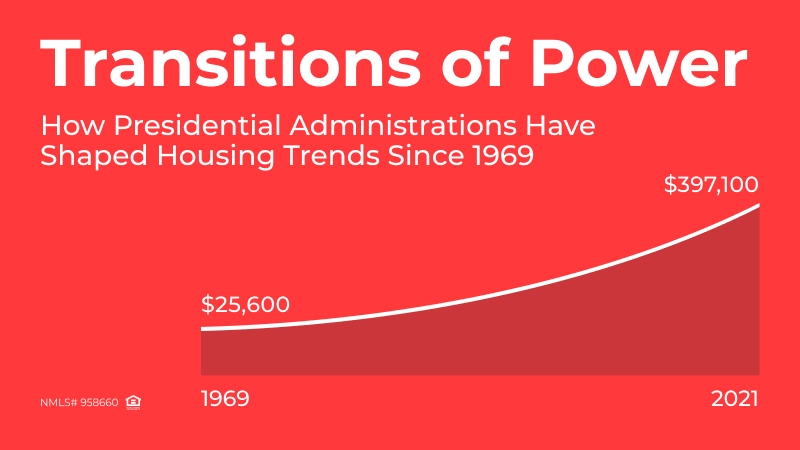

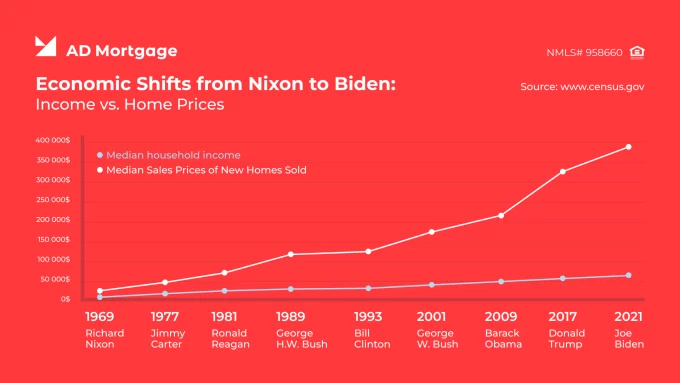

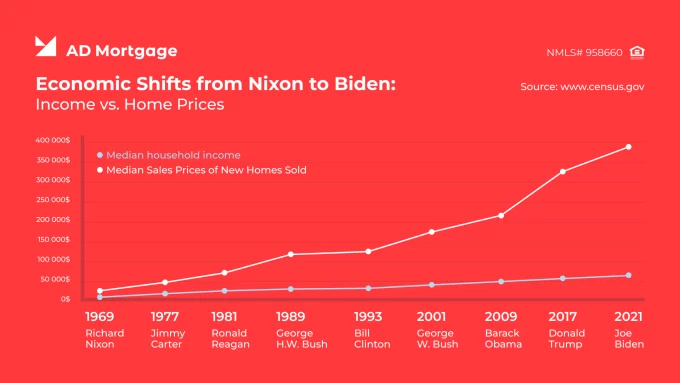

The housing market serves as a barometer for economic health, reacting to shifts in policy, economic conditions, and public confidence. Each new presidential administration brings changes that ripple through the housing sector. It influences everything from home prices and interest rates to lending standards and affordability. By examining historical trends in housing during presidential administration transitions, we gain valuable insights into how political and economic forces shape one of the most vital aspects of the American dream: homeownership.

This blog explores the interplay between presidential administration transitions and housing market dynamics, starting with the Nixon administration in 1969. Through this journey, we’ll uncover key housing trends, policy shifts, and lessons learned from over five decades of change.

Nixon Administration (1969–1974): Rising Stagflation and Market Challenges

The Nixon presidential administration began in 1969. It was a time of economic turbulence that significantly influenced the U.S. housing market. Richard Nixon faced a complex landscape of rising inflation, stagnant economic growth, and increasing global competition. All of it created headwinds for homeowners, prospective buyers, and the broader real estate industry.

Economic Backdrop: Stagflation Emerges

The term “stagflation,” which came to define the 1970s, began to take shape during Nixon’s presidency. Characterized by high inflation and stagnant economic growth, stagflation posed unique challenges to the housing market. The 1973 oil embargo exacerbated inflation, driving up costs across the economy. This included both construction materials and energy. Mortgage interest rates, which hovered around 7% when Nixon took office, steadily climbed to nearly 9% by the time he resigned in 1974. It eroded affordability for many homebuyers.

As inflation grew, home prices also increased, albeit unevenly across regions. Rising costs and higher borrowing rates led to a slowdown in housing market activity. Many potential buyers were priced out, and builders faced reduced demand, leading to lower housing starts.

Policy Interventions: Mixed Success in Housing

One of the most significant housing-related policy initiatives during Nixon’s presidency was the continued expansion of the Department of Housing and Urban Development (HUD). HUD was originally established in 1965. Nixon sought to address urban decay and promote affordable housing. However, his presidential administration’s approach was met with mixed results.

Nixon introduced programs aimed at revitalizing cities and expanding housing opportunities, including subsidized housing and community development initiatives. Still, these efforts often fell short of their goals due to inadequate funding and bureaucratic hurdles. Additionally, federal housing policies during this period focused more on urban renewal than on addressing broader market challenges. It left many suburban and rural areas without targeted support.

