Non-QM loans are great solutions to include in a lending portfolio, as they help brokers serve a wider range of borrowers. However, like all mortgage products, Non-QM loans have their limitations that brokers should be aware of. This article compares Non-QM loan pros and cons to assist you in making an informed decision on whether non-traditional mortgages fit your borrower’s scenario.

Quick Overview: Non-QM Loans at a Glance

Non-QM loans are more flexible mortgage options designed for borrowers who do not meet strict CFPB Qualified Mortgage standards but can still afford homeownership.

To qualify for a Non-QM loan, a borrower must demonstrate the ability to repay the loan and maintain overall financial stability. It is important to note that Non-QM loans are neither ‘no-doc’ nor subprime loans.

Non-QM loans can be beneficial for borrowers with unstable or complex income – for example, self-employed individuals or gig workers. Additionally, Non-QM loans are often used as a temporary solution, with a plan to refinance into a QM loan in the future.

Pros of Non-QM Loans

- Flexible Underwriting Beyond QM Rules. Unlike the rigid requirements of traditional lending, Non-QM underwriting guidelines provide more flexibility in documentation rules, employment history, and other standards. Nevertheless, this flexibility does not mean a lack of regulation, and Non-QM loans still maintain responsible lending practices.

- Ability to Evaluate Real Income Patterns. Non-QM underwriting accepts alternative documentation for verification of income and employment. Manual reviews help create a more accurate understanding of a borrower’s cash flow and payment capacity.

- Expanded Borrower Eligibility. Some types of borrowers – freelancers, seasonal workers, or retirees – are typically excluded from the traditional mortgage process. Non-QM loans are an option for brokers to serve these categories and help them achieve homeownership if they can afford it.

- Scenario-Driven Underwriting. Manual underwriting offers an individual approach compared to automated traditional review systems. Unique borrower circumstances are considered to ensure that a Non-QM loan is the right choice for each situation.

- Access When QM Rules Fall Short. Compared to conventional financing, Non-QM loans offer a wider range of options and may serve as a long-term strategic solution. For example, Non-QM loans can be creatively used for second homes and investment properties.

Cons of Non-QM Loans

- Higher Interest Rates. Non-QM loans typically come with higher costs. This article explains the five core reasons why.

- Larger Down Payment or Reserves. Lenders typically require down payments of 10% to 30% of the loan amount and larger cash reserves than those required for conventional loans.

- More Complex Underwriting. Due to more detailed manual underwriting, Non-QM timelines are generally longer. Additionally, borrowers should be prepared for potential additional verifications or explanation requests.

- Limited Lender Availability. Fewer lenders offer Non-QM loans than conventional mortgages, so terms and pricing options might be limited. Consider partnering with AD Mortgage, a leading Non-QM lender that provides a variety of mortgage solutions, making it easy to choose the right one for your client.

- Requires Stronger Expectation-Setting. Non-QM loan timelines, pricing, documentation, and other features can vary significantly from QM products. Brokers should educate their clients and set realistic expectations to ensure borrower satisfaction.

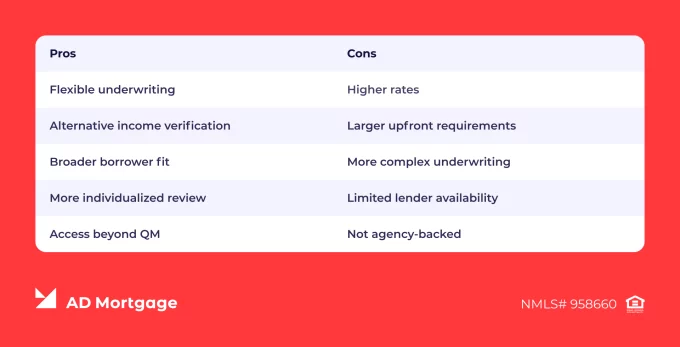

Non-QM Pros vs Cons Table

When deciding whether Non-QM loans are a good fit, a side-by-side comparison can be useful. The table below summarizes the most important benefits and drawbacks.

