The role of a mortgage broker is vital in helping clients through the complex world of home financing. While conventional mortgages may seem like a well-trodden path, there are unconventional insights and strategies that can enhance your ability to serve clients effectively.

In this blog post, we will explore the unconventional wisdom surrounding conventional mortgages and provide you with valuable insights to help you unlock their full potential. Let’s dive in and discover the untapped possibilities of conventional mortgages.

Customization and Creativity

One of the unconventional aspects of conventional mortgages is the level of customization and creativity they offer. As a mortgage broker, you have the freedom to work with various lenders and explore different loan programs. Unlike government-backed loans with rigid guidelines, conventional mortgages provide flexibility in terms of loan structures, interest rates, and eligibility criteria. Embrace this freedom and think creatively to tailor solutions that meet your clients’ unique needs and financial goals.

Understanding the Overlays

While conventional mortgages have more lenient guidelines compared to government-backed loans, lenders may still impose additional requirements called “overlays.” These overlays can vary from lender to lender. They can include stricter credit score requirements, lower debt-to-income ratios, or specific property conditions. Unconventional wisdom lies in understanding these overlays and knowing which lenders have more favorable terms, enabling you to find the best fit for your clients. A&D Mortgage simplifies this process by no having overlays.

Unveiling Mortgage Insurance Options

Mortgage insurance is often viewed as an unavoidable cost associated with conventional mortgages, but there are unconventional ways to navigate this aspect. Educate yourself on the different mortgage insurance options available, such as borrower-paid mortgage insurance (BPMI) and lender-paid mortgage insurance (LPMI). By exploring these alternatives, you can help clients optimize their loan structure and potentially save them money over the long term.

The Power of Seasoned Loans

Seasoned loans, also known as non-seasoned or non-warrantable loans, offer unconventional opportunities within conventional mortgage lending. These loans involve financing properties that don’t meet traditional guidelines, such as non-warrantable condominiums or properties with unique characteristics. By understanding the intricacies of seasoned loans and working with lenders who specialize in this niche, you can expand your clients’ options.

Leveraging Jumbo Loans

Conventional jumbo loans, although categorized as non-conforming mortgages due to their higher loan limits, present intriguing possibilities for your clients. Unconventional wisdom lies in leveraging jumbo loans to help high-net-worth individuals finance luxury properties or access greater loan amounts while still benefiting from competitive interest rates. Developing relationships with lenders who specialize in jumbo loans can open doors to a whole new clientele.

Educating Clients about Debt-to-Income Ratios

Debt-to-income (DTI) ratios play a crucial role in mortgage approvals. Clients often assume that lower DTI ratios are always better. However, higher DTI ratios can still be acceptable depending on the overall financial picture. By educating your clients about the nuances of DTI ratios and demonstrating how different lenders interpret them, you can help them understand their borrowing capacity more accurately.

Embracing Technology for Streamlined Processes

In today’s digital age, mortgage brokers can leverage technology to streamline the conventional mortgage process and enhance client experience. Embrace digital tools for document collection, electronic signatures, and online applications to expedite transactions and reduce administrative burdens. By staying ahead of the curve technologically, you position yourself as a forward-thinking broker and provide a seamless mortgage journey for clients.

Conclusion

In conclusion, conventional mortgages are a realm of untapped potential and unconventional wisdom for mortgage brokers. By harnessing the flexibility, customization, and opportunities they provide, you can elevate your services, exceed client expectations, and carve a niche for yourself in the industry. Embrace unconventional wisdom and unlock the full potential of conventional mortgages to better serve your clients and achieve success in your career as a mortgage broker.

Ready to Take Your Business to the Next Level?

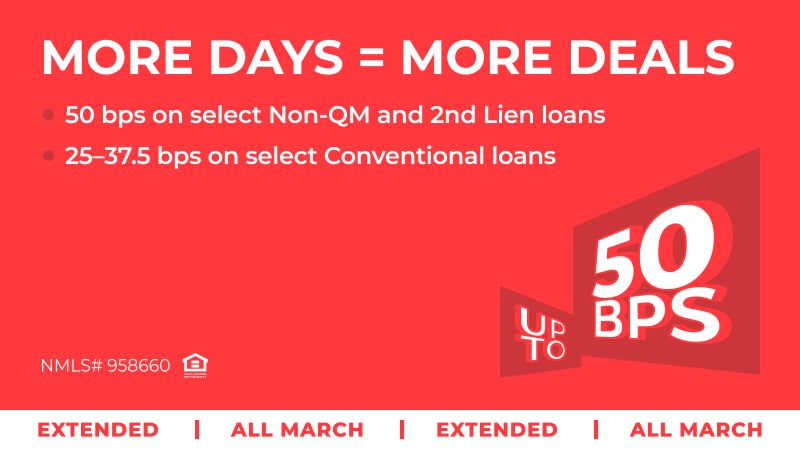

A&D Mortgage offers a full suite of products to meet your clients’ needs. These include DSCR loans, bank statement loans, and conventional loans. As a trusted mortgage lender, we provide flexible solutions and competitive rates. This way, you can deliver the best options for your borrowers.

Explore our exclusive broker package and benefit from partnering with A&D Mortgage today. Plus, use our loan calculator for instant quotes and pricing on any product. Become a partner and access the best tools to grow your business.