In 1973, Nixon imposed a temporary freeze on federal housing programs as part of his broader economic strategy to combat inflation. This decision, known as the “housing moratorium,” halted the construction of federally subsidized housing. Moreover, the moratorium drew criticism from advocates who argued it worsened the housing crisis for low-income families. While the moratorium was intended to stabilize the economy, its impact on the housing market was largely negative. It limited the availability of affordable housing and further constrained supply.

Mortgage Market Trends: Rising Rates and Volatility

The Nixon years saw increasing volatility in the mortgage market. As inflation drove up borrowing costs, lenders became more cautious, tightening underwriting standards. Fixed-rate mortgages, the most common product at the time, became less attractive to buyers due to rising rates, and alternative mortgage structures were not yet widely available.

For existing homeowners, inflation provided some benefits. Rising home prices meant that those who had already purchased homes gained equity, shielding them from some of the economic turbulence. However, for first-time buyers, affordability became a growing concern as wages failed to keep pace with the rising costs of housing.

Legacy and Lessons

The housing market during Nixon’s presidency offers lessons about the interplay between economic policy and real estate. His presidential administration’s attempts to balance inflation control with housing affordability highlighted the difficulties of managing competing economic priorities. The combination of stagflation, rising interest rates, and inconsistent housing policies underscored the need for comprehensive strategies to address both short-term challenges and long-term market stability.

While Nixon’s tenure was marked by economic struggles, the groundwork laid by HUD and the lessons learned from his policies informed future approaches to housing. The issues faced during this period serve as a reminder of the importance of aligning fiscal policy with the needs of the housing market to promote sustainable growth.

Ford Administration (1974–1977): Economic Turbulence and Housing Policy Reform

The presidency of Gerald Ford (1974–1977) was marked by significant economic challenges. Most notably, it included stagflation—a combination of stagnation and inflation—that profoundly affected the U.S. housing market. Ford’s presidential administration implemented several policies aimed at stabilizing the housing sector and promoting homeownership during this tumultuous period.

Economic Context and Housing Challenges

Upon assuming office in August 1974, President Ford faced an economy grappling with high inflation and unemployment rates. The 1973 oil crisis had exacerbated these issues. It led to increased costs for goods and services, including construction materials. This economic environment resulted in a decline in housing starts and a slowdown in the real estate market.

Housing and Community Development Act of 1974

In response to these challenges, President Ford signed the Housing and Community Development Act on August 22, 1974. This legislation aimed to revitalize urban areas and expand affordable housing through several key measures.

- Community Development Block Grants (CDBG). The act introduced CDBGs, providing federal funds directly to local governments for community development projects. This approach empowered local authorities to address specific housing and infrastructure needs, promoting more efficient and tailored urban development.

- Extension of FHA Programs. The legislation extended all unsubsidized Federal Housing Administration (FHA) insurance programs until June 30, 1977, increasing the availability of mortgage credit.

Leadership in Housing and Urban Development

In March 1975, President Ford appointed Carla A. Hills as Secretary of Housing and Urban Development (HUD). She became the third woman to hold a cabinet position in U.S. history. Hills focused on implementing the Housing and Community Development Act’s provisions, emphasizing the importance of local decision-making in housing projects. She advocated for reducing federal oversight, stating that the act would “return power from the banks of the Potomac to people in their own communities.”

Housing Market Trends

Despite these initiatives, the housing market faced continued difficulties. In his 1976 State of the Union Address, President Ford acknowledged the disappointing performance of the housing industry in 1975. Still, he expressed optimism for recovery, citing lower interest rates and increased mortgage availability as positive indicators.

Data from the U.S. Census Bureau indicates that the average sales price of new homes sold in the United States was $39,300 in January 1975. By January 1977, this figure had risen to $45,500, reflecting a gradual increase in home prices during Ford’s tenure.

Legacy and Impact

Ford’s presidential administration took significant steps to address the housing challenges of the mid-1970s. By promoting local control through the Housing and Community Development Act and extending FHA programs, the administration sought to stimulate the housing market and support urban development. While the effectiveness of these measures was tempered by broader economic conditions, they laid the groundwork for future federal housing policies that emphasized local autonomy and flexible funding mechanisms.

Carter Administration (1977–1981): Inflation and Energy Crises

Jimmy Carter’s presidency was characterized by significant economic challenges. These challenges left an indelible mark on the housing market. High inflation, rising interest rates, and the ripple effects of the energy crises of the 1970s created a difficult environment for both homeowners and prospective buyers. Despite efforts to address these issues, Carter’s presidential administration struggled to balance economic stabilization with housing affordability.

Economic Challenges: Inflation and Skyrocketing Interest Rates

The U.S. economy during Carter’s tenure was dominated by inflation. By 1979, it reached double-digit levels. Stagflation severely impacted the housing market. As inflation climbed, so did mortgage interest rates, which rose from approximately 8.5% in 1977 to over 16% by 1981. These skyrocketing rates made borrowing more expensive, pricing many potential buyers out of the market and cooling housing demand.

The Federal Reserve, under Chairman Paul Volcker, implemented aggressive monetary policies to curb inflation. While these measures eventually succeeded in reducing inflation in the early 1980s, they came at a significant cost. The sharp increase in interest rates led to a dramatic decline in housing affordability, as monthly mortgage payments for new loans became prohibitively expensive.

