Your client just got a big promotion. It’s a huge win! Their income is skyrocketing, and they’re excited about putting extra money toward their mortgage. But there’s a catch. Hidden in the fine print of their mortgage agreement could be a nasty surprise: a prepayment penalty. This unexpected curveball in the mortgage game, a hidden fee, can eat into your client’s hard-earned cash if they decide to pay off their mortgage faster than planned. So, it’s important to understand that this isn’t just a financial detail; it’s a potential pitfall on your client’s path to homeownership.

Get the ADvantage

with our loyalty program

Earn and redeem points for valuable benefits for you and your clients

Unlock RewardsAs a broker, grasping it and knowing the ins and outs of mortgage prepayment penalties is non-negotiable. Moreover, it’s not enough to understand these penalties yourself. Your clients rely on you; you need to be able to break these vague costs down into plain English for them. That way, you’ll protect your clients from unexpected expenses, avoid unnecessary disappointment, demonstrate your expertise and commitment to their financial well-being, and find the best solution for each client’s situation. And this article is here to help. We’ll walk you through prepayment penalties, plain and simple. You’ll learn what they are, why they exist, their types, what they mean to your clients, and how to talk about them without sounding like a financial robot.

What is a Prepayment Penalty?

Prepayment penalty is a type of fee that some mortgage lenders charge when a borrower pays off all or part of their mortgage earlier than agreed to in the loan contract. It’s like an extra cost for repaying their debt ahead of schedule.

So, when exactly might your client run into a prepayment penalty? There are a few common situations. First, if they decide to pay off their entire mortgage early, such as when they sell their home, they could owe a penalty. Second, refinancing can also trigger a prepayment penalty. This means that if your client gets a new mortgage to replace an old one, and that new mortgage pays off the old one in full, they could be on the hook for a fee. Lastly, making a really big payment on a mortgage – like a huge chunk of the balance (typically 20% of the loan balance or more, as stated by CNN) – can sometimes lead to a prepayment penalty.

However, it’s important to note that according to the CFPB, prepayment penalties do not normally apply if a borrower pays extra principal on their mortgage “in small chunks at a time”. Finally, be sure to check with the lender directly if the mortgage is a Non-QM one, as these loans may have them.

But remember, these are just general cases. The fine print of each mortgage is different, so it’s important to read the details carefully.

Types of Prepayment Penalties

Mortgage prepayment penalties come in two major types: soft and hard. As these terms suggest, they describe the conditions under which your client may owe a fee for paying off their mortgage early.

A soft prepayment penalty is generally less restrictive. A fee usually only applies when a borrower refinances their mortgage. This means that if they sell a home and pay off the mortgage with the proceeds, they typically won’t owe a penalty. However, if they decide to get a new mortgage to replace an old one, they could be subject to a prepayment penalty.

Let’s take a scenario as an example. Your client took out a mortgage with a soft prepayment penalty. A few years later, interest rates dropped significantly. They decide to refinance their mortgage to get a lower interest rate. Refinancing comes with a fee. On the other hand, selling their home and using the proceeds to pay off the mortgage typically won’t incur a prepayment penalty. This is how a soft prepayment penalty applies.

A hard prepayment penalty is more restrictive. This fee applies to both refinancing and paying off the entire mortgage early, such as when selling a home. This means a borrower could face a penalty no matter how they decide to pay off their loan ahead of schedule.

Let’s say your client bought a home with a mortgage that had a hard prepayment penalty. A few years later, they get a fantastic job offer in another city and decide to sell their house. Unfortunately, with a hard prepayment penalty, they’ll probably have to pay a fee if they pay off the mortgage early, even if it’s to use the proceeds from the house sale.

Why Do Lenders Charge Prepayment Penalties?

Now that you understand the basics of prepayment penalties, you’re probably wondering why lenders charge them. Why wouldn’t they want to get the debt repaid faster, what’s the catch?

The point is that lenders are in the business of making a profit, and mortgages are a significant source of income. When a person borrows money to purchase a home, the lender expects to earn a specific amount of interest over the life of the loan. This income is essential for covering operating costs, paying employees, and generating profit for the lender.

