Non-QM loans are a valuable tool in a broker’s belt thanks to their flexible guidelines. They help borrowers who don’t fit standard Qualified Mortgage (QM) requirements – for example, self-employed individuals or those who rely on investment income – but who still have the ability to repay the mortgage. To better support clients with this opportunity, brokers should understand the Non-QM loan requirements.

What is a Non-QM Loan?

A Non-QM loan is a mortgage option that does not meet at least one of the CFPB’s Qualified Mortgage standards. The purpose of these loans is to support those who don’t fit QM’s stricter underwriter criteria but can afford the mortgage to achieve homeownership.

Non-QM loans offer greater underwriting flexibility and may allow alternative income documentation, such as bank statements or asset utilization. Unlike QM loans, Non-QM options consider the borrower’s financial profile as a whole rather than focusing on rigid guidelines.

However, the ability to repay is crucial. Non-QM loans are not subprime loans, and only creditworthy borrowers can qualify.

Learn more about what Non-QM loan in the article: What Is a Non-QM Loan? A Clear Guide | AD Mortgage

Who Can Qualify for a Non-QM Loan?

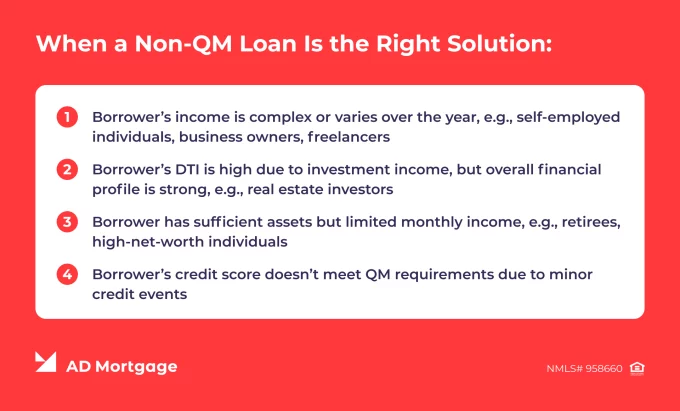

As Non-QM loans have flexible requirements that largely depend on the lender’s guidelines and the borrower’s situation, there are multiple scenarios where this solution can be useful. We’ve created a list of the most common cases to help you quickly determine whether your client qualifies.

Types of borrowers that can benefit from Non-QM loans:

- Self-Employed Individuals and Business Owners: While these borrowers cannot qualify for QM loans with standard W-2 forms, Non-QM loans allow alternative ways to document income, for example, using bank statements, profit-and-loss statements, or tax returns.

- Real Estate Investors. Borrowers whose income depends on property performance often have higher debt-to-income (DTI) ratios and complex portfolios. Documents such as asset statements or tax returns help evaluate property cash flow and the borrower’s ability to repay.

- Borrowers with a Recent Credit Event. If the borrower experienced a minor credit event, Non-QM loans might still offer a financing option. However, the borrower must demonstrate current financial strength and responsible credit behavior.

- Asset-Rich Borrowers with Limited Income. Those who have sufficient assets but limited monthly income – such as retirees or high-net-worth individuals – can support a mortgage using existing assets. Lenders evaluate asset liquidity and net worth rather than focusing solely on income.

General Requirements for Non-QM Loans

Non-QM mortgage requirements can vary from lender to lender based on underwriting guidelines, market conditions, and borrower profiles. Here is an outline of common lender expectations:

- Income Documentation. Compared to traditional W-2s and paystubs, Non-QM loans allow alternative documentation – bank statements, profit-and-loss statements, asset depletion, and other forms of income verification. This approach helps evaluate borrowers’ overall financial profiles, considering various income sources.

- Debt-to-Income (DTI) Ratio. Non-QM loans generally allow higher DTIs, sometimes over 50%, depending on credit score, assets, down payment, and other compensating factors.

- Credit Score. FICO score requirements usually range between 620 and 700, based on the lender and the mortgage program. For Non-QM loans, borrowers must demonstrate their creditworthiness and, therefore, borrowers with poor credit scores are not eligible.

- Down Payment. Typically, the down payment for Non-QM loans is larger than for QM loans and ranges from 10% to 30% of the loan amount. Additionally, the larger size of the down payment can be a strong compensating factor.

Why are Non-QM Loan Requirements Different?

As Non-QM loans are not subject to the strict limits established by the Consumer Financial Protection Bureau (CFPB). Therefore, lenders can offer more flexible conditions in terms of DTIs, documentation, credit history, and loan features. In addition, lenders’ underwriting guidelines vary, allowing them to evaluate borrowers individually rather than relying on rigid rules.

Manual underwriting helps lenders consider a variety of factors to assess a borrower’s financial situation more realistically. While focusing on the ability to repay the loan, lenders can provide tailored solutions for different loan scenarios and serve a broader range of borrowers who can afford a mortgage.

Common Benefits and Drawbacks of Non-QM Loans

Despite their advantages, Non-QM loans are not a silver bullet. Brokers need to clearly understand the limitations of this tool to shape their workflow efficiently and set realistic expectations for borrowers. In addition, as non-qualified mortgage requirements vary across lenders, it is best to get familiar with them in advance.

Non-QM Loan Benefits

- Flexible Qualifications. Non-QM criteria allow a wider audience of borrowers to qualify. The borrower eligibility depends on their ability to repay, not on strict parameters.