The high cost of borrowing also dampened new construction. Housing starts fell sharply during Carter’s presidency, as builders faced declining demand and rising costs for materials. This slowdown further exacerbated the housing supply shortage, which disproportionately affected low- and middle-income families.

One of the Carter administration’s most enduring contributions to the housing market was the passage of the Community Reinvestment Act (CRA) in 1977. The CRA aimed to combat discriminatory lending practices, such as redlining, by encouraging financial institutions to provide loans in underserved and low-income communities.

Under the CRA, banks and mortgage lenders were evaluated on their efforts to meet the credit needs of all segments of their communities, particularly those that had been historically excluded. The immediate impact of the CRA on homeownership rates was limited. However, the legislation laid the groundwork for greater access to credit in the decades that followed. The act also highlighted the importance of equitable lending practices, which became a focal point in future housing policies.

Energy Efficiency in Housing

The energy crises of the 1970s significantly influenced Carter’s housing policies. Rising oil prices and concerns about energy dependence prompted the administration to promote energy efficiency in residential construction and renovation. Programs were introduced to incentivize homeowners to install insulation, upgrade heating systems, and adopt other energy-saving measures.

These initiatives had a modest impact during Carter’s presidency. Still, they reflected a growing awareness of the link between energy policy and housing. The emphasis on energy efficiency became more prominent in later decades as environmental concerns gained traction.

Legacy and Lessons

Carter’s presidential administration faced one of the most challenging economic periods in modern history. Its housing policies reflected a mixture of ambition and constraint. The CRA remains a landmark in efforts to ensure lending equity, while the focus on energy efficiency presaged future sustainability trends in housing. However, the era’s high inflation and interest rates underscored the difficulty of maintaining housing affordability during periods of economic instability.

The lessons from Carter’s presidency emphasize the need for balanced approaches that address short-term economic pressures while fostering long-term resilience in the housing market. Despite its challenges, this period laid important groundwork for future policy innovations.

Reagan Administration (1981–1989): Deregulation, Recovery, and Housing Market Shifts

Ronald Reagan’s presidency marked a period of significant transformation for the U.S. economy. Housing trends reflected the era’s broader economic and political shifts. When Reagan took office in 1981, the country was in the grips of a severe recession. Mortgage rates were at historic highs, inflation was rampant, and housing activity had slowed dramatically. Over his two terms, Reagan implemented sweeping economic reforms, including deregulation and tax changes. All this reshaped the housing market and laid the groundwork for future trends.

Economic Backdrop: Tackling Inflation and Recession

When Reagan assumed office, the U.S. economy was still struggling with stagflation that had defined the 1970s. Mortgage interest rates reached a record high of 18.45% in 1981, making homeownership unattainable for many Americans. The Federal Reserve, under Chairman Paul Volcker, continued its aggressive monetary policy to combat inflation, which began to decline by the mid-1980s.

As inflation fell, so did interest rates, albeit gradually. By 1989, mortgage rates had dropped to around 10%, significantly improving housing affordability compared to the early years of Reagan’s presidency. This decline in rates coincided with an economic recovery that bolstered consumer confidence and spurred activity in the housing market.

Deregulation and Its Impact on Housing

Reagan’s economic policies, often referred to as “Reaganomics,” emphasized deregulation, tax cuts, and reduced government intervention. In the housing sector, these principles translated into significant changes that would have both immediate and long-term effects.

- Savings and Loan Deregulation.

>A key aspect of Reagan’s housing legacy was the deregulation of the savings and loan (S&L) industry, which had traditionally been the primary source of mortgage financing. The Depository Institutions Deregulation and Monetary Control Act of 1980, enacted just before Reagan took office, and the Garn-St. Germain Depository Institutions Act of 1982 allowed S&Ls to engage in riskier investments and offer adjustable-rate mortgages (ARMs). While these changes expanded credit availability, they also contributed to instability in the S&L industry, culminating in a major crisis by the late 1980s.

- Tax Reforms.

The Tax Reform Act of 1986 significantly altered the tax landscape for real estate. It eliminated many tax shelters that had previously incentivized speculative investments in housing. While this discouraged some forms of over-leveraged investing, it also reduced certain incentives for rental property development. As a result, it lead to a slowdown in multifamily construction.

Choose a top nationwide lender that cares about your growth!

Get Started

Housing Market Trends: Recovery and Refinancing Boom

The mid-1980s saw a housing market recovery as inflation cooled and economic growth resumed. Lower interest rates encouraged refinancing. Refinancing allowed millions of homeowners to lower their monthly payments and build equity. For prospective buyers, declining rates made homeownership more accessible, driving an increase in home sales.

Home prices began to rise steadily during Reagan’s presidency, particularly in suburban areas, as economic optimism fueled demand. However, affordability challenges persisted for many, especially in high-cost urban markets.

Legacy and Lessons

Reagan’s presidency marked a turning point in the housing market, characterized by economic recovery and significant policy changes. Deregulation expanded access to credit. However, it also introduced new risks, as evidenced by the later collapse of the S&L industry. Tax reforms reshaped investment patterns in real estate, with mixed consequences for housing supply and affordability.

