Saving for a down payment is one of the biggest hurdles people face when trying to buy a home. For many, it can feel like an impossible dream. But what if there was a way to help your clients overcome this challenge? Using gift funds for a down payment can be that lifeline. This is money that a family member or friend gives to a borrower to help with a down payment. This can be a huge help for buyers who are struggling to save up the full amount on their own. While the concept of gift funds may seem simple, there are specific rules and guidelines about who can give the money, how much, under what conditions, and what paperwork is required.

As a mortgage broker, it’s important to know the ins and outs of using gift funds for a down payment. That way you’ll become a valuable resource for your clients, guiding them through the process and ensuring they have all the necessary documentation and meet the mortgage lender‘s requirements. This will make you their go-to expert for mortgage advice, managing expectations and avoiding potential pitfalls. You can spot red flags early and prevent issues that could delay or derail the homebuying process.

What Are Gift Funds?

Get the ADvantage

with our loyalty program

Earn and redeem points for valuable benefits for you and your clients

Unlock RewardsSo, what are gift funds in the context of mortgages? Simply put, someone gives this money to a potential borrower to help them buy a home. It’s like getting a financial boost from a loved one or someone who wants to help them achieve their dream of homeownership. This money is used to cover part or all of the down payment. But who can give your client a gift like this? It’s usually someone they know and trust. Most often, it’s a family member – like their parents, siblings, or grandparents – who want to help them get started on their homeownership journey.

For example, Fannie Mae describes “acceptable donors” as “a relative, defined as the borrower’s spouse, child, or other dependent, or by any other individual who is related to the borrower by blood, marriage, adoption, or legal guardianship; or a non-relative that shares a familial relationship with the borrower defined as a domestic partner (or relative of the domestic partner), an individual engaged to marry the borrower, former relative, or godparent.”

But it’s not just family; sometimes employers or even charitable organizations offer gift funds as a benefit or assistance program. For instance, FHA’s list of “Who May Provide a Gift” also includes “the borrower’s employer or labor union, a charitable organization, a governmental agency or public entity that has a program providing home ownership assistance to low- and moderate-income families, or first-time homebuyers.”

It’s important to remember that not everyone can give your client money for a down payment, as stated by Fannie Mae, “The donor may not be, or have any affiliation with, the builder, the developer, the real estate agent, or any other interested party to the transaction.” Some lenders may also have specific restrictions on who can provide gift funds.

Down Payment Gift Rules by Loan Type

The rules for using gift funds for a down payment can vary depending on the type of loan your client is getting. Let’s break it down.

Conventional Loans

Conventional loans are the most common type of mortgage. With these loans, gift funds are generally pretty flexible. Family, relatives, and friends can usually give a potential borrower money for their down payment, and the paperwork isn’t too difficult. They’ll typically need a gift letter for a mortgage stating the amount, the donor’s contact information, and that the money is a gift and will not be repaid. However, some Conventional loans may have minimum borrower contribution requirements or some restrictions. For example, for transactions that include gifts, Fannie Mae requires the borrower to make a minimum contribution of 5% from their own funds if the LTV is greater than 80%. Additionally, according to Experian, “gift funds can’t be used on investment properties” when it comes to Conventional loans.

FHA Loans

FHA loans are government-insured mortgages designed to help people with lower incomes. They have specific rules about gift funds. While family and friends are still good options, as we’ve already mentioned above, money can also come from employers or even some charitable organizations. This is exactly the case with FHA loans. However, the Federal Housing Administration emphasizes that “only family members may provide equity credit as a gift on the property being sold to other family members.”

Also, along with a gift letter, the FHA borrower must provide a transfer of gift funds – a document that shows a deposit and withdrawal.

VA Loans

VA loans are loans for military service members and veterans. These loans are borrower-friendly and don’t even require a down payment. However, the VA does allow for gift funds to be put down if a borrower wants to start off with equity. The rules are usually quite lenient about who can give money to your client. It could be a relative, a friend, or even a government agency. The paperwork required to document the gift funds is the same as for FHA loans.

USDA Loans

USDA loans are a solution for people looking to purchase property in rural areas. Like VA loans, USDA mortgages allow for gift funds as an optional down payment and have specific requirements. According to the USDA Handbook, “Gift funds are considered the applicant’s own funds, therefore, they are eligible to be returned to the applicant at loan closing as applicable. Gift funds may not be contributed from any source that has an interest in the sale of the property (seller, builder, real estate agent, etc.). Gift funds must have a proper source: a gift letter to state the funds do not have to be repaid and a bank statement as evidence of funds from the donor’s account. Cash on hand is not an acceptable explanation for the source of funds…”

Non-QM Loans

Non-QM loans are mortgage options for borrowers who don’t fit the traditional mold. Unlike conforming loans (like FHA, VA, or Conventional), Non-QM loans offer more flexibility in terms of qualifying borrowers. This includes more lenient rules regarding gift funds. For example, A&D Mortgage accepts gift funds on all of its Non-QM products. However, there are some limitations. According to the A&D’s guidelines, “Gift funds are allowed for primary or second home purchase and Rate/Term transactions with 80% CLTV without any contribution from the borrower. For CLTV above 80% CLTV, a borrower must contribute at least 5% from their own funds. For investment transactions, the borrower must contribute at least 20% from their own funds with a maximum of 80% CLTV. Gift funds are ineligible for CLTV above 80% on Investment property.

