USDA and FHA loans are both government-backed programs designed to make homeownership more accessible. FHA loans best suit buyers with limited credit or higher debt, while USDA loans are ideal for low- to moderate-income borrowers purchasing homes in eligible areas.

This article highlights the differences between these two programs, helping brokers match clients with the most suitable option more efficiently.

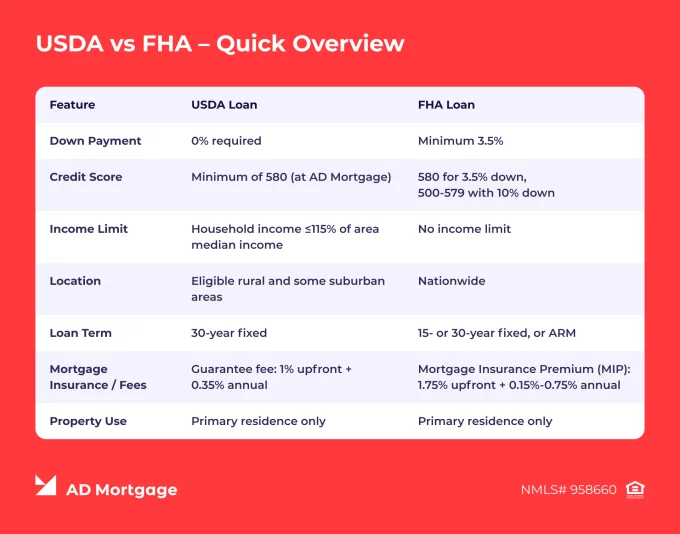

USDA loan vs FHA loan: Quick Comparison Table

The difference between USDA and FHA loans is clearly shown in the table below, which compares their key features side by side. Although they have some similarities, such as property use requirements, these two types of loans vary significantly, especially in income limits and location eligibility.

FHA vs USDA Down Payment and Loan Limits

USDA loans allow financing up to 100% of the home’s purchase price, meaning that the borrower does not have to make a down payment. FHA loans, on the other hand, require a down payment, the size of which depends on the borrower’s credit score. A minimum down payment of 3.5% applies to borrowers with a FICO score of 580 or higher. For those with scores between 500 and 579, a down payment of 10% is required.

While the USDA does not set a maximum loan amount, borrowers’ income and debt levels influence how much they can qualify for.

Unlike USDA loans, FHA loans have maximum loan limits set by HUD and updated annually. These limits are based on median home prices and vary by county.

USDA vs FHA Credit Score and Eligibility

Both USDA and FHA loans have occupancy rules, limiting eligible properties to primary residences. Beyond that, the properties must meet safety standards, ensuring they are livable.

In terms of credit scores, the programs have different regulations:

- FHA loans: For a standard 3.5% down payment, a minimum credit score of 580 is required. Borrowers with scores between 500 and 579 must make a 10% down payment.

- USDA loans: The borrower must demonstrate stable income and maintain a debt-to-income (DTI) ratio of 41% or less. The USDA does not set a minimum credit score, and the requirements vary by lender.

Location and Property Type

FHA loans do not have any location restrictions and can finance properties located anywhere within the United States. In contrast, USDA loans are limited to certain rural and suburban areas designated on the USDA Eligibility Map.

FHA vs USDA Mortgage Insurance, Fees, and Overall Cost

FHA costs include a Mortgage Insurance Premium (MIP) paid upfront and annually. At closing, 1.75% of the loan amount is charged, and the fee can be financed into the loan. Then, MIP is paid annually, and its amount ranges between 0.15% and 0.85% of the remaining balance, depending on the loan term, LTV, and other factors.

The USDA charges a ‘guarantee fee.’ An upfront fee of 1% of the loan amount is paid at closing but can be rolled into the loan. An annual fee of 0.35% of the remaining balance is paid monthly together with mortgage payments.

Overall, USDA loan terms usually offer lower monthly payments than FHA loans.

USDA vs FHA Closing Time and Loan Process

The approval process is structured differently for these two types of loans. FHA mortgages are processed and approved entirely by the lender, typically within 30 to 45 days. The timeline from application to closing is often similar to that of conventional loans.

USDA loans require a two-step approval process, first by the lender and then by the USDA office. Although the review usually takes 30-45 days, it can extend to 60 days in busy seasons.

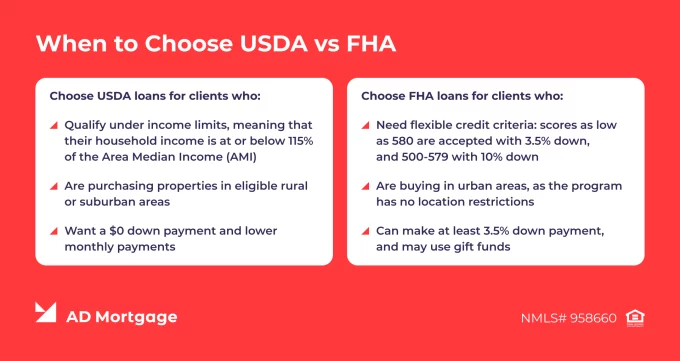

When Brokers Should Recommend Each

This quick and easy guide will help brokers determine which program best fits their clients’ needs.

Choose USDA loans for clients who:

- Qualify under income limits, meaning that their household income is at or below 115% of the Area Median Income (AMI)

- Are purchasing properties in eligible rural or suburban areas

- Want a $0 down payment and lower monthly payments

Choose FHA loans for clients who:

- Need flexible credit criteria: scores as low as 580 are accepted with 3.5% down, and 500-579 with 10% down

- Are buying in urban areas, as the program has no location restrictions

- Can make at least 3.5% down payment, and may use gift funds

If neither of the two options suits, AD Mortgage offers more than 20 mortgage programs, supporting brokers in serving a wider audience of borrowers.

FAQ: USDA Loan vs FHA for First-Time Buyers

What’s Cheaper – USDA or FHA Loan?

USDA loans tend to be more affordable due to a $0 down payment, and lower monthly and upfront fees, compared to FHA loans.

How Long Does a USDA Loan Take to Close?

Typically, USDA loans close in 30-45 days, as they require approval both from the lender and the USDA office.

Do USDA Loans Require PMI?

No. Instead of Private Mortgage Insurance (PMI), USDA loans require a guarantee fee. An upfront fee of 1% is charged at closing and can be financed into the loan, and the annual fee of 0.35% is paid monthly.

Can Brokers Help Clients Qualify Faster?

Yes. Brokers can move the application quicker by performing an eligibility review early, verifying documentation in advance, and using digital processing at AD Mortgage’s Partner Portal.

Does AD Mortgage Offer FHA Loans Too?

Yes. AD Mortgage offers FHA Standard, FHA High Balance, and FHA Streamline Refinance programs.

Conclusion

Both USDA and FHA loans open doors for underserved borrowers and help them achieve homeownership at affordable costs. However, the programs’ requirements differ, and brokers need to understand them clearly to guide their clients efficiently.

A broker’s success lies in pairing the client with the right program. AD Mortgage supports our partners during all stages of the mortgage process to help them close more deals quickly. Become our partner today to optimize your daily workflow.