The lessons of the Reagan era highlight the importance of balancing market freedom with regulatory safeguards. While the policies of the 1980s contributed to a housing rebound, they also set the stage for future crises. Reagan’s approach underscores the delicate interplay between economic policy and housing market stability, a dynamic that remains relevant today.

George H.W. Bush Administration (1989–1993): Housing Challenges Amid Recession and Reform

The presidency of George H.W. Bush spanned a transitional period for the U.S. economy and the housing market. His presidential administration began on a wave of economic stability and optimism. However, it soon faced a significant recession, a crisis in the savings and loan (S&L) industry, and tightening credit conditions that strained the housing sector. Bush’s tenure was marked by efforts to stabilize the economy while addressing growing housing affordability issues. Still, these challenges limited the effectiveness of his policies.

Economic Backdrop: Recession and Tight Credit Conditions

Bush took office in January 1989, inheriting a relatively strong economy. However, by the early 1990s, the U.S. entered a recession caused by factors including restrictive monetary policies, high levels of consumer and corporate debt, and lingering instability from the S&L crisis. This economic downturn, which lasted from July 1990 to March 1991, had a significant impact on the housing market.

Mortgage interest rates, which had fallen during the Reagan presidential administration, stabilized in the 9% to 10% range during Bush’s presidency. While this was a relief compared to the double-digit rates of the early 1980s, these levels still posed challenges for affordability, particularly during the recession. The economic slowdown led to job losses and reduced consumer confidence, further suppressing demand for home purchases.

Housing starts also declined significantly during the recession, dropping from 1.4 million units in 1989 to just over 1 million in 1991. This slowdown in construction compounded existing supply issues, particularly in regions already struggling with affordability.

The Savings and Loan Crisis: Fallout and Recovery

One of the most significant economic challenges during Bush’s presidency was the fallout from the S&L crisis. Deregulation in the 1980s had allowed these institutions to engage in riskier lending and investment practices, leading to widespread insolvencies. By the time Bush took office, the crisis had reached its peak, with over 1,000 S&Ls failing.

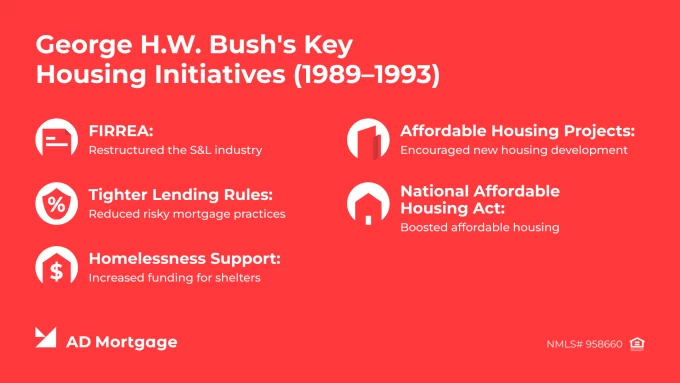

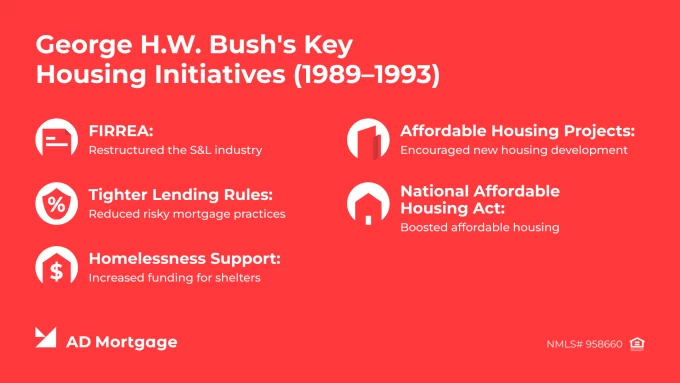

To address this crisis, Bush signed the Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA) in 1989. This legislation restructured the S&L industry, created the Resolution Trust Corporation (RTC) to manage failed institutions, and introduced stricter regulatory oversight. FIRREA was instrumental in resolving the immediate crisis. However, it also led to a credit crunch as surviving lenders tightened their standards, further restricting access to mortgage financing.

Housing Affordability and Policy Responses

Bush’s administration sought to address growing concerns about housing affordability, particularly for low- and middle-income families. The National Affordable Housing Act of 1990 was a key initiative in this effort. The act established the HOME Investment Partnerships Program. The program provided federal block grants to states and local governments for affordable housing development. It also reinforced efforts to combat homelessness through increased funding and support for shelters and transitional housing.

However, these measures were often overshadowed by the broader economic downturn. Many Americans continued to struggle with stagnant wages and high housing costs, limiting the impact of federal programs.

Legacy and Lessons

George H.W. Bush’s presidency highlighted the interconnectedness of economic stability, regulatory policy, and the housing market. His presidential administration made important strides in resolving the S&L crisis and promoting affordable housing. Still, the recession and credit tightening limited the broader housing market’s recovery.

The challenges of the Bush era underscore the importance of proactive oversight in financial markets and the need for targeted policies to address affordability during economic downturns. While the housing market faced significant headwinds during his tenure, the reforms implemented under Bush laid the groundwork for future stabilization and growth.