- Alternative Documentation. While QM loans have a short list of accepted documents – such as W-2 forms and tax returns – Non-QM loans allow greater variability. Borrowers can verify their incomes with bank statements, profit-and-loss statements, asset depletion, rental cash flow, or other documents.

- Higher DTI Ratios. Non-QM loans allow higher debt-to-income ratios while the borrower has an overall strong financial profile and can afford to repay the mortgage.

- Individual Approach. Manual underwriting ensures that each borrower’s case is carefully considered. Factors like assets, cash flow, reserves, and down payment size are examined to determine a complete picture of the financial profile.

- Wider Accessibility. People with unstable or limited income – including self-employed individuals, investors, freelancers, retirees, gig workers – can achieve homeownership with Non-QM loans. Also, this funding can be used for properties that are not eligible for QM loans, such as non-warrantable condos, mixed-use properties, or investment projects.

Non-QM Loan Drawbacks

- Higher Interest Rates. Due to more complex underwriting processes, higher perceived risk, and increased operational costs, lenders typically offer higher rates for Non-QM loans, compared to traditional funding.

- Larger Down Payments. For similar reasons, the down payments are of larger sizes – between 10% and 30%.

- Extended Timeline. Underwriting takes 30 to 60 days on average, so qualifying for a Non-QM loan is rather time-consuming, compared to other mortgages.

- Fewer Programs and Lenders. Non-QM loans are less widely available than traditional funding. Partnering with a trusted lender, such as AD Mortgage, can help brokers access a variety of programs and match their clients with the best-fit option.

How Brokers Can Help Clients Navigate Non-QM Requirements

Here are some key tips that will help brokers assess whether Non-QM loans fit their clients’ needs:

- Initial Evaluation of the Borrower’s Profile. Check the financial situation of your client to determine strengths and potential weaknesses. Additionally, ensure that the property type is eligible.

- Comparison of QM and Non-QM Programs. Review the QM requirements to check whether the borrower qualifies before moving to Non-QM options. While QM loans typically offer more favorable terms, qualification can be more difficult, so consider whether it may be beneficial to use Non-QM loans as a temporary solution.

- Ability to Repay and Compensating Factors Check. Educate your client on how the underwriting process differs for Non-QM loans, and how compensating factors, such as liquid reserves, assets, and down payment size, play an important role in qualification.

- Loan Scenario Development. Choose a loan scenario that best fits your client’s needs, aligning the program with the borrower’s income structure and goals. Then, create a step-by-step plan and set realistic expectations regarding its implementation.

Non-QM Loan Requirements at AD Mortgage

AD Mortgage, a leading Non-QM lender with over 20 years of experience in the mortgage industry, has flexible Non-QM loan programs tailored to fit various borrower profiles, helping our approved partners to serve a wide range of clients.

AD Mortgage’s Non-QM loan programs include:

- 12/24 Month Bank Statement. Loan amounts up to $4 million, DTIs up to up to 55%, no tax returns required – great for self-employed individuals.

- 1099. Loan amounts up to $4 million, DTIs up to 55%, cash out available, 1099s for the last 1 year allowed – great for self-employed and contract borrowers.

- 1Y + 2Y P&L. Loan amounts up to $2.5 million and DTIs up to 55%. Bank statements are not required up to 70% LTV – great for self-employed individuals.

- ITIN. Loan amounts up to $1.5 million, primary residence and investment allowed – great for those who have an Individual Taxpayer Identification Number but do not have a Social Security Number.

Learn more about AD Mortgage’s Non-QM Loan programs and how we can support your clients with flexible mortgage solutions.

FAQ: Non-QM Guidelines

What Is a Non-QM Loan?

Non-QM loans are mortgage solutions that, unlike Qualified Mortgages, do not comply with at least one of the CFPB’s Qualified Mortgage standards. However, they still include requirements related to the borrower’s ability to repay the loan.

Generally, Non-QM loans offer more flexible conditions but may involve higher costs compared to QM loans.

What Are the Basic Requirements for a Non-QM Loan?

Non-QM guidelines vary by lender and program, but typically include a FICO score of at least 620, DTIs that may exceed 50% (depending on compensating factors), and down payments ranging from 10% to 30% of the loan amount. Additionally, Non-QM loans allow alternative income documentation, such as bank statements and asset utilization.

Can Borrowers with a Low Credit Score Qualify for a Non-QM Loan?

Although lenders usually allow lower credit scores for Non-QM loans, the borrower’s overall financial profile must be strong. Lower credit scores can be approved if supported by significant compensating factors.

Do Non-QM Loans Require a Larger Down Payment?

Typically, yes. On average, down payments range between 10% and 30%, depending on lender guidelines, program terms, borrower profile, and compensating factors.

How Do Debt-to-Income Ratios Work with Non-QM Loans?

Most lenders allow debt-to-income (DTI) ratios of up to 50% and sometimes higher, offering more flexibility compared to traditional loan programs.

Is a Non-QM Loan Right for a Self-Employed Borrower?

Yes. Self-employed individuals, including business owners and freelancers, can verify their income using alternative documentation, whereas QM loans typically require traditional income documentation, such as tax returns.

Fill out the short form and get a call from our AE

Struggling with a loan scenario?

Get a solution in 30 minutes!