If a borrower pays off the mortgage early, the lender loses out on the potential interest income they would have earned over the remaining term of the loan. To compensate for this loss, lenders often include prepayment penalties in the mortgage contract. These penalties are typically a percentage of the outstanding loan balance and are designed to recoup some of the lost interest income.

Beyond protecting their bottom line, lenders also use prepayment penalties as a risk management tool. According to ScienceDirect’s study, “Overall, prepayment penalties allow lenders to reduce this interest rate risk because they reduce borrowers’ incentives to prepay their mortgages.” The early years of a mortgage are particularly risky for lenders due to fluctuating interest rates. If interest rates decline significantly, borrowers may be tempted to refinance in order to obtain a lower rate. Prepayment penalties, especially during the initial years of the loan, discourage early refinancing and help stabilize the lender’s income.

As a mortgage broker, you should clearly understand the lender’s perspective, so that you can better explain prepayment penalties to your clients. While these fees may seem unfair to borrowers, it’s essential to recognize the financial implications for lenders. This knowledge can help create transparency in the client-broker relationship.

Common Models for Prepayment Penalties

Choose a top nationwide lender that cares about your growth!

Get StartedAs mentioned above, a prepayment penalty may amount to a percentage of the outstanding loan balance. However, there are other ways lenders can calculate prepayment penalties. Let’s break down the most common models.

When it comes to a model based on a percentage of the remaining loan balance, the prepayment penalty is calculated as a portion of the outstanding mortgage amount. For example, a lender might charge a 3% penalty. This means that if your client still owes $200,000 on their mortgage, the prepayment penalty would be $6,000.

Another common method, a straightforward one, is a fixed dollar amount. This means a borrower will pay a specific amount regardless of their remaining loan balance. This fixed amount is typically specified in the mortgage contract. For instance, a lender might set a flat fee of $3,500 if your client pays off their mortgage early.

A third widespread model is based on the number of months’ worth of interest. This means a borrower will pay an amount equal to several months of their mortgage interest. For example, if the penalty is six months’ interest and your client’s monthly mortgage payment is $1,500, the prepayment penalty would be $9,000.

It’s important to remember that these are just examples, and the actual prepayment penalty can vary widely depending on the lender and the terms of a mortgage. Some lenders may even combine these models, creating more complex penalty structures.

How to Identify Prepayment Penalties in Mortgage Documentation

Finding a prepayment penalty hidden in the depths of the mortgage documents can feel like looking for a needle in a haystack. But with a little know-how, you can help your clients navigate these documents like a pro.

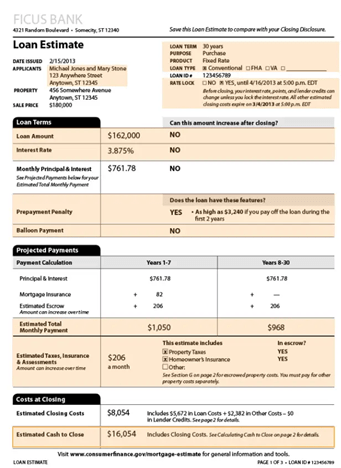

The first place to look is the Loan Estimate. This document, which a borrower should receive within three business days of applying for a mortgage, should outline any potential prepayment penalties, usually in the terms and conditions section.

Image source: https://www.businessinsider.com/personal-finance/mortgages/what-is-loan-estimate-mortgages

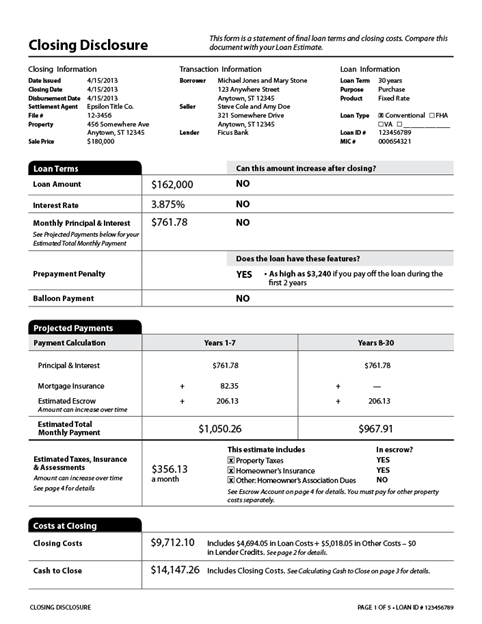

The Closing Disclosure is another important document to review for a prepayment penalty. It provides a final look at the loan terms before your client signs on the dotted line. Make sure your client carefully reviews the details of the prepayment penalty, including when it applies and how it’s calculated.