Clinton Administration (1993–2001): Housing Boom and Subprime Beginnings

The presidency of Bill Clinton, from 1993 to 2001, was marked by a period of sustained economic growth and a notable housing market boom. Clinton’s administration oversaw rising homeownership rates, relatively low inflation, and a surge in housing affordability, driven in part by robust economic conditions and targeted policy initiatives. However, some of the seeds of the future housing crisis were also sown during this period, as deregulation and the expansion of subprime lending began to reshape the mortgage landscape.

Economic Growth and Favorable Conditions

Clinton’s presidency coincided with one of the longest periods of economic expansion in U.S. history. Between 1993 and 2000, unemployment dropped from 6.9% to 4.0%, inflation remained low, and median household incomes rose steadily. These favorable economic conditions fueled consumer confidence and spurred growth in the housing market.

Mortgage interest rates also declined during Clinton’s tenure. As a result, home loans became more affordable for many Americans. By the mid-1990s, rates had fallen to around 7% from highs of over 9% at the beginning of the decade. This decrease in borrowing costs contributed to increased demand for housing, driving home prices upward while enabling more families to enter the housing market.

National Homeownership Strategy: Expanding Access to Housing

A key priority of Clinton’s administration was increasing homeownership, particularly among first-time and low- to moderate-income buyers. In 1995, the administration launched the National Homeownership Strategy. The Strategy aimed to raise the U.S. homeownership rate to a record high by the year 2000.

The strategy focused on reducing barriers to homeownership, such as high down payment requirements, limited access to credit, and a lack of affordable housing options. It encouraged lenders to adopt more flexible underwriting standards, promoted public-private partnerships to develop affordable housing, and expanded access to government-backed loan programs like those offered by the Federal Housing Administration (FHA).

These efforts were largely successful. By the end of Clinton’s presidency, the U.S. homeownership rate had risen to 67.5%, up from 64% in 1993. However, the push to expand homeownership also led to riskier lending practices, as financial institutions introduced products that catered to borrowers with lower credit scores and minimal savings.

The Rise of Subprime Lending

During the Clinton years, the expansion of subprime lending became a notable trend. Initially seen as a way to increase credit access for underserved populations, subprime loans allowed borrowers with lower credit scores to purchase homes. However, these loans often came with higher interest rates and less favorable terms. These factors would later contribute to instability in the housing market.

Clinton also signed legislation that further deregulated the financial sector. The repeal of the Glass-Steagall Act in 1999 allowed commercial banks, investment banks, and insurance companies to consolidate, paving the way for the growth of mortgage-backed securities. While these changes contributed to short-term economic growth, they also increased systemic risks that would culminate in the 2008 financial crisis.

Legacy and Lessons

The Clinton presidential administration’s housing policies helped millions of Americans achieve homeownership and drove significant growth in the housing market. However, the emphasis on expanding credit access without fully accounting for potential risks laid the groundwork for future challenges.

The Clinton era underscores the importance of balancing housing accessibility with financial stability. While economic prosperity and targeted policies created opportunities for many, the long-term consequences of deregulation and subprime lending highlight the need for careful oversight and sustainable lending practices. Clinton’s legacy in housing remains a blend of progress and cautionary lessons.

George W. Bush Administration (2001–2009): The Housing Boom and the Great Recession

The presidency of George W. Bush, from 2001 to 2009, was a transformative and tumultuous period for the U.S. housing market. Defined by a dramatic housing boom in the early years and a catastrophic collapse by the end, Bush’s presidential administration oversaw both the height of homeownership expansion and the seeds of the Great Recession. The interplay of economic conditions, deregulation, and risky lending practices created a volatile environment that reshaped the housing market and financial system.

The Housing Boom: An Era of Easy Credit

Bush took office amid a period of economic uncertainty following the dot-com bubble burst and the September 11 attacks. To stimulate the economy, the Federal Reserve lowered interest rates to historic lows. It made borrowing cheaper and fueled demand for homes. These conditions spurred a rapid increase in home prices, with double-digit annual appreciation rates in many markets by the mid-2000s.

The Bush administration prioritized homeownership as a cornerstone of the American Dream. Bush’s “Blueprint for the American Dream” initiative, launched in 2002, sought to expand homeownership opportunities, particularly for low- and middle-income families. Programs encouraged lenders to offer more flexible underwriting standards and lower down payment requirements, enabling more people to qualify for mortgages.

While these policies successfully increased the national homeownership rate to a peak of 69% in 2004, they also contributed to an environment of unchecked credit expansion. Subprime and non-traditional mortgage products, such as adjustable-rate mortgages (ARMs) and stated-income loans, became widespread. They allowed many borrowers to enter the market but often under terms they could not sustain long-term.

The Housing Crisis: Collapse and Consequences

By 2006, the housing bubble began to show signs of strain. Home prices reached unsustainable levels, and rising interest rates made adjustable-rate mortgages more expensive for borrowers. As homeowners struggled to make payments, foreclosure rates soared, leading to a collapse in housing prices and the destabilization of financial markets.

The crisis was exacerbated by the securitization of mortgages. Financial institutions bundled loans, including subprime loans, into mortgage-backed securities (MBS) and sold them to investors worldwide. When homeowners began defaulting en masse, the value of these securities plummeted, triggering a global financial crisis.

