of 680 successfully closed on a mortgage in three weeks. Note that this scenario is hypothetical and can be used for educational purposes only. While it is possible to close in 21 days, usually it takes more time, and the timeframe depends on the lender, documentation, and borrower profile.

Borrower’s profile:

- Type: Independent contractor

- Identification: Valid ITIN

- FICO score = 680

- Loan type: Non-QM ITIN mortgage

- Property: Primary residence, SFR

- Down payment: 25%

- Cash reserves: 8 months PITI

- Income documentation: 12 months bank statements + P&L statement

Borrower’s steps for a fast close:

As there are no traditional income documents, the broker provided 12 months of bank statements and a P&L statement to verify the income quickly.

Then, asset seasoning was performed to verify that the down payment and cash reserves were in borrower’s account for 90 days.

With upfront preparation and parallel processing of the documents, a loan package was ready quickly, becoming clear-to-close in 18 days.

Result:

Overall, the loan was closed in 21 days with a fixed rate of 6.75% , which is 1.25% above market conventional loan rates.

FAQs

Can I Get a Mortgage with an ITIN Number?

Yes, there are ITIN mortgage programs that help individuals who don’t have SSNs but pay taxes in the U.S. to achieve homeownership.

Who Qualifies for an ITIN Loan?

Foreign nationals, self-employed contractors, dependents of U.S. citizens, or other individuals with a valid Individual Taxpayer Identification Number (ITIN) may be eligible for ITIN loans.

What are the Requirements for an ITIN Loan?

To apply for an ITIN loan, the borrower must have a valid ITIN, provide proof of stable income and creditworthiness, and make a down payment. However, the requirements depend on the lender’s guidelines.

Are ITIN Mortgage Rates Higher?

On average, ITIN mortgage rates are higher than those of traditional loans due to the potentially higher risks for lenders. Strengthening other factors such as credit score, down payment, or cash reserves, helps lower the interest rate in individual cases.

What Credit Score do You Need for an ITIN loan?

The credit score depends on the lender’s guidelines but typically a minimum of 600 is required.

How Much is a Down Payment on a House with an ITIN Number?

For ITIN loans, a down payment is higher than for conventional loans, usually about 20% of the property value.

Conclusion

ITIN loans are a wonderful opportunity for non-U.S. citizens to become homeowners in the United States. Brokers can help them fulfill their dream by providing quick and accurate service and explaining details with expertise.

A&D Mortgage will assist you every step of the way. With our expert support and innovative loan tools, you can offer the best terms for your clients.

Try out our ITIN loan scenario request form to check the loan terms for your clients quickly. And if you have any questions, feel free to contact us directly!