Image source: https://www.consumerfinance.gov/owning-a-home/closing-disclosure/

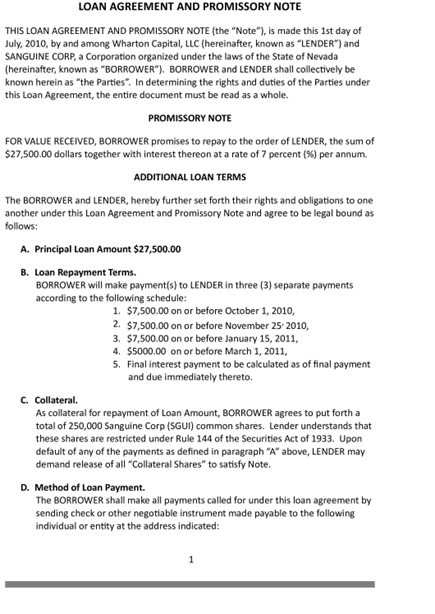

Finally, the Loan Agreement should include a special section titled “Loan Prepayment Terms” or similar. This section will detail any conditions under which penalties will be applied.

Image source: https://www.sec.gov/Archives/edgar/data/926287/000101041210000341/wharton27500loanagree.htm

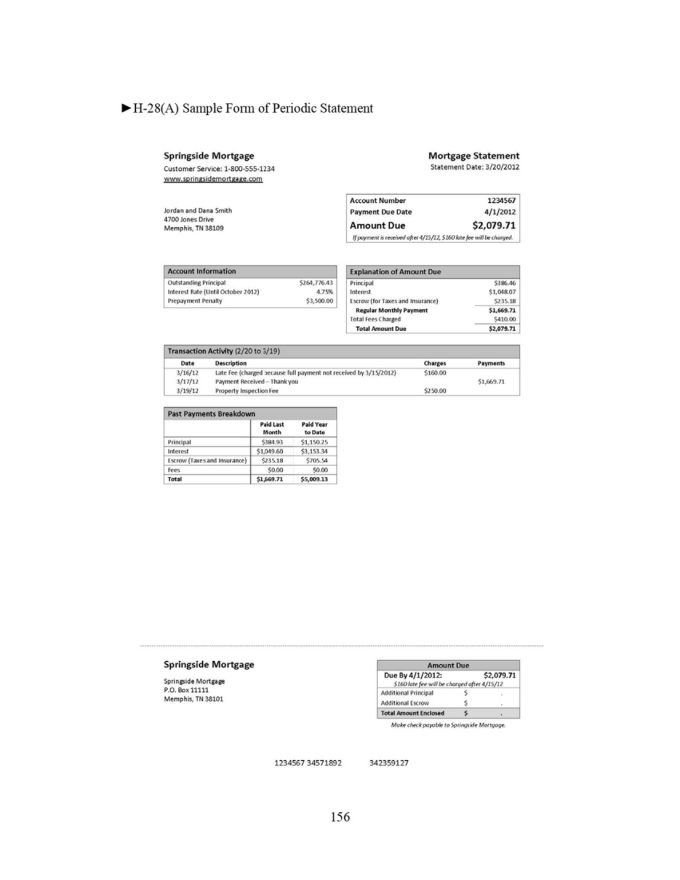

If your client is already in the process of paying off their mortgage, they may also find prepayment penalty information on their periodic statements – under CFPB rules, the servicer or lender must include it (12 C.F.R. § 1026.41).