Bush’s presidential administration took several steps to address the crisis. In 2008, the Federal Housing Finance Agency (FHFA) placed Fannie Mae and Freddie Mac, the government-sponsored enterprises (GSEs) at the center of the housing market, into conservatorship. Additionally, the Emergency Economic Stabilization Act authorized the $700 billion Troubled Asset Relief Program (TARP) to stabilize banks and financial institutions.

Despite these efforts, the crisis had devastating consequences. By the end of Bush’s presidency, the housing market was in freefall, with home prices down by nearly 30% in some areas. Millions of Americans lost their homes to foreclosure, and the U.S. entered its deepest recession since the Great Depression.

Legacy and Lessons

The Bush administration’s housing legacy is one of contrasts. Efforts to expand homeownership succeeded in the short term but relied on risky lending practices and minimal regulatory oversight, which ultimately led to the collapse. The securitization of mortgages and inadequate safeguards for borrowers created systemic vulnerabilities that culminated in the Great Recession.

The lessons of the Bush era emphasize the need for balance between expanding access to credit and maintaining financial stability. While promoting homeownership remains a worthy goal, the policies of this period highlight the dangers of prioritizing short-term gains over sustainable practices. The housing market’s collapse during Bush’s presidency remains a pivotal moment in modern economic history, reshaping the way policymakers and financial institutions approach housing and lending.

Obama Administration (2009–2017): Recovery, Reform, and Housing Market Stabilization

The presidency of Barack Obama, from 2009 to 2017, came at a time of unprecedented challenges for the U.S. housing market. Obama inherited the aftermath of the 2008 financial crisis, which had decimated home values, led to millions of foreclosures, and left the housing market in disarray. Over the course of his two terms, the Obama administration implemented a series of policy responses. They were aimed at stabilizing the housing market, helping homeowners in distress, and reforming the broader housing finance system. By the end of his presidency, the housing market had begun to recover. However, lingering issues related to affordability and access to credit remained.

When Obama assumed office in January 2009, the U.S. was in the midst of the worst housing market crisis since the Great Depression. Home prices had fallen sharply, and millions of Americans were struggling with mortgage defaults and foreclosures. The foreclosure rate hit its peak in 2009, and nearly 10 million homes were lost to foreclosure during the 2008-2010 period.

In response, the Obama administration rolled out several initiatives aimed at stabilizing the housing market and preventing further damage to the economy. The cornerstone of these efforts was the Home Affordable Modification Program (HAMP), introduced in 2009 as part of the broader Making Home Affordable (MHA) program. HAMP was designed to help homeowners who were struggling to make their mortgage payments by providing loan modifications, reducing monthly payments, and making homeownership more sustainable for borrowers at risk of foreclosure.

Additionally, the Home Affordable Refinance Program (HARP) was launched to assist underwater homeowners (those owing more than their homes were worth). The program allowed them to refinance into more affordable mortgages, even if they had little or no equity. These programs, although criticized for slow implementation and limited success in reaching at-risk homeowners, played a role in stabilizing the housing market and reducing the number of foreclosures.

Housing Market Stabilization and Recovery

By the mid-2010s, the housing market began to show signs of recovery, aided by a combination of government programs, low interest rates, and improving economic conditions. The Federal Reserve maintained historically low interest rates throughout Obama’s presidency. It made mortgage financing more affordable and helped revive demand for housing. This contributed to a gradual increase in home prices, which by 2016 had recovered to pre-crisis levels in many markets.

In addition to federal programs, private mortgage insurers and lenders began to adjust their practices, moving away from the high-risk lending practices that had fueled the housing bubble. The housing market recovery was also spurred by strong demand from first-time homebuyers, who took advantage of low mortgage rates and the availability of FHA loans.

Despite these positive trends, the recovery was uneven. Some regions rebounded much faster than others. Housing affordability, especially in high-demand urban areas, became a growing concern as home prices and rents increased faster than wages in many parts of the country.

In response to the financial collapse of 2008, Obama’s presidential administration enacted significant regulatory reforms aimed at preventing a future crisis. The Dodd-Frank Wall Street Reform and Consumer Protection Act, passed in 2010, was a landmark piece of legislation that overhauled financial regulation, including provisions related to the housing market. One of its key components was the creation of the Consumer Financial Protection Bureau (CFPB), which was tasked with overseeing mortgage lending practices, ensuring greater consumer protection, and reducing the risk of predatory lending.

Dodd-Frank also included new rules designed to strengthen the mortgage market, including the Qualified Mortgage (QM) rule. The rule sought to ensure that borrowers could repay their loans and that lenders were held accountable for issuing risky products. The measures aimed to bring more stability to the mortgage industry and protect consumers from the kind of reckless lending that contributed to the housing crash.

Legacy and Lessons

The Obama administration’s approach to housing policy focused on stabilizing the market after the 2008 crisis and implementing long-term reforms to prevent future collapses. While the recovery was slow and uneven, the efforts to assist struggling homeowners through HAMP, HARP, and other initiatives helped mitigate the damage caused by the crisis. Moreover, the regulatory reforms enacted under Dodd-Frank reshaped the financial landscape, emphasizing consumer protection and lender accountability.