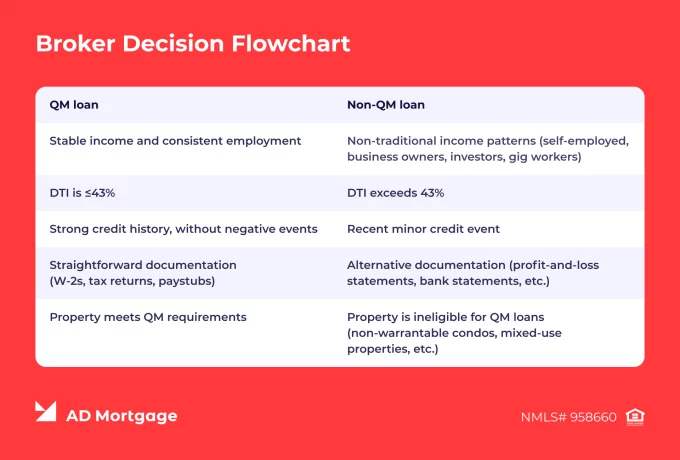

When Non-QM Loans Make Sense

- Borrower does not fit QM requirements but has the Ability-to-Repay (ATR) – for example, business owners or high-asset low-income retirees.

- Borrower has non-standard income – such as gig workers or freelancers with fluctuating monthly income.

- Non-QM loan is considered a strategic financing decision – for instance, when purchasing an investment property or planning to refinance into conventional loan shortly.

When Brokers Should Pause

Despite their advantages, Non-QM loans are not a universal solution. They should not be used carelessly, and brokers should inform their clients about the limitations. When are Non-QM loans not the right choice?

- Borrower doesn’t understand Non-QM terms and pricing

- There is no long-term financial strategy

- Borrower’s expectations are unrealistic

Broker Takeaway

To explain Non-QM loans to your borrowers, you can use the following talking points:

- ‘Non-QM loans are not inherently risky. We just need to make sure this product fits your needs to avoid any issues.’

- ‘To benefit from the flexibility Non-QM loans offer, pricing, timelines, and terms need to be clearly understood upfront.’

- ‘When structured properly, Non-QM loans can be a smart solution that help you achieve your long-term goals.’

How AD Mortgage Supports Brokers Using Non-QM

Partnering with an experienced lender is key to successfully closing Non-QM loans at favorable terms. AD Mortgage is a leading wholesale Non-QM mortgage lender that offers over 20 mortgage programs, including a wide range of Non-QM solutions:

- DSCR – Solution for new and experienced real estate investors. DSCR as low as 0, cash-out available up to 75% LTV, gift funds allowed.

- ITIN – Solution for individuals who have an ITIN but do not have an SSN. Loan amounts up to $1.5 million, DTI up to 50%, minimum FICO of 660, and up to 70% CLTV for Super Prime.

- 12/24 Month Bank Statement – Solution for self-employed individuals. Minimum FICO of 620 or no score, up to $4 million purchase, and up to $3 million cash-out.

If you are not sure which one of Non-QM loan programs fits your client’s situation best, submit a Scenario Form to AD Mortgage. Our experts will reach out to you within 30 minutes with a tailored solution.

FAQ: Non-QM Loan Advantages and Disadvantages

What are the Pros and Cons of Non-QM Loans?

Non-QM loans offer flexible underwriting and alternative income verification, but they typically come with higher interest rates, larger down payment requirements, and longer timelines.

Are Non-QM Loans Risky?

Non-QM loans are not inherently risky. However, there are risks connected to the more complex underwriting process and reduced liquidity in the secondary market, which lead to risk-based pricing and, therefore, higher interest rates.

Are Non-QM Loans Regulated?

Yes. Non-QM loans are fully regulated and must comply with federal and state lending laws, including Ability-to-Repay (ATR) requirements.

Why Do Brokers Use Non-QM Loans?

Non-QM loans help brokers serve a wider range of clients, as many borrowers who can afford homeownership do not meet strict QM requirements.

Can Borrowers Refinance out of Non-QM Loans?

Yes. When they meet the requirements, borrowers can refinance into conventional loans to access lower interest rates or a more stable payment structure.

Direct Answer: Non-QM loans offer underwriting flexibility for borrowers who don’t fit qualified mortgage standards, but they come with trade-offs such as higher pricing and fewer standardized protections. Understanding both sides helps brokers place these loans responsibly.

DSCR loans:

Grow your portfolio!

Submit Your Scenario Today