For WVOE, P&L, and Asset Utilization, the borrower must contribute at least 20% from their own funds with a maximum of 80% CLTV. Gift funds are ineligible for CLTV above 80%.

Asset Utilization:

Boost your client’s options!

- Minimum FICO 599

- Up to 80% CLTV

- Checking, savings, stocks, bonds

Grow Your Services with A&D Mortgage!

See Program DetailsThe ITIN borrower(s) must contribute at least 5% from their own funds on Primary Residence and Second Homes and at least 20% on Investment. Gift funds are ineligible for CLTV above 80% on Investment property.

First-time home buyers must contribute at least 5% from their own funds on Primary Residence and Second Homes and at least 20% on Investment. Gift funds are ineligible for CLTV above 80% on Investment property.”

The lender will accept gift funds from a borrower’s relative or “any other individual who is related to the borrower by blood, marriage, adoption, legal guardianship, future spouse, or domestic partner residing with the borrower.” The documentation requirements to support gift funds are fairly straightforward: “an executed gift letter” and “proof of transfer and receipt of funds.”

How to Document a Down Payment Gift

As we’ve already mentioned, to use gift funds for a down payment, your client will need to provide some paperwork to a lender. Let’s take a closer look at them.

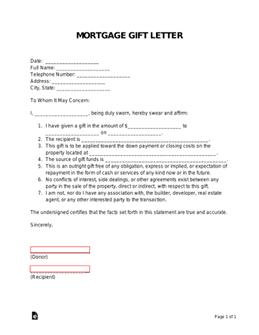

The most important document required is a gift letter. This letter is a formal statement from the person giving the money to your client, saying that it’s a gift and they don’t have to pay it back. A gift letter should include a few key pieces of information. First, it requires the names and contact information of both the person giving the gift and the person receiving it. Second, it should clearly state the amount of the gift. Third, it should explain the relationship between the two people – such as a parent, sibling, or friend. Most importantly, the letter should state that the money is a gift and that there’s no expectation of repayment.

Here’s an example of a gift letter:

Image source: https://eforms.com/mortgage-gift-letter/

While the gift letter is the main document, your client may also need to provide additional documentation. This could include bank statements showing the transfer of funds from the donor to the recipient. Some lenders might also ask for a copy of the donor’s tax return to verify their income.

By providing all the necessary documentation, your client will help verify the source of the down payment and smooth out the loan process.

Tips for a Smooth Gift Fund Process

Handling gift funds can be a tricky process. To ensure a smooth experience for both you and your clients, there are some best practices to follow. First and foremost, explain the gift fund process to your clients up front, including the required documentation and potential obstacles. This will help manage expectations and avoid misunderstandings.

A common pitfall is treating a gift like a loan. It’s essential to emphasize that a giver must really gift funds, with no expectation of repayment. Any indication of a loan can complicate the process and potentially jeopardize the mortgage approval. Additionally, be aware of gift fund limits. Some loan programs have restrictions on the amount of gift funds a borrower can use.

Timing is also important when using gift funds. Ideally, the borrower should get and document the funds before submitting the loan application. This will help streamline the process and avoid delays. However, there may be instances where one can receive gift funds after the application. In these cases, it’s important to communicate with the lender promptly and provide the necessary documentation as soon as possible.

By following these tips, you can help ensure a smooth and successful gift fund process for your clients.

Alternative Down Payment Options

While gift funds for down payment can be a lifeline for many homebuyers, it’s important to remember that not everyone has access to this type of financial assistance. That’s where alternative down payment options come into play.

One option to explore is low-down payment loans. These mortgages allow buyers to put down less than 20% of the home’s purchase price. While they may come with additional costs, such as private mortgage insurance (PMI), they can make homeownership more accessible for many. FHA loans are a popular example of a low down payment option, often requiring as little as 3.5% down.

Another avenue to consider is down payment assistance programs. These programs offer financial assistance to help buyers cover the cost of a down payment. They come in a variety of forms, including grants, loans, and deferred payment options. These programs often target first-time homebuyers, low-income individuals, or specific geographic areas. It’s essential to research the programs available in your clients’ area, as eligibility requirements can vary.

Importance of Broker Guidance

Choose a top nationwide lender that cares about your growth!

Get StartedWhen it comes to gift funds for down payments, many people think that everything is as simple as twice two makes four, without understanding the nuances, the rules, and the potential pitfalls. That’s why your expertise here becomes invaluable. By demystifying this misconception and clearly communicating the options, rules, and requirements, you can help your clients ensure a smooth and efficient loan process without delays and unpleasant surprises.

It’s important to remember that the mortgage industry is constantly changing; so are the rules regarding gift funds. That’s why, as a mortgage broker, you should stay up-to-date on the latest regulations and best practices. By staying informed, you can ensure that your clients receive accurate and timely advice.

Conclusion

Mortgage gift funds for down payment provide a valuable opportunity for homebuyers to achieve their dreams. But without your expertise as a mortgage broker, it can be a wasted opportunity. Your clients need a knowledgeable guide to help them through this complex process.

By providing clear explanations, efficient paperwork management, and unwavering support, you turn a potential obstacle into a stepping stone to homeownership. Your role is critical in turning gift funds into keys that unlock doors to new beginnings.

Ready to expand your gift fund knowledge? The A&D Mortgage Broker Package offers the resources and support you need to succeed. Sign up today and unlock new opportunities for your business.