Image source: https://nafcucomplianceblog.typepad.com/MortgageServicing/Proposed_Model_Forms_Periodic_Statements_TILA.pdf

Remember, it’s important for your client to read the fine print carefully and not skip over any sections or paragraphs. If something is unclear, encourage them to ask the lender for clarification. It’s better to be safe than sorry when it comes to prepayment penalties.

While it may seem overwhelming, taking the time to understand the mortgage documents is essential.

Explaining Prepayment Penalties to Clients

Prepayment penalties may seem like a huge injustice to your clients. That’s why it’s necessary to discuss this sensitive issue with them well in advance and provide them with appropriate explanations. With the right approach, you can turn a complex topic into a clear and understandable conversation.

Start by keeping it simple – explain that a prepayment penalty is a fee that will be charged if they pay off their mortgage early. Use plain language, avoiding jargon. Give real-life examples to illustrate the concept, such as, “Imagine you win the lottery and want to pay off your mortgage right away. A prepayment penalty is a fee you might have to pay in that situation.”

Stress the importance of carefully reviewing and understanding the mortgage contract. Emphasize that the details of the prepayment penalty, including when it applies and how much it costs, are usually found in the fine print. Encourage clients to ask questions if something isn’t clear.

It also doesn’t hurt to emphasize the lender’s perspective in your explanations. Make it clear to your clients that prepayment penalties help protect lenders from the risks associated with interest rate changes and the unpredictability of the economy.

Avoiding Prepayment Penalties

As they say, it’s better to avoid problems than to solve them. So, how can your clients avoid a prepayment penalty? The good news is that “not all mortgages have a prepayment penalty”. Therefore, the best way to avoid it is to choose a mortgage that doesn’t have one. For example, some government-backed loans typically have no prepayment penalties: “Some mortgages – like FHA, VA and USDA loans – aren’t permitted to have prepayment penalties at all…”, CNN mentions.

If your client already has a mortgage with a prepayment penalty, they can try to negotiate it away. Some lenders may be willing to remove the penalty if the borrower agrees to a slightly higher interest rate. It’s worth a try, especially if your client thinks they might want to pay off their mortgage early.

Another strategy is to wait out the penalty period. Most prepayment penalties apply for a specific number of years, usually three to five, according to Experian. If your client can hold off on refinancing or selling their home until after this period, they can avoid the fee altogether.

Finally, encourage your client to consider making extra payments toward their principal balance without triggering the prepayment penalty. Some mortgages allow for additional payments without incurring a fee. It’s necessary for your client to review the terms of their loan to see if this option is available.

By explaining these options and encouraging your client to carefully read the terms of their mortgage, you can increase their chances of avoiding a prepayment penalty.

Legal Aspects and Regulations

Prepayment penalties aren’t just about numbers and fees; there are laws in place to protect both borrowers and lenders. One of the most significant pieces of legislation is the Dodd-Frank Wall Street Reform and Consumer Protection Act. This law introduced stricter rules for the mortgage industry, including limitations on prepayment penalties.

For example, Dodd-Frank placed restrictions on how long a lender can charge a prepayment penalty. It also sets limits on the penalty amount. These rules are designed to protect consumers from unfair practices.

However, it’s essential to remember that laws can vary from state to state. Some states have their own regulations governing prepayment penalties. This means that even if a mortgage complies with federal law, it might still be subject to additional state requirements.

Conclusion

Prepayment penalties can be a real headache for homeowners and a tricky subject for mortgage brokers. They’re those hidden fees that can pop up when you least expect them and take a bite out of your clients’ hard-earned money.

By understanding how common prepayment penalty models work, you’ve learned it from soup to nuts. But it’s not just about knowing it yourself. It’s about being able to explain things clearly to your clients. When you can break down complex financial issues into simple terms, you build trust. By helping them understand prepayment penalties, you’re not only protecting their wallets, you’re protecting their peace of mind.

So, the next time you’re sitting down with a client, take a moment to talk about prepayment penalties. It may not be the most exciting topic, but it’s one that could save them a lot of money and stress in the long run. After all, isn’t that what being a great mortgage broker is all about?

Want to learn more useful information about mortgage-related topics? Or discuss potential partnership opportunities? Feel free to contact AD Mortgage, we’ll be happy to assist you.