However, the recovery also revealed ongoing challenges. Housing affordability became a pressing issue as home prices outpaced wage growth, and many Americans remained shut out of homeownership due to tight credit conditions. The Obama administration’s housing legacy is one of stabilization and recovery, but also of unfinished work in addressing long-term issues of affordability, access to credit, and sustainable homeownership.

Trump Administration (2017–2021): Deregulation, Tax Reform, and Pandemic Disruption

The Trump administration, from 2017 to 2021, presided over a period of robust economic growth and significant changes to the housing market, punctuated by the unexpected disruption of the COVID-19 pandemic in its final year. President Donald Trump’s approach to the housing market emphasized deregulation, tax reform, and infrastructure investment. His policies were designed to stimulate economic activity and homeownership. Still, the pandemic drastically altered housing trends, leading to a surge in demand, skyrocketing home prices, and heightened affordability challenges.

Economic Growth and Housing Market Strength

When Trump took office in January 2017, the U.S. housing market was stable and growing. Unemployment was low, consumer confidence was high, and the economy was expanding. These favorable conditions contributed to rising home prices and robust housing demand. By 2019, median home prices had increased by nearly 15% compared to 2016. Those prices reflected strong buyer interest and limited inventory.

The presidential administration’s emphasis on deregulation played a role in maintaining the momentum of the housing market. Trump sought to roll back provisions of the Dodd-Frank Act, which had been enacted during the Obama administration to tighten financial regulations. In 2018, the Economic Growth, Regulatory Relief, and Consumer Protection Act was signed into law. The Act eased compliance requirements for smaller lenders and regional banks. This deregulation aimed to increase credit availability, particularly for small businesses and rural homebuyers.

The Tax Cuts and Jobs Act (TCJA) of 2017 was a hallmark of Trump’s presidency, with significant implications for the housing market. Key provisions of the TCJA included:

- Cap on State and Local Tax (SALT) Deductions.

The law capped deductions for state and local taxes at $10,000. This change disproportionately affected high-tax states such as California, New York, and New Jersey, where property taxes are substantial. Many homeowners in these states faced higher net tax liabilities, which contributed to slower home price growth in some high-cost areas.

- Mortgage Interest Deduction (MID) Cap.

The TCJA also reduced the mortgage interest deduction cap from $1 million to $750,000. This had a limited impact on most middle-income homebuyers but affected high-income households purchasing expensive properties.

While these changes were intended to simplify the tax code and spur economic growth, they created regional disparities in housing affordability and dampened demand for high-end homes in certain markets.

The COVID-19 pandemic, which began in early 2020, reshaped the housing market in ways that no one could have anticipated. The Federal Reserve’s rapid response to the economic downturn included cutting interest rates to near-zero levels, triggering a refinancing boom and driving mortgage rates to historic lows. These low rates, combined with a shift to remote work, fueled a wave of demand for housing, particularly in suburban and rural areas.

At the same time, the pandemic exacerbated pre-existing supply constraints. Builders faced delays due to labor shortages, supply chain disruptions, and rising material costs. This imbalance between supply and demand led to a sharp increase in home prices, with the median home price surpassing $350,000 by mid-2021.

The Trump administration responded with various economic relief measures, including the CARES Act, which provided mortgage forbearance options for homeowners affected by the pandemic. By the end of Trump’s presidency, more than 7 million homeowners had entered forbearance plans. It helped prevent a wave of foreclosures during the economic downturn.

Legacy and Lessons

The Trump administration’s housing policies reflected a focus on deregulation, tax incentives, and economic growth, which supported a strong housing market during most of his tenure. However, the pandemic introduced unprecedented volatility, highlighting vulnerabilities in the housing system, such as limited supply and rising affordability challenges.

The combination of low interest rates, tax changes, and pandemic-driven demand reshaped the market, creating a competitive environment that left many first-time buyers struggling to afford homes. Trump’s legacy in housing is one of economic strength disrupted by global crisis, underscoring the importance of balancing growth-oriented policies with strategies for long-term stability and affordability.

Biden Administration (2021–2025): Affordability Challenges, Supply Shortages, and Pandemic Recovery

The Biden administration focused on addressing critical challenges in the U.S. housing market. That included rising housing costs, limited inventory, and the lingering effects of the COVID-19 pandemic. Amidst economic uncertainty, supply chain disruptions, and inflation, the presidential administration pursued policies aimed at boosting housing supply, improving affordability, and expanding access to homeownership for underserved communities.

Economic Context and Housing Market Challenges

Joe Biden entered office during a period of heightened housing demand fueled by the COVID-19 pandemic. Historically low mortgage rates and a shift toward remote work had driven a surge in homebuying, particularly in suburban and rural areas. However, this demand collided with longstanding supply constraints, leading to sharp increases in home prices. By 2022, the median home price in the U.S. had surpassed $400,000, representing a significant affordability challenge for first-time buyers.

The Federal Reserve’s efforts to combat inflation, which surged to 40-year highs in 2022, further complicated the housing market. Interest rate hikes pushed mortgage rates above 7% by late 2022, dramatically increasing monthly payments for prospective buyers and cooling demand. This dual pressure of high prices and rising borrowing costs created an affordability crisis that the presidential administration has worked to address through targeted policies.

