A&D Mortgage has announced Prime Jumbo program update, aiming to make home buying and refinancing more accessible and flexible for a broader range of borrowers. This adjustment is especially timely, given the fluctuating real estate market and the needs of potential homeowners. Let’s delve into these changes and understand what they mean for prospective homebuyers.

Expanded Eligibility and Increased Borrowing Power

Looking for a suitable loan program?

Choose among 20+ programs and get

a detailed loan calculation

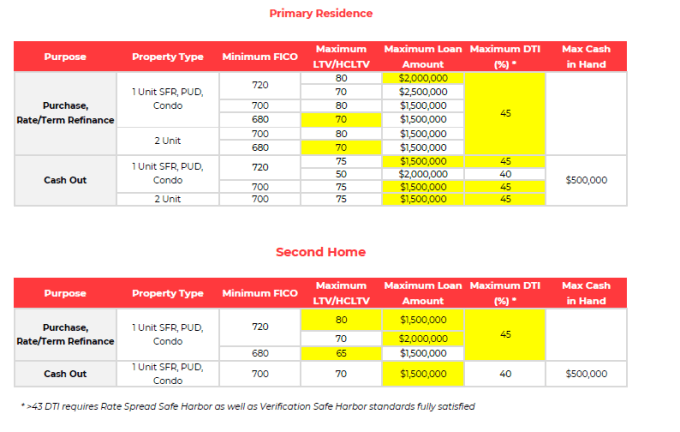

The first notable change is the expansion of the Debt-to-Income (DTI) ratio to 45% for primary residences and second homes. Traditionally, a lower DTI ratio was a stringent requirement, which sometimes acted as a barrier for potential borrowers with higher debt levels. This expansion means that individuals with higher debt relative to their income now have a better chance of qualifying for a mortgage, opening the door for more people to enter the housing market.

Moreover, for primary residences, there has been an increase in the maximum Loan-To-Value (LTV), Combined Loan-To-Value (CLTV), and Home Equity Combined Loan-To-Value (HCLTV) ratios to 70% for borrowers with a FICO score of 680. This adjustment is significant as it allows borrowers to finance a larger portion of their home’s value, reducing the need for large down payments. Similar enhancements have been made for second homes, with the maximum LTV increased to 80% for loans with a FICO score over 720.

Enhanced Cash-Out Refinancing Options

For homeowners looking to leverage their property’s equity, the changes to cash-out refinancing options are particularly beneficial. For primary residences, the program now supports a DTI ratio expansion to 45% for loans with a FICO score above 700 and LTVs of 75%. Additionally, the maximum loan amount for such refinancings has been elevated to $1.5 million. This is a game-changer for borrowers looking to tap into their home equity for renovations, investments, or consolidating debt.

Second homes are not left out of these enhancements. The changes include an increase in the maximum loan amount for cash-out refinancing to $1.5 million. This update provides significant flexibility for second home owners, enabling them to access more substantial amounts of their equity for various purposes. Refinancing the borrowers existing loan, may increase total finance charges over the life of the loan.

What These Changes Mean for Your Clients

The updates to A&D Mortgage’s Prime Jumbo program represent a shift towards more inclusive and flexible financing options. If you have a potential homebuyer or client looking to refinance, here’s what these changes could mean for them:

- Broader Eligibility: The expansion of the DTI ratio means that if they have higher existing debt but steady income, they could now be eligible for a mortgage or refinancing.

- Increased Financing Options: With the raised LTV/CLTV/HCLTV ratios, your clients can now borrow more against the value of their property. This is particularly beneficial if they’re looking to buy a home but have limited funds for a down payment.

- Greater Access to Home Equity: The enhanced cash-out refinancing options allow them to leverage their property’s value more effectively. Whether they’re looking to renovate, invest, or pay off debt, these changes could provide them with the financial flexibility they need.

These revisions to A&D Mortgage’s Prime Jumbo program are set to make a significant impact on the housing finance landscape. By offering more inclusive criteria and greater borrowing power, these changes open up new possibilities for a wide range of borrowers.

Summary of Prime Jumbo Program Update

Primary Residence

Purchase, Rate/Term Refinance:

For 1 Unit SFR, PUD, Condo:

- Expanded DTI to 45% in more circumstances

- Increased max LTV/CLTV/HCLTV to 70% for FICO 680

For 2 Unit:

- Expanded DTI to 45% in more circumstances

- Increased max LTV/CLTV/HCLTV to 70% for FICO 680

Cash Out:

For 1 Unit SFR, PUD, Condo:

- Expanded DTI to 45% for loans with FICO ≥ 700 and 75% LTVs

- Increased max loan amount on same loans to $1.5 million

For 2 Unit:

- Expanded DTI to 45%

- Increased max loan amount to $1.5 million for loans with 75% LTVs

Second Home

Purchase, Rate/Term Refinance:

For 1 Unit SFR, PUD, Condo:

- Expanded DTI to 45%

- Max LTV increased to 80% for loans with FICO 720

- Maximum Loan Amount increased to $2 million for loans with FICO 720 and 70% LTVs

Cash Out:

For 1 Unit SFR, PUD, Condo:

- Maximum Loan Amount increased to $1.5 million.