Policies to Increase Housing Supply

A central focus of Biden’s housing agenda has been increasing the supply of affordable housing. The American Rescue Plan Act (ARPA), passed in 2021, provided funding to address housing insecurity by supporting rental assistance programs, expanding homelessness prevention services, and offering emergency housing vouchers.

In addition to ARPA, the administration’s proposed Build Back Better Plan included significant investments in housing construction and rehabilitation, though it faced challenges in Congress. Despite these setbacks, the administration has allocated billions to programs designed to build or preserve affordable housing units, including funding for the Low-Income Housing Tax Credit (LIHTC) and incentives for local governments to ease zoning restrictions.

The presidential administration has also emphasized addressing supply chain issues and labor shortages in the construction industry. These efforts aim to accelerate homebuilding and ease the imbalance between supply and demand, particularly in regions experiencing rapid population growth.

Affordability and Equity Initiatives

The Biden administration has placed a strong emphasis on promoting housing equity and reducing disparities in access to homeownership. In 2022, the Department of Housing and Urban Development (HUD) implemented measures to expand the availability of FHA loans and reduce costs for borrowers with lower credit scores. Additionally, the administration has worked to strengthen enforcement of fair housing laws.

To combat rising rents, Biden has supported initiatives to protect renters’ rights and increase transparency in rental agreements. Programs aimed at helping first-time homebuyers, such as down payment assistance grants, have also been prioritized.

Legacy and Ongoing Challenges

The Biden administration’s housing policies reflect a commitment to tackling systemic challenges in affordability, supply, and equity. While progress has been made, persistent issues—such as rising construction costs, inflation, and resistance to zoning reform—highlight the complexity of solving the housing crisis.

Biden’s housing legacy is still unfolding, but it is likely to be defined by efforts to create a more equitable and sustainable housing market. By addressing affordability and supply shortages, his presidential administration seeks to lay the groundwork for a more accessible housing system.

What May Happen During the 2nd Trump Administration

As President Donald Trump embarks on his second term in 2025, his administration is expected to implement significant changes to housing and mortgage regulations. Key initiatives include reducing regulatory barriers, privatizing government-sponsored enterprises (GSEs), and addressing housing affordability.

Deregulation Efforts

The presidential administration plans to reduce regulations affecting housing construction and financing. President Trump has argued that regulations account for up to 30% of new home costs. He has proposed opening federal land for large-scale housing projects to increase supply and reduce prices.

Privatization of Fannie Mae and Freddie Mac

A significant policy under consideration is the privatization of GSEs Fannie Mae and Freddie Mac. They play a central role in the U.S. mortgage market. Allies of President Trump are exploring plans to remove these entities from government control, aiming to reduce federal involvement in the housing finance system. However, this move could lead to higher mortgage rates, potentially adding around $1,200 annually to the typical American mortgage.

Housing Affordability Initiatives

To combat rising housing costs, the administration intends to reduce barriers to new construction and increase federal incentives for affordable housing. The strategy includes curbing speculative investments that drive up prices, to make housing more accessible to Americans.

Impact on Mortgage Rates

Economic policies such as significant tax cuts and increased tariffs could influence inflation and, consequently, mortgage rates. Economists predict that the average 30-year fixed mortgage rate may range between 6% and 7% in the near future, influenced by the presidential administration’s fiscal policies.

Project 2025 and HUD

The Heritage Foundation’s “Project 2025” blueprint has influenced the administration’s policy direction. It suggests a restructuring of the Department of Housing and Urban Development (HUD). The plan advocates for reducing HUD’s role in housing programs and eliminating certain regulations, such as the Affirmatively Furthering Fair Housing rule. While the presidential administration has not officially adopted this blueprint, its proposals align with President Trump’s deregulatory agenda.

Key Points

- Under President Nixon, the focus was on combating inflation and managing economic volatility, which influenced housing affordability and mortgage rates.

- The Carter administration grappled with stagflation, leading to high interest rates that suppressed housing demand.

- President Reagan‘s tenure emphasized deregulation and tax reforms. It spurred a housing boom but also contributed to the Savings and Loan crisis.

- The George H.W. Bush administration faced the aftermath of this crisis, implementing measures to stabilize the housing market amid a recession.

- The Clinton years saw efforts to expand homeownership through policies encouraging flexible lending. While increasing ownership rates, they also sowed seeds for future financial instability.

- President George W. Bush‘s era experienced a housing bubble fueled by subprime lending and minimal regulatory oversight. This culminated in the 2008 financial crisis.

- The Obama administration responded with programs aimed at market stabilization and homeowner assistance, alongside significant regulatory reforms like the Dodd-Frank Act to enhance financial oversight.

- President Trump‘s policies focused on deregulation and tax reforms intended to stimulate economic growth.

- The Biden administration has prioritized addressing housing affordability and supply shortages. They implemented measures to support renters and homeowners during the COVID-19 pandemic.

Conclusion

The interplay between U.S. presidential administration and the housing market reveals a complex relationship. Policy decisions, economic conditions, and regulatory changes collectively shape housing trends. From the Nixon era through the Biden administration, each presidency has left a distinct imprint on the housing sector.

While presidential policies significantly influence the housing market, they operate within broader economic and social contexts. Factors such as global economic trends, technological advancements, and demographic shifts also play crucial roles. Understanding this interplay is essential for stakeholders aiming to navigate the housing market’s complexities and